You’ve made a few smart investments. You believe in bold ideas and want to support founders who are building the future.

Now, you’re ready to grow—raise your first fund, build a real team, and become a trusted name in venture capital. But that won’t happen without a clear plan.

You need a solid business plan to help you stay focused, explain your vision to investors, and build a strong foundation for success.

Wondering how to write one?

No worries! This venture capital business plan example is here to help!

Venture Capital Business Plan Sample

Explore the business plan of Equivara Ventures. Get practical insights that help you write your own plan. From mission and investment strategy to market analysis and financial projections, this sample covers it all.

1. Executive Summary

Equivara Ventures is a San Francisco-based venture capital firm specializing in early-stage investments across high-growth sectors, including technology, clean energy, fintech, and healthcare.

We partner with visionary founders who are building scalable, innovative companies positioned to drive disruptive change in their industries.

Beyond capital, Equivara provides strategic mentorship, access to extensive industry networks, and hands-on operational support. Guided by a mission-driven philosophy, we prioritize long-term value creation, responsible investing practices, and the acceleration of portfolio companies from seed through Series B stages.

Mission Statement

To empower visionary founders with the capital, guidance, and strategic support needed to build impactful, market-defining companies.

Vision

To be a leading early-stage venture capital firm known for investing in startups that shape a smarter, more sustainable future.

Investment Approach

Equivara targets pre-seed to Series A startups (from the very beginning of their journey) that demonstrate strong scalability potential, differentiated market positioning, and social relevance.

The firm focuses on sectors where innovation meets real-world application, especially in underserved markets or industries undergoing systemic transformation.

Target Market

Our main clients include:

- Early-stage startups in tech, SaaS, clean energy, healthcare, and fintech

- Female- and minority-led ventures seeking active VC involvement

- Accelerators and incubators looking for strategic capital partners

- Institutional and accredited investors seeking early-stage equity exposure

Core Offerings

Equivara offers:

- Seed to Series A capital (beginning of their journey) in exchange for equity

- Strategic advisory in fundraising, product-market fit, and go-to-market execution

- Resource support, including legal toolkits, hiring playbooks, and workshops

- Transparent Limited Partners (LPs) reporting, portfolio analytics, and co-investment syndication

Financial Outlook (3-year summary)

Equivara is positioned to deliver strong financial returns and create long-term value. Below is a summary of the firm’s 3-year financial projections:

| Metric | Year 1 | Year 2 | Year 3 |

|---|---|---|---|

| Management Fee Revenue | $1,000,000 | $1,000,000 | $1,000,000 |

| Carried Interest (from exits) | – | – | $1,200,000 |

| Total Revenue | $1,000,000 | $1,000,000 | $2,200,000 |

| Operating Expenses | $960,000 | $960,000 | $960,000 |

| Net Income (before taxes) | $40,000 | $40,000 | $1,240,000 |

| Target IRR (Fund-Level) | – | – | 18–22% |

| Expected MOIC (Fund-Level) | – | – | 3.0x |

| Break-even Status | Reached | Reached | Profitable |

In addition to that, Equivara is currently raising a $50 million fund to invest in 25–30 high-potential startups over a five-year period.

Long-Term Vision

Equivara Ventures aims to become a top-performing, next-generation VC firm—defined not just by returns, but by the market-shaping impact of its portfolio companies.

Liking the plan you're reading? It's AI generated.

Generate Your Own Using Bizplanr AI

2. Business Description

Business Overview

Equivara Ventures is a privately held venture capital firm headquartered at 1200 Market Street, Suite 900, San Francisco, California.

The firm is focused on early-stage investments in high-growth startups across sectors, including technology, clean energy, health, fintech, and SaaS. It aims to back innovative, scalable companies with the potential for market disruption and long-term value creation.

Value Proposition

Equivara stands out by taking a mission-driven, inclusive approach to venture capital:

- Actively seeking out female- and minority-led startups.

