Unlike a coffee shop or a boutique, starting a real estate company requires a significant investment (in millions of $$$ to be precise).

If you’re planning to become a realtor, business planning isn’t optional.

Here’s an example for you to refer to. It’s a story of Skyline Ventures Real Estate Development, a company based in San Diego, owned by Michael Turner. He’s writing a business plan to pitch to investors/lenders to raise $5 million for one of his real estate projects.

If you plan to write a business plan for your real estate business, this sample plan here can be your guiding document:

Real Estate Business Plan (Skyline Ventures Real Estate Development)

1. Executive Summary

Skyline Ventures Real Estate Development, LLC is a small real estate company based in San Diego, California. The firm builds mid-scale residential, retail, and mixed-use properties that meet real local needs and fit the city’s focus on sustainable growth.

San Diego keeps growing, but buildable land is hard to find. Many older blocks are being rebuilt, and that’s pushing demand for new homes and shops close to the city center. Skyline Ventures works in this space, creating modern and energy-saving buildings that suit working families and small business owners who can’t afford luxury units.

The company’s office is about 3,200 square feet and sits in Downtown San Diego. The team handles all planning, permits, construction, and investor work from there. With modular building, they save time, lower costs, and maintain good control over quality.

Problem

San Diego has a serious housing problem. The city is growing fast, but there are not enough homes to meet the need. Land costs a lot, and getting approval from the city takes too long.

Many builders choose luxury projects because they make more money. This leaves very few mid-priced homes for normal working families.

Small shop owners also face trouble. Rents keep going up, and it’s hard to find small shops in good areas. The prices of materials and labor are also rising. This makes it hard for small developers to start new projects.

Because of all this, more people want homes and shops that are affordable and quick to build. Skyline Ventures has a good chance to fill this gap with mid-sized modular projects that fit local needs and stay on budget.

Solution

Skyline Ventures plans to build mid-rise buildings, about five to eight floors tall. It uses modular construction to make the work go faster. Some parts are built in a workshop first. After that, they are taken to the site and put together. This saves almost a quarter of the time and lowers carbon use by about one-third.

Each project is designed with care for the environment. Skyline follows LEED building rules and works toward top green approval. The designs include rooftop gardens, systems that save energy, and open spaces for people who live there or come to visit.

Core Services

Skyline Ventures provides a full range of real estate services. The team manages each step of development from start to finish.

- Land buying, entitlements, and permits

- Design and build homes and mixed-use projects

- Construction management

- Sales, leasing, and asset management

- Development help for joint-venture projects

Key to Success

The company’s success depends on a few key practices that guide every project:

- Use modular and eco-friendly methods to save time and cost

- Stick to clear contracts and strong project control

- Build investor confidence through honest reporting

- Focus on infill areas with strong demand and low vacancies

- Partner closely with local builders and designers

Financial Outlook

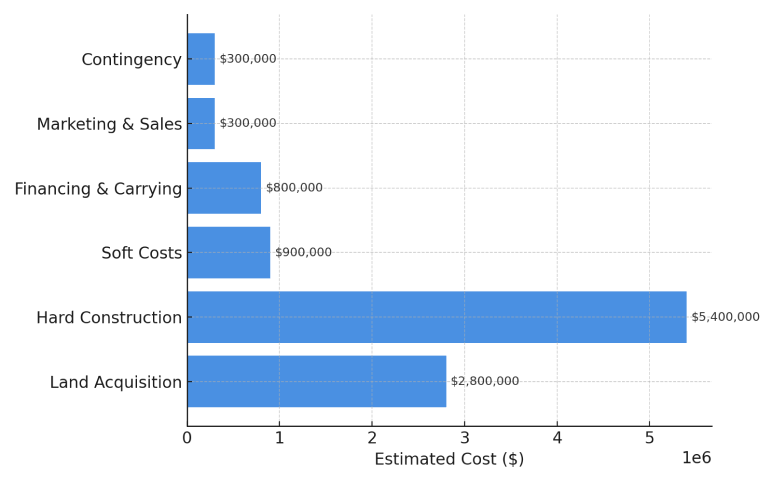

Skyline Ventures plans to grow by building a few mid-sized projects across Southern California. The first one, Elm Street Residences, will need around $10.5 million in total.

