Because of high living costs and inflation, many people can’t afford to buy a home. That’s why real estate investment businesses that offer affordable rental homes are in demand.

Starting this business isn’t just about owning properties—you also need a clear plan to buy, renovate, and manage rental units well.

Here’s an example of PrimeStone Realty Group, which plans to buy and renovate a 12-unit apartment building. The founders made this plan to get a $1,050,000 loan and show how the business will earn rent, handle daily operations, and grow its properties.

If you’re planning your own real estate investment business, this example can guide you in structuring your ideas and preparing for lenders or investors.

Real Estate Investment Business Plan (PrimeStone Realty Group)

1. Executive Summary

Nearly half of renters in Nashville spend more than 30% of their income on housing, showing strong demand for clean, reasonably priced rental homes. PrimeStone Realty Group is an established real estate investment business focused on meeting this demand by acquiring and improving small multifamily properties.

To date, the company has a proven track record of comparable renovation projects. It renovated and leased a 4-unit building at one location and later an 8-unit building at another. Both properties were upgraded, fully rented, and stabilized as long-term rental properties. This experience provides a strong foundation for the company’s next acquisition.

Based on this track record, PrimeStone now plans to purchase and renovate a 12-unit apartment building located at 1714 Porter Road, Nashville, TN 37206, in East Nashville.

This property includes:

- 8 one-bed / one-bath units

- 4 two-bed / one-bath units

The renovation plan includes light to moderate improvements such as new flooring, fresh paint, updated fixtures, and refreshed kitchens and bathrooms. Exterior work will include basic landscaping and small parking repairs. These upgrades will improve the quality of the units while keeping rents below nearby luxury apartments.

The property is intended for renters who want modern, fairly priced homes. Target tenants include hospital staff from Vanderbilt University Medical Center and Ascension Saint Thomas, downtown workers with short commutes, creative and remote workers relocating to East Nashville, small families or roommates, and long-term local renters priced out of newer luxury buildings.

To complete the purchase and renovations, PrimeStone is requesting a $1,050,000 loan from Truist Bank under its Commercial Real Estate Investment Program. The loan has a 7.2% fixed rate for seven years with a 25-year amortization. The owners will invest their own funds as well:

- Isabella Martinez: $345,000

- Ryan Cole: $230,000

- Total equity: $575,000

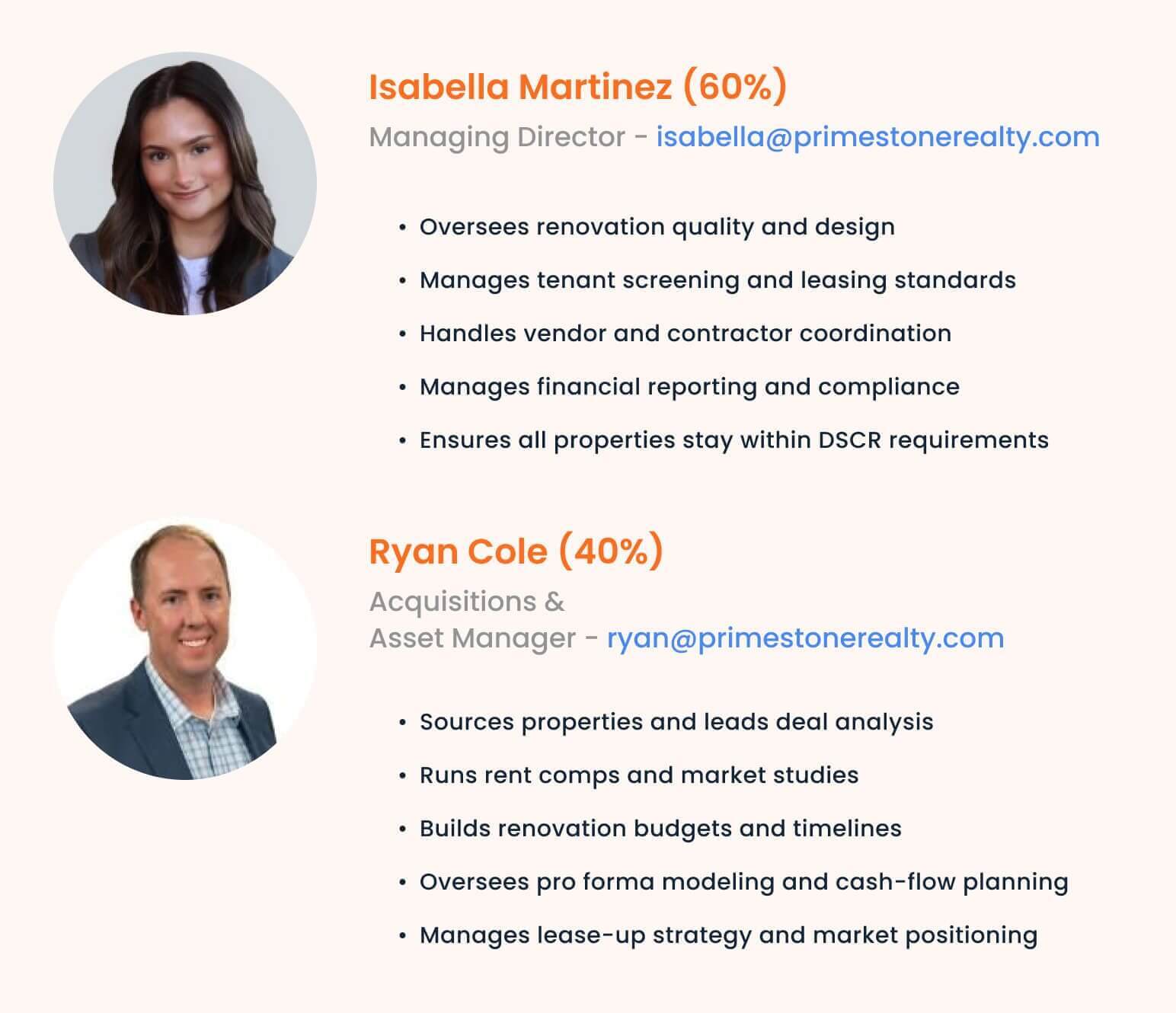

PrimeStone is owned by Isabella Martinez (60%) and Ryan Cole (40%). Isabella handles financial review and ongoing property oversight. Ryan manages acquisitions, inspections, and leasing. Both owners are closely involved in daily operations to ensure the work is done properly and residents receive excellent customer service.

The mission of PrimeStone is to provide safe, updated, and fairly priced homes backed by excellent customer service and transparent communication. The company’s long-term vision is to build a stable portfolio of value-added multifamily properties across Nashville—housing that benefits both the community and the business through steady income and long-term equity gains.

At full occupancy, the building can generate up to $18,600 per month in rental income. During the early lease-up period, the business expects a gradual increase in occupied units rather than immediate full occupancy.

