So, you're thinking about starting an investment business. Maybe it’s a small private fund, a real estate syndicate, or something more niche like crypto advisory.

Whatever the focus, one thing’s clear: You need a solid plan. One that helps you map out where the money goes, how investors get paid, and why anyone should trust you with their capital.

Not sure how to lay all that out?

Don’t worry. We’ve put together an investment company business plan sample (and a template) to help you get it right from the start.

Let's go!

Investment Company Business Plan Sample

Take a look at a sample business plan of VanguardPath Capital. It walks you through the key steps and elements needed to build a successful investment company business plan.

1. Executive Summary

VanguardPath Capital is a boutique investment advisory firm based in Dallas, Texas. It provides wealth management services to high-net-worth individuals, families, and small businesses.

With a client-first approach and a commitment to transparency, the firm aims to deliver personalized financial strategies that support long-term growth and stability.

Business Overview

Founded by Lucas Bennett, VanguardPath Capital operates as a Limited Liability Company (LLC), combining boutique-level personalization with digital efficiency. The firm is designed to deliver trust-driven, ethical financial advisory services with a long-term view.

Services Offered

VanguardPath Capital delivers a focused suite of advisory services, including:

- Personalized investment portfolio management

- Retirement and estate planning

- Tax-efficient investment strategies

- Access to alternative investments (e.g., private equity, real estate, venture capital)

- ESG (environmental, social, and governance) investment options

- Market insights and educational resources

Market Opportunity

The U.S. wealth management sector continues to grow, driven by an increase in high-net-worth individuals and demand for more personalized advisory services. VanguardPath focuses on a well-defined target market in the Dallas-Fort Worth area, serving clients who value trust, ethics, and financial planning.

Strategic Positioning

VanguardPath stands out by using a boutique approach, unlimited service levels, and client education. It has a competitive advantage in terms of high-touch engagement, strong advisor access, and discipline in terms of using ESG and alternative investments.

Financial Snapshot

The firm is expected to break even by the end of Year 2, after that it’s projected to be profitable and have a high cash flow.

| Metric | Year 1 | Year 2 | Year 3 |

|---|---|---|---|

| Revenue | $350,000 | $770,000 | $1,140,000 |

| Operating Expenses | $341,000 | $422,000 | $504,000 |

| Net Profit (Pre-Tax) | -$41,000 | $348,000 | $636,000 |

| Assets Under Management | $25M | $60M | $100M |

| Clients to Break Even | ~48 | — | — |

| Break-even Timeframe | — | End of Year 2 | — |

Funding Request

VanguardPath Capital is seeking $500,000 in initial funding to support:

- Office lease and setup

- Digital platform development

- Team hiring and compensation

- Marketing and brand visibility

- Licensing and compliance setup

Liking the plan you're reading? It's AI generated.

Generate Your Own Using Bizplanr AI

2. Business Description

VanguardPath Capital is a boutique investment advisory firm built around the principles of client-first service, disciplined strategy, and long-term financial success.

Business Location

VanguardPath Capital is headquartered at 1748 Lakefront Drive, Suite 300, Dallas, Texas 75207. The Dallas-Fort Worth metroplex offers access to a growing population of high-net-worth individuals, professionals, and business owners. The central location enables easy interaction with clients, hosting of regional events, and close connections with industry partners.

Mission Statement

To guide clients on a clear financial path toward long-term security and wealth creation through disciplined, transparent, and client-centered investment strategies.

Vision Statement

To become a trusted leader in the independent investment advisory space, helping clients navigate complex markets and make confident financial decisions.

Background and Founding

At VanguardPath Capital, which is led by Lucas Bennett, the principal philosophy is the need to improve the nature of financial advice accessible to clients.

Lucas worked in the investment business for many years, and he witnessed plenty of cases when big companies focused on quantity rather than quality. He reacted by establishing VanguardPath Capital to provide a highly customized experience based on industry expertise and discipline-driven investment philosophy.

Business Model and Core Values

As a Limited Liability Company (LLC), VanguardPath Capital operates with flexibility and accountability. The firm earns revenue through percentage-based asset management fees, fixed-rate planning services, and strategic consulting offerings.

Clients benefit from a hybrid model that combines digital tools with personalized service.

