Do you know where your business will be six months from now? What about next year? When do you expect returns?

You cannot avoid questions like these and you should not have to. Every business owner will face them sooner or later - from investors, lenders, and even their own team.

And the best way to be ready is with a financial forecast that shows you have done the work and thought things through. Answering them requires more than gut feelings or rough estimates. It takes planning, data, and clear financial projections in a business plan that shows you have done the work.

Financial projections provide a structured approach to tackle questions like these. In this blog, we will look closer at what financial projections for a business are and how it is the backbone of any solid business plan.

What are financial projections in a business plan?

Financial projections are a core component of a business plan, providing a data-backed estimate of a company’s future financial performance. They track expected cash inflows, outflows, revenues, and expenses, acting as a financial roadmap that outlines how funds will be allocated, loans repaid, and growth targets achieved.

These projections bring the numbers behind your business to life. They connect your goals, strategies, and operations, showing how plans on paper translate into measurable results.

But that’s just the start. Financial projections do much more than tracking income and expenses. They are a cornerstone of smart business plan, be it startups or existing businesses for several other reasons.

What are the core components included in financial projections?

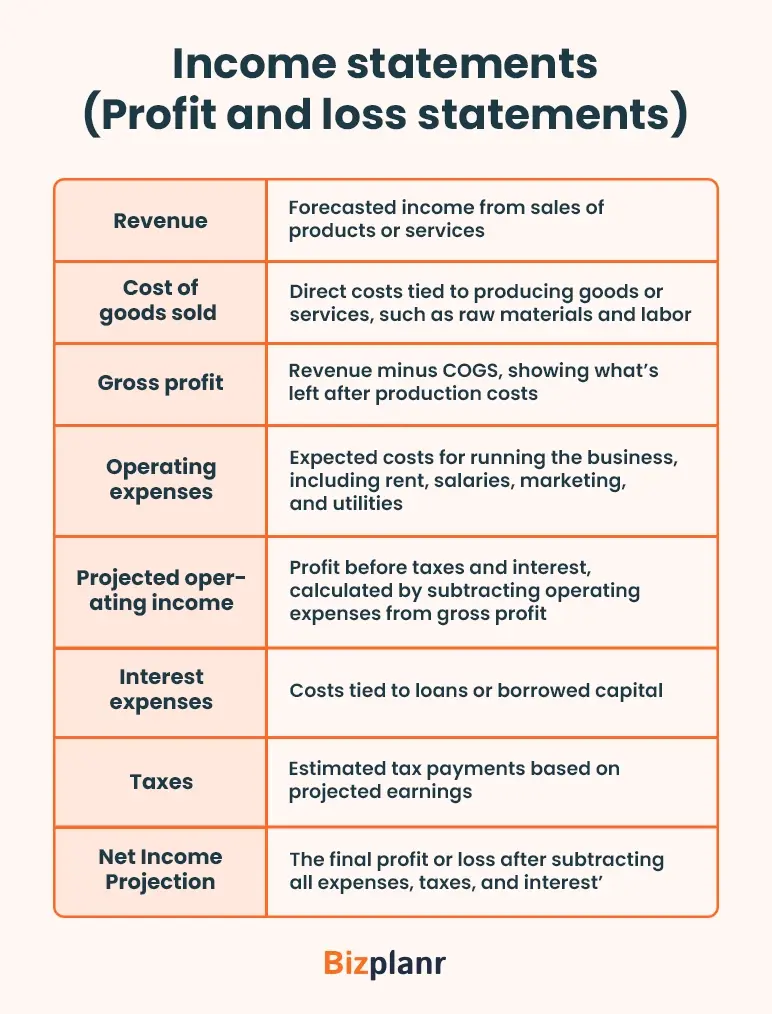

You need to have three core financial statements included in financial projections:

- Income statement (Profit & Loss Statement)

- Cash flow statement

- Balance sheet

These statements act as the foundation for accurate financial projections and smarter decisions.

Income statements (Profit and loss statements)

Income statements show what your business earns, what it spends, and what’s left over. Here’s what you’ll typically find in a projected income statement (profit and loss statement)

Make sure your income statement has all of the above components.