The money will go toward:

- $2.8 million for land

- $5.4 million for building work

- $900,000 for design, permits, and planning

- $800,000 for loans and running costs

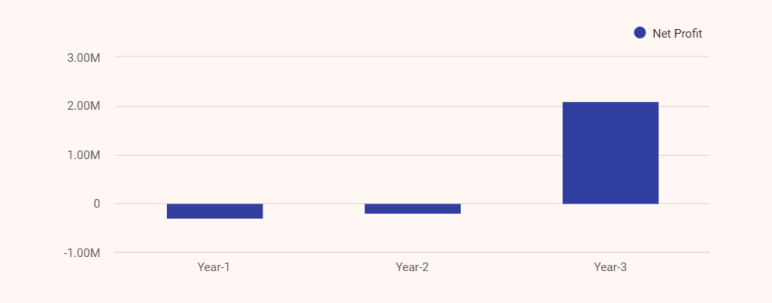

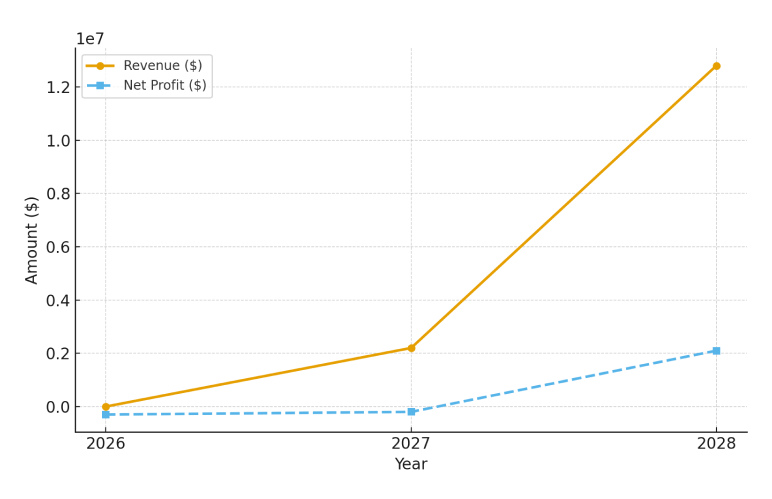

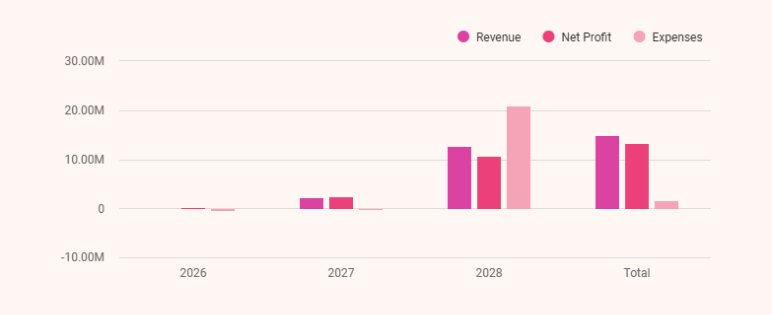

In 2026, most work will go into buying land and getting city papers done. The company may lose around $300,000 that year as things get started.

By 2027, about half of the building is expected to be completed. Early leasing could generate around $2.2 million in revenue, reducing the projected loss to approximately $200,000.

In 2028, when all units are ready and rented out, the project could make about $12.8 million. That’s roughly $2.1 million profit, close to 20%. Investors might see about an 18% return in just over three years.

| Year | Revenue ($) | Gross Margin ($) | EBITDA ($) | Net Profit ($) |

|---|---|---|---|---|

| Year 1 (2026) | – | – | -300,000 | -300,000 |

| Year 2 (2027) | 2,200,000 | 600,000 | -200,000 | -200,000 |

| Year 3 (2028) | 12,800,000 | 3,000,000 | 2,300,000 | 2,100,000 |

By Year 3 (2028), full leasing and stabilized occupancy are projected to bring $12.8M in gross revenue and $2.1M in profit, around a 20% margin.

Funding Needs

Skyline Ventures requires 5.0 million in outside capital to complete the Elm Street Residences project. This amount includes 3.5 million in equity and 1.5 million in mezzanine financing.