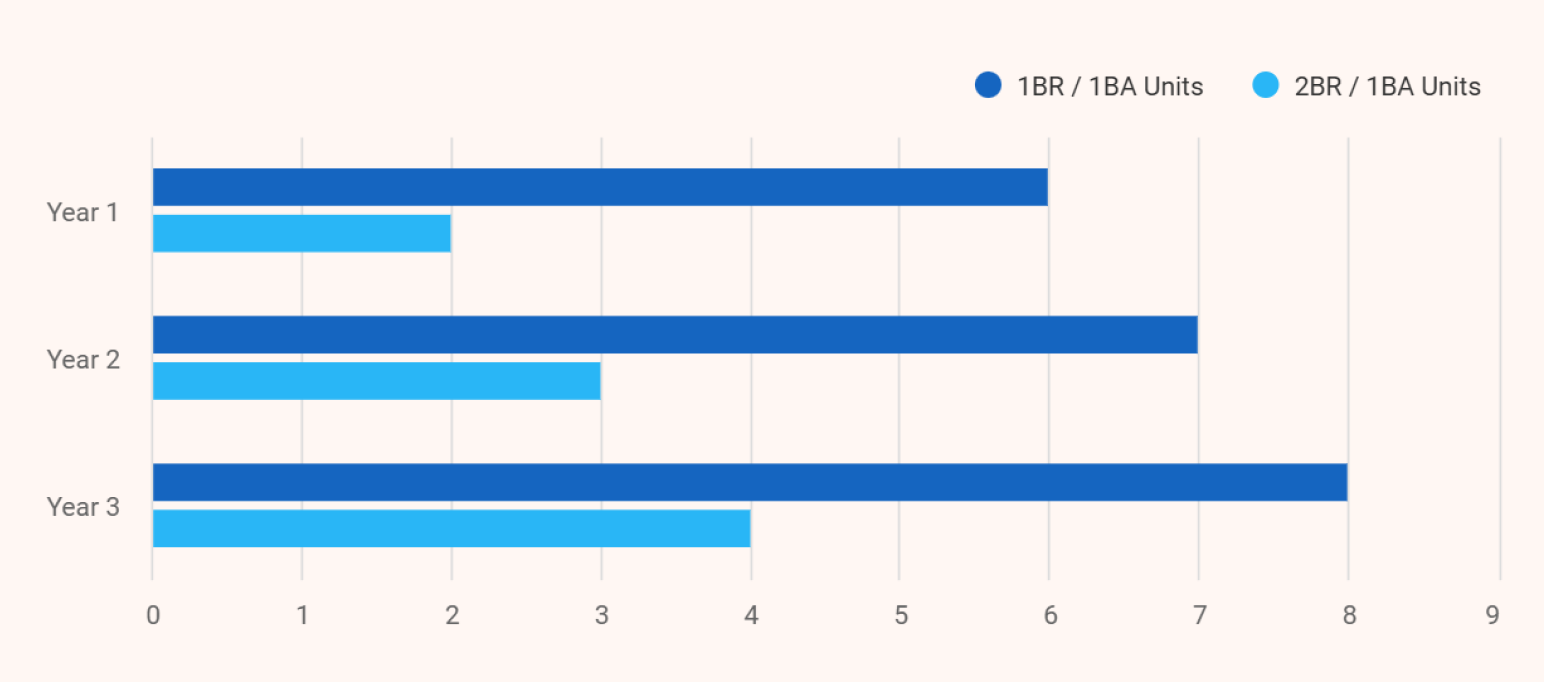

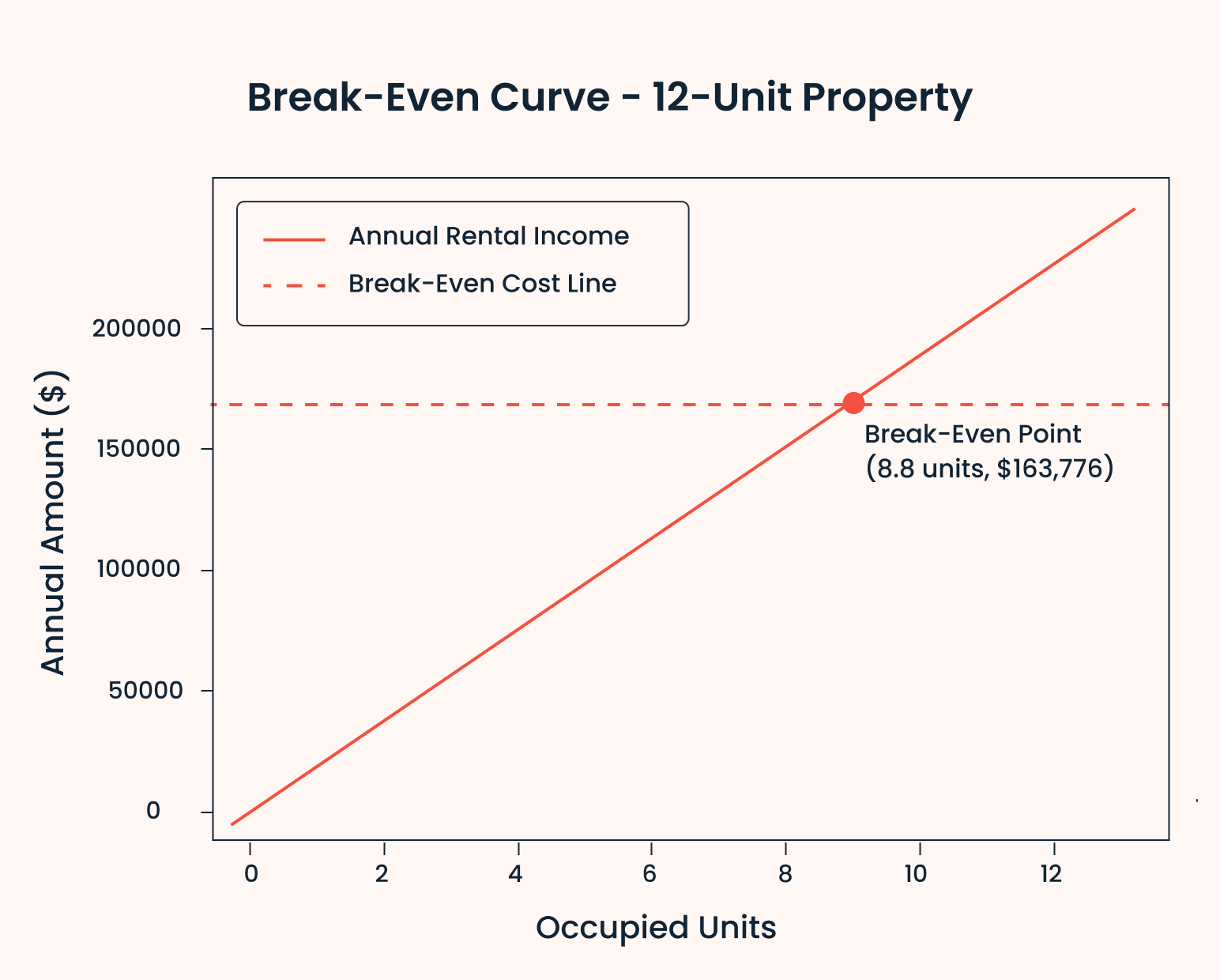

In the first year, the plan assumes 8 of the 12 units are occupied as renovations are completed and leasing begins. In the second year, occupancy is expected to increase to 10 units, and by the third year, the property is projected to stabilize at 12 occupied units, which is consistent with similar properties PrimeStone has managed in the past. The property will reach break-even by early Year 2.

Certainly! Here is the HTML code for the table shown in the images, using only the tags you specified.HTML

| Year | Units Occupied | 1BR / 1BA Units | 2BR / 1BA Units |

|---|---|---|---|

| Year 1 | 8 units | 6 | 2 |

| Year 2 | 10 units | 7 | 3 |

| Year 3 | 12 units | 8 | 4 |

Even with these realistic lease-up levels, the property is expected to generate enough income to comfortably cover the estimated monthly loan payment of about $7,648, allowing the business to maintain positive cash flow as the property stabilizes.

2. Company Overview

PrimeStone Realty Group is a real estate investment company focused on buying and improving small and mid-size multifamily properties in Nashville. Our corporate office is located at 512 East Morehead Street, Suite 420, and our operating market is Nashville, Tennessee, with a focus on neighborhoods such as East Nashville, The Nations, Wedgewood-Houston, and Hermitage.

These areas are known for:

- Strong renter demand

- High absorption of renovated units

- Steady population growth

- Walkable neighborhoods with growing retail

- Reliable demand from healthcare workers, creatives, and young professionals

PrimeStone is a well-established company. It has already renovated a 4-unit building in The Nations and an 8-unit building in Hermitage. Both buildings were upgraded with new kitchens, bathrooms, floors, and some landscaping. They quickly rented out, with 1-bedroom units around $1,500 and 2-bedroom units around $1,800 per month. The tenants include young professionals and small families. This past experience gives PrimeStone a strong foundation for the Porter Road project and future growth.

We operate as a Limited Liability Company (LLC). This structure protects the owners’ personal assets, keeps financial records clear, and supports long-term growth as we add more properties to the portfolio.

Business Model

PrimeStone follows a clear and consistent investment approach:

- Purchase underperforming or outdated multifamily properties

- Complete targeted renovations, mainly interior upgrades

- Reposition units at reasonable market rents

- Hold properties long term for reliable cash flow and growing equity

The company focuses on buildings where renovations create strong value without large construction risks. The upgrades emphasize clean interiors, modern finishes, and smart updates that tenants care about—avoiding expensive luxury amenities.

Ownership

PrimeStone is owned and operated by:

Both owners are actively involved in day-to-day operations to ensure quality management and excellent service for residents.

Competitive Positioning

PrimeStone offers “renovated Class B” homes that balance quality and affordability. Instead of competing with new luxury buildings that charge higher rents for pools, clubhouses, and concierge services, PrimeStone focuses on:

- Clean, modern interiors

- Fair monthly rent

- Fast lease-up

- Lower operating costs

- Strong tenant retention

This approach makes PrimeStone properties attractive to renters who want updated units without paying for expensive amenities.

Business Goals

Short-Term Goals:

- Complete full property renovations under four months

- Lease at least 8 of the 12 units within the first year

- Stabilize occupancy with positive cash flow

Long-Term Goals:

- Maintain high occupancy through strong management

- Grow NOI (Net Operating Income) year-over-year as units stabilize

- Acquire the next 16–20 unit property after 5–7 years of the current project

- Reach break-even by Year 2

3. Market Research

Nashville is growing fast, and the number of new homes hasn’t kept up with the people moving in. Almost half of renters in the city spend more than 30% of their income on housing, which shows a big need for reasonably priced rental units like the ones PrimeStone offers.