- Offering a suite of founder-focused services such as mentorship, legal resources, hiring playbooks, and strategic growth planning.

- Maintaining strong relationships with leading accelerators like Y Combinator and Techstars for exclusive deal flow.

- Providing Limited Partners (LPs) with detailed reporting, performance reviews, and co-investment opportunities.

Business Objectives

Our objectives reflect our commitment to strategic growth, impactful investing, and long-term success. At Equivara, we aim to:

- Deploy $50 million in early-stage capital over five years.

- Build a portfolio of 25–30 startups with strong exit potential.

- Become a recognized voice in thought leadership and responsible investing.

- Achieve top-quartile fund performance metrics among peers.

- Strengthen partnerships with accelerators, incubators, and co-investors.

The global venture capital industry continues to play a critical role in fostering innovation and economic growth, especially within high-tech sectors.

3. Market Analysis

Industry Overview

The global venture capital industry continues to play a critical role in fostering innovation and economic growth, especially within high-tech sectors.

The U.S. venture capital (VC) ecosystem remained strong in 2024, with total investments reaching $209 billion, marking a 30% increase from the previous year.

Early-stage venture funding—particularly in Artificial Intelligence, climate tech, digital health, and fintech—continues to attract investor interest due to its potential for outsized returns and long-term value creation.

Target Market Description

Equivara Ventures targets a dual market:

1) Startup Founders & Teams

Equivara targets early-stage companies across high-growth sectors. The firm has a particular focus on:

- Female- and minority-led startups, addressing an underserved segment with strong potential for innovation and leadership.

- Founders seeking both capital and active mentorship, including operational support, strategic growth planning, and network access.

- Accelerators and incubators such as Y Combinator and Techstars, where Equivara partners to source curated, investment-ready startups looking for strategic venture partners.

2) Investment Partners (Limited Partners - LPs)

On the investor side, Equivara engages:

- Institutional investors, family offices, and accredited individuals seeking exposure to high-growth, early-stage equity opportunities

- Investors are motivated by portfolio diversification, co-investment opportunities in startups, and alignment with impact-driven mandates like diversity, sustainability, and innovation.

By serving both founders and investors with personalized solutions and a hands-on approach, Equivara Ventures is positioned to become a trusted bridge between capital and transformative entrepreneurial talent.

Market Trends

Several key market trends are shaping new opportunities for venture capital firms like Equivara Ventures, including:

- Inclusive Investing: Funding for underrepresented founders has become a priority across institutional portfolios.

- AI & Deep Tech Surge: Seed-stage interest in AI, cybersecurity, and automation has sharply increased post-2023.

- Climate Tech Expansion: Renewed regulatory and investor focus on clean energy startups has made climate tech one of the fastest-growing VC sectors.

- Operational VC Models: Firms offering value-added services beyond capital, like Equivara, are gaining favor with founders.

Competitor Analysis

Equivara Ventures operates in a competitive landscape featuring firms such as:

| Firm | Key Focus/Strengths |

|---|---|

| Andreessen Horowitz | Aggressive investing strategy; extensive platform support for founders |

| First Round Capital | Early-stage seed funding specialist; highly founder-friendly approach |

| Foundry Group | Sector-agnostic firm; emphasizes strong portfolio support and community-building |

| Lightspeed Venture Partners | Global investment reach; strong presence in fintech and enterprise technology sectors |

| Initialized Capital | Founder-first philosophy; focuses on software and infrastructure startups |

What sets Equivara apart is its strong commitment to diversity, hands-on operational support for founders, and a unique hybrid model that blends impact-driven investing with disciplined financial performance.

SWOT Analysis

Here is the SWOT analysis of Equivara Ventures:

4. Services Offered

Equivara Ventures provides a comprehensive suite of investment and support services designed to help startups succeed from inception to scale.

