So, you’re thinking about starting a holding company?

Well, it’s a smart way to bring all your ventures under one roof—whether you’re managing multiple businesses, investing in new ones, or planning for long-term growth.

But as simple as the idea sounds, making it work takes more than just paperwork. You’ll need a clear plan that helps you map out what your holding company owns, how it’ll operate, and where you want to take it.

Wondering how to draft a plan?

No worries; this holding company business plan sample is here to help you.

Holding Company Business Plan Sample

Here’s the Aurevia Capital Group business plan example to help you better understand how to create a clear and complete holding company business plan that wins investors. Let’s dive right in!

1. Executive Summary

Aurevia Capital Group is a privately held holding company based in Charlotte, North Carolina. We focus on acquiring and supporting a mix of businesses in real estate, technology, healthcare, logistics, and financial services. Rather than engaging in day-to-day operations, Aurevia provides strategic oversight, capital allocation, and operational support to its subsidiaries. By building a network of strong, complementary businesses, we create long-term value and ensure each one has the tools and leadership to succeed.

Vision

To become a respected name in private investments by helping strong businesses grow smarter and go further through strategic support and long-term partnerships.

Ideal Customers

We work with a mix of people and organizations who need capital, guidance, or both. Our ideal customers include:

- Business owners who are ready to retire or sell their business and want someone they can trust to take it forward

- Small to mid-sized companies need funding or operational support to grow.

- Investors who want access to a broad, professionally managed portfolio.

- Corporate clients who use the services provided by our portfolio companies (like real estate, tech, or logistics).

Unique Selling Points (USPs)

Aurevia Capital Group stands out from other holding companies as:

- We don’t just buy businesses—we help them thrive.

- We handle legal, HR, finance, and IT support, so the businesses we own can stay focused on their core work—serving customers and growing their operations.

- Our portfolio spans different industries, which reduces risk and creates smart partnerships between companies we own.

- We’re long-term partners, not short-term flippers.

Financial Highlights

We’re currently seeking $1.2 million in funding to support our first few business purchases, build out our internal team, and strengthen the systems we need to manage our portfolio. Further, we expect to see steady growth in revenue and profitability within the first 3 years as we bring more companies under our wing and help them perform better.

Liking the plan you're reading? It's AI generated.

Generate Your Own Using Bizplanr AI

2. Business Overview

Aurevia Capital Group is a private holding company based in Charlotte, North Carolina. We focus on buying and growing small to mid-sized businesses across real estate, technology, healthcare, logistics, and financial services.

Instead of running the day-to-day operations of each company, we focus on the big picture. We support our businesses by providing capital, strategy, and operational help—so they can grow faster and smarter. Our goal is to build a strong group of businesses that work well together and bring long-term value to everyone involved.

We believe in finding companies with great potential, giving them the tools and leadership they need to succeed, and letting their teams focus on what they do best.

Mission

To buy and support promising companies, helping them grow with smart strategy, strong leadership, and long-term planning.

Core Values

At Aurevia Capital Group, we run our business based on these key values:

- Trust – We build lasting relationships with honesty and transparency.

- Partnership – We treat our companies like partners, not just assets.

- Growth – We focus on steady, long-term value for every business we own.

- Excellence – We aim to bring top-level guidance and resources to every company in our portfolio.

- Simplicity – We make complex processes easier, so founders and teams can focus on what matters.

Business Model

Aurevia Capital Group is a privately owned company that makes money by investing in businesses and helping them grow. We buy companies or take a large ownership stake, then support them with things like legal, HR, finance, and IT. We also own and manage real estate as part of our portfolio.

Revenue comes from the profits of our portfolio companies, real estate income, and equity growth over time.

Future Goals

At Aurevia Capital Group, we aim to:

- Buy strong, scalable businesses in high-potential industries.

- Become a trusted partner for business owners looking to sell or grow.

- Build a diverse and stable portfolio that supports each company’s growth.

- Use smart branding, networking, and partnerships to expand our presence nationwide.

3. Market Analysis

Industry Overview

The private investment and holding company space has been gaining a lot of attention, especially in the U.S., where more small to mid-sized businesses are looking for capital, growth support, or exit strategies. As more long-time business owners approach retirement and begin stepping away from their companies, there's a growing need for firms that can step in—not just with money, but with guidance.

Also, industries like healthcare, tech, logistics, and financial services are growing fast. These are the same areas Aurevia Capital focuses on, making now a great time to build a strong, diverse portfolio.

