Buying a home is exciting—but it also comes with risk. Hidden issues like structural damage or electrical problems can turn a dream purchase into a costly mistake. That’s why home inspection services are in high demand.

If you’re detail-driven and ready to help buyers make confident decisions, starting a home inspection business can be a smart opportunity.

However, success doesn’t happen by chance. Like any business, it demands a solid business plan to build trust, attract clients, and grow steadily in a competitive market.

In this post, we’ve presented a practical home inspection business plan example that will help you draft a plan to get started the right way.

Home Inspection Business Plan Sample

Let’s take a look at the StructSure Inspections business plan sample to understand the important details and key sections you should include in your own plan.

This example will guide you through each part of a strong, well-structured plan.

1. Executive Summary

StructSure Inspections is a Franklin, Tennessee–based residential and light-commercial inspection firm built for speed, clarity, and trust. We combine experienced trade knowledge with modern tools, such as thermal imaging, drone roof scans, and same-day digital + video reporting to remove uncertainty from real-estate decisions.

Our core market is Williamson and Davidson Counties, two of the fastest-growing housing corridors in the state. Buyers want confidence, agents want turnaround, and builders want documented quality checks. We serve all three with a service model that is precise, visual, and on time.

Our differentiation is practical, not theoretical: faster turnaround, clearer visual evidence, and reliable communication. We use technology to make things easier for everyone. Buyers can get the info they need to make confident decisions, keeping agents from avoiding delays, and giving builders better documentation.

Unlike big national brands, we’re local, responsive, and bilingual (English and Spanish). That means smoother scheduling, clear on-site communication, and easy-to-understand reports. Our reputation and partnerships grow naturally because clients know they can count on us for consistent 24-hour turnaround—no gimmicks or discounts needed.

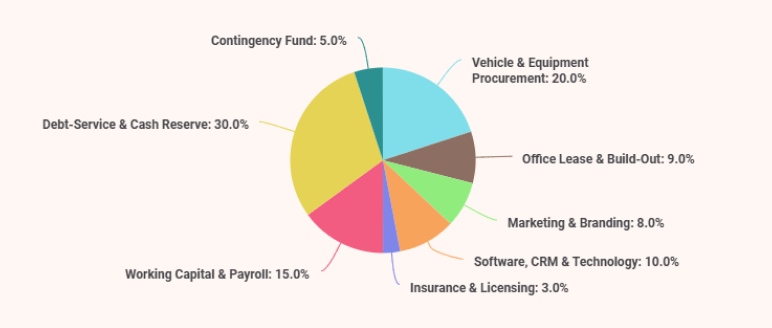

We are seeking a $185,000 term loan (for 5 years at 9% fixed), paired with $45,000 in owner equity, to complete the start-up and provide prudent working capital. Uses include vehicle and equipment procurement, office build-out, initial marketing lift, and a conservative operating reserve to smooth the first two quarters of the ramp.

The reserve is intentional; it protects loan service while our inspection cadence grows from ~60 per month to break-even at ~60 per month reliably (with add-ons), then toward 100+ per month by Year 3.

Operationally, StructSure launches with two inspection teams covering morning and afternoon slots, Monday–Saturday, with a premium Sunday option for time-sensitive transactions. Reports are delivered in under 24 hours (often same day) through Spectora, enriched with annotated photos and brief explainer clips so clients actually understand what matters. Add-ons such as radon testing, drone roof imaging, and thermal scanning are priced transparently and bundled when appropriate to increase value and ticket size without slowing the process.

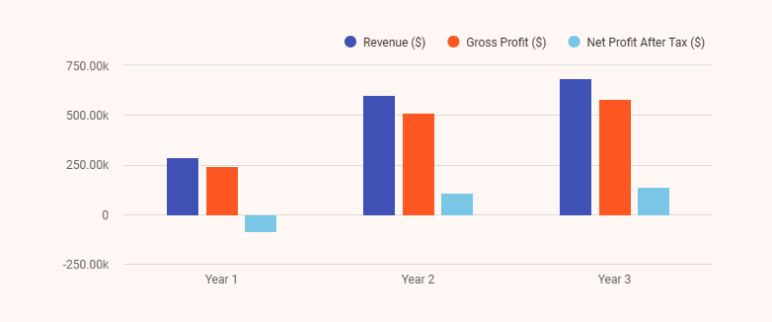

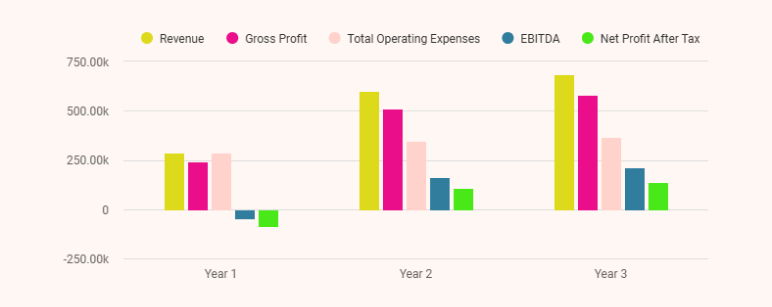

Financially, our plan is conservative and lender-oriented. Revenue grows steadily over the first three years as we add inspectors and expand relationships with agents and brokerages. Here’s a quick outlook:

| Category | Year 1 | Year 2 | Year 3 |

|---|---|---|---|

| Revenue ($) | 285,000 | 598,500 | 684,000 |

| Gross Profit ($) | 242,250 | 508,725 | 581,400 |

| Total Operating Expenses ($) | 288,200 | 346,000 | 368,200 |

| EBITDA ($) | -45,950 | 162,725 | 213,200 |

| Net Income Before Tax ($) | -87,950 | 120,725 | 171,200 |

| Income Tax ($) | - | 12,100 | 34,200 |

| Net Profit After Tax ($) | -87,950 | 108,625 | 137,000 |

In the first year, StructSure aims to bring in around $285,000 in revenue and build strong relationships with 25+ agents and three brokerages. In Year 2, adding a third inspector and taking on more inspections should push revenue to about $598,500. By Year 3, the business is expected to level out at roughly $684,000 a year.