Core Services

Equity investments

Equivara offers Seed to Series A funding in exchange for equity ownership. Each investment is backed by deep due diligence, a strong thesis around the market opportunity, and a hands-on growth partnership with the startup team. The average check size aligns with the portfolio stage and projected scalability.

Startup advisory

Founders gain access to:

- Fundraising and pitch support

- Market strategy and positioning

- Product roadmap alignment and business model refinement

These services are embedded into Equivara’s investment model, ensuring portfolio companies are equipped to hit major growth milestones.

Founder resources

To accelerate growth, Equivara provides:

- Legal templates (term sheets)

- Hiring playbooks and onboarding tools

- Go-to-market toolkits and performance dashboards

- Expert-led workshops in leadership, finance, and technology

Investor relations

Transparency and trust are maintained through:

- Quarterly and annual LP reporting

- Portfolio performance dashboards

- Market outlook reports and fund updates

- Co-investment opportunities with vetted startups

Deal syndication

Equivara partners with trusted VC firms and angel networks to:

- Share vetted deals for co-investment

- Reduce risk through diversification

- Expand the exposure and support available to each portfolio company

Unique Selling Points (USPs)

Here’s what sets us apart:

- Mission-driven investment model with a strong Diversity, Equity, and Inclusion (DEI) focus

- Highly curated founder support platform

- Multi-sector specialization in fast-growing markets

- Personalized investor communication and reporting

- An active syndication network that enhances funding potential and reach

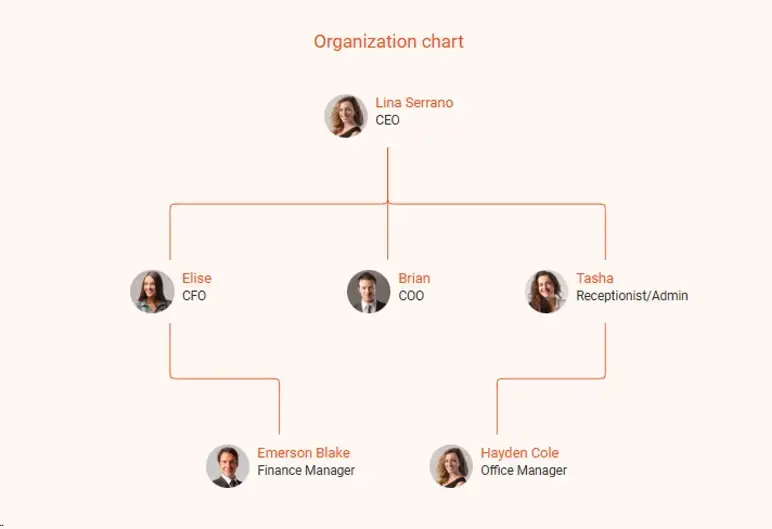

5. Organization and Management

Equivara Ventures operates as a Limited Partnership (LP-GP structure), a common setup for venture capital firms.

The firm is privately owned, with key management holding equity stakes in the General Partnership. The fund itself is being raised from institutional and accredited investors to finance startup investments and operations over five years.

Leadership Team

Lina Serrano – CEO (Owner): Founder of Equivara Ventures, Lina brings a visionary leadership style with deep experience in startup investing, portfolio building, and founder support. She oversees the firm’s strategic direction and LP engagement.

Brian Kato – COO (Portfolio Manager): Brian is responsible for operational execution and portfolio performance, managing relationships with startup teams and ensuring scalable, value-driven growth across investments.

Elise Vaughan – CFO (Accountant): Elise manages fund finances, investor reporting, and financial compliance, ensuring transparency and accountability in fund performance.

Tasha Velez – Receptionist/Admin: Tasha provides critical administrative support to both the internal team and external stakeholders, helping coordinate communications, schedules, and investor touchpoints.

Organizational Chart

Advisory Board Members

Our advisory board blends expertise in tech, regulation, and growth to guide Equivara’s success.