Target Market

Aurevia Capital Group mainly serves these groups:

- Small and mid-sized business owners – Owners looking to sell or partner with a company that can help them scale or exit smoothly.

- Founders seeking succession support – Entrepreneurs who want to retire or move on but still care about their company’s future.

- Private investors – People or firms that want to invest in a solid, professionally-managed portfolio without doing the heavy lifting.

- Corporate clients – Companies that use services offered by Aurevia’s subsidiaries (like tech consulting, staffing, logistics, etc.).

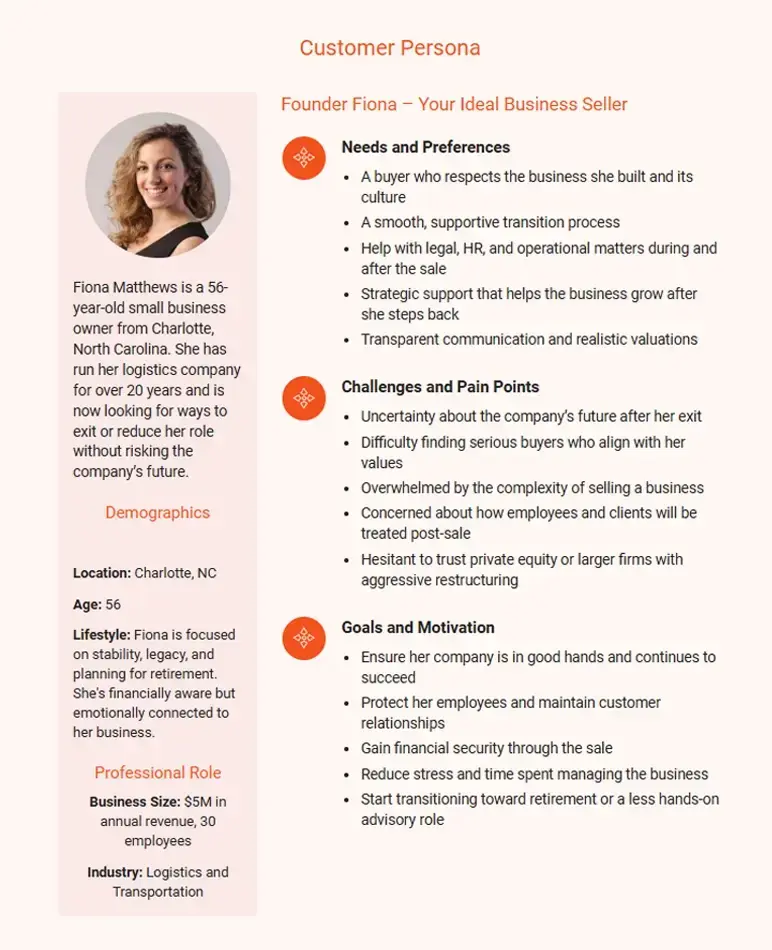

Here’s a detailed customer persona we’ve created to better understand our target audience and align our investment and support approach to their needs.

Competitive Analysis

This space is definitely competitive. Several big players do something similar, but most of them operate at a much larger scale or focus only on one sector.

Key Competitors

Aurevia Capital Group focuses on small to mid-sized businesses, but we share the space with several larger, well-known investment firms. Here’s a look at key firms in our space and how we differ.

- Berkshire Hathaway Inc.

A massive conglomerate known for buying solid companies and letting them run independently. It’s great at what it does, but it operates at a much higher level than most small businesses can reach. - Icahn Enterprises

Known for aggressive investing and turnaround strategies. Often targets struggling companies for value investing. - Leucadia National Corporation

Has a wide range of investments, especially in finance. More of a financial investor than an operations partner. - Brookfield Asset Management

A global firm focused mostly on real estate, infrastructure, and energy. Very institutional and less involved with small private businesses. - Crescent Growth Capital

Works on structured finance and tax credit investments. Not a direct competitor, but still in the broader investment ecosystem.

Competitive Edge

Aurevia Capital Group stands out by offering personalized support and strategic guidance that larger holding companies often miss. We focus on building strong relationships with business owners and providing customized solutions such as operational support, legal and HR help, and strategic growth planning. Our hands-on approach and commitment to long-term partnerships make us a trusted choice for founders looking to exit, scale, or stabilize their businesses.

SWOT Analysis

4. Services Offered

Aurevia Capital Group provides a range of strategic services designed to support the growth and stability of the companies we acquire and manage. Everything we do is built around helping businesses thrive with the right tools, leadership, and resources.