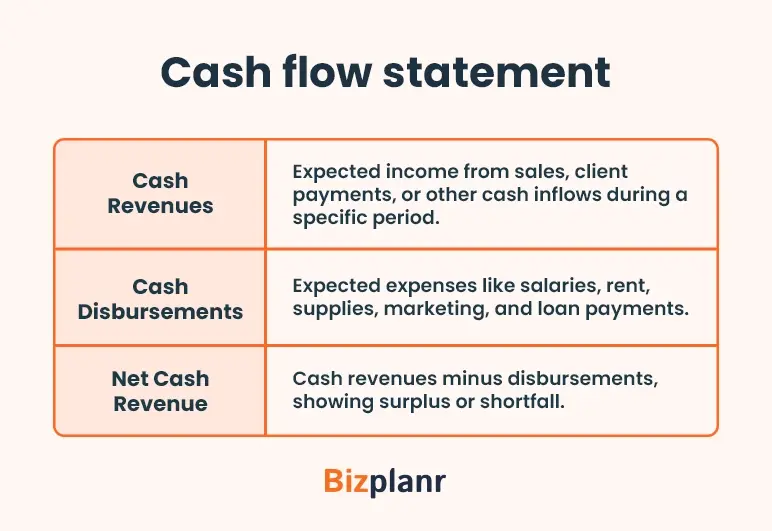

Cash flow statement

Cash flow statements are financial statements that show whether your business can manage its money and repay loans on time. Oftentimes, it is the first thing investors look at to decide if you’re worth the risk.

The cash flow statement shows three main parts.

If you have a strong cash flow, it means your business can keep operating, pay off debts, and even reinvest in growth.

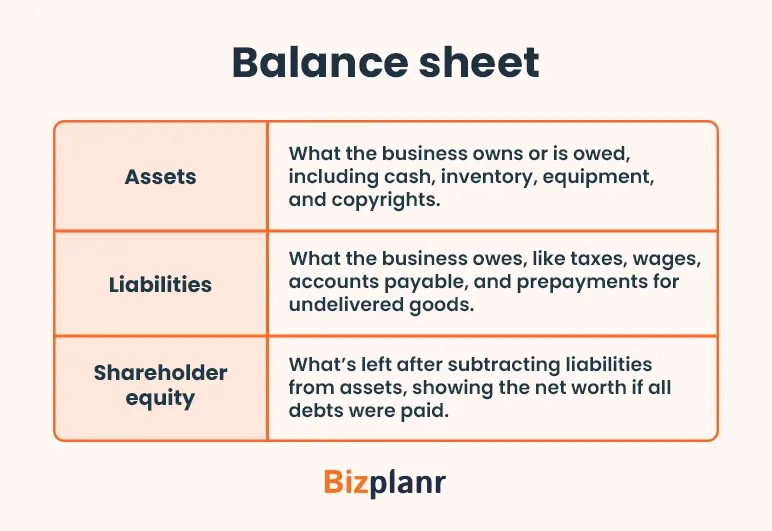

Balance sheet

A balance sheet shows where your business stands financially at a specific moment. It’s a quick overview of what you own, what you owe, and what’s left over.

A balance sheet is built around three key parts.

The balance sheet works because assets always equal liabilities plus equity. Investors, lenders, and even you can look at it and know immediately whether the business is stable, stretched thin, or ready to grow.

Income statements, cash flow statements, and balance sheets form the foundation for accurate financial forecasting and smarter decisions.

The income statement highlights revenues and costs, the cash flow statement monitors inflows and outflows, and the balance sheet shows the company’s financial position at any given time.

Now that we know the core components of a financial projection, let us create financial projections.

Create financial projections with these 7 steps

Because so much depends on these forecasts, we can never overstate the importance of their accuracy, whether it is for startups or existing businesses.

Here is a step-by-step guide to creating your financial projections:

1. Define the purpose of a financial forecast

The first step to creating financial projections is knowing why you want to do it. It answers a bunch of important questions. How many products will you sell? How much revenue will that bring in? Will your current budget cover what’s ahead, or will you need more funding?