These funds bridge the gap between the developer’s 1.0 million contribution and the 6.0 million senior construction loan, ensuring the project’s 10.5 million total budget is fully capitalized. This structure allows the company to complete development while keeping sufficient liquidity for future work.

2. Company Overview

Skyline Ventures Real Estate Development, LLC is a San Diego–based company that builds mid-rise homes and mixed-use buildings. Its goal is to create spaces that are modern, useful, and fit the city’s growing needs.

The company started in 2025. The team has experts in design, finance, and building work. They focus on mid-sized projects that offer good quality at fair prices. Modular methods help them save time and reduce waste.

The office is in Downtown San Diego and covers 3,200 sq. ft. The staff manages design, planning, and investor work. They also team up with builders and engineers to finish safe and reliable projects across Southern California.

Departments

Skyline Ventures runs with key teams that handle each part of a project. This setup keeps work simple and moves smoothly from start to end.

Acquisition & Finance (60%) – Looks after land search, budgets, and funding. The team also manages site picks, money plans, and bank work.

Project Operations (25%) – Handles builders, job plans, site work, and checks. The team makes sure every project is safe, on time, and within budget.

Sales & Leasing (10%) – Works on ads, client talks, and renting after the project is done.

Legal & Compliance (5%) – Manages papers, deals, and local laws to keep each project safe and legal.

Mission

Skyline Ventures aims to become a trusted builder in San Diego. It focuses on affordable and eco-friendly city projects built with clear planning and strong work. Each project uses energy-saving methods that help both the city and its people.

History/Background

Skyline Ventures was started in 2025 to meet the rising need for affordable, well-built homes and shops in San Diego. The company focuses on mid-sized city projects that use smart, modular building methods to save time and cost.

Its roots come from the founder’s long experience in real estate development. He has worked with investors, lenders, and city planners on many successful projects. This experience built a strong network that helps Skyline Ventures grow steadily and deliver projects on time.

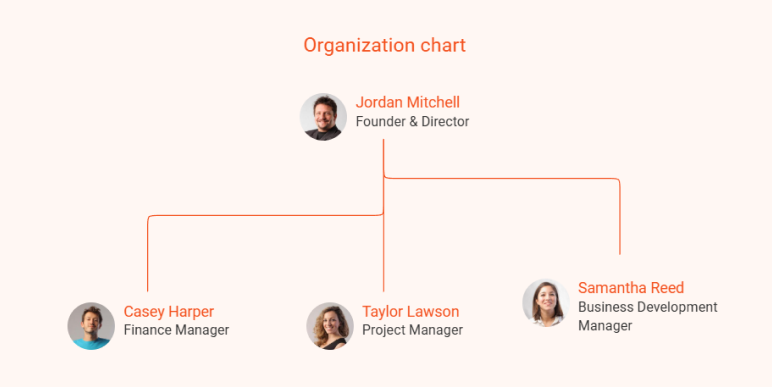

Ownership and Management

The company is led by Jordan Mitchell, a real estate developer with over 15 years of experience in multifamily and mixed-use projects across California.

Before starting Skyline Ventures, he worked with Lennar Urban and managed more than 400 residential unit projects.

Startup Summary

Start-up Expenses

| Category | Amount ($) |

|---|---|

| Licensing & Compliance | 25,000 |

| Marketing & Branding | 35,000 |

| Insurance & Legal Retainer | 40,000 |

| Total Start-up Expenses (Loss at Start-up) | 100,000 |

Start-up Assets

| Category | Amount ($) |

|---|---|

| Land Acquisition (Elm Street Site) | 2,800,000 |

| Design, Permits & Consultants | 900,000 |

| Hard Construction | 5,400,000 |

| Financing & Carrying Costs | 800,000 |

| Marketing, Sales & Contingency | 600,000 |

| Total Assets | 10,500,000 |

Funding Sources

| Source | Amount ($) |

|---|---|

| Developer Equity Investment | 1,000,000 |

| Private Equity Investment | 3,500,000 |

| Mezzanine Financing | 1,500,000 |

| Senior Construction Loan | 6,000,000 |

| Total Funding | 12,000,000 |

Objective

Skyline Ventures plans to grow slowly and earn trust as a mid-sized real estate developer in San Diego.

