Loans don’t get approved on a few conversations and handshakes. You need a business plan. One that shows how the business works, where the money goes, and how you plan to pay it back.

It isn’t just for the bank’s checklist. A good business plan helps you explain your business, catch problems early, and make your case to lenders, investors, and even co-founders.

Entrepreneurs who create a business plan are 152% more likely to start their business. So yes, it’s worth the time.

And thanks to tools like Bizplanr, which make it easier to write a business plan. This blog walks you through the rest: How to write a business plan for a loan, what to include, what lenders care about, and how to avoid common mistakes.

Get Your Business Plan Ready In Minutes

Answer a few questions, and AI will generate a detailed business plan.

Understanding what lenders look for in a business plan

You’ve got maybe 10 minutes of lender’s attention, and they’ve already seen three plans today. Your business plan must be excellent to get attention. So, how to write a business plan that gets attention?

Let’s walk you through each part of the lender’s checklist.

What lenders care about

A business plan should answer key questions within the first few scrolls. You’re writing it for someone who reads business plans all day and needs a reason to say yes. Lenders want proof that the business works, the numbers are grounded, and the loan request makes sense.

| ✅ They want to see | 🚫 They don't want |

|---|---|

| A clear business model | Corporate buzzwords and filler text |

| Realistic financial projections | Made-up numbers with no basis |

| Market research with actual data | Claims with no source or context |

| A repayment plan that adds up | Vague promises buried in general statements |

The faster someone can understand what you do and why it works, the better.

Show you’ve done the work

Before anyone approves a loan, they want to see that you understand your business in practice. At the very least, the person reviewing your plan should be able to answer these questions within a few minutes:

- What does this business offer, and what problem does it solve?

- Who’s buying, and how do you know there’s real demand?

- What brings in revenue, and what affects it over time?

- What does it cost to keep the business operating—fixed and variable?

- How does the loan support growth or stability, and when is it paid back?

Your plan should show you’ve worked through the operations, the financial gaps, and the role the loan plays.

The role of numbers and market knowledge

Strong ideas don’t move loan decisions. Strong financials do. You need numbers that mean something to write a solid business plan for a loan. You’re expected to include:

- Cash flow projections that outline how income is timed against your costs.

- Revenue estimates built from realistic assumptions.

- Market demand backed by actual research.

If you're learning how to make a business plan for a loan or starting from scratch with no model to reference, focus on making your numbers easy to follow.

Avoid treating your business plan as a one-time task

Lenders don’t just want to see where your business is today. They want to know you’re prepared for what could change next month or next quarter. A plan that doesn’t adapt gives the impression that you’re focused on getting approved, not on running the business long-term.

Even if you're just figuring out how to create a business plan for a loan, build something you'll revisit.

Stephanie Devine, founder of The Very Good Bra, secured a PayPal Working Capital loan right in the middle of the pandemic because her plan clearly showed how the funding would keep the business running and evolving. That’s the kind of clarity lenders want.

Her plan reflected real problems and how she planned to handle them. And that’s what gave it weight.

You're already ahead of most applicants if you’ve got clarity, solid numbers, and a plan that leaves no key questions hanging. What comes next is putting all of that into a structure lenders can follow without effort, and that’s what we’re covering next.

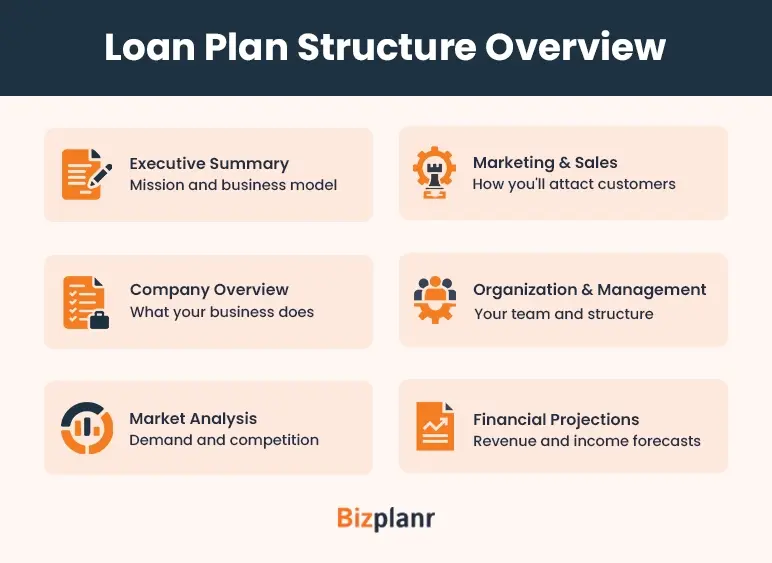

Important sections of a loan application business plan

Writing a business plan for a loan is about putting the correct details in the right place. Lenders are trained to scan for specific signals: Financial readiness, operational clarity, repayment strategy, and market awareness.