Dr. Minaj Desai – AI & Deep Tech Specialist: Offers deep domain knowledge in artificial intelligence, helping evaluate technical teams and disruptive solutions.

Karen Belle – Regulatory Advisor & Former SEC Counsel: Brings compliance and legal expertise to guide investment structuring and ensure SEC-aligned operations.

Rob Manes – Growth Marketing and SaaS Scaling Expert: Provides strategic support to portfolio companies on growth marketing, demand generation, and SaaS scaling best practices.

6. Marketing and Sales Strategy

Equivara Ventures employs a sophisticated and multi-tiered marketing strategy designed to attract both high-potential startups and institutional investors.

The firm uses content marketing, events, partnerships, and digital infrastructure to build credibility, generate deal flow, and maintain strong LP relations.

Marketing Plan

1) Thought leadership content

Equivara maintains a strong online presence through:

- Regularly published insights on LinkedIn and Medium covering investment trends, portfolio wins, and founder interviews

- Data-backed articles on startup growth, fundraising strategies, and industry disruption

- CEO and advisor thought pieces shared via partner publications and podcasts

2) Startup conference sponsorships

The firm actively participates in major events to boost brand visibility and meet early-stage founders.

- TechCrunch Disrupt

- Web Summit

- Y Combinator Demo Days

- SaaStr Annual

Team members frequently speak at panels or serve as mentors in startup pitch sessions.

3) Accelerator & incubator partnerships

Equivara collaborates with:

- Y Combinator, Techstars, and local innovation hubs to gain early access to curated cohorts

- Community-based incubators that align with Equivara’s diversity-driven investment thesis

These partnerships provide a competitive edge in deal sourcing.

4) Online deal flow portal

A custom digital submission portal allows startup founders to pitch directly, simplifying the application process and enabling real-time tracking of potential investments.

5) Referral network

The firm incentivizes startup referrals from:

- Legal and accounting firms

- Mergers and Acquisitions (M&A), as well as corporate finance consultants

- Startup alumni and ecosystem advisors

This personal network approach allows for warm introductions and higher conversion rates.

6) Targeted PR & press features

Equivara invests in strategic media placements:

- Features in TechCrunch, Crunchbase News, and Forbes

- Portfolio highlights and fund announcements

- Media releases for funding rounds and industry partnerships

Sales Strategy

Since Equivara’s model is built on fund deployment and equity returns, its “sales” focus is two-fold:

1) For Startups

- Position Equivara as a value-added investor and trusted long-term partner

- Use branding, referrals, and content to attract high-potential founders who align with the firm’s mission

2) For LPs/Investors

- Offer compelling fund decks and private data rooms with strong financial models and investment thesis.

- Host LP webinars and updates featuring key advisors and startup spotlights

- Provide co-investment rights to top-performing LPs

Pricing and Returns Model

Equivara operates under a traditional 2/20 venture fund model:

- 2% annual management fee used for firm operations and portfolio support

- 20% carried interest on profits after returning investor capital

This model ensures alignment between Equivara’s success and that of its LPs and founders.

7. Financial Projections

Equivara Ventures' financial projections reflect planned fund deployment, operational growth, and active portfolio management. The projections offer a realistic view of expected revenue, expenses, and profitability over the first three years.

Income Statement (3-year forecast)

| Income Statement | Year 1 | Year 2 | Year 3 |

|---|---|---|---|

| Revenue | |||

| Management Fees (2%) | $1,000,000 | $1,000,000 | $1,000,000 |

| Carried Interest | – | – | $1,200,000 |

| Total Revenue | $1,000,000 | $1,000,000 | $2,200,000 |

| Operating Expenses | |||

| Salaries & Compensation | $600,000 | $600,000 | $600,000 |

| Marketing & Travel | $150,000 | $150,000 | $150,000 |

| Office, Admin & Tech | $100,000 | $100,000 | $100,000 |

| Legal & Advisory | $100,000 | $100,000 | $100,000 |

| Depreciation | $10,000 | $10,000 | $10,000 |

| Total Expenses | $960,000 | $960,000 | $960,000 |

| Net Profit (EBIT) | $40,000 | $40,000 | $1,240,000 |

| Taxes (Assumed 25%) | $10,000 | $10,000 | $310,000 |

| Net Income | $30,000 | $30,000 | $930,000 |

Balance Sheet (3-year snapshot)