Key Offerings

| Service | Simple Description |

|---|---|

| 1) Business purchase & Investment | We buy small to mid-sized businesses and help them grow, while keeping what makes them special. |

| 2) Business guidance & support | We help business owners make better decisions, set goals, and grow their companies with clear advice and support. |

| 3) Operations & back-office support | We take care of things like HR, finance, IT, and legal work so businesses can focus on running and growing. |

| 4) Real estate management | We own and manage buildings and properties used by our companies or held for long-term investment. |

| 5) Portfolio services (writes by subsidiary) | Some of our companies offer services like tech help, staffing, or logistics. We support them so they can grow and reach more customers. |

5. Marketing Strategies

Aurevia Capital Group will use a mix of personalized outreach, digital visibility, and strong relationships to connect with business owners, investors, and partners. The focus is on being approachable, professional, and clear about what we do and how we help.

Digital Presence

We’ll build a clean, professional website that shows who we are and how to connect. It’ll include real examples, company updates, and insights. Also, we’ll stay active on LinkedIn and other platforms where business owners are. Our posts will be simple, useful, and easy to relate to.

Content & Thought Leadership

We’ll share articles, guides, and interviews that actually help. Topics will cover things business owners care about, like selling or scaling. No fluff—just honest advice from real experiences.

Owner Education & Events

We’ll host friendly webinars and small sessions for business owners. The goal is to teach, not pitch—think exit planning, growth tips, real talk. It’s also a way to meet owners who might need us now or later

Referral Partnerships

We’ll build strong relationships with people who already work closely with business owners, like accountants, attorneys, brokers, and consultants.

When they come across an owner thinking about selling or finding a growth partner, we want Aurevia to be the first name that comes to mind. We’ll make it easy and rewarding for them to refer deals our way.

Direct Outreach & Networking

Sometimes, the best way to find great companies is still the personal way. We’ll attend industry events, speak at small business panels, and reach out directly to owners who seem like a great fit.

We’re not into pressure—we believe honest, respectful conversations open more doors than pushy tactics ever could.

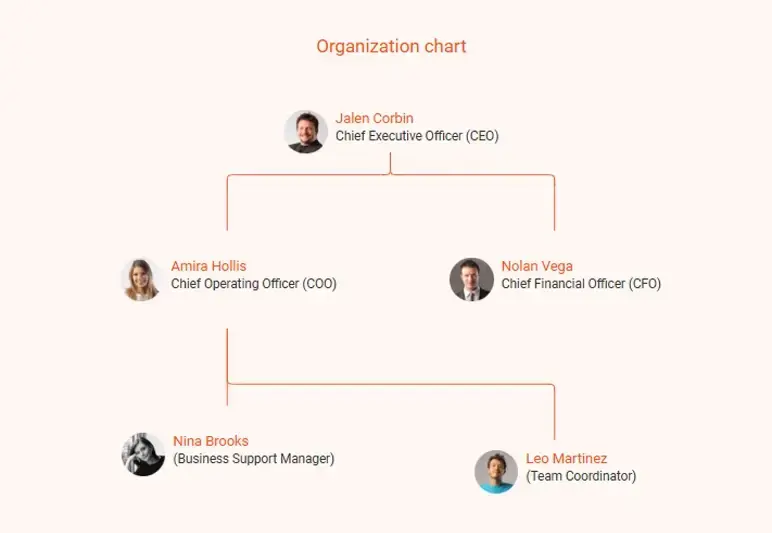

6. Management Team

Aurevia Capital Group is structured as a Limited Liability Company (LLC). This structure provides flexibility in management and operations while also protecting the personal assets of its owner and investors. As a privately held holding company, Aurevia oversees a growing portfolio of businesses through strategic ownership and guidance, not day-to-day management.

Key Management Team

The leadership team at Aurevia brings a strong mix of experience in acquisitions, finance, operations, and strategic planning. Each member plays a critical role in growing the portfolio and supporting its companies.

Jalen Corbin – Chief Executive Officer (CEO/Owner)

Jalen is the founder and driving force behind Aurevia. He leads the company’s strategic vision, acquisition strategy, and investor relationships. With a sharp eye for opportunity, he focuses on building long-term value through smart investments and leadership.

Amira Hollis – Chief Operating Officer (COO)

Amira manages Aurevia’s day-to-day operations and works closely with the leadership teams of portfolio companies. She ensures each business is aligned with Aurevia’s goals and operates efficiently post-acquisition.