As we grow, expenses will stay under control, leading to an EBITDA of about $162,725 in Year 2 and $213,200 in Year 3. A working capital reserve is maintained in Year 1 to ensure on-time payments during the early months of operation.

Want to create a plan like this for your business?

Use Bizplanr AI to build a solid plan in minutes!

2. Company Overview

StructSure Inspections, LLC is a licensed Tennessee limited liability company headquartered at 627 Maple Valley Road, Suite A, Franklin, TN 37064. The firm was established in early 2026 to meet the region’s growing need for modern, technology-supported property inspection services that align with the speed and transparency expected in today’s real-estate market.

Facilities

Office

1,200 sq. ft. leased space ($21,600 / yr) with front-desk reception, equipment storage, and meeting area.

Vehicles

Two leased vans ($650 each / month) fitted with branded wraps and shelving for ladders, radon monitors, and protective gear.

Location Advantage

Our office is in the Cool Springs Business District in Franklin, which is close to both Williamson and Davidson Counties—two of the fastest-growing housing areas in Tennessee. Being near I-65 helps us reach cities like Nashville, Brentwood, and Murfreesboro in less than 40 minutes. The area’s growing mix of homes, brokerages, and title companies also helps us build strong referral connections.

Mission Statement

We aim to provide clear, accurate, and quick inspection reports that help buyers, agents, and property owners make confident decisions.

Vision Statement

To become Middle Tennessee’s most trusted inspection partner by blending real-world construction expertise with modern imaging technology and unmatched client service.

Legal and Ownership Structure

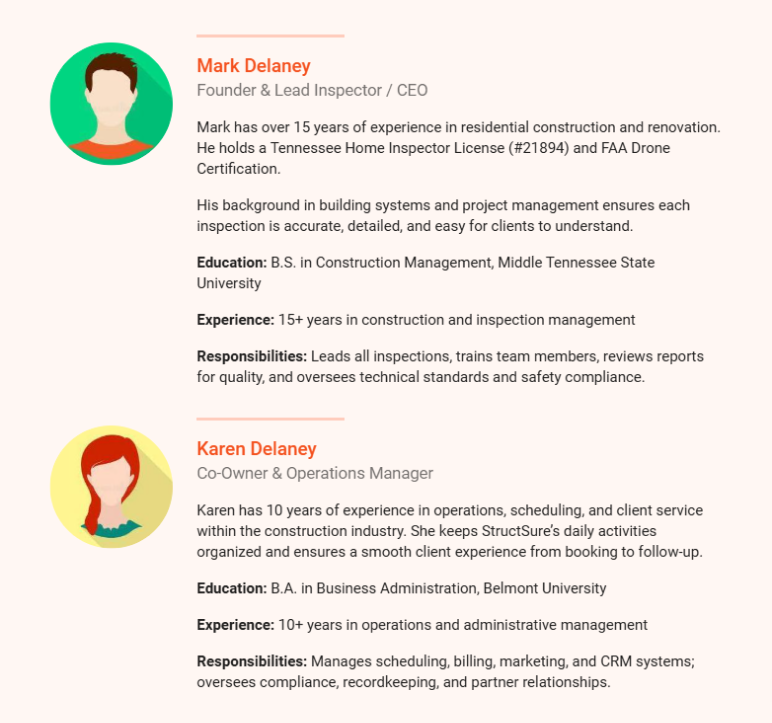

StructSure is a privately owned LLC registered in Tennessee. The business is run by Mark and Karen Delaney, who bring strong experience in both inspections and operations.

| Owner | Role | Equity | Background |

|---|---|---|---|

| Mark Delaney | Founder & Lead Inspector / CEO | 80% | Former residential contractor with 15 years of experience in Williamson and Davidson Counties. Licensed Tennessee home inspector since 2023. |

| Karen Delaney | Co-Owner / Operations Manager | 20% | Experienced administrator with 10 years in project coordination and client management for contracting firms. |

Mark handles all inspection work, hiring, and quality control. Karen manages scheduling, marketing, office operations, and compliance. This setup keeps the business efficient and ensures smooth day-to-day management.

Background Story

After fifteen years as a residential contractor, Mark Delaney repeatedly saw homebuyers overwhelmed by dense, technical inspection reports. Realtors complained about slow turnaround and vague photos; builders worried about liability from inconsistent documentation. Seeing this gap, Mark retrained, earned his Tennessee Home Inspector License #HI-21894, and founded StructSure with one goal: To bring professional-grade documentation and clarity to every inspection.

Karen Delaney’s operations background complements that technical expertise. Her focus on organization, marketing, and client communication ensures the business scales efficiently without losing its personal touch. Together, they shaped a workflow where precision, presentation, and punctuality are equally valued.

Future Goals

Over the next few years, we’re focused on growing steadily and making our operations even smoother with additional services.

- By the third quarter of 2026, we plan to have all our licensing done, get our vehicles ready, and launch a full marketing strategy.

- By 2027, the goal is to handle around 60 inspections per month to cover all the operating expenses.

- We’ll add a third inspector and increase to around 100 inspections per month in 2028.

- Till 2029, we aim to introduce new services, such as energy efficiency and insurance inspections, to reach more clients and create new income streams.

3. Industry and Market Analysis

The home inspection industry has become one of the most resilient and essential components of the real estate transaction process in the United States. For buyers, lenders, and agents, an inspection is not a luxury—it is a non-negotiable safeguard. StructSure Inspections enters this market at a time when Tennessee’s housing demand and property values are climbing steadily, and both buyers and sellers are seeking faster, more visual inspection solutions that provide transparency and confidence.