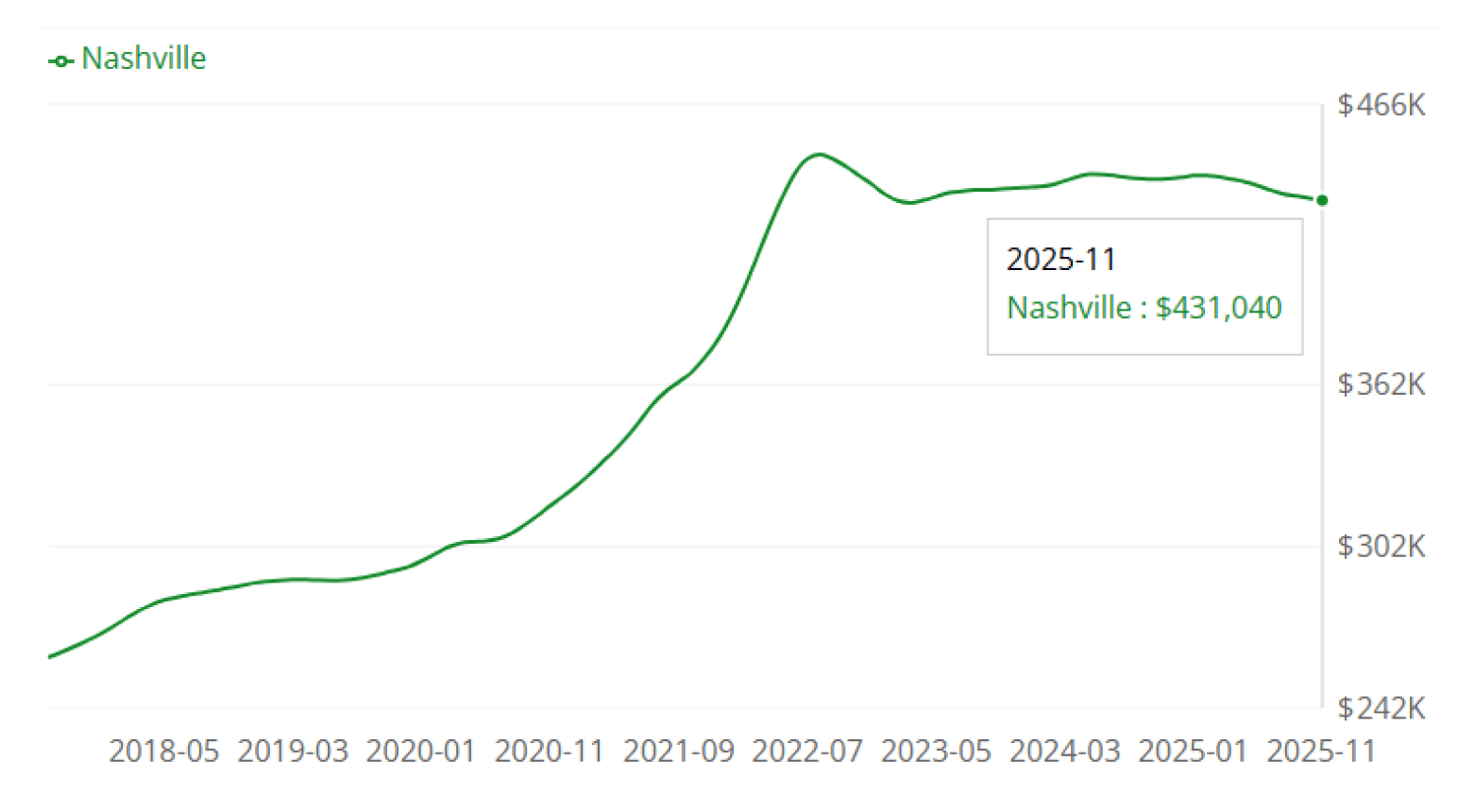

The city’s population has reached 704,963 in 2025, and many of these households have middle-income earnings. With a median household income of $75,197, most people cannot afford high-end luxury rents or buy a home—the average home value in the city is $431,040.

Multifamily demand remains very strong across Nashville. In June 2025, the average multifamily occupancy rate was 94.2%, meaning very few units stayed vacant for long. This creates a healthy environment for landlords offering renovated, reasonably priced apartments.

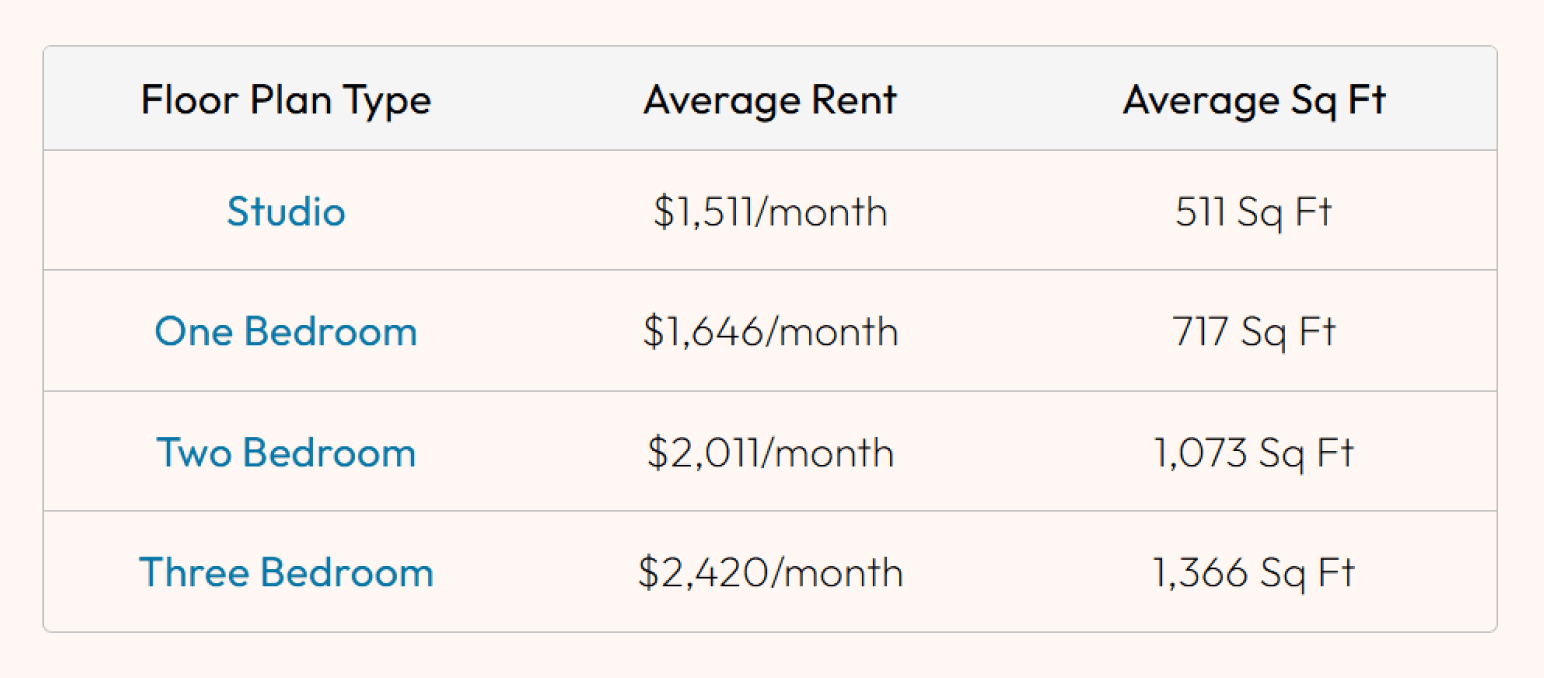

As of December 2025, the average rent in Nashville is:

(Source)

PrimeStone’s Porter Road property is perfect for people who want affordable, updated housing. With modern interiors and fair rents, the building is set to attract tenants quickly, stay full, and provide steady long-term performance.

Target Tenents

PrimeStone’s Porter Road property is designed for Nashville’s key rental customers—people who want updated, affordable, and convenient homes that fit their lifestyles and budgets.

| Target Renters | Description / Notes | What They Want |

|---|---|---|

| Hospital Staff | Employees at Vanderbilt University Medical Center, Ascension Saint Thomas, and other local healthcare facilities | Safe, clean, convenient units near work, easy to maintain |

| Downtown Professionals | Office workers and other professionals seeking a short commute and modern, comfortable housing | Short commute, modern interiors, quiet environment |

| Creative Workers | Artists, designers, and other creatives relocating to East Nashville / Wedgewood-Houston | Trendy neighborhood, stylish interiors, flexible space for work or hobbies |

| Small Families & Roommates | Local families or groups looking for updated, reasonably priced apartments | Comfortable layouts, fair rent, access to parks, schools, and local shops |

By focusing on these groups, PrimeStone ensures that the Porter Road property attracts reliable tenants, leases quickly, and maintains high occupancy over the long term.