Nolan Vega – Chief Financial Officer (CFO)

Nolan oversees all financial planning, forecasting, and reporting for Aurevia and its holdings. He plays a key role in financial due diligence, funding strategy, and maintaining financial health across the group.

Organization Chart

7. Operations Plan

The operations plan explains how Aurevia Capital Group manages its day-to-day functions to discover new business opportunities, support its portfolio, and maintain efficient internal systems—all while staying lean and focused on long-term growth.

Office Setup and Hours

Aurevia operates from its main office at 8209 Summit Crest Boulevard, Suite 400, Charlotte, NC 28210. The space serves as the operational and strategic hub for leadership and internal teams.

- Standard hours: Monday to Friday, 9 AM – 6 PM

- Meetings with investors, partners, or sellers can be scheduled outside these hours when needed

- A hybrid work model allows flexibility for key team members

Staffing and Training

Aurevia maintains a small, focused leadership team. Rather than building a large staff, we invest in keeping our team trained and well-informed.

Ongoing training covers:

- Financial analysis and investment evaluation

- Compliance and legal updates in M&A( Mergers and Acquisitions)

- CRM and portfolio management tools

- Strategic leadership development

This helps the team stay sharp and supports business growth and company management.

Daily Operations

Though Aurevia doesn’t manage its subsidiaries’ daily operations, the internal team runs a structured, consistent workflow focused on strategy and support.

Our daily tasks include:

- Reviewing new acquisition opportunities and managing deal flow

- Overseeing financial performance and operational updates from subsidiaries

- Communicating with investors and preparing updates or reports

- Supporting acquired businesses with tools, systems, or compliance needs

- Planning internal growth and strategic initiatives

Technology and Tools

To stay efficient and scalable, Aurevia uses a range of modern tools:

- CRM software to track relationships with sellers, investors, and advisors

- Deal tracking tools for managing acquisition pipelines

- Cloud-based finance systems for budgets and reporting

- Secure file sharing for legal and compliance documentation

These tools help streamline operations and keep the team aligned and informed.

8. Financial Plan

The financial plan highlights Aurevia Capital Group’s projected financial performance over the next three years. The firm aims to drive sustainable growth through strategic acquisitions, efficient capital deployment, and operational optimization across its portfolio.

