As the global workforce undergoes unprecedented shifts, like the "Great Resignation," one thing is clear: yesterday's business assumptions might not withstand today's realities.

Just as a map's usefulness diminishes with each new landscape change, outdated assumptions can steer your business off course.

Hence, in this blog, we discuss the critical role of major assumptions in a business plan in shaping a successful business plan.

Whether you're starting a new venture or scaling an existing one, understanding these assumptions will help you move forward with clarity and confidence.

Let’s begin.

What are business plan assumptions?

Business plan assumptions are the things you believe will happen for your business to succeed. They are educated guesses about future events, like how much you’ll sell, how much things will cost, or how the market will react to your product or service.

These assumptions help you plan your finances, set goals, and make crucial decisions.

Example:

You might assume that your new product will sell 1,000 units in the first month. Based on this, you can estimate your revenue, plan how many products to produce, and decide how much to spend on marketing.

In short, business plan assumptions are the "what ifs" that guide how you build and run your business plan.

6 major assumptions in a business plan

Your business plan relies on several key assumptions that fall under the following broad categories:

1) Market assumption

Market assumptions in a business plan focus on your target market, predicting its growth, emerging trends, and potential future changes.

This helps you align your strategies with market dynamics and anticipate shifts that could impact your business. This category covers what you believe about your target market and industry.

Market assumption covers:

- Who are your customers?

- What is the size and growth of your market?

- What does the competitive landscape look like?

- How price-sensitive are your customers?

- What’s your expected market penetration rate?

Your market assumptions should be based on research, such as industry reports, customer surveys, and competitor analysis.

For example, if you assume a 10% annual growth in your target market, it should align with reliable data, not just optimistic guesses.

2) Financial assumption

Financial assumptions are at the core of your business plan. It’s a financial forecast that provides the expected annual growth rate, balance sheet assumptions, and other expenses.

Remember, financial assumptions aren’t just arbitrary guesses. They are based on market analysis, historical data, and financial models to ensure they reflect realistic and achievable outcomes.

These assumptions include:

- Revenue streams: Identify how your business will generate income, whether from a single source or multiple streams.

- Pricing strategy: Set product or service prices based on market research and competition.

- Cost structure: Outline fixed costs like rent and variable costs tied to production.

- Revenue assumptions: Include growth rates, market share, and seasonal impacts.

- Cost assumptions: Factor in fixed expenses, variable costs, and inflation projections.

- Funding & financing: Predict interest rates, loan repayment terms, and equity details.

- Profit margin assumptions: Define gross margins and potential efficiency improvements.

- Operational factors: Plan hiring, production capacity, and supplier stability.

- Economic factors: Assess industry growth, market conditions, and competition.

- Contingency plans: Allocate reserves and account for potential delays or setbacks.

3) Operational assumption

Operational assumptions focus on how your business will function on a day-to-day basis. What makes them important is that they provide a clear picture of several key elements:

| Aspect | Description | Why It’s Important | Example |

|---|---|---|---|

| Resource Management | Assumptions about the availability and allocation of resources like staff, equipment, and materials. | Ensures you have the necessary resources to operate efficiently and meet customer demand. | Hiring 10 employees to manage production and customer service. |

| Process Efficiency | Assumptions about how smoothly and efficiently processes will run. | Helps predict production output, manage timelines, and optimize workflow. | Assuming a 95% production efficiency rate. |

| Cost Control | Estimates of fixed and variable costs associated with daily operations. | Provides a clear understanding of operating expenses, enabling better budget management and profitability. | Fixed costs: $5,000/month rent; Variable costs: $2/unit. |

| Scalability and Growth | Assumptions about how the business can expand operations as demand increases. | Assesses the scalability of the business model and prepares for future growth without major disruptions. | Facility can handle a 30% increase in production without additional infrastructure. |

| Risk Mitigation | Identification of potential risks and assumptions about handling them. | Helps prepare contingency plans, minimizing operational disruptions and maintaining business continuity. | Assuming a backup supplier can deliver within 48 hours in case of a disruption. |

4) Regulatory assumption

Regulatory assumptions address the legal and compliance landscape affecting your business. Making these assumptions beforehand can save your business from costly penalties, operational disruptions, and legal complications.

By identifying potential regulations early—such as industry-specific compliance standards, tax obligations, or environmental laws—you can:

- Plan resources for compliance costs

- Adapt operations to meet legal standards

- Avoid fines and penalties

- Build trust with investors and stakeholders

- Ensure smoother business expansion into new markets

To conduct regulatory assumption, consider:

- Licensing requirements: Identify any licenses or permits needed to operate legally in your industry.