Comparable Properties

To understand where Porter Road fits in the Nashville market, here are some similar properties and what they offer.

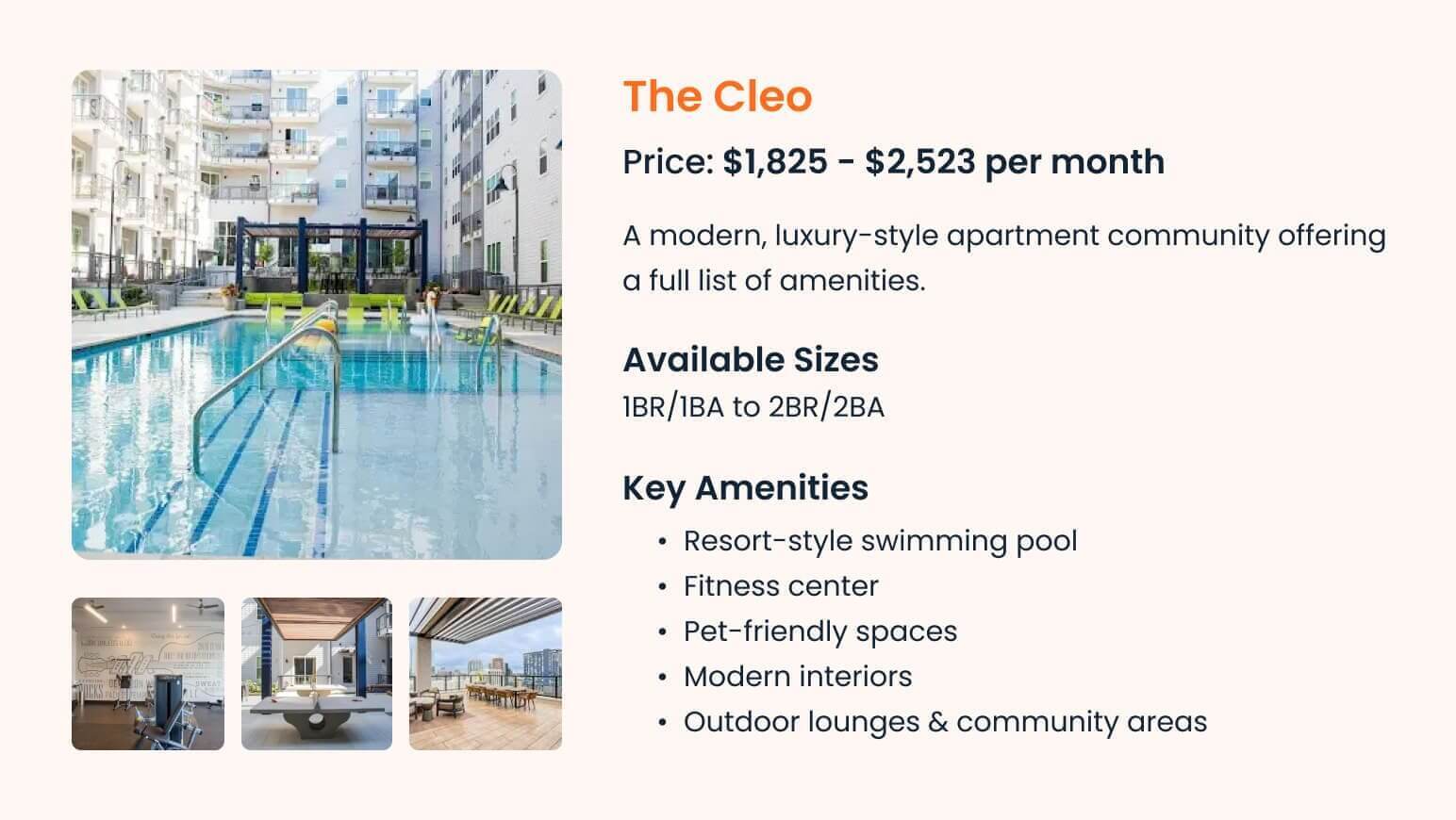

1. The Cleo

This property is about 2 miles from our property and offers higher-end apartments with modern finishes and more amenities.

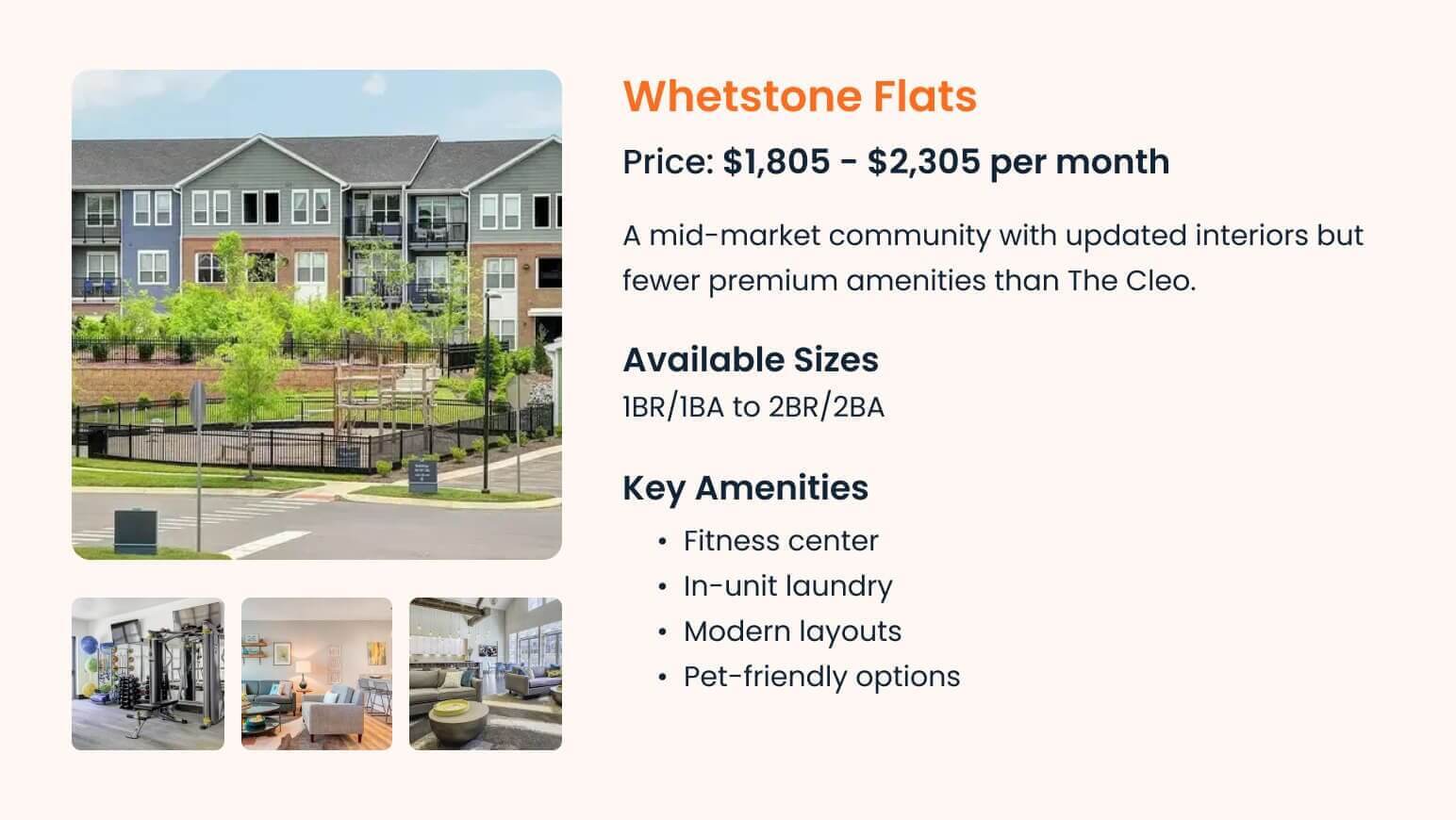

2. Whetstone Flats

This property is about 1.8 miles from our property and has updated units at mid-range rents.