The firm’s core values are:

- Integrity – Always acting in the client’s best interest

- Clarity – Making complex financial concepts easy to understand

- Discipline – Using structured, time-tested investment methods

- Transparency – Open communication and clear pricing

- Education – Helping clients become confident financial decision-makers

3. Market Analysis

VanguardPath Capital is a financial firm with a dynamic environment in which the demand for customized, transparent financial advice is growing among high-net-worth individuals and small businesses.

Industry Overview

The global wealth management industry continues to experience strong growth. By 2025, global assets under management (AUM) will be approximately $145.4 trillion. This growth is driven by rising affluence, generational wealth transfers, and increasing demand for sustainable investment strategies.

In the U.S. alone, 562,000 new millionaires were added in 2024; this expanding client base is creating new opportunities for firms offering bespoke advisory services.

Market Needs & Gaps

Despite the size of the industry, many clients report dissatisfaction with fixed investment plans and impersonal service models. Larger institutions often favor scalability over flexibility, and this has left the high-net-worth individuals still feeling underserved.

Key market gaps include:

- Limited access to ESG-focused investments

- Lack of educational resources and transparency in fees

- One-size-fits-all portfolios that fail to reflect individual goals

Target Market Profile

The firm’s primary focus is on:

- Wealthy families and individuals

- Business leaders and small entrepreneurs

- Near-retiree professionals

- ESG- and values-based investors

To have a closer idea of the typical client, check this buyer persona:

This persona brings the firm's ideal client into focus, showcasing the personalized value VanguardPath Capital delivers.

Regulatory Landscape

The financial advisory is governed by a range of compliance standards, particularly those set by the U.S. Securities and Exchange Commission (SEC) and Financial Industry Regulatory Authority (FINRA).

VanguardPath Capital adheres to these regulations with a proactive compliance strategy. The firm uses modern portfolio management platforms with built-in compliance workflows and ensures all advisors operate under a fiduciary model, always acting in the best interest of the client.

4. Competitive Analysis

The wealth management landscape is filled with established institutions and digital platforms, yet many clients continue to seek a personal touch.

Primary Competitors

To better understand VanguardPath Capital’s positioning in the marketplace, the table below offers a side-by-side comparison with leading competitors:

| Competitor | Strengths | Gaps/Weaknesses | How VanguardPath stands out |

|---|---|---|---|

| Fisher Investment | National reach, fee-only model | Less flexibility, minimal customization | Personalized strategies, ESG expertise |

| Edward Jones | Community presence, relationship focus | Pre-packaged solutions | True customization, tech integration |

| Charles Schwab Advisory | Hybrid advisory model, robust tech | Limited 1-on-1 advisor access | Direct advisor support, deeper planning |

| Vanguard Personal Advisors | Low-cost structure, strong brand | Impersonal, passive focus | Active management, ongoing guidance |

| Merrill Lynch Wealth Mgmt | Premium brand, banking integration | High entry thresholds, formality | Boutique feel, approachable service |

Key Differentiators

To stand out in a crowded wealth management landscape, VanguardPath Capital uses:

- Boutique model: A human-centric, relationship-driven approach

- Flexible service tiers: Custom solutions based on individual goals

- ESG and alternatives: Emphasis on modern, ethical, and high-potential investments

- Client education & access: Clients work closely with senior advisors, not just support teams

- Local market expertise: Strong presence and engagement in the Dallas business community

SWOT Analysis

Have a quick look at the SWOT analysis for VanguardPath:

5. Services Offered

VanguardPath Capital offers a comprehensive suite of investment advisory services. Each offering is designed to provide clarity, customization, and long-term value, backed by disciplined strategies and expert guidance.

1) Personalized Investment Portfolio Management

Individual portfolios are customized according to the goals, risk tolerance, and time horizon of each client. Portfolios are dynamically reviewed and changed to keep up to date with the market trend and personal changes.

2) Retirement & Estate Planning

Planning for retirement and legacy transitions is a cornerstone of the firm’s advisory model. VanguardPath Capital develops integrated strategies that include income planning, asset preservation, tax efficiency, and intergenerational wealth transfer.