National Industry Landscape

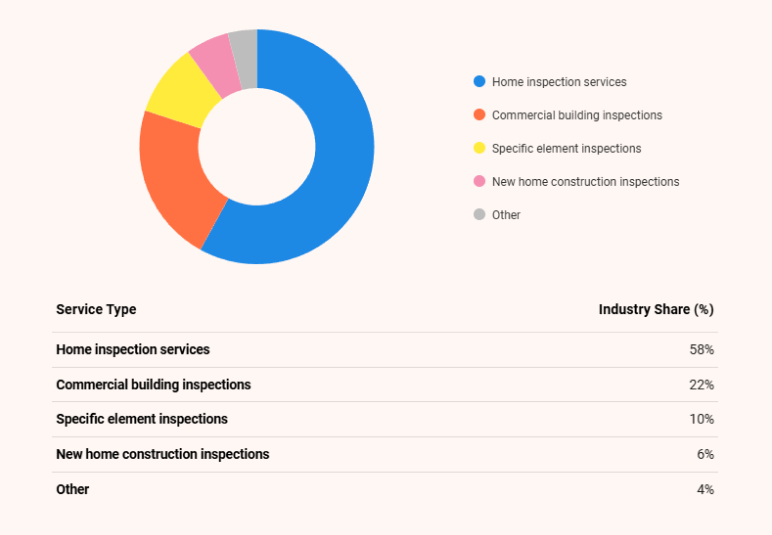

According to the IBISWorld report, the US Building Inspectors industry is estimated to generate around $5 billion in revenue in 2025. There are approximately 30,620 registered inspection businesses nationwide. Over the last five years, the industry has grown at an average annual rate of 3.2%, driven by increased housing transactions, tighter lending regulations, and the expanding role of technology in property evaluation.

Here, we’ve attached a chart showing the U.S. building inspection industry’s service segmentation. Most comes from home inspections, followed by commercial and specialty inspections like radon or new construction checks.

Regional Market: Middle Tennessee & Williamson County

StructSure’s base in Franklin gives it proximity to dynamic housing markets in Williamson and Davidson Counties. Here’s what public data shows:

- In 2023, Williamson County’s population was about 254,609, up 2.29% year-over-year.

- The county’s median household income in 2023: $131,202.

- The Federal Reserve FRED series confirms a median household income of $136,007 (2023) for Williamson County.

- Population projections suggest 271,904 residents by 2025, with approx. 1.39% growth in the prior year.

These figures validate that the county is affluent, growing, and supports buyers with disposable capacity—favorable conditions for premium inspection services.

Local real estate dynamics to note:

- New construction in suburbs, infill, and emerging corridors sustains demand for phased inspections (pre-drywall, mechanical checks).

- Resale market remains active, and buyers often want fast inspection scheduling to stay on closing timelines.

- Investor & flipping activity in Davidson County and surrounding areas adds off-peak demand for repeat inspections.

- Together, these factors provide a stable base and growth runway for an inspection business with good differentiation.

Customer Analysis

StructSure serves four buyer groups with different triggers, budgets, and booking behaviors. The mix is stable even in slower sales cycles because inspections remain a standard step in U.S. transactions. Only about 1 in 7 buyers skipped all inspections in 2023. This implies ~85% still use at least one inspection, which keeps demand resilient.

| Segment | Main Needs | Buying Behavior |

|---|---|---|

| Homebuyers & Agents | Fast, reliable inspections and clear reports | Book quickly through agent referrals; expect a 24-hour turnaround |

| First-Time Buyers | Guidance and transparent pricing | Seek reassurance and plain-language summaries |

| Investors / Property Managers | Consistent, repeat inspections | Schedule recurring work across multiple properties |

| Builders / Contractors | Quality checks during construction | Pre-schedule phased inspections with documentation |

Recent Trends

Key industry trends shaping demand:

Technology Integration

The use of drones, infrared imaging, and mobile inspection apps has reduced inspection report turnaround time by 40–60%. These tools improve accuracy and enable same-day reporting for most inspections.

Standardization

Buyers increasingly expect certified inspectors and consistent report quality. Professional associations like ASHI, InterNACHI have set clear national standards for inspector training and digital report delivery that include annotated photos and actionable recommendations.

Insurance and Liability Focus

More insurance carriers now require detailed inspection documentation before underwriting or renewing home policies, especially for older or higher-value properties.

Growing DIY/Homeownership Awareness

Online real estate platforms (Zillow, Realtor.com) have made homebuyers more informed and proactive about property quality. Buyers now view home inspections as essential due diligence rather than a formality.

Find this sample plan helpful? It’s an AI-generated!

Create a winning business plan using Bizplanr AI

4. Services Offered

StructSure Inspections, LLC offers complete home and small commercial inspection services that help clients clearly understand a property’s condition before making a purchase or investment. Our focus is on making the process simple, fast, and transparent so buyers, sellers, and agents get clear answers without long waits or confusing reports.

Every inspection includes photos, short videos when needed, and an easy-to-read digital report delivered within 24 hours. This quick turnaround helps buyers meet tight deadlines and gives agents confidence that deals will move forward smoothly.

Core Services

1) Standard Home Inspection (≤ 3,000 sq ft)

Price: $425

Full inspection of structure, roof, foundation, HVAC, plumbing, and electrical systems. Includes 50–70 photos and a digital PDF report.

2) Large Home Inspection (> 3,000 sq ft)

Price: $525

Detailed inspection for high-value or multi-story homes; includes crawl spaces, attics, and detached structures.

3) Pre-Listing Inspection

Price: $375

For sellers wanting to identify issues before listing. Reduces surprises during buyer inspections.

4) Annual Maintenance Inspection

Price: $350

Designed for homeowners to track ongoing wear, identify energy inefficiencies, and plan maintenance budgets.

5) Commercial / Multi-Unit Property Inspection

Price: $0.20–$0.25 per sq ft (min $800)

Covers small offices, retail spaces, and mixed-use properties. Focus on mechanical systems and safety compliance.

Add-On & Specialized Inspections

In addition to our main inspection packages, clients can choose from several add-on and specialized services. These options give a deeper look into specific areas of concern and help customize each inspection based on property type and needs.

| Add-On | Price | Description |

|---|---|---|

| Radon Testing | $150 | 48-hour test with calibrated sensors. Results in EPA-approved format. |

| Thermal Imaging Scan | $100 | Detects hidden leaks, insulation gaps, and electrical issues. |

| Drone Roof Inspection | $125 | High-quality aerial images for roofs that are hard or unsafe to access. |

| Pre-Drywall / Phase Inspection | $300 | For new builds – records progress before walls are closed. |

| 24-Hour Rush Service | +$100 | Ensures report delivery within one business day. |

Vendor and Partner Network

StructSure partners with trusted suppliers and service providers to keep operations reliable and costs stable:

- Enterprise Commercial Leasing for vehicle fleet management

- Hiscox Insurance for liability and coverage policies

- Cardinal Health for safety gear and supplies

- Office Depot Commercial for office supplies

- Spectora / HubSpot / QuickBooks for core software platforms

These partnerships help StructSure maintain consistent pricing, strong vendor support, and the flexibility to grow efficiently.

Future Plans

As the business grows, StructSure will expand its services to include:

- Energy-efficiency audits

- Insurance inspection reports

- Mold and moisture diagnostics

These services will use our existing technology and experience, creating new revenue opportunities with minimal added cost.

5. Competitor Analysis

The home inspection landscape in Middle Tennessee is competitive but fragmented. It has a mix of national inspection companies and small local inspectors. StructSure fits right in the middle—offering friendly local service, modern tools, and fast results that stand out in the market.

Key Competitors

1) Pillar To Post Home Inspectors (National Franchise)

Pillar To Post is a big, well-known national inspection company with a large team and a strong brand name.

Strengths:

- Strong national brand recognition.

- Large pool of inspectors for scheduling flexibility.

- Established training and operational standards.

Weaknesses:

- Slower turnaround times (often 2–3 days).

- Limited personalization for clients.

- Franchise fees drive higher service prices.

2) HomeTeam Inspection Service (Multi-Inspector Model)

HomeTeam uses a group inspection system that works well for big real estate offices and busy agents.

Strengths:

- Efficient team structure for large properties.

- Recognized and trusted among established brokerages.

- Consistent brand presence across multiple cities.

Weaknesses:

- 15–20% higher pricing than independent inspectors.

- No Spanish-language communication options.

- Less flexibility for smaller or customized jobs.

3) AmeriSpec Inspection Services (Established Network)

AmeriSpec has decades of experience in both residential and light commercial inspections and is known for its network of certified professionals.

Strengths:

- Established credibility and market longevity.

- Broad service range, including commercial properties.

- Strong industry reputation.

Weaknesses:

- Reports often lack visuals and interactive detail.

- Minimal use of advanced tools like drones or thermal imaging.

- Less focus on same-day report delivery.

4) Independent Local Inspectors

Many small, independent inspectors work locally, offering low-cost, owner-operated service across the Franklin and Nashville areas.

Strengths:

- Affordable pricing for basic inspections.

- Direct client communication with the inspector.

- Strong community ties in smaller neighborhoods.

Weaknesses:

- Quality and consistency vary widely.

- Basic or handwritten reports with limited visuals.

- Limited capacity to handle multiple or large-scale jobs.

Local Positioning Insights

| Factor | Market Reality | StructSure's Positioning |

|---|---|---|

| Turnaround Time | 48-72 hours typical | 24 hours guaranteed |

| Report Format | PDF, text-heavy | Digital, image-based, mobile-friendly |

| Service Scope | Basic visual inspection | Infrared, drone, radon, and video included |

| Language Access | English only | Bilingual support |

| Brand Perception | "Old-school" or "corporate" | Professional yet approachable |

Competitive Advantages

StructSure stands out for being fast, clear, and dependable while offering the personal service clients value most. Here’s what makes StructSure stand out:

- Every report is ready within 24 hours, so buyers and agents can stay on track for closing.

- We use drones, thermal cameras, and digital software to make inspections quicker, safer, and more accurate.

- Our digital reports include photos and short videos, making it easy for anyone to understand the results.

- We speak both English and Spanish to better serve a wider range of clients and agents.

- As a local business, clients work directly with the owners for flexible scheduling and quick decisions.

- Every inspection follows the same proven process for reliable results.

- Our strong relationships with area agents and builders help build steady referrals and repeat clients.

These strengths make StructSure a modern, customer-focused choice—offering the quality of a big company with the care of a local business.

6. Marketing Plan

StructSure Inspections’ marketing strategy focuses on visibility, relationships, and trust—the three pillars that consistently drive bookings in the home inspection industry. In a service business like ours, reputation builds revenue. That’s why our plan combines digital reach with local relationship marketing, ensuring we stay top-of-mind with both buyers and agents when they’re ready to book.

Marketing Objective

Our main goal is to reach 250 active agent partners and 1,200+ inspections per year by Year 3 through consistent digital exposure, community presence, and referral-based growth.

We’ll achieve this by:

- Dominating local Google search and paid listings for “Franklin home inspection.”

- Building strong, ongoing partnerships with real estate agents and brokerages.

- Creating repeat business through excellent client experience and follow-ups.

- Using visuals—video reels, sample reports, testimonials—to communicate our difference.

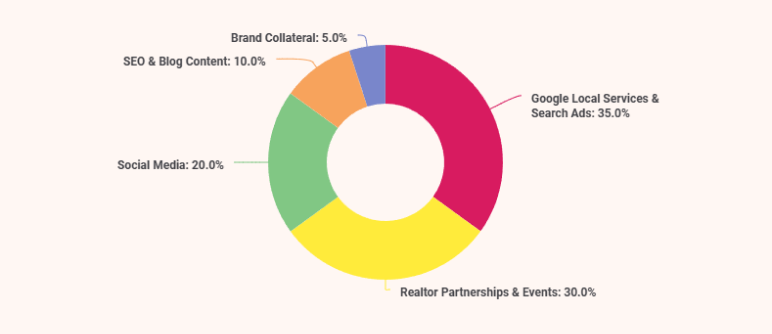

Marketing Channels & Budget

| Channel | Monthly Spend ($) | Purpose / Focus | Share of Budget |

|---|---|---|---|

| Google Local Services & Search Ads | 1,000 | Capture "home inspector near me" searches | 35% |

| Realtor Partnerships & Events | 900 | Sponsorships, agent lunches, and referral incentives | 30% |

| Social Media (Instagram, Facebook, LinkedIn) | 600 | Showcase behind-the-scenes work, video reels, and testimonials | 20% |

| SEO & Blog Content | 300 | Improve organic visibility for Franklin + Nashville searches | 10% |

| Brand Collateral (Uniforms, Wraps, Flyers) | 150 | Local brand recall | 5% |

| Total Monthly Spend | $2,950 | 100% |

Digital Marketing Strategy

StructSure’s marketing plan focuses on being visible online, building strong relationships with realtors, and earning trust through quality service and reviews.

Google Ads & SEO Optimization

We’ll focus on showing up where local homebuyers and agents are already searching:

- Focus on high-intent keywords: “Franklin home inspection,” “drone inspection Nashville,” “radon testing Franklin TN.”

- Maintain an active Google Business Profile with reviews, photos, and service updates.

- Invest in Local Services Ads (LSA) to rank above competitors for relevant searches.

Social Media Engagement

We’ll use social media to show our work and build trust with local clients. Here’s how:

- Post weekly video reels showing thermal scans, drone flyovers, and “inspection tips.”

- Use simple, trust-building captions like “What your inspector looks for under your roof.”

- Collaborate with realtors for co-branded posts (“Partner Spotlight” content).

Content Marketing

Our goal is to educate and stay visible through helpful content.

- Launch a blog section: “Home Health Reports”—short articles on home maintenance, energy efficiency, and inspection readiness.

- Monthly email newsletter to realtor partners with tips, referral updates, and scheduling promotions.

Referral & Partnership Strategy

Realtors account for roughly 60% of all inspection bookings in the U.S., so we prioritize building and rewarding these relationships. Hence, our actions include:

- Hosting quarterly “Coffee & Compliance” meetups for local agents.

- Offering a $25 credit per referral after three completed inspections.

- Creating co-branded flyers for agent open houses and listings.

- Building partnerships with Keller Williams, Compass, and Parks Realty by Year 2.

Customer Retention & Reputation Management

A satisfied client is our best advertisement. We’ll focus on:

- Sending a “thank-you + feedback” email within 24 hours of every completed inspection.

- Encouraging Google reviews (goal: 200+ 5-star reviews by end of Year 2).

- Offering annual re-inspection discounts for homeowners and investors.

- Maintaining personalized communication through our CRM (HubSpot Starter).

Promotions & Launch Offers

To gain early traction and build brand awareness, StructSure will run:

Grand opening offer. “$50 off first inspection” for the first 90 days.

Realtor partner promotion for a free thermal scan with every 3rd agent-booked inspection.

Seasonal Campaigns:

- “Spring Home Health Check” (discounted maintenance inspections)

- “Summer Roof Scan Special” (drone roof imaging promo)

These campaigns will rotate quarterly to maintain visibility and seasonal relevance.

Metrics & Performance Tracking

We’ll measure marketing success using:

| Metric | Target | Frequency |

|---|---|---|

| Website conversions (form fills/bookings) | 8-10 per week | Monthly |

| Cost per lead (Google Ads) | ≤ $20 | Monthly |

| Realtor partnerships | 100+ by Year 2 | Quarterly |

| Google review count | 200+ 5 ratings | Yearly |

| Customer repeat rate | ≥ 20% by Year 3 | Annual |

7. Operations Strategy

StructSure Inspections keeps things simple, reliable, and efficient. From booking to final report, the entire process is built to be quick and stress-free. Smart software, clear scheduling, and a small, focused team help ensure every inspection is accurate and delivered on time.

Business Model

The company operates from the Cool Springs Business District in Franklin, right off the I-65 corridor. This location makes it easy to serve clients across Williamson and Davidson Counties. StructSure runs two inspection teams, each handling about two inspections per day. This setup gives flexibility for managing same-day bookings and urgent requests without overloading the staff, ensuring steady quality and dependable service.

Weekly Operations Schedule

| Day | Hours | Focus |

|---|---|---|

| Monday - Friday | 8:00 AM – 7:00 PM | Standard home & builder inspections |

| Saturday | 9:00 AM – 4:00 PM | Overflow and investor work |

| Sunday | By appointment | Premium rush or emergency service |

Daily Workflow and Process

Booking & Scheduling

Clients can book online or by phone. The Spectora system handles confirmations, payments, and reminders automatically. Appointments are added to the team calendar and include the right tools (drone, radon kit, or thermal camera).

Pre-Inspection Preparation

Inspectors review the property listing and past reports to plan their work. Large homes (over 3,000 sq. ft.) are flagged for extra time.

On-Site Inspection

Two inspectors check the structure, roof, HVAC, plumbing, and electrical systems. Drone and thermal scans are used when needed for better accuracy.

Report Generation

Inspectors upload findings, notes, and photos into Spectora’s mobile app, which creates a digital report. Reports are reviewed by Mark Delaney before being sent to clients—usually within 24 hours.

Client Follow-Up

After report delivery, clients get a thank-you email, maintenance checklist, and referral link. Realtor partners receive a short summary (with client approval).

Staffing Structure

| Role | Headcount | Annual Compensation | Primary Responsibilities |

|---|---|---|---|

| Mark Delaney - Lead Inspector / CEO | 1 | $85,000 | Oversees all inspections, quality control, and training |

| Senior Inspector | 1 | $65,000 | Conducts inspections, manages junior staff |

| Junior Inspector | 1 | $48,000 | Assists on inspections, handles add-ons (drone/radon) |

| Operations Manager (Karen Delaney) | 1 | $55,000 | Scheduling, billing, compliance, customer service |

| Marketing Coordinator (PT) | 1 | $24,000 | Digital content, ad management, partner outreach |

| Bookkeeper (Contractor) | — | $6,000 | Monthly reconciliation and tax prep |

Total payroll: approximately $283,000 annually.

StructSure’s small but cross-trained team keeps payroll predictable while maintaining coverage for growth.

Milestones

- LLC formation, licensing, and equipment onboarding (Q2 2026)

- Marketing launch and first inspections (Q3 2026)

- Agent partnerships established (Q4 2026)

- Break-even by Q3 2027 (~60 inspections/month)

- 3-inspector cadence with 100+ monthly inspections (Year 3)

Quality Control and Compliance

StructSure maintains high standards through proper licensing, regular audits, strong safety measures, and secure data handling. These practices ensure accuracy, reliability, and full compliance with state and industry requirements.

1) Licensing & Certification

StructSure holds Tennessee Home Inspector License #HI-21894 and FAA Part 107 Drone Certification. Inspectors complete ongoing training through InterNACHI and ASHI to stay updated with best practices.

2) Internal Audits

Every tenth inspection report is reviewed for accuracy, photo quality, and consistency to maintain quality and client confidence.

3) Safety & Insurance

The company carries $3 million in E&O and general liability coverage (Hiscox Insurance), plus workers’ compensation and vehicle/drone insurance for full protection.

4) Data Security

Client data is stored in encrypted cloud systems with automatic backups every 48 hours to ensure privacy and information safety.

Equipment

Inspection Tools

- FLIR E6-XT infrared cameras

- DJI Mini 4 Pro drones

- RadonEye Pro continuous radon monitors

- Moisture meters, voltage testers, and safety PPE

Software

Spectora (field & reporting), HubSpot CRM (follow-up & retention), QuickBooks Online (financials).

8. Key Management Team

StructSure Inspections is led by a small but skilled team that combines practical construction experience with strong business and customer service skills. The company’s strength comes from having hands-on owners who stay involved in daily operations while keeping professional systems, records, and compliance in place—qualities that make the business both reliable and lender-ready.

Leadership Overview

StructSure is owned and managed by Mark and Karen Delaney, a husband-and-wife team with complementary backgrounds. Mark Delaney brings over 15 years of construction experience and leads all inspection work and quality control. Karen Delaney manages office operations, scheduling, marketing, and client communication.

Together, they aim to grow StructSure into a trusted, modern home inspection company that can expand across Middle Tennessee while maintaining strong relationships and consistent service quality.

Extended Team

| Role | Position | Experience / Function |

|---|---|---|

| Senior Inspector | Full-Time | 8+ years field experience, manages daily inspections and new-hire mentoring |

| Junior Inspector | Full-Time | Licensed trainee; assists on inspections, drone operations, and radon testing |

| Marketing Coordinator (PT) | Part-Time | Handles local advertising, event planning, and content scheduling |

| Bookkeeper (Contractor) | Monthly Support | Manages bookkeeping, reconciliations, and tax prep via QuickBooks Online |

Advisory & Support Network

StructSure also leverages professional advisors to enhance compliance and strategic decisions:

- CPA – Thompson & Weaver Accounting (Franklin, TN): Monthly bookkeeping and annual tax filings.

- Legal Counsel – Langston & Bailey PLLC: Contract review and risk management guidance.

- Insurance Partner – Hiscox: $3M E&O + General Liability coverage.

- Technical Mentor – InterNACHI Education Team: Ongoing certification support.

9. Financial Plan

StructSure Inspections’ financial plan focuses on steady growth, healthy profit margins, and careful use of funding. The projections are based on real data from similar inspection businesses in Tennessee and industry research from IBISWorld. The goal is to stay profitable from the first year while managing debt responsibly and allowing room to grow.

Startup Cost Breakdown

| Category | Amount ($) | Details |

|---|---|---|

| Lease (1,200 sq ft + deposit) | 21,600 | 12-month lease in Franklin's Cool Springs district |

| Vehicle Leases | 30,000 | Two branded vans leased through Enterprise Commercial |

| Inspection Equipment | 15,000 | FLIR infrared cameras, DJI drones, radon monitors, ladders |

| Software & CRM Setup | 3,000 | Spectora + HubSpot licenses and initial configuration |

| Marketing Launch | 12,000 | Branding, website, Google Ads, and local event promotions |

| Insurance & Licensing | 5,000 | E&O, liability, drone certification, state licensing |

| Working Capital Reserve | 25,000 | Covers payroll and operating expenses for the first quarter |