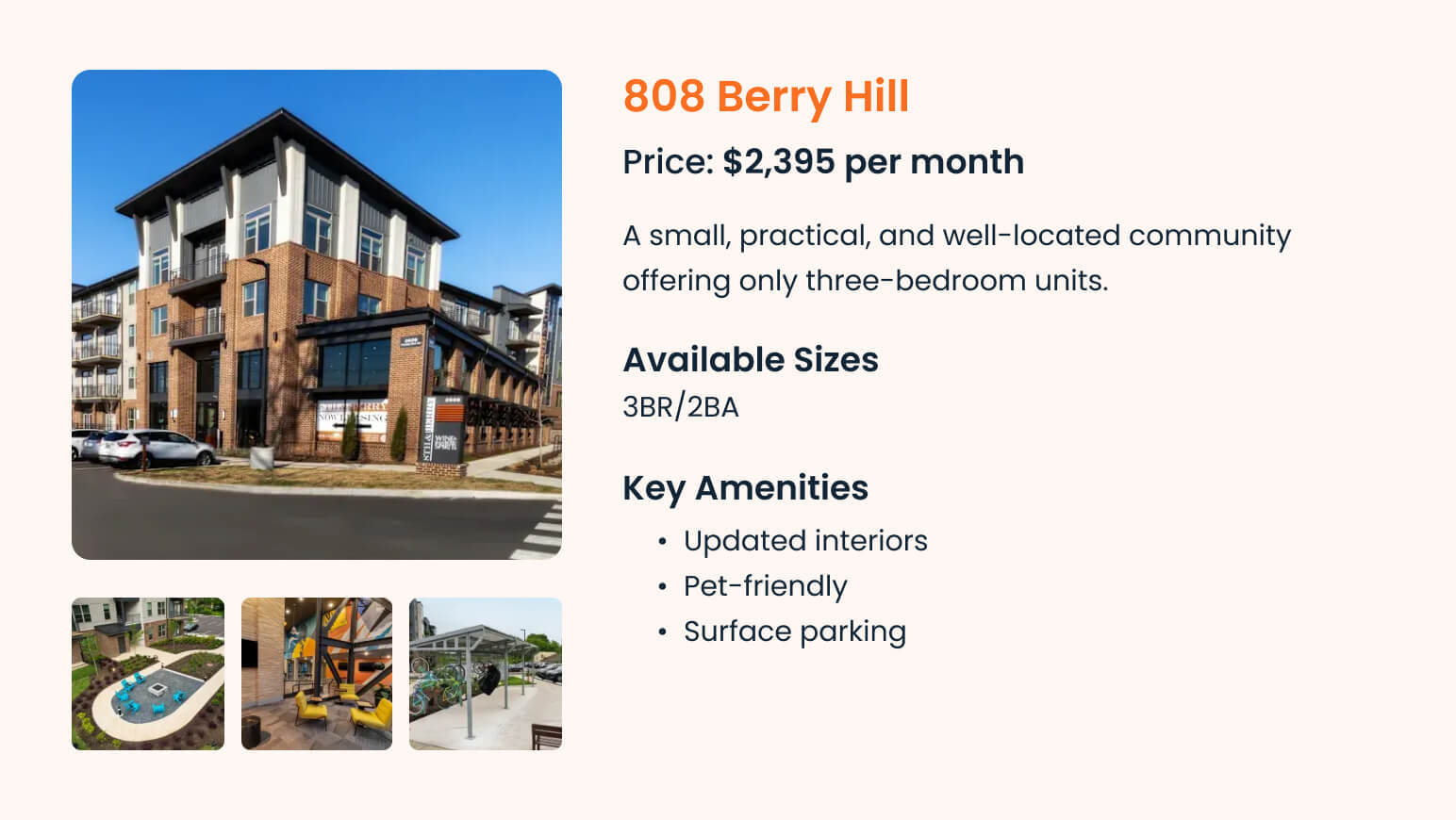

3. 808 Berry Hill

This property is about 2.3 miles from our property and offers larger three-bedroom units in a small community.

PrimeStone delivers updated, well-designed Class B units at honest prices, giving renters a modern home without paying for luxury extras.

4. Property Overview and Renovations Plan

Property address: 1714 Porter Road in East Nashville

Building Size: 12 units

- 8 × 1BR/1BA (640 sq ft)

- 4 × 2BR/1BA (820 sq ft)

The property is a masonry building built in the 1980s. It is close to restaurants, coffee shops, hospitals, parks, grocery stores, and main roads, making it convenient for daily living and commuting. Easy access to public transportation adds to the property’s appeal for renters.

12 parking lots are also available for tenants. Each unit has a separate entrance for more privacy and less shared maintenance.

Pre-Renovation Condition

The property is occupied and operating, but it looks dated. Most issues are cosmetic, which makes it a good value-add opportunity.

| Area | Existing Condition |

|---|---|

| Flooring | Old vinyl and worn carpet |

| Lighting | Basic, outdated light fixtures |

| Countertops | Standard laminate surfaces |

| Appliances | Older white appliances |

| Cabinets | Faded and tired finishes |

| Bathroom Fixtures | Aging sinks, faucets, and hardware |

| Tubs & Showers | Standard fiberglass units |

| Paint | Dull interior paint throughout units |

| Landscaping | Minimal and overgrown in some areas |

| Parking Lot | Cracks and surface wear |

The property is not distressed, but the interiors are behind current renter expectations. With updates, the building can better match demand for clean, well-maintained Class B rentals.

Renovation Plan and Budget

PrimeStone plans light to moderate renovations focused on improving comfort, durability, and overall appearance without over-improving the property.

✅ Interior upgrades

✅ New flooring throughout units

✅ Modern light fixtures

✅ Updated cabinet finishes

✅ Durable countertops

✅ Refreshed bathrooms with new fixtures

✅ Fresh neutral paint

✅ Exterior and common area upgrades

✅ Parking lot patching and restriping

✅ Basic landscaping cleanup

✅ Exterior touch-ups and minor refinishing

The renovation budget is:

- 1-bedroom units: $17,000 per unit

- 2-bedroom units: $21,000 per unit

These updates are designed to support higher occupancy, reduce maintenance issues, and keep rents affordable.

Unit Layouts & Floor Plan

After renovations, units will offer clean, modern layouts designed for everyday living.

| 1BR/1BA (640 sq ft) | 2BR/1BA (820 sq ft) |

|---|---|

|

|

|

|

| Rent: $1,450/month | Rent: $1,750/month |

After Renovation Value (ARV)

After renovations are complete and all units are leased, the Porter Road property is expected to settle into steady operations. By Year 3, net operating income is projected to reach $148,300, reflecting normal rent levels and stabilized expenses.

Based on recent sales of renovated Class B apartment buildings in East Nashville, a property producing this level of income is estimated to be worth between $2.0 million and $2.2 million. The value increase comes from real improvements such as updated units, full occupancy, and consistent rent collections rather than short-term assumptions.

5. Operations & Staffing Plan

PrimeStone Realty Group uses a streamlined operating model built around internal management, a dedicated on-site maintenance technician, specialized vendors, and a tech-enabled property management workflow.

Staffing Plan

PrimeStone Realty Group uses a small, hands-on team. Core roles are handled by the owners, while day-to-day property needs are supported by a maintenance technician and outsourced services. This keeps costs controlled while ensuring smooth operations.

| Role | Main Responsibility | Payment |

|---|---|---|

| Managing Director (Isabella Martinez) | Oversees renovations, vendors, finances, and overall property operations | No salary taken until the property reaches full occupancy |

| Acquisitions & Asset Manager (Ryan Cole) | Handles property analysis, budgeting, leasing strategy, and performance tracking | No salary taken until the property reaches full occupancy |

| Full-Time Maintenance Technician | Manages repairs, unit turnovers, basic plumbing/electrical work, and property upkeep | $50,000 per year |

| Turnover Cleaning (Outsourced) | Deep cleaning of units between tenants | Paid per job |

| Leasing Agent (Contracted) | Unit showings, applications, and lease execution | 8% of the first month's rent |

Property Management, Insurance & Compliance

PrimeStone uses Buildium to manage day-to-day tasks at $160/month. The software handles online rent payments, digital leases, maintenance requests, expense tracking, renewals, and financial reporting. This keeps operations accurate and organized.

The property will be covered under a commercial multifamily insurance policy. This policy includes building coverage, liability protection, and loss-of-income coverage.

- Estimated cost: Approximately $8,200 per year.

PrimeStone follows all laws for owning and renting property at the local, state, and federal levels. Licenses are kept current, the property meets safety rules, and leases are clear and legal. This keeps risk low and operations running smoothly.

Maintenance Workflow

PrimeStone follows a clear and practical maintenance process to keep the property in good condition and avoid larger repair issues over time.

When tenants have an issue, they submit a work order through Buildium. The on-site maintenance technician responds within 24–48 hours. If a repair is more complex or requires licensing, the issue is passed to a qualified contractor.

To avoid breakdowns, preventive maintenance is done on a regular schedule:

- HVAC filters are changed every quarter

- Mechanical systems are checked twice a year

- Exterior pressure washing is done once a year

- Landscaping is maintained seasonally

When a unit turns over, the team prepares it quickly for the next tenant. This includes deep cleaning, small paint touch-ups, checking appliances, and fixing flooring if needed. This keeps units ready to rent and lowers empty time.

Leasing & Tenant Management

Leasing and tenant management are designed to be straightforward, fair, and efficient.

All applicants are checked for income, credit, rental history, and jobs. This makes sure renters can pay and are likely to stay longer.