Say you are starting a skincare brand and introducing a new line of organic face creams. How do you know how much inventory to order, what your marketing budget should look like, or when you might break even?

You would calculate production costs for ingredients, packaging, and labor. Then, you would factor in marketing expenses for social media ads and influencer collaborations, along with shipping fees for online orders.

Once you have those numbers, compare them against projected revenue to see whether the product line is likely to turn a profit and how long it might take.

Now imagine sales don’t grow as quickly as expected. Your forecast would highlight the shortfall early, giving you time to lower production costs, increase advertising, or secure short-term funding to stay on track.

2. Gather past financial statements and historical data

When you create financial projections, the second important thing is keeping all the financial statements i.e. income statement, cash flow statement, and balance sheet and collecting all historical data. Before you can predict what’s ahead, you need to understand where the business has been. That means collecting every piece of historical financial data that is important. Be sure to gather:

- Revenue: Total income earned from sales.

- Losses: Any financial shortfalls or negative balances.

- Liabilities: Debts and obligations the business must pay.

- Investments: Funds put into the business for growth.

- Equity: Ownership value after liabilities are deducted.

- Expenditures: Costs incurred to run the business.

- Comprehensive Income: Total earnings, including adjustments for taxes.

- Earnings Per Share: Profit distributed per share, if applicable.

- Fixed Costs: Regular expenses like rent, salaries, and utilities.

If you’re launching an organic skincare line, review historical cash flow data like past sales, expenses, and profit margins to estimate revenue, manage budgets, and set pricing strategies.

Suppose your last product launch brought in $15,000 in sales in the first three months but required $10,000 in production and marketing costs; you already have a baseline to estimate profits. You can project whether scaling up production or increasing ad spend will yield higher returns or strain your budget.

Also, consider fixed costs like rent, staff salaries, and utilities, as well as variable expenses such as packaging, raw materials, shipping, and influencer partnerships. If the historical data shows that influencer ads drove the most sales, you can invest more in that channel.

3. Choose a time frame for your forecast

You decide how far into the future you want to go. It could be a few weeks, a few months, or multi year financial projections. Most businesses stick to one fiscal year because it’s easier to track progress and make adjustments within that time frame.

Markets shift, customer preferences change, and unexpected events happen so short-term forecasts tend to be more accurate than long-term ones. A forecast for the next quarter can rely on current trends, while one for the next five years will depend more on assumptions and estimates.

When you decide to launch an organic face cream as part of your skincare line you can create a financial forecast for one fiscal year to understand if the product can turn a profit and how quickly.

For the first three months, you forecast sales based on your marketing campaigns and distribution channels. Next, you calculate expenses. Since market trends and customer demand can shift, you also create a six-month and one-year projection. If costs rise due to bulk orders or higher ad spending, you adjust your projections to see whether the profits still hold up.

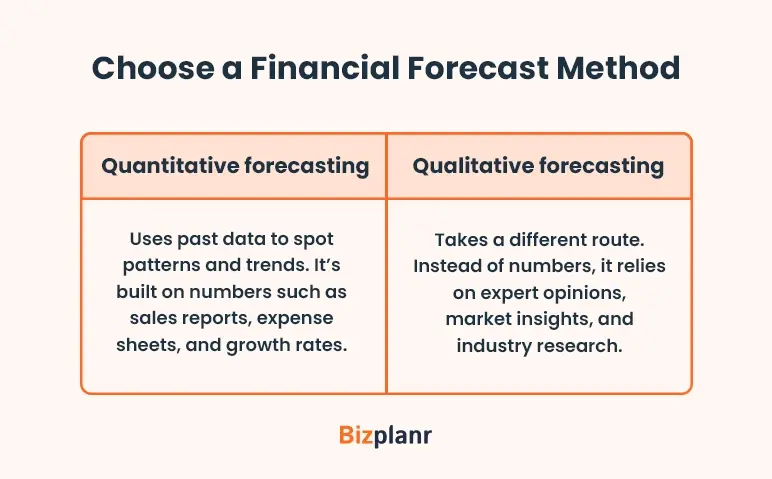

4. Choose a financial forecast method

The next step is to choose the financial forecasting method that works for your business. This decision shapes how you plan, spend, and grow. Financial forecasting often involves building a financial model to analyze various projection scenarios and their impacts.