| Balance Sheet | Year 1 | Year 2 | Year 3 |

|---|---|---|---|

| Assets | |||

| Cash & Bank Balances | $990,000 | $960,000 | $2,170,000 |

| Fixed Assets (net) | $50,000 | $40,000 | $30,000 |

| Total Assets | $1,040,000 | $1,020,000 | $2,200,000 |

| Liabilities | |||

| Accounts Payable | $20,000 | $20,000 | $20,000 |

| Equity | |||

| Partner Capital Contribution | $1,030,000 | $1,020,000 | $1,010,000 |

| Retained Earnings | -$10,000 | -$20,000 | $1,170,000 |

| Total Liabilities & Equity | $1,040,000 | $1,020,000 | $2,200,000 |

Cash Flow Statement

| Cash Flow | Year 1 | Year 2 | Year 3 |

|---|---|---|---|

| Cash Inflows | |||

| Management Fee Revenue | $1,000,000 | $1,000,000 | $1,000,000 |

| Carried Interest Received | – | – | $1,200,000 |

| Total Inflows | $1,000,000 | $1,000,000 | $2,200,000 |

| Cash Outflows | |||

| Operating Expenses | $950,000 | $950,000 | $950,000 |

| Tax Payments | $10,000 | $10,000 | $310,000 |

| Total Outflows | $960,000 | $960,000 | $1,260,000 |

| Net Cash Flow | $40,000 | $40,000 | $940,000 |

| Opening Cash Balance | $950,000 | $990,000 | $1,030,000 |

| Ending Cash Balance | $990,000 | $1,030,000 | $1,970,000 |

Break-Even Analysis

| Break-even Item | Value |

|---|---|

| Fixed Annual Operating Costs | $950,000 |

| Average Revenue per Year | Year 1–2: $1,000,000 Year 3: $2,200,000 |

| Contribution Margin | 100% (services-based) |

| Break-even Point | Achieved in Year 1 (slight surplus), with profitability in Year 3 from carried interest |

8. Funding Request

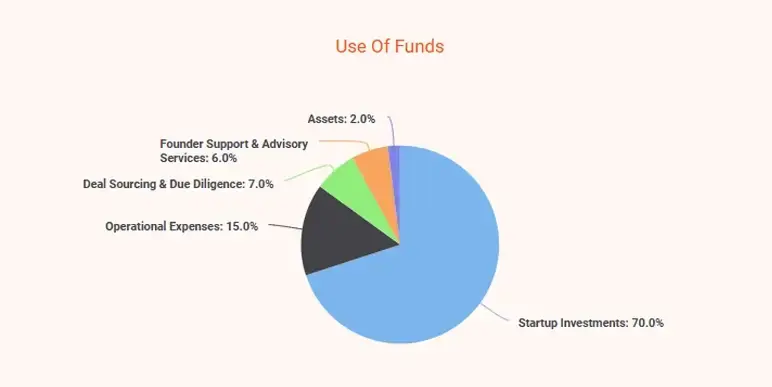

Equivara Ventures is currently raising a total of $50 million for its inaugural venture fund.

This capital will be deployed strategically across early-stage investments and operational infrastructure to support the firm’s long-term mission and performance objectives.