The property is well-suited for:

- Medical staff working nearby

- Downtown Nashville workers

- Creative and remote professionals

- Roommates renting two-bedroom units

Once approved, leasing is handled digitally. Leases are signed online, deposits are collected electronically, and reminders are automated. This keeps the process fast and organized.

For renewals, rents are adjusted based on similar renovated Class B properties in the area. The focus is on keeping good tenants, limiting unnecessary rent jumps, and reducing move-out costs through fair pricing and good service.

Key Vendors and Local Partners

Along with the in-house maintenance role, PrimeStone works with trusted local vendors for specialized work. This keeps operations efficient while avoiding the cost of full-time specialists.

| Logo | Vendor Name | Type of Work |

|---|---|---|

|

Music City Remodels | Flooring, interior paint, kitchen, and bathroom upgrades |

|

Precision Air | HVAC repairs, servicing, and system checks |

|

Happy Hiller | Electrical fixes and plumbing repairs |

|

Nuveldy's | Unit turnover cleaning between tenants |

|

LawnWise | Lawn care, trimming, and basic landscaping |

6. Marketing & Leasing Strategy

PrimeStone uses a simple and practical marketing plan to lease units quickly and keep vacancy low. The focus is on platforms and partners that already bring strong renter demand in Nashville.

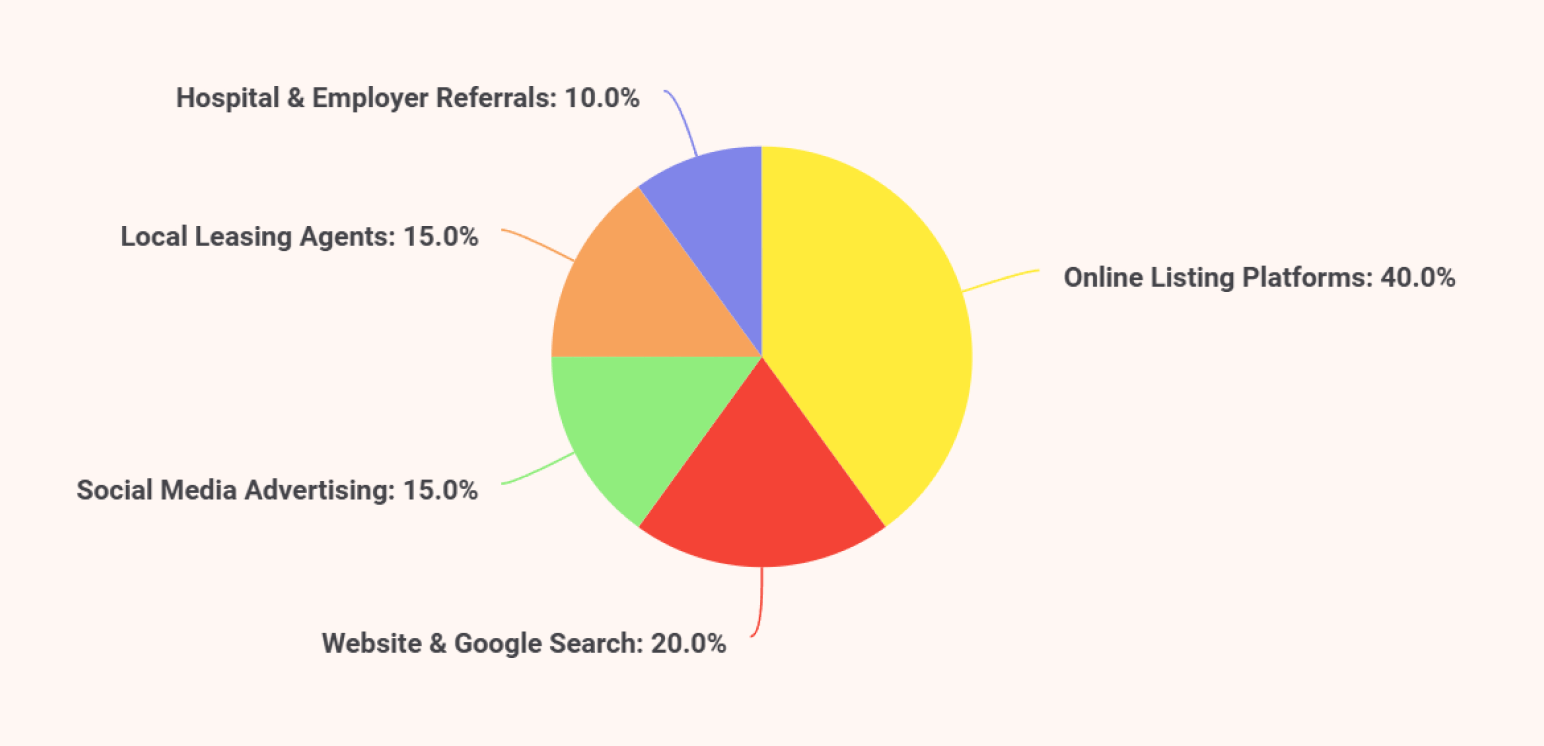

Marketing Channels

1. Online Listing Platforms

Most renters find the property through popular rental websites. Listings are posted on Apartments.com, Zillow, and HotPads. These sites bring steady interest from people looking for one- and two-bedroom apartments.

2. Website & Google Search

PrimeStone maintains a basic website with property details, availability, and contact forms. Google search and local SEO also help capture renters actively looking in East Nashville.

3. Social Media Advertising

Paid ads run on platforms like Facebook and Instagram. These ads target people working nearby, especially healthcare staff and young professionals looking to move into East Nashville.

4. Local Leasing Agents

Local real estate agents help rent out the property. They show it to potential tenants and bring in qualified renters, especially when the property is first available.

5. Hospital & Employer Referrals

PrimeStone works with hospital relocation contacts and local employers to reach medical staff and professionals moving into Nashville.

This mix of online listings, local support, and direct referrals helps maintain steady demand and smooth leasing activity.

Lease-Up Strategy

To ensure a strong start, PrimeStone focuses on attracting tenants quickly while keeping occupancy stable. The plan begins even before renovations are fully complete to generate early interest. Two units will be fully furnished, appealing to tenants who want move-in-ready homes.

Pre-Leasing Steps:

- Share photos of renovated units online to show upgrades

- Build a waiting list of potential tenants

- Run social media ads with “Coming Soon” messages

- Highlight the property’s location, modern interiors, and fair rents

Once the property is ready, the focus shifts to active leasing.

- Launch full listings on all major rental platforms

- Offer online self-scheduling for tours

- Process applications quickly and digitally

- Execute leases online for convenience

- Send automated reminders to keep tenants informed

PrimeStone offers move-in deals to make renting simple and attractive. New tenants can get a lower first month’s rent, pick flexible move-in dates, or choose a furnished unit for a small extra charge. These options help tenants settle in easily and stay longer.

7. Financial Projections

PrimeStone expects steady income from the 12-unit Porter Road property through rent. With full occupancy, the building can generate $18,600 per month, or $223,200 per year.

| Unit Type | Number of Units | Monthly Rent per Unit | Total Monthly Rent | Total Annual Rent |

|---|---|---|---|---|

| 1BR/1BA | 8 | $1,450 | $11,600 | $139,200 |

| 2BR/1BA | 4 | $1,750 | $7,000 | $84,000 |

| Total | 12 | - | $18,600 | $223,200 |

Total Project Cost

To buy and renovate the Porter Road property, PrimeStone has a clear budget plan:

| Uses of Funds | Amount |

|---|---|

| Purchase Price | $1,250,000 |

| Renovation Budget | $220,000 |

| Closing Costs | $32,000 |

| Lease-Up & Marketing | $12,000 |

| Software & Branding | $4,000 |

| Reserves (4 months P&I) | $28,000 |

| Total Uses | $1,546,000 |

| Equity Remainder (Contingency) | $79,000 |

This shows that all costs are covered for buying, fixing, marketing, and starting the property, with extra money set aside in case of unexpected expenses.