Without the right approach, your numbers can lead you in the wrong direction. There are two ways to forecast - quantitative and qualitative.

Let’s go back to the organic skincare line. If you are an existing business selling body lotions for the past year, quantitative forecasting can help predict sales for the new face cream. You would look at trends from previous product launches, seasonal spikes, and ad performance to make projections.

But if this is your first product, you would turn to qualitative forecasting. You might gather insights from industry reports, consult skincare market experts, and study trends in clean beauty.

5. Document and keep an eye on numbers

Financial forecasts are not set in stone. That’s why tracking your forecast and keeping it updated is just as important as creating it. Numbers that made sense last quarter might look completely different after a new product launch, a supply chain delay, or a sudden spike in demand.

Take the organic skincare line as an example. You launch the new face cream and initially project sales of 500 units a month. But after three months, a competitor drops prices, or an influencer unexpectedly boosts your brand. Suddenly, sales double, and production costs increase to keep up. If you’re not monitoring your forecast, these changes can throw off your budget and cash flow.

Using a financial forecasting tool can make this process easier. It tracks trends, automates calculations, and gives real-time updates, so you’re not constantly chasing spreadsheets. Keeping financial projection scenarios and forecasts current keeps your business prepared and flexible.

6. Build a visual report

Graphs, charts, and dashboards bring the data to life, helping you quickly spot patterns and trends.

Sample financial plan visual report

Continuing the skincare example: Say your original forecast projected $10,000 in monthly sales for the organic face cream. After the influencer promotion, sales spiked to $15,000 in the third month.

A visual report could

- Show the sales jump on a line graph

- Highlighting the timeline of the spike

- Compare actual sales to the forecast.

Instead of scanning spreadsheets, visuals help you see patterns like seasonal spikes or rising costs, at a glance. You can also make decisions quickly as they highlight areas where costs are too high or returns are better than expected, so adjustments are clear. Moreover, visual reports also make it easier to explain performance and justify future projections.

7. Analyze financial data

The final step to prepare financial projections is analyzing financial data against income statement projections. It helps you validate whether your predictions were accurate and highlights what worked, what did not, and what needs to change.

For example, with the organic skincare line, you projected $10,000 in sales for the first month. If the actual sales came in at $7,500, you need to know why. Was it a marketing issue? Did production delays push back shipments? Or did customer demand not match expectations? On the other hand, if sales hit $12,000, the extra revenue points to a bigger market than expected, or costs are about to go up.

Instead of calculating a single break-even point for the entire business, analyze break-even points for each product or service. This highlights which offerings are profitable and which may need pricing adjustments, cost reductions, or stronger marketing efforts.

By isolating break-even points, you can prioritize high-margin products, cut underperformers, and make data-driven decisions to improve profitability.

If marketing expenses were higher than planned but drove stronger sales, you might allocate more of your budget there next time. If shipping costs were too high, you might look for cheaper suppliers or adjust pricing.

That’s all. Follow the above steps to create financial predictions that are grounded in data and reflect realistic expectation.

Why do financial projections matter in your business plan?

Businesses can use financial projections in business planning for:

1. Budget planning

- Budgeting defines limits, so businesses avoid overspending and build savings for the company's future revenues.

- Financial forecasting relies on past trends to estimate income and expenses, ensuring decisions are based on facts

- Budgets and forecasts work together to manage cash flow, reduce risks, and help businesses stay prepared for unexpected challenges.

2. Define business goals

- Projections evaluate whether ideas are financially feasible, helping businesses avoid costly mistakes.

- Forecasting highlights funding shortfalls, market shifts, or weak profit margins so businesses can act early.

- With clear data, businesses can confidently raise capital, boost sales, or cut costs to stay profitable.