3) Tax-Efficient Investment Strategies

Clients benefit from structured portfolios that minimize taxable events. Tactics include tax-loss harvesting, strategic asset placement, and drawdown planning—all built to enhance after-tax returns.

4) Access to Alternative Investments

To expand beyond traditional stocks and bonds, the firm provides access to vetted alternative investment opportunities, including:

- Private equity

- Venture capital

- Real estate investment trusts (REITs)

These options are ideal for clients seeking portfolio diversification and higher-growth potential.

5) ESG (Environmental, Social, Governance) Investment Options

VanguardPath Capital incorporates ESG principles for clients who prioritize socially responsible investing. ESG portfolios align with client values while meeting financial return objectives, using a blend of screened funds and direct holdings.

6) Market Insights and Client Education

Clients receive timely market reports, educational webinars, and quarterly performance reviews to stay informed and engaged. These resources empower clients to participate confidently in their financial journey.

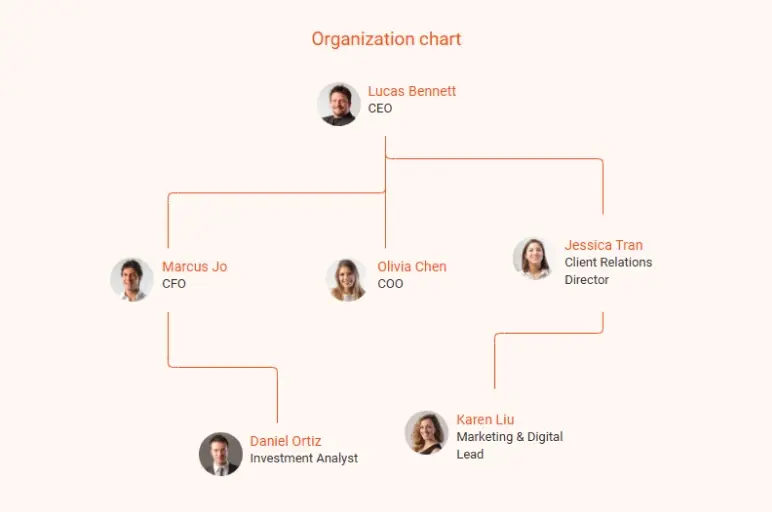

6. Organization and Management

VanguardPath Capital is built around a small, expert team committed to transparency, discipline, and long-term client success.

Key Management Team

Lucas Bennett – Founder & CEO

Brings more than 10 years of experience working as a wealth manager and is in charge of leadership, general direction, and strategic links with major clients. Monitors adherence, investment policy, and organisational culture.

Olivia Chen – Chief Operating Officer (COO)

Manages day-to-day operations, vendor relationships, and internal workflows. Focuses on service delivery efficiency and process optimization.

Marcus Patel – Chief Financial Officer (CFO)

Manages the operating budget, forecasting, and performance measuring. Provides well-calculated fiscal policies and regulations.

Mia Rodriguez – Administrative Coordinator

Serves as the first point of contact for clients. Manages scheduling, communications, and general administrative tasks.

Organizational Structure

The firm maintains a hierarchy that encourages collaboration and client-centered service.

Senior Financial Advisor

Dr. Thomas Grayson

Focuses on issues in complex planning, retirement transitions, and ESG strategies. Works directly with clients to craft personalized financial plans.

7. Marketing and Sales Strategy

VanguardPath Capital uses multi-channel marketing and a personalized sales approach to reach high-net-worth clients.

Marketing Strategy

To reach its ideal audience, VanguardPath Capital uses targeted digital strategies, educational outreach, and local market engagement. The marketing approach emphasizes long-term visibility and brand credibility.

Local SEO & digital presence

The firm targets key search terms such as “investment advisor Dallas TX” and “wealth management for HNWIs in Texas.” A fully optimized website with fast load times, local keywords, and secure client portals serves as the digital hub for all marketing activities.

Content marketing

To establish thought leadership and provide ongoing value, VanguardPath publishes weekly blog posts, newsletters, and market updates. This content helps build trust while enhancing search engine visibility.

LinkedIn & social media engagement

Recognizing where its clients are most active, the firm leverages LinkedIn to share timely insights and reach professionals through targeted ads. Social media also supports brand presence and promotes events.