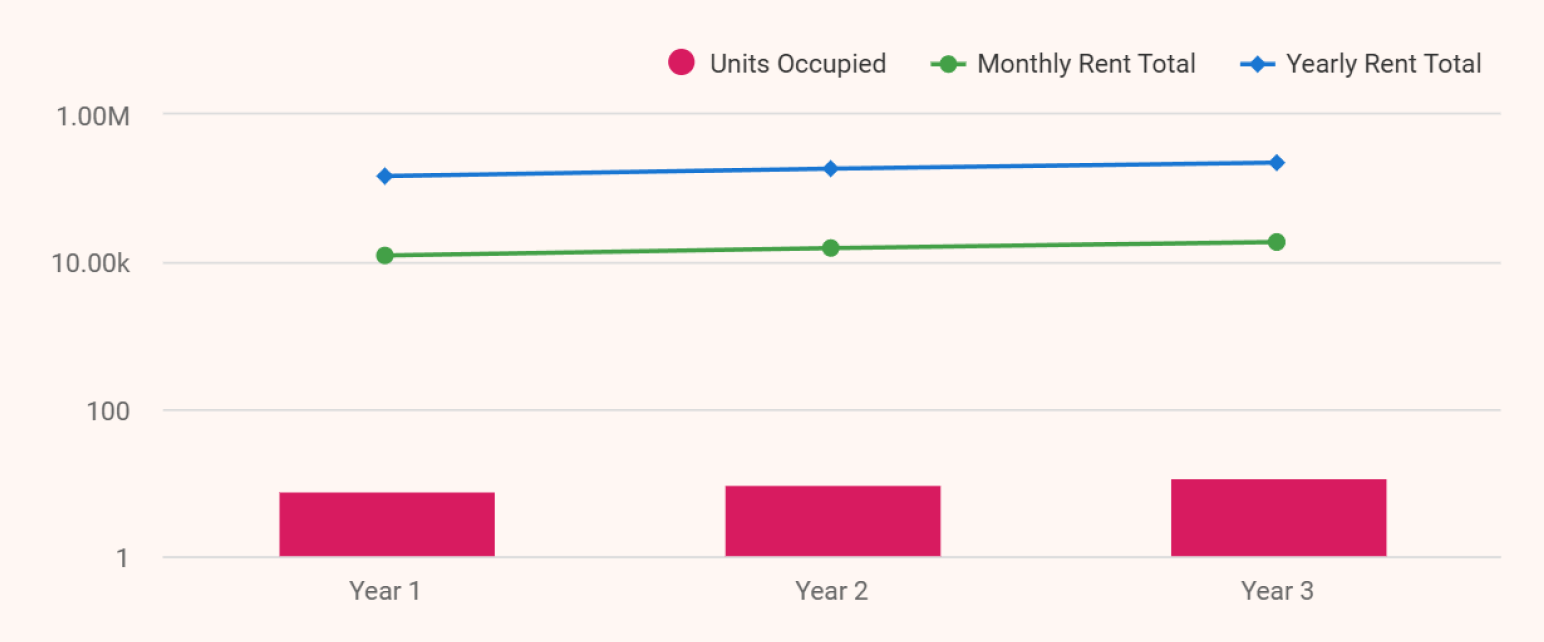

Revenue Projections

At the start, we’re not planning to raise rents until the building reaches full occupancy.

| Year | Units Occupied | 1BR / 1BA Units | 2BR / 1BA Units | Monthly Rent Total | Yearly Rent Total |

|---|---|---|---|---|---|

| Year 1 | 8 units | 6 | 2 | $12,200 | $146,400 |

| Year 2 | 10 units | 7 | 3 | $15,400 | $184,800 |

| Year 3 | 12 units | 8 | 4 | $18,600 | $223,200 |

Many real estate investors also earn extra income from pet fees or parking, but for now, this property will focus on regular rent only. After full occupancy is reached—or possibly after five years of operations—these additional charges may be introduced.

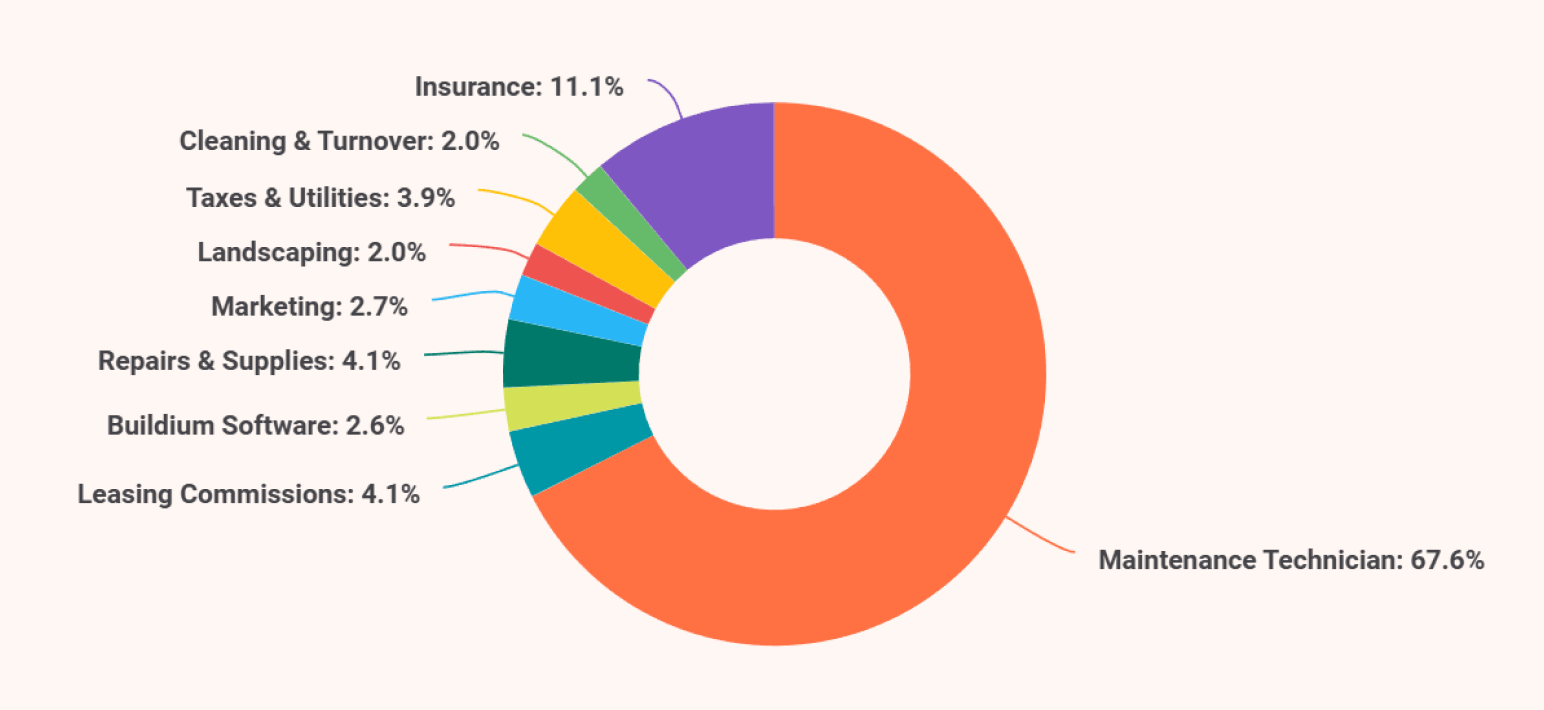

Operating Expenses

PrimeStone expects annual operating costs of about $72,000. These cover the day-to-day running of the property and ensure smooth operations without surprises.