3. Mitigate potential financial risks

- Forecasting allows businesses to test “what-if” or worst case scenarios and see how changes might impact finances.

- Contingency plans like emergency funds or contract adjustments keep businesses flexible during disruptions.

- Being prepared means businesses can recover faster from setbacks and protect their bottom line.

Take Air Canada’s story as an example:

A case in February, 2024 Air Canada posted its first profit since the pandemic, a comeback built on sharp planning and quick decisions. When travel demand shifted, they adjusted operations, cut costs, and leaned on financial forecasts to stay ahead of risks. Their projections showed where trouble might hit and how to map a way out, resulting in a profitable recovery.

4. Calculate return on investment (ROI)

- Projections analyze revenue, expenses, and cash flow to determine whether an investment makes sense.

- Businesses can model different outcomes to avoid risky decisions and set realistic goals.

- ROI forecasts provide clarity, so time and money are focused on efforts that drive growth.

5. Impress investors

- Investors get proof that businesses are ready to handle funds responsibly and generate returns.

- Financial projections outline growth strategies and performance targets, giving investors confidence in the business’s future.

- Banks and lenders evaluate forecasts to ensure businesses can manage loans and meet repayment terms without strain.

And there you have it. Financial forecasting gives your business direction, but it all comes down to the numbers that back it up.

However, predictions aren’t one-and-done. To ensure the forecasts remain effective and adaptable, you must follow best practices to keep forecasts accurate and ready for whatever comes next.

Best practices to follow while creating financial projections

How do you keep forecasts sharp and worth trusting? You get better at building them by following good practices. Let’s get into it.

- The fewer assumptions you make, the better. Be realistic about your expectations for the future so your projections have a good chance of being accurate

- Forecasts should go beyond the numbers. They need to capture the reasons behind those numbers. How much time can be allocated? Are there location constraints?.

- Growth comes with costs. Some obvious, some not. Make sure nothing gets missed. Go over the numbers carefully. Check for gaps, extra expenses, and anything that could throw off the plan.

- Not every problem calls for a change in the numbers. Know when to update the forecast and when not to. Sometimes, the forecast is fine, but the way the business operates isn’t.

- Use a financial forecasting tool that covers all the key parts -organizes data, tracks performance to make forecasts more accurate and save time that would otherwise be spent crunching numbers.

With the right approach (and the right tool), forecasts become the guide that helps you make correct decisions.

Start financial projection with accuracy

Where does your business stand right now, and where is it headed?

These are the questions investors will ask and now, with a solid financial forecast knowledge, they are the questions you can confidently answer.

You know how much funding you need, where it will go, and when returns will start rolling in. Your budgets are backed by data, not guesswork. Your growth plans are grounded in numbers, not hopes.

With Bizplanr, you can build forecasts that show exactly how your business will grow and how you will keep it on track. And for even more advanced forecasting, Bizplanr offers a comprehensive business plan tool that includes 400+ sample plans and AI assistant.

Get Your Business Plan Ready In Minutes

Answer a few questions, and AI will generate a detailed business plan.

Frequently Asked Questions

What should I do if I don’t have historical financial data?

If you don’t have historical financial data, start with industry benchmarks and market research. Look at similar businesses in your industry and analyze their performance metrics. Use estimates based on market trends, pricing strategies, and expected expenses. Focus on being realistic and refine your projections as actual data becomes available.

Can I use financial projections for internal planning, or are they only for investors?

Financial projections are useful for both internal planning and investor presentations. Internally, they help with budgeting, setting goals, managing cash flow, and preparing for risks. For investors, they show the business’s financial potential and ability to grow, making them an important part of funding proposals.

How often should I update my financial projections?

Update your financial projections regularly - monthly, quarterly, or whenever major changes occur. Changes in sales, expenses, market conditions, or business strategies should also trigger updates.

What do I do if my projections don’t match actual performance?

If your projections don’t match actual performance, review the numbers to find out why. Look for gaps in assumptions, unexpected expenses, or changes in revenue patterns. Adjust your projections based on what you’ve learned and focus on fixing any operational issues that caused the differences.