Educational events & client seminars

Through its community engagement plan, it conducts physical and remote seminars on financial issues. These events build trustworthiness.

Referral program

Client satisfaction is a growth engine. A formal referral program encourages existing clients to introduce new prospects, rewarding both parties and reinforcing loyalty.

Sales Strategy

VanguardPath Capital’s sales strategy is rooted in relationship-building, education, and trust.

- Consultative discovery: Advisors begin by understanding each client's unique goals through in-depth conversations before offering any recommendations.

- High-touch onboarding: Advisor-led sessions where new clients are onboarded, guided through the platform, and taken through the contents of their financial plans.

- Ongoing engagement: Regular check-ins, quarterly reviews, and timely market updates ensure clients stay informed and connected.

- Transparent pricing: Pricing is discussed early with clear explanations of services, structure, and value alignment.

Distribution Channels

VanguardPath Capital reaches prospective clients through a combination of direct and strategic outreach methods designed to build relationships and extend local visibility.

- Direct client acquisition via website and referrals

- Local networking through Dallas-area events and business chambers

- Online advertising via Google Ads and LinkedIn targeting

- Educational channels such as webinars and thought leadership blogs

8. Financial Plan

VanguardPath Capital’s financial plan is based on conservative estimates and industry benchmarks, with revenue from asset management, consulting, and planning services.

Revenue Projections

Revenue is forecasted based on assets under management (AUM), consulting fees, and educational service income. Projections are as follows:

| Category | Year 1 | Year 2 | Year 3 |

|---|---|---|---|

| Assets Under Management (AUM) | $25M | $60M | $100M |

| Average AUM Fee (%) | 1.00% | 0.95% | 0.90% |

| Revenue from AUM | $250,000 | $570,000 | $900,000 |

| Consulting & Planning Fees | $30,000 | $50,000 | $70,000 |

| Webinars & Educational Services | $20,000 | $30,000 | $30,000 |

| ESG Portfolio Design Services | $10,000 | $20,000 | $25,000 |

| Alternative Investment Access Fees | $15,000 | $25,000 | $30,000 |

| Tax Strategy Sessions | $5,000 | $10,000 | $15,000 |

| Estate Planning Packages | $10,000 | $15,000 | $20,000 |

| Corporate Investment Plans | $10,000 | $20,000 | $30,000 |

| Total Revenue | $350,000 | $770,000 | $1,140,000 |

Operating Expenses

Start-up and operational costs include salaries, office rent, marketing, technology, and compliance.

| Expense Category | Year 1 | Year 2 | Year 3 |

|---|---|---|---|

| Salaries & Benefits | $180,000 | $240,000 | $300,000 |

| Office Rent & Utilities | $36,000 | $38,000 | $40,000 |

| Marketing & Advertising | $40,000 | $50,000 | $60,000 |

| Tech & Platform Costs | $30,000 | $35,000 | $40,000 |

| Professional Services | $25,000 | $25,000 | $25,000 |

| Compliance & Licensing | $20,000 | $22,000 | $24,000 |

| Miscellaneous | $10,000 | $12,000 | $15,000 |

| Total Expenses | $341,000 | $422,000 | $504,000 |

Profit and Loss Forecast

Take a look at the P&L forecast of VanguardPath:

| Category | Year 1 | Year 2 | Year 3 |

|---|---|---|---|

| Total Revenue | $350,000 | $770,000 | $1,140,000 |

| Total Operating Expenses | $341,000 | $422,000 | $504,000 |

| Operating Profit | $9,000 | $348,000 | $636,000 |

| Capital Expenditures | $50,000 | $0 | $0 |

| Net Profit (Pre-Tax) | -$41,000 | $348,000 | $636,000 |

Cash Flow Considerations

Initial funding of $500,000 will ensure sufficient cash flow in Year 1, covering set-up and operating costs. Positive cash flow is projected from Year 2 onward.