| Category | Amount ($) |

|---|---|

| Maintenance Technician | $50,000 |

| Leasing Commissions | $3,000 |

| Buildium Software | $1,920 |

| Insurance | $8,200 |

| Repairs & Supplies | $3,000 |

| Marketing | $2,000 |

| Landscaping | $1,500 |

| Taxes & Utilities | $2,880 |

| Cleaning & Turnover | $1,500 |

| Total | $72,000 |

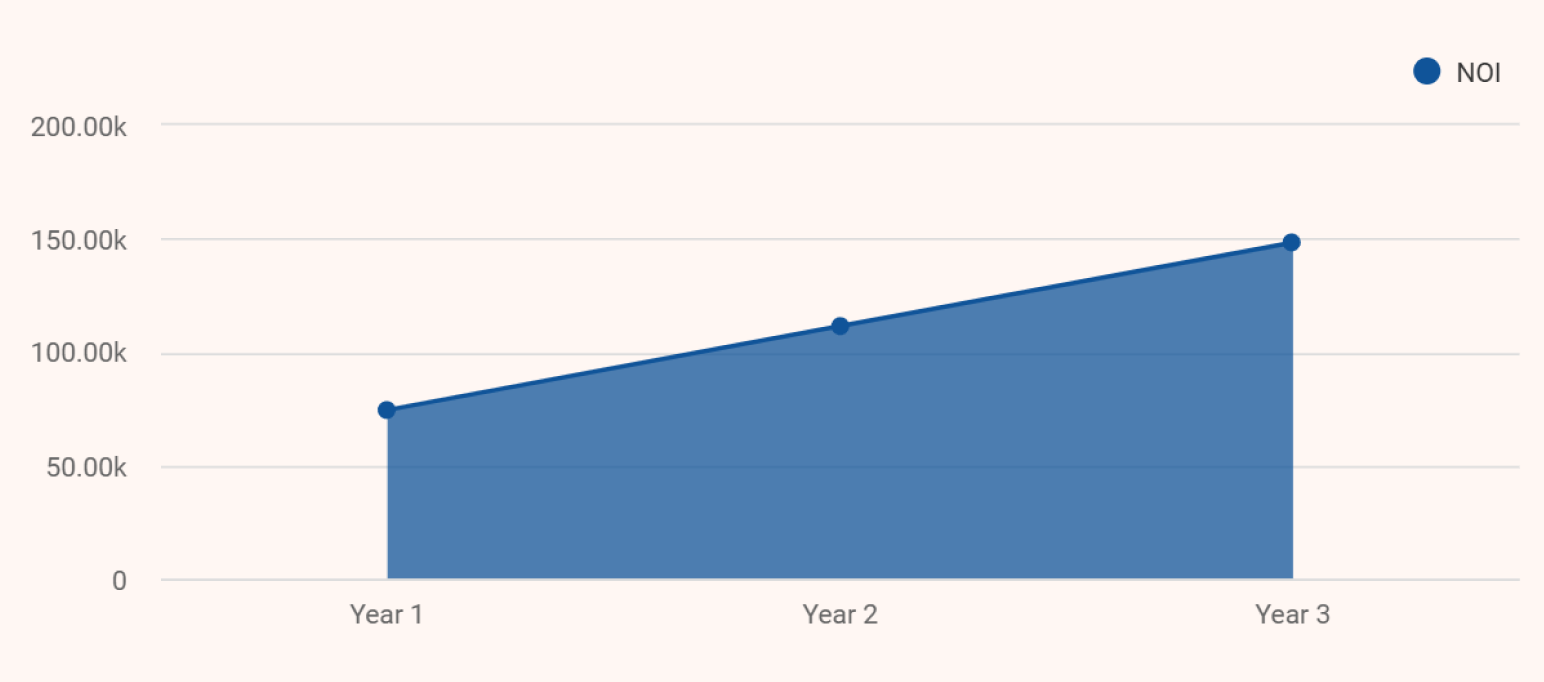

Net Operating Income (NOI)

PrimeStone expects the property to generate healthy net income after covering all operating expenses.

| Year | Yearly Rent Total ($) | Operating Expenses ($) | NOI ($) |

|---|---|---|---|

| Year 1 | $146,400 | $72,000 | $74,400 |

| Year 2 | $184,800 | $73,400 | $111,400 |

| Year 3 | $223,200 | $74,900 | $148,300 |

Capitalization Rate (Cap Rate)

At stabilization, the Porter Road property generates an implied capitalization rate of about 9.6 percent, based on Year 3 net operating income of $148,300 and total project costs of $1,546,000.

In practical terms, this means the property produces solid income relative to what was invested once renovations are complete. That level of return fits PrimeStone Realty Group’s plan to hold the asset for ongoing cash flow rather than relying on a short-term sale.

Funding Requirement

To complete the purchase and renovation of the Porter Road property, PrimeStone is requesting a $1,050,000 loan from Truist Bank under its Commercial Real Estate Investment Program.

The loan terms are straightforward and stable:

- Interest rate: 7.2% fixed

- Term: 7 years

- Amortization: 25 years

Based on these terms, the estimated annual loan payment is about $91,776, or roughly $7,648 per month.

Along with the bank loan, the owners will contribute $575,000 in equity. This equity comes from profits and retained capital generated through PrimeStone’s earlier projects—a renovated 4-unit property and an 8-unit property, both successfully leased and stabilized. This owner investment shows a strong financial commitment and reduces overall risk for the lender.

Loan to Value (LTV)

The total cost of the Porter Road project is $1,546,000. Out of this amount, PrimeStone Realty Group is using a loan of $1,050,000, which puts the loan-to-value ratio at about 68 percent. The remaining 32 percent is being funded directly by the owners.

This structure was chosen on purpose. Using more equity reduces pressure during the renovation period and the early leasing phase. If costs rise slightly or leasing takes longer than expected, the project can still move forward without cash strain. The lower loan balance also keeps monthly payments manageable in the first few years.

Debt Coverage & Cash Support

In the first year, the property is expected to generate a NOI of about $74,400, while the annual debt payment is $91,776. Since the building will still be leasing up during this period, PrimeStone will use the Equity Remainder (Contingency) of $79,000 to comfortably support loan payments during early operations.

| Year | NOI | Annual Debt | DSCR |

|---|---|---|---|

| Year 1 | $74,400 | $91,776 | 0.81 |

| Year 2 | $111,400 | $91,776 | 1.21 |

| Year 3 | $148,300 | $91,776 | 1.62 |

As occupancy increases, rental income grows while the loan payment stays the same. This allows the DSCR to strengthen over time and move well above lender requirements.

8. Appendix

The Appendix includes supporting documents and additional details that back up PrimeStone Realty Group’s business plan.

Projected Profit & Loss Statement (Property-Level)

| Category | Year 1 | Year 2 | Year 3 |

|---|---|---|---|

| Gross Rental Income | $146,400 | $184,800 | $223,200 |

| Operating Expenses | |||

| Maintenance Technician | -$50,000 | -$50,000 | -$50,000 |

| Leasing Commissions | -$3,000 | -$3,000 | -$3,000 |

| Buildium Software | -$1,920 | -$1,920 | -$1,920 |

| Insurance | -$8,200 | -$8,200 | -$8,200 |

| Repairs & Supplies | -$3,000 | -$3,200 | -$3,500 |

| Marketing | -$2,000 | -$2,200 | -$2,500 |

| Landscaping | -$1,500 | -$1,500 | -$1,500 |

| Taxes & Utilities | -$2,880 | -$3,180 | -$3,480 |

| Cleaning & Turnover | -$1,500 | -$2,200 | -$2,800 |

| Total Operating Expenses | -$72,000 | -$73,400 | -$74,900 |

| NOI | $74,400 | $111,400 | $148,300 |

| Debt Service | -$91,776 | -$91,776 | -$91,776 |

| Net Profit / (Loss) | -$17,376 | $19,624 | $56,524 |

Projected Cash Flow Statement

| Item | Year 1 | Year 2 | Year 3 |

|---|---|---|---|

| Cash Inflow from Operations (NOI) | $74,400 | $111,400 | $148,300 |

| Debt Service Paid | -$91,776 | -$91,776 | -$91,776 |

| Net Operating Cash Flow | -$17,376 | $19,624 | $56,524 |

| Reserve / Equity Support Used | $17,376 | $0 | $0 |

| Net Cash Movement | $0 | $19,624 | $56,524 |

Projected Balance Sheet

| Item | Year 1 | Year 2 | Year 3 |

|---|---|---|---|

| Assets | |||

| Property (Purchase + Renovation) | $1,470,000 | $1,470,000 | $1,470,000 |

| Cash & Reserves | $28,000 | $47,624 | $104,148 |

| Total Assets | $1,498,000 | $1,517,624 | $1,574,148 |

| Liabilities | |||

| Bank Loan (Truist) | $1,050,000 | $1,050,000 | $1,050,000 |

| Total Liabilities | $1,050,000 | $1,050,000 | $1,050,000 |

| Equity | |||

| Owner Equity | $448,000 | $467,624 | $524,148 |

| Total Equity | $448,000 | $467,624 | $524,148 |

| Total Liabilities + Equity | $1,498,000 | $1,517,624 | $1,574,148 |

Break-Even

| Item | Value |

|---|---|

| Total Units | 12 |

| Full Occupancy Annual Rent | $223,200 |

| Operating Expenses (Annual) | $72,000 |

| Debt Service (Annual) | $91,776 |

| Total Fixed Costs (Expenses + Debt) | $163,776 |

| Break-Even Units | ~9 units |

Download a Free Real Estate Investment Business Plan Template

Want to create a real estate investment business plan but need guidance? You’re in the right place. Download our free real estate investment business plan template (PDF) and start building your plan today.

This simple template uses easy prompts and real examples to help you explain your investment strategy, property purchases, renovation plans, and financial numbers. You can change it to match your market, goals, and property types.

Conclusion

After reviewing this PrimeStone Realty business plan sample, you should now understand how to organize your own real estate investment plan.

If you want an even faster option, you can use an AI business plan generator. It helps you create a full, lender-ready plan in minutes. Just answer a few basic questions, and your plan is ready.

Get Your Business Plan Ready In Minutes

Answer a few questions, and AI will generate a detailed business plan.

Frequently Asked Questions

Do I really need a real estate investment business plan?

Yes, you do. Lenders and investors want to know you have a clear plan before giving money. It also helps you stay organized and make better decisions as your business grows.

Read More: 10 Reasons Why a Business Plan is Essential

What should I include about my property in a real estate investment business plan?

Include unit size, number of bedrooms, current condition, expected rent, and neighborhood details. You should also mention parking and any extra features.

How do I show renovations in a real estate investment business plan?

Explain what you plan to update, such as kitchens, bathrooms, or flooring. Add the cost for each item and the total budget. Then share how these updates will improve the property and attract tenants.