- Compliance standards: Understand regulations that govern your sector, including health, safety, and environmental laws.

- Tax implications: Assess the tax obligations relevant to your business model.

5) Economic assumption

Economic assumptions consider broader economic factors that can significantly impact your business operations and profitability. Often underrated or overlooked, these factors can have a profound effect if ignored, making it crucial for businesses to address them early on.

Key economic assumptions should cover:

- Economic conditions: Evaluate the current economic climate, including inflation rates, unemployment levels, and consumer confidence.

- Interest rates: Consider how changes in interest rates may affect borrowing costs and consumer spending.

- Currency fluctuations: If operating internationally, assess how currency exchange rates might impact profitability.

6) Technology assumption

In today’s modern era, one critical assumption that every business must incorporate into the planning process is technological. Technology is evolving rapidly, and businesses that fail to keep pace risk falling behind—or even becoming obsolete.

Therefore, making technological assumptions isn’t just important; it’s mandatory.

These assumptions help you anticipate changes, adopt new tools, and align your operations with the latest technological advancements to ensure your business remains competitive and sustainable.

Key points to consider include:

- Technology adoption: Determine how quickly customers adopt new technologies relevant to your product or service.

- Infrastructure needs: Identify the technology infrastructure required to support operations, such as software systems or hardware investments.

- Innovation trends: Stay informed about emerging technologies that could disrupt or enhance your industry.

Other important assumptions to boost your business plan

While core elements like financial projections and market analysis are crucial, incorporating additional assumptions can enhance the depth and flexibility of your business plan.

These assumptions help address overlooked areas and prepare your business for various scenarios.

| Assumption | Description | Why It Matters |

|---|---|---|

| Procurement Assumption | Estimate the availability, cost, and quality of key materials or services needed for operations. | Ensures timely access to resources, controls costs, and minimizes production interruptions. |

| Supply Chain Assumption | Assess the reliability and scalability of suppliers and logistics partners. | Helps maintain operational continuity and mitigate risks related to delays or shortages. |

| Partnership Assumption | Evaluate potential collaborations or alliances that can accelerate growth or add value. | Expand your reach, resources, and expertise, providing competitive advantages. |

| Workforce Assumption | Anticipate the availability of skilled labor and potential recruitment challenges. | Supports business growth by ensuring you can attract and retain the necessary talent. |

| Market Entry Assumption | Consider the potential barriers or enablers for entering new markets or regions. | Informs expansion strategies, reduces entry risks, and improves market penetration success. |

Now, as we are well aware of business forecasting elements, let's move on to the section that provides an overview of mistakes to avoid while making business assumptions.

Why are assumptions important in a business plan?

Here are some strong reasons why assumptions are important:

Shapes your financial projections

Assumptions lay the groundwork for financial planning, guiding cash flow, revenue growth, balance sheets, and other financial statements.

Accurate assumptions help estimate how much money your business will need, when it will become profitable, and how much you can expect to earn.

Helps you identify risk

Assumptions are like building a bridge before the water rises. It helps you find potential risks as well as uncertainties, which helps you prepare contingency plans and reduce the impact of unexpected challenges.

Informs strategic decision

If you have a clear estimate of your operational costs, target market, and external factors, decision-making becomes easier and more strategic. Knowing how much to spend and when allows you to make proactive decisions, keeping your business ready for what’s next.

Builds credibility with investors

Understanding key business assumptions can significantly impress investors and lenders. When they see well-estimated figures from your balance sheet, financial data, and business forecasts, it builds their confidence in your plan.

This clarity increases their interest and makes them more likely to invest in your business with enthusiasm.

Provides flexibility and adaptability

Assumptions give you a framework to adjust your business plan as new information becomes available. By regularly reviewing and updating assumptions, you can adapt to market changes and stay on track.