| Cash Flow Item | Year 1 | Year 2 | Year 3 |

|---|---|---|---|

| Beginning Cash Balance | $0 | $159,000 | $499,000 |

| Cash Inflows | |||

| - Operating Revenue | $350,000 | $770,000 | $1,140,000 |

| - Funding Injection | $500,000 | $0 | $0 |

| Total Inflows | $850,000 | $770,000 | $1,140,000 |

| Cash Outflows | |||

| - Operating Expenses | $341,000 | $430,000 | $504,000 |

| - Capital Expenditures (Office Setup, Tech) | $50,000 | $0 | $0 |

| - Loan Repayments (if any) | $0 | $0 | $0 |

| Total Outflows | $391,000 | $430,000 | $504,000 |

| Net Cash Flow | $459,000 | $340,000 | $636,000 |

| Ending Cash Balance | $159,000 | $499,000 | $1,135,000 |

Break-Even Analysis

Based on projected fixed and variable costs, VanguardPath Capital is expected to reach break-even by the end of Year 2.

| Metric | Value |

|---|---|

| Fixed Annual Costs | $250,000 |

| Average Gross Margin (AUM & Other Revenue) | 75% |

| Average Revenue per Client | $7,000 |

| Break-even Revenue Target | $333,000 |

| Estimated Clients to Break Even | ~48 clients |

| Expected Break-even Timeframe | End of Year 2 |

9. Funding Request

VanguardPath Capital is seeking $500,000 in initial funding to establish and grow the firm’s operations over the first 18–24 months. Funds will be allocated as:

| Use of Funds | Estimated Amount |

|---|---|

| Office space lease, furnishing | $100,000 |

| Digital platform & technology stack | $120,000 |

| Staff hiring & initial salaries | $150,000 |

| Marketing & brand development | $80,000 |

| Licensing, legal, and compliance | $30,000 |

| Operating cushion/reserve capital | $20,000 |

| Total | $500,000 |

Purpose and Impact

This funding will enable VanguardPath Capital to:

- Set up a professional Dallas office to build trust

- Build secure digital systems for clients and compliance

- Hire a core team for operations and service delivery

- Launch focused marketing to attract prospects

- Cover licensing and regulatory needs without cash flow strain

The requested funding is designed to create a strong, professional foundation that supports responsible growth and high client satisfaction.

Download a Free Investment Company Business Plan Template

Want to write a business plan for your investment firm but not sure where to start? Download our free investment company business plan template (PDF) and start creating your plan with ease.

This customizable template covers everything you need from services and target clients to revenue models, licenses, and risk strategies. Whether you're offering portfolio management or private equity services, the template fits into everything.

Conclusion

With this sample investment business plan, you now have a clear idea of what to include and how to organize it.

Still stuck? Use an AI-powered tool like Bizplanr to make the process faster and easier. Just answer a few quick questions about your investment services, and it’ll generate a full plan ready to use for banks, partners, or internal planning.

Start strong and build with confidence!

Get Your Business Plan Ready In Minutes

Answer a few questions, and AI will generate a detailed business plan.

Frequently Asked Questions

Why do I need a business plan for an investment company?

A business plan helps you organize your strategy, stay clear on your goals, and explain what you do to others. Here’s why it matters:

- Shows potential investors or clients that you’re serious

- Helps you stick to a clear investment method

- Keeps you compliant with regulations

- Makes it easier to track growth and changes

What should I include in my investment firm’s financial projections?

Start by including expected income from management fees, performance fees, and any other revenue streams. List your fixed costs like licenses, salaries, and tech tools, along with variable costs such as marketing and legal fees.

Then, add cash flow projections, a break-even point, and a revenue forecast based on your client or fund targets. Keep the numbers grounded and relevant to how your firm operates.

How do I stand out in the investment space?

Go specific instead of general. Try one or more of these:

- Pick a niche (like healthcare startups, ESG funds, or early-stage SaaS)

- Focus on a type of client (like HNIs, family offices, or Gen Z investors)

- Build a unique model, maybe a transparent fee structure or a data-backed approach

- Show real results or insights that others don’t offer

Always remember, the more focused you are, the easier it is to build trust.

How often should I update my investment business plan?

At least once a year, or whenever your services, fee model, or regulatory approach changes. Keeping the plan updated helps you make better long-term decisions.

Can I use this plan to raise money?

Yes. A solid business plan shows you understand the market, know the risks, and have a clear strategy. It gives investors or banks the confidence that you’re serious and prepared.