The Elm Street Residences should be done by June 2028. Around 68% of the homes need to be rented at about $3.35 per square foot for the project to cover its cost. Investors can expect a return of roughly 18 to 20 percent. That means close to double their money in a little over three years.

Two more projects are also in line — Pacific Grove Townhomes and Haven Commercial Plaza. Together, they will be worth about $25 million by the third year. Skyline will keep in touch with brokers, lenders, and city teams to move each one forward step by step.

3. Industry Overview

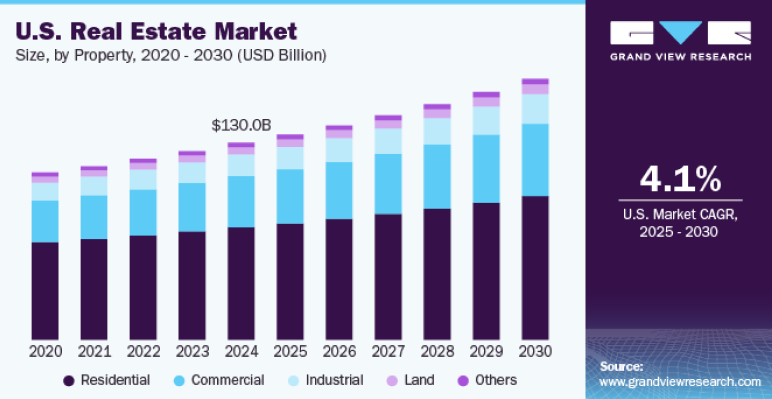

The U.S. housing market was worth $130 billion in 2024. It’s likely to grow by about 4% each year until 2030. This rise comes from more jobs, a strong economy, and more people moving to cities.

In 2024, the U.S. population reached around 336.6 million. About 80% of people live in cities, which increases the need for homes, offices, and shops. Builders are putting up more homes, but prices are still rising because of higher labor and material costs.

Since 2022, property prices have dropped about 20%, while cap rates have gone up by around 2%, based on CBRE’s 2024 Real Estate Outlook. Even with these changes, rental and industrial buildings remain in demand because they stay full and bring regular income.

Buying homes has become harder because prices and loan rates are high. More people are renting instead. In 2024, about 440,000 new apartments were completed, and around 900,000 are still being built. Many families also share homes now — about 44 million households have more than one generation living together.

Technology is transforming the real estate industry. The Colliers 2024 Report notes that demand for data centers is rising rapidly due to the growth of AI and cloud computing.

These market patterns also shape Skyline Ventures’ focus and the people it serves.

Demographics and Target Segment

Our client base falls into two main groups.

Primary Segment

Private equity investors, institutional funds, and family offices, seeking mid-scale development opportunities in growth-oriented markets.

Secondary Segment

Commercial tenants and urban residents aged 28–50. This group values convenience, sustainability, and access to downtown employment zones. They represent the core target market for Skyline’s mixed-use and residential products.

Together, these segments establish a balanced portfolio base of stable tenants and capital partners.

Ongoing shifts in the market continue to create new building and investment trends.

Industry Trends

Real estate is changing fast as:

- Many builders now use ready-made parts to finish work faster and save money.

- More people want green buildings that use less energy.

- Old downtown spaces near train stations are being rebuilt for new housing and shops.

- Many new buildings now combine homes, shops, and offices in the same complex to save space and attract more people.

- Short-term and bridge loans are helping more builders start construction.

4. Competitive Analysis

The real estate market in San Diego is active and competitive. Many builders and investors choose the city because there are steady jobs, a strong tourism industry, and limited land available for new projects. These factors keep both housing and commercial construction in high demand.

Still, mid-size and green projects are less common. Large builders often work on luxury towers or mixed-use sites, while small builders focus on short projects for quick profit. This gives Skyline Ventures a clear space to work on mid-size, practical, and eco-friendly buildings that support the community.

Local Competitors

Several well-known real estate companies operate in and around San Diego, each with its own focus and project style.

- Lennar Urban (San Diego): Builds tall apartment towers around the city. The company has strong funding and a solid name, but takes longer to complete large projects.

- Kilroy Realty (Southern California): Develops large offices and mixed-use buildings for tech firms and major clients. It does not focus much on mid-size housing.

- Hanover Company: Builds high-end apartments, condos, and homes. The projects are known for quality