Use of Funds

The fund will be allocated across the following key areas:

| Category | Amount | Percentage of Total Fund | Purpose |

|---|---|---|---|

| Startup Investments | $35,000,000 | 70% | Direct investments into 25–30 early-stage startups |

| Operational Expenses | $7,500,000 | 15% | Salaries, office setup, technology tools, admin costs |

| Deal Sourcing & Due Diligence | $3,500,000 | 7% | Scouting, travel, networking events, external expert evaluations |

| Founder Support & Advisory Services | $3,000,000 | 6% | Workshops, playbooks, resource development for portfolio companies |

| Reserve & Contingency | $1,000,000 | 2% | Unexpected operational needs or strategic reallocation |

| Total | $50,000,000 | 100% |

Exit Strategy for Fund

Returns will be distributed to Limited Partners through:

- Equity exits via M&A or Initial Public Offering (IPOs) of portfolio companies

- Secondary share sales during later-stage fundraising rounds

- Follow-on funds or rolling Special Purpose Vehicles (SPVs) to capitalize on maturing opportunities

Equivara Ventures aims to become a top-performing, mission-aligned fund delivering both strong financial outcomes and meaningful societal impact.

Download a Free Venture Capital Business Plan Template

Ready to build your venture capital business plan but want a little guidance? No problem—our free venture capital business plan template is here to support you.

This investor-ready template has helped many emerging fund managers and firms get started with confidence. It includes real examples and practical insights to guide you through every key section. Customize it based on your business-specific needs, and create a plan that makes a strong first impression.

Conclusion

With this venture capital business plan sample, you now have a clear structure to build a smart, detailed plan that speaks to investors, partners, and team members.

But if you want a quicker, simpler way to get your plan done, Bizplanr can help. This AI-powered business plan tool creates customized, ready-to-share plans in minutes. Just answer a few short questions, and your venture capital business plan is good to go.

Get Your Business Plan Ready In Minutes

Answer a few questions, and AI will generate a detailed business plan.

Frequently Asked Questions

How to write a solid business plan for venture capital?

Follow these key steps to craft a strong business plan for venture capital:

- Start with a clear structure by outlining your fund’s purpose, strategy, and operations.

- Focus on how you will find deals, manage investments, and generate returns.

- Use simple, direct language and avoid unnecessary jargon.

- Support your plan with real data, market research, and practical examples.

- Build trust by being transparent about your team, processes, and goals.

- Review the plan carefully and seek feedback from experienced venture capital professionals.

A strong business plan clearly shows investors how your business will succeed. It should be easy to follow, fact-based, and focused on results rather than buzzwords.

What are the primary revenue streams of a venture capital business?

Venture capital firms make money mainly in two ways:

- Management fees: This is typically 1.5–2.5% of the total fund size, paid annually by investors (limited partners) to cover operational costs.

- Carried interest (carry): This is the big incentive. VCs earn a share of the profits (usually 20%) from successful investments after the fund hits a performance benchmark.

Some firms may also earn advisory fees or co-invest, but the two above are the core revenue streams.

Why is market analysis important for a venture capital firm?

Market analysis helps a VC firm:

- Assess opportunity size — Is the market big enough to support high returns?

- Evaluate scalability — Can the business model work across different markets or segments?

- Spot trends — Understanding shifts in customer behavior, tech, or regulation gives a firm an edge.

- Back the right startups — A founder might have a good product, but without a strong market, it's hard to grow.

In short, market analysis is how VCs reduce risk and improve the odds of a strong exit.

Where do I find a free venture capital business plan sample PDF?

You can find a free venture capital business plan sample PDF on business planning platforms such as Upmetrics, LivePlan, Bizplanr, IdeaBuddy, PlanGrowLab, etc.

Make sure the example aligns with the type of VC firm you want to build (seed stage, growth stage, sector-specific, etc.).

How often should I review and update my venture capital business plan?

It's recommended to review and update your VC business plan every 6–12 months, or when:

- You raise a new fund

- Market dynamics shift (e.g., regulatory, tech trends)

- Your investment thesis evolves

- Portfolio performance or strategy changes

- New partners or advisors join the team

Frequent updates keep your pitch sharp, relevant, and aligned with investor expectations.