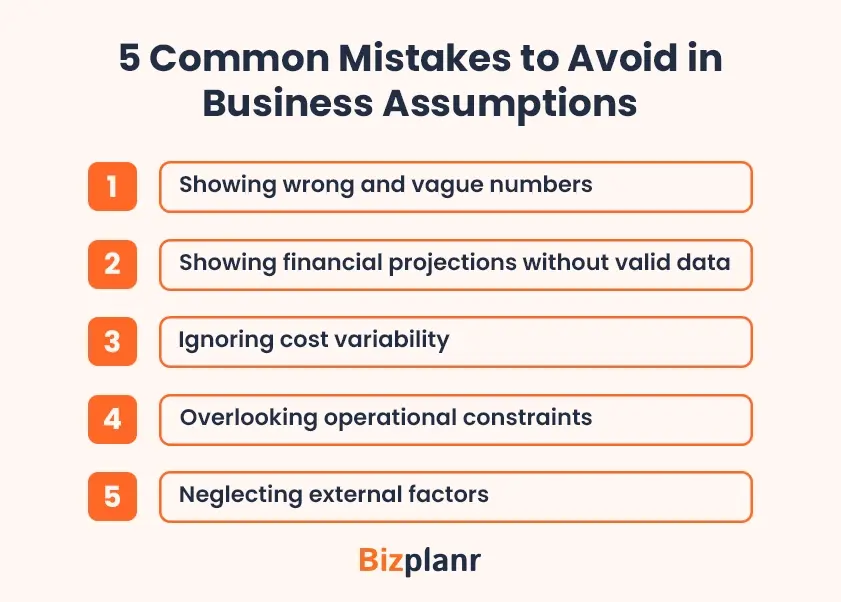

5 common mistakes to avoid in business assumptions

According to a study, 45% of new businesses fail within the first five years, often due to insufficient market research and poorly prepared business plans. Clearly, a large number of people are making major mistakes.

Hence, here are some common ones that you can avoid:

1) Showing wrong and vague numbers

Making vague assumptions or bold claims to impress investors is a costly mistake that can damage your business in the long run. Building your business plan on incorrect or unsupported assumptions creates a ripple effect.

One wrong assumption leads to another, and soon, the entire foundation of your business plan is flawed. When that happens, your business strategy won’t just be ineffective—it could fail.

2) Showing financial projections without valid data

Financial projections built on assumptions rather than verified data can compromise the credibility of your business plan.

Without accurate financial statements—like the income and cash flow statement—you risk providing unrealistic projections that fail to align with market conditions, which leads investors to mistrust and poor decision-making.

3) Ignoring cost variability

Assuming growth, profit margins, and net income based purely on fixed costs is a common error. Fixed costs are rarely constant and can be impacted by inflation, supplier price changes, or economic shifts.

It’s important to account for these fluctuations to avoid underestimated expenses and reduced profit margins. Hence, include a range of cost scenarios and regularly update your assumptions to reflect changing market conditions.

4) Overlooking operational constraints

If you assume that your operations will always run smoothly with unlimited production and seamless distribution, you're setting yourself up for failure. There may be material shortages, supply chain disruptions, or logistical challenges.

Overlooking these potential scenarios is a critical mistake. Always address such risks in your operational assumptions to ensure a realistic and resilient business plan.

5) Neglecting external factors

Strategic planning addresses all critical factors impacting your business. Similarly, assumptions in a business plan should consider external elements like competitors, market trends, and technological shifts. Ignoring these factors is a critical mistake that can lead to inaccurate planning and missed opportunities.

Conclusion

As we’ve explored the role of assumptions in business plans, it’s clear that assumptions can either strengthen or weaken the foundation of your business.

Throughout our discussion, we’ve highlighted crucial takeaways, including the importance of assumptions, their key categories, and common mistakes to avoid when developing assumptions for a business plan.

However, creating a business plan with thoughtful assumptions can feel overwhelming, but with the right tools, the process becomes much easier. Bizplanr’s AI-business plan generator platform simplifies the task, helping you craft a comprehensive plan with ease.

Start building your business on a foundation of smart, informed assumptions today, with Bizplanr.

Get Your Business Plan Ready In Minutes

Answer a few questions, and AI will generate a detailed business plan.

Frequently Asked Questions

What are the major types of assumptions in a business plan?

Key assumptions include financial (revenue, expenses, income statement), operational (supply chain, production), market (target audience, competition), and strategic (marketing strategies, growth plans).

How can I ensure my business plan assumptions are realistic?

Base assumptions on accurate data from industry reports, historical performance, and market research. Regularly review and adjust them to align with current market trends and economic conditions.

What is an example of a financial assumption in a business plan?

A common financial assumption is projecting a 10% annual increase in sales based on past performance, reflected in the income statement and cash flow projections.

How often should assumptions in a business plan be reviewed?

Review assumptions quarterly or whenever there are significant changes in the market, supply chain, or internal business operations to ensure they remain valid and aligned with your goals.