Income Statement

| Income Statement | Year 1 | Year 2 | Year 3 |

|---|---|---|---|

| Revenue | |||

| Investment Income | $250,000 | $500,000 | $900,000 |

| Subsidiary Service Rev. | $150,000 | $375,000 | $600,000 |

| Real Estate Income | $60,000 | $75,000 | $100,000 |

| Total Revenue | $460,000 | $950,000 | $1,600,000 |

| Operating Expenses | |||

| Payroll & Team Costs | $180,000 | $250,000 | $320,000 |

| Legal & Due Diligence | $100,000 | $80,000 | $60,000 |

| Marketing & Branding | $70,000 | $90,000 | $100,000 |

| Admin & Infrastructure | $60,000 | $70,000 | $80,000 |

| Depreciation | $15,000 | $20,000 | $25,000 |

| Other Operating Exp. | $30,000 | $50,000 | $65,000 |

| Total Expenses | $455,000 | $560,000 | $650,000 |

| EBITDA | $5,000 | $390,000 | $950,000 |

| Interest Expense | $10,000 | $20,000 | $25,000 |

| Taxes (20%) | $0 | $74,000 | $185,000 |

| Net Income | -5,000 | $296,000 | $740,000 |

Cash Flow Statement

| Cash Flow Statement | Year 1 | Year 2 | Year 3 |

|---|---|---|---|

| Operating Cash Flow | |||

| Net Income | -$5,000 | $296,000 | $740,000 |

| Depreciation | $15,000 | $20,000 | $25,000 |

| Change in Working Capital | -$30,000 | -$20,000 | -$40,000 |

| Net Cash from Ops | -$20,000 | $296,000 | $725,000 |

| Investing Activities | |||

| Business Acquisitions | -$700,000 | -$400,000 | -$300,000 |

| Asset Purchases | -$50,000 | -$75,000 | -$100,000 |

| Net Cash from Investing | -$750,000 | -$475,000 | -$400,000 |

| Financing Activities | |||

| Equity Raised | $1,200,000 | $0 | $0 |

| Debt Raised / Repaid | $100,000 | $0 | -$50,000 |

| Net Cash from Financing | $1,300,000 | $0 | -$50,000 |

| Net Cash Flow | $530,000 | -$179,000 | $275,000 |

| Opening Cash Balance | $0 | $530,000 | $351,000 |

| Closing Cash Balance | $530,000 | $351,000 | $626,000 |

Balance Sheet

| Balance Sheet | Year 1 | Year 2 | Year 3 |

|---|---|---|---|

| Assets | |||

| Cash | $530,000 | $351,000 | $626,000 |

| Accounts Receivable | $40,000 | $70,000 | $110,000 |

| Fixed Assets (net) | $150,000 | $200,000 | $270,000 |

| Investment in Subsidiaries | $700,000 | $1,100,000 | $1,400,000 |

| Total Assets | $1,420,000 | $1,721,000 | $2,406,000 |

| Liabilities | |||

| Accounts Payable | $30,000 | $50,000 | $60,000 |

| Long-Term Debt | $100,000 | $100,000 | $50,000 |

| Taxes Payable | $0 | $74,000 | $185,000 |

| Total Liabilities | $130,000 | $224,000 | $295,000 |

| Equity | |||

| Founder's Equity | $1,200,000 | $1,200,000 | $1,200,000 |

| Retained Earnings | -$5,000 | $297,000 | $911,000 |

| Total Equity | $1,195,000 | $1,497,000 | $2,111,000 |

| Total Liabilities & Equity | $1,420,000 | $1,721,000 | $2,406,000 |

Funding Requirement

Aurevia Capital Group is seeking $1.2 million in growth capital to support its initial acquisitions, build operational infrastructure, and scale its leadership team for long-term portfolio development. Here’s a detailed breakdown:

| Use of Funds | Amount (USD) |

|---|---|

| Initial Business Acquisitions | $700,000 |

| Team Expansion & Strategic Hiring | $200,000 |

| Infrastructure & Systems Setup | $150,000 |

| Legal & Structuring Costs | $80,000 |

| Branding & Marketing | $70,000 |

| Total Funding Requested | $1,200,000 |

9. Exit Strategy

Even though Aurevia Capital Group is focused on growing and holding strong businesses for the long run, it’s smart to have a plan for how the company, or its investments, could be sold or transitioned in the future.

These exit options help make sure investors and stakeholders have ways to benefit from the company’s success when the time is right.

Possible Exit Options

- Selling a Business We Own

- Buyout by Business Owners

- Merging with Another Company

- Going Public (IPO)

Each of these options provides flexibility based on market conditions and portfolio performance. Aurevia remains open to the path that offers the greatest value to its partners and investors. Our long-term approach doesn’t rule out a smart, well-timed exit when the opportunity is right.

Download Free Holding Company Business Plan Template

So, ready to create your holding company business plan but not sure where to begin? No worries! Download our free holding company business plan template to help you take the first step with ease.

This template walks you through each section of a comprehensive business plan, making the process simple and hassle-free. You can also customize it to match the unique goals of your holding company, whether you're focused on acquisitions, portfolio management, or long-term value creation.

Conclusion

Now that you’ve explored the sample business plan, creating a professional plan for your holding company should feel much easier.

However, if you’re still unsure about the details or looking for a simple way to put your plan together, try using our AI business plan generator. It makes the process easy and helps you include all the essential sections.

So, don’t wait—start your holding company business plan today!

Get Your Business Plan Ready In Minutes

Answer a few questions, and AI will generate a detailed business plan.

Frequently Asked Questions

What should be included in a successful holding company business plan?

A successful holding company business plan should cover:

- Executive Summary

- Business Overview

- Market Analysis

- Management Team

- Acquisition Strategy

- Products and Services

- Operations Plan

- Financial Plan

- Exit Strategy

Why do I conduct an industry analysis for writing an investment holding company business plan?

Industry analysis helps you see the big picture before making any moves. It tells you which sectors are growing, where the risks are hiding, and who you’ll be competing with. For a holding company, this insight is crucial—it ensures you’re putting your time, money, and energy into industries that actually have long-term potential. In short, it helps you make smarter, more confident investment decisions.

Can a business plan help me secure funding for my holding company?

Yes. A strong business plan shows potential investors or lenders how your company will grow, manage risk, and make money. It builds confidence in your strategy and increases your chances of getting funding.

Where do I find a free holding company business plan sample PDF?

You can find a variety of holding company business plan templates and downloadable PDFs on platforms like Upmetrics, LivePlan, Bplans, PlanGrow Lab, and SCORE.

How much does it cost to write a complete real estate holding company business plan?

The cost to write a holding company business plan can vary greatly from $7 (or even free) to $25,000, depending on the plan writing method, type of business plan, and the level of detail you need.