If your plan doesn’t surface those things quickly, it slows the review or gets ignored altogether. Here’s how to structure your plan to work for loan reviewers, not against them.

1. Executive summary

This is the first section lenders read, and the only one some will finish if it's weak. A good executive summary sets the tone and answers the basics upfront. Here’s what it should ideally include

- What your business does, who it serves, and why it exists

- How your business makes money (your model and revenue streams)

- How much funding do you need, why you need it, and how you plan to repay it

- What your revenue, margins, and repayment projections look like

Tip: Treat this section like a filter. The clearer and more grounded it is, the more seriously the rest of your plan gets read.

2. Company overview

This section gives lenders context to what your business is and how it operates day to day. It should be specific and practical.

What to include:

- A plain explanation of what your business does and how it works

- The market need your business is addressing, and why is it relevant now

- How your business makes money (include revenue streams if there’s more than one)

- Your long-term vision—what growth looks like and what the loan helps unlock

Tip: Keep this focused on operations and outcomes. Instead of saying you're “revolutionizing” something, explain how the business runs, who pays for it, and why it’s built to last.

AI tools like Bizplanr can also help shape this section with clearer messaging, so you avoid filler and get to the point faster.

3. Market analysis

Lenders need to know you’ve done more than look at an opportunity—you’ve broken it down, sized it properly, and understand where your business fits. This section should connect three things clearly: The demand, the customer, and the competition. For that, you must include the following:

- Market size and relevance: Along with a list of stats, focus on the portion of the market that applies to your business and back it with actual data.

- Customer segmentation: Define your target groups, how they spend, and what makes them buy.

- Competitor landscape: Identify your key competitors and explain how you’re positioned differently to show you know who’s already in the space and how you’ll survive next to them.

Tip: Connect this section directly to the financials. If your projections depend on winning a piece of the market, this is where you prove that piece is real and within reach. An AI can pull live market data and structure a market overview in seconds.

If you need a deeper walkthrough, here’s a complete guide on writing a market analysis.

4. Marketing and sales strategies

This section explains how you plan to reach your customers and turn those efforts into actual sales. Keep it practical and focused on actions.

What to include:

- Marketing channels: List the platforms, campaigns, or tools you’ll use to reach specific customer groups.

- Sales process: Outline how leads become paying customers, including key steps like outreach, conversion, or onboarding.

- Pricing strategy: Show how your pricing supports your financial goals and fits within the market context.

Tip: Include expected costs where possible. If you're budgeting for paid ads, partnerships, or sales tools, mention them here so they connect clearly to your projections.

If you're using an AI tool to draft this section, start with its structure and benchmarks, but make sure to customize it with your actual strategy, costs, and reasoning.

Want a faster start for your business plan?

Auto-generate your marketing strategy templates

5. Organization and management

This section shows who’s behind the business and how things run. A clear breakdown of roles makes it easier to understand how decisions are made and who’s accountable for what.

What to include

- Team structure: Describe the key people involved and what they handle day-to-day.

- Leadership bios: Include relevant experience tied to the role they’re filling now

- Upcoming hires: Mention any positions you plan to fill and how they’ll support operations or growth.

Tip: Focus less on resumes and more on showing that your team can deliver what the plan promises, especially when managing money, customers, or execution. Lenders want to know the plan is in capable hands. Your team is part of the risk assessment, so treat it like a core asset.

6. Financial projections

This section backs up everything you’ve said so far, with numbers. Your financials should show that the business model works, the loan is reasonable, and there’s a realistic path to repayment.

What to include:

- 3–5 year projections: Include income statements, balance sheets, and cash flow summaries with monthly or quarterly breakdowns for at least the first year.

- Revenue and expense assumptions: Be specific about what drives your numbers (e.g., customer volume, pricing, cost of goods, staffing).

- Loan repayment plan: Show exactly how and when the loan will be paid back—amount, timeline, and source of repayment.

Tip: Avoid overestimating revenue or leaving out costs to make the numbers look cleaner. Lenders don’t expect perfection, but they do expect logic, and if you're unsure how to structure this section, reviewing a business plan for a bank loan example can help.