| Total Startup Investment | 111,600 | Funded through equity + loan proceeds |

Financial Assumptions

| Assumption | Year 1 | Year 2 | Year 3 |

|---|---|---|---|

| Average Inspection Fee ($) | 475 | 475 | 475 |

| Inspections / Year | 600 | 1,260 | 1,440 |

| Variable Cost (% of Revenue) | 15% | 15% | 15% |

| Payroll + Benefits ($) | 210,000 | 265,000 | 283,000 |

| Fixed Overhead ($) | 72,000 | 75,000 | 78,000 |

| Loan Repayment ($) | 42,000 | 42,000 | 42,000 |

| Tax Rate | 0% | 10% | 20% |

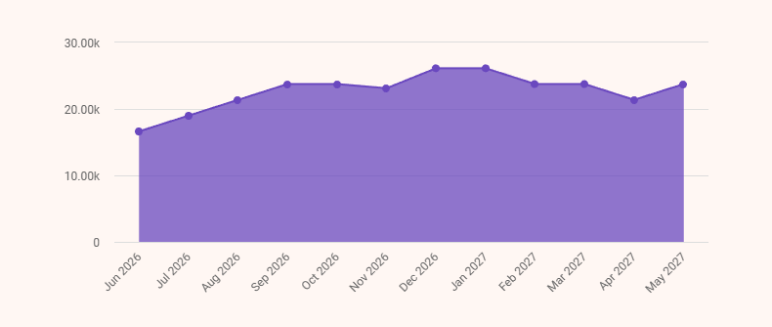

Monthly Revenue Projections

| Month | Estimated Inspections | Avg Fee ($) | Total Revenue ($) |

|---|---|---|---|

| Jun 2026 | 35 | 475 | 16,625 |

| Jul 2026 | 40 | 475 | 19,000 |

| Aug 2026 | 45 | 475 | 21,375 |

| Sep 2026 | 50 | 475 | 23,750 |

| Oct 2026 | 50 | 475 | 23,750 |

| Nov 2026 | 55 | 475 | 26,125 |

| Dec 2026 | 55 | 475 | 26,125 |

| Jan 2027 | 55 | 475 | 26,125 |

| Feb 2027 | 50 | 475 | 23,750 |

| Mar 2027 | 50 | 475 | 23,750 |

| Apr 2027 | 45 | 475 | 21,375 |

| May 2027 | 50 | 475 | 23,750 |

| Total (Year 1) | 630 Inspections | — | $285,000 |

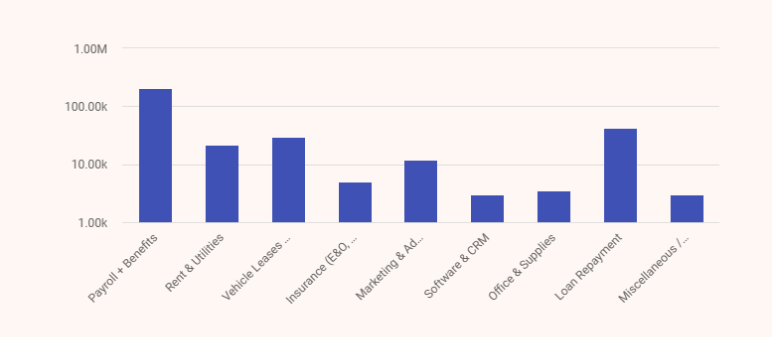

Monthly Expense (Year 1)

| Expense Category | Monthly ($) | Annual ($) |

|---|---|---|

| Payroll + Benefits | 17,500 | 210,000 |

| Rent & Utilities | 1,800 | 21,600 |

| Vehicle Leases & Fuel | 2,500 | 30,000 |

| Insurance (E&O, Liability, Auto) | 420 | 5,000 |

| Marketing & Advertising | 1,000 | 12,000 |

| Software & CRM | 250 | 3,000 |

| Office & Supplies | 300 | 3,600 |

| Loan Repayment | 3,500 | 42,000 |

| Miscellaneous / Contingency | 250 | 3,000 |

| Total Operating Expenses | 27,520 / mo avg | ≈ $330,000 / yr |

Profit & Loss Projections

| Category | Year 1 ($) | Year 2 ($) | Year 3 ($) |

|---|---|---|---|

| Revenue | 285,000 | 598,500 | 684,000 |

| Cost of Services (Variable 15%) | 42,750 | 89,775 | 102,600 |

| Gross Profit | 242,250 | 508,725 | 581,400 |

| Payroll & Benefits | 210,000 | 265,000 | 283,000 |

| Rent & Utilities | 21,600 | 21,600 | 22,000 |

| Vehicle Leases & Fuel | 30,000 | 31,000 | 32,000 |

| Insurance (All) | 5,000 | 5,200 | 5,400 |

| Marketing & Advertising | 12,000 | 14,000 | 15,000 |

| Software & Subscriptions | 3,000 | 3,000 | 3,200 |

| Office & Supplies | 3,600 | 4,000 | 4,200 |

| Miscellaneous | 3,000 | 3,200 | 3,400 |

| Total Operating Expenses | 288,200 | 346,000 | 368,200 |

| EBITDA | -45,950 | 162,725 | 213,200 |

| Loan Payments (P + I) | 42,000 | 42,000 | 42,000 |

| Net Income Before Tax | -87,950 | 120,725 | 171,200 |

| Income Tax (0%/10%/20%) | - | 12,100 | 34,200 |

| Net Profit After Tax | -87,950 | 108,625 | 137,000 |

Cash Flow Statement

| Category | Year 1 ($) | Year 2 ($) | Year 3 ($) |

|---|---|---|---|

| Operating Cash Inflow | 285,000 | 598,500 | 684,000 |

| Operating Cash Outflow | (330,000) | (372,000) | (400,000) |

| Net Operating Cash Flow | -45,000 | 226,500 | 284,000 |

| Investing Activities (Equipment, Leasehold) | (111,600) | (5,000) | (5,000) |

| Financing Activities | +230,000 (funding) | (40,000 loan repay.) | (45,000 loan repay.) |

| Net Change in Cash | +73,400 | +181,500 | +234,000 |

| Opening Cash Balance | 0 | 73,400 | 254,900 |

| Closing Cash Balance | 73,400 | 254,900 | 488,900 |

Projected Balance Sheet

| Assets | Year 1 ($) | Year 2 ($) | Year 3 ($) |

|---|---|---|---|

| Current Assets | |||

| Cash | 73,400 | 254,900 | 488,900 |

| Accounts Receivable | 25,000 | 35,000 | 40,000 |

| Prepaid & Deposits | 3,000 | 3,000 | 3,000 |

| Total Current Assets | 101,400 | 292,900 | 531,900 |

| Fixed Assets | |||

| Equipment (Net) | 15,000 | 13,000 | 10,000 |

| Leasehold Improvements (Net) | 10,000 | 9,000 | 8,000 |

| Total Fixed Assets | 25,000 | 22,000 | 18,000 |

| Total Assets | 126,400 | 314,900 | 549,900 |

| Liabilities + Equity | |||

| Current Liabilities (AP + Accruals) | 15,000 | 12,000 | 10,000 |

| Long-Term Debt (Bank Loan) | 155,000 | 115,000 | 70,000 |

| Total Liabilities | 170,000 | 127,000 | 80,000 |

| Owner Equity (Initial) | 45,000 | 45,000 | 45,000 |

| Retained Earnings | (88,600) | 142,900 | 424,900 |

| Total Equity | (43,600) | 187,900 | 469,900 |

| Total Liabilities + Equity | 126,400 | 314,900 | 549,900 |

Break-Even Analysis

| Metric | Value |

|---|---|

| Fixed Costs (Annual) | $288,000 |

| Average Revenue per Inspection | $475 |

| Gross Margin | 85% |

| Break-Even Revenue / Month | = $28,200 |

| Break-Even Volume / Month | ~60 inspections |

| Timeline | Achieved by Q3 2027 |

Scenario Analysis (Year 1)

| Metric / Indicator | Downside Case (-25%) | Base Case (Projected) | Best Case (+20%) |

|---|---|---|---|

| Annual Revenue | 214,000 | 285,000 | 342,000 |

| Total Inspections (est.) | 470 | 630 | 760 |

| Gross Margin (%) | 80 % | 85 % | 87 % |

| Gross Profit ($) | 171,200 | 242,250 | 297,540 |

| Operating Expenses ($) | 288,200 | 288,200 | 298,000 |

| EBITDA ($) | -117,000 | -45,950 | -600 |

| Net Income After Tax ($) | -157,000 | -87,950 | -12,000 |

| Operating Cash Flow ($) | -90,000 | -45,000 | +5,000 |

| Closing Cash Balance ($) | 28,000 | 73,400 | 124,000 |

| Debt Service Coverage Ratio (DSCR) | 0.7x | 0.9x | 1.3x |

| Break-Even Point (Inspections / mo) | 70 - 75 | 60 | 50 - 55 |

10. Funding Request

StructSure will be funded through a combination of owner equity and a term loan from Pinnacle Financial Partners.

Funding Structure

| Source | Amount ($) | Purpose |

|---|---|---|

| SBA / Bank Term Loan | 185,000 | Office lease, vehicles, equipment, software, insurance, and working capital |

| Owner Equity (Mark & Karen Delaney) | 45,000 | Initial deposits, legal setup, and marketing launch |

| Total Funding | 230,000 | Complete project capitalization |

Loan Repayment Schedule (Year 1)

Monthly Payment: $2,749

| Month | Opening Balance ($) | Principal ($) | Interest ($) | Closing Balance ($) |

|---|---|---|---|---|

| Jun 2026 | 185,000 | 1,362 | 1,387 | 183,638 |

| Jul 2026 | 183,638 | 1,373 | 1,376 | 182,265 |

| Aug 2026 | 182,265 | 1,385 | 1,364 | 180,880 |

| Sep 2026 | 180,880 | 1,396 | 1,353 | 179,484 |

| Oct 2026 | 179,484 | 1,408 | 1,341 | 178,076 |

| Nov 2026 | 178,076 | 1,420 | 1,329 | 176,656 |

| Dec 2026 | 176,656 | 1,432 | 1,317 | 175,224 |

| Jan 2027 | 175,224 | 1,444 | 1,305 | 173,780 |

| Feb 2027 | 173,780 | 1,456 | 1,293 | 172,324 |

| Mar 2027 | 172,324 | 1,468 | 1,281 | 170,856 |

| Apr 2027 | 170,856 | 1,480 | 1,269 | 169,376 |

| May 2027 | 169,376 | 1,493 | 1,256 | 167,883 |

5-Year Amortization Summary

| Year | Opening Balance ($) | Principal Paid ($) | Interest Paid ($) | Total Annual Payment ($) | Closing Balance ($) |

|---|---|---|---|---|---|

| 1 | 185,000 | 16,617 | 15,251 | 31,868 | 167,883 |

| 2 | 167,883 | 18,179 | 13,689 | 31,868 | 149,704 |

| 3 | 149,704 | 19,880 | 11,988 | 31,868 | 129,824 |

| 4 | 129,824 | 21,729 | 10,139 | 31,868 | 108,095 |

| 5 | 108,095 | 108,095 | 8,216 | 31,868 | — |

Key Financial Ratios

| Metric | Year 1 | Year 2 | Year 3 |

|---|---|---|---|

| Gross Margin % | 85% | 85% | 85% |

| Net Margin % | -29% | 19% | 21% |

| Current Ratio | 1.1 | 1.4 | 1.8 |

| Debt-to-Equity | 3.3 | 2.0 | 1.2 |

| Return on Equity | -181% | 47% | 75% |

Download a Free Home Inspection Business Plan Template

Planning to launch your own home inspection business but unsure where to start? Not to worry! Download our free home inspection business plan template (PDF) and build a solid plan with ease.

This ready-to-use template helps you cover every important section, such as services, pricing, market, licensing, and more. You can customize it based on your target area, inspection specialties (like radon, mold, or roofing), and business goals.

Conclusion

Now that you’ve explored a real-life sample business plan, it should be much easier for you to build a strong plan for your home inspection company.

However, if you’re short on time or feeling stuck with the details, consider using an AI-powered business plan generator, Bizplanr. It’ll help you make things easier and create a solid first draft of your business plan in just a few minutes.

You’ll need to enter a few basic details about your home inspection services, and AI will take care of the rest!

Get Your Business Plan Ready In Minutes

Answer a few questions, and AI will generate a detailed business plan.

Frequently Asked Questions

Why do I need a business plan for my home inspection company?

A home inspection business runs smoother by having a clear direction, which comes from having a business plan. It helps you outline the target market, services, pricing, marketing, and financial goals. It also shows your clients or investors that you're serious and prepared to run a home inspection company.

How do I make my home inspection services stand out?

Think about what makes you different. Whether it’s your fast response time, digital reports, or weekend availability, highlight those strengths.

Some great differentiators to mention:

- 24-hour report turnaround

- Specialty inspections (radon, mold, termite, etc.)

- Easy online scheduling

- Friendly walkthroughs with every report

Make sure to clearly mention the strengths in your business plan; they help set you apart from the competition.

What should I include in the financial section?

Focus on giving a clear picture of where the money goes and how you’ll grow:

- Startup costs (tools, insurance, licensing, marketing)

- Your pricing model and revenue projections

- Monthly/annual expenses

- Break-even point (how long until your business pays for itself)

Back it up with local market research if possible; numbers feel more real when they’re backed by research.

Can I update my home inspection business plan later?

Definitely, and you should! As your business grows or shifts direction, revisit and revise your plan. A good rule of thumb? Update it once a year or whenever you make a major change to your services, pricing, or marketing strategy.

How long should the business plan be?

It really depends on who it’s for:

- If it’s just for you and the internal team, 8–10 pages is enough.

- If you’re applying for a loan or bringing on a partner, aim for 15-25 pages with more detailed financials and market research.