If you need a more detailed walkthrough, here’s a complete guide on creating financial projections for your business plan.

These are the important elements of a business plan that lenders focus on most. Depending on your business and loan type, it may make sense to include things like risk analysis, product details, or operational plans, anything that helps explain how the business runs and how the loan fits in.

Getting the structure right puts you in a strong position, but even a well-organized plan can fall flat if you overlook a few avoidable missteps. Let’s cover those next.

Common mistakes to avoid when writing a business plan for a loan application

Even when the structure is solid, a few wrong choices can make lenders hesitate or reject the application entirely. These mistakes are easy to avoid once you know what to look for.

Here’s what causes problems and how to fix them.

1. Too much vision, too little execution

Big goals don’t matter if the steps to reach them aren’t clear. The plan loses weight if you talk about growth without showing how it happens through people, systems, timelines, and money.

Fix: Show the path, not just the destination. Tie every goal to actions, resources, and measurable outcomes.

2. Underestimating expenses or over-projecting revenue

Lenders are used to seeing projections that look good on paper but don’t reflect the realities of running a business. If the numbers seem inflated or the costs feel too low, it creates doubt whether the plan is grounded in actual data or just optimism.

Fix: Use conservative, data-backed projections. Build in realistic costs and show you’ve thought about worst-case scenarios.

3. Ignoring competition

Not mentioning competitors can make the plan feel incomplete. Even if your offering differs, lenders expect to see that you’ve studied the market and understand who else is serving your target customers. Without that, it’s hard to tell whether or not your strategy is grounded in reality.

Fix: Acknowledge who’s in your space. You don’t need to outmatch everyone, but you do need to explain how you’ll survive next to them.

4. Not having any contingency plans

A plan that only accounts for ideal conditions can feel unrealistic. Lenders want to see that you’ve thought through what happens if things don’t go exactly as expected—delays, slower sales, or unexpected costs.

Fix: Briefly show what happens if sales fall short, funding takes longer, or costs rise. You don’t need a disaster plan, just a backup plan that shows you’ve thought ahead.

5. Not customizing the plan for loan approval

A business plan written for investors won’t always work for lenders. If your plan focuses too much on vision, equity growth, or exit strategy, it misses the lender’s priorities.

Fix: Make sure your plan directly answers how much you need, what it’s for, how it improves the business, and how you’ll pay it back.

Avoiding these mistakes will remove the usual roadblocks that slow down loan approvals. And if you want to save time while ensuring your plan checks all the right boxes, there’s a smarter way to build it. 🧐

Make a lender-ready business plan using Bizplanr

If you’ve read this far, you already know what lenders expect and how long it usually takes to get a business plan into shape. Bizplanr makes that process faster, clearer, and built entirely around lender standards.

When you click “Generate Plan,” you’re guided through each section one at a time. The AI asks focused, lender-specific questions such as what your business does, who you serve, how much you need, and how you’ll use the funds. As you respond, it gives real-time feedback to help you phrase things clearly and professionally.

This approach saves over 10 hours you’d otherwise spend formatting, editing, and searching for the right numbers. You can generate a basic plan for free, but if you're applying for funding, the Pro version unlocks full financials, detailed sections, and lender-ready exports.

Build Your Loan-Ready Business Plan in No Time

Get a complete business plan built around what banks want to see.

Conclusion

If you’re applying for a loan, your business plan will decide whether a lender trusts you with their money. So, it must be clear, well-structured, and backed by realistic numbers.

Getting that right means giving lenders the information they’re scanning for: how your business runs, what it needs, and how the loan gets repaid.

If you’re short on time or want to avoid overthinking every section, Bizplanr helps you get started faster.

Frequently Asked Questions

What documents do I need, along with a business plan for a loan?

Banks usually ask for financial statements, tax returns, legal business documents (like registration or licenses), bank statements, and sometimes personal financial info if you're a sole proprietor.

How long should my business plan be for a bank loan?

Typically, a business plan should be between 8 to 15 pages, which is long enough to explain your business and short enough to stay focused.

Can I use the same business plan for different lenders?

Yes, but adjust the loan request, repayment terms, and supporting documents to match each lender’s process and expectations.

What’s the difference between a regular and a loan-specific business plan?

A regular plan might focus on long-term growth or attracting investors. A loan-specific plan focuses more on cash flow, financial stability, and how the loan will be repaid.

Will banks accept AI-generated business plans?

Yes, as long as the content is accurate, specific, and complete. The quality of information is something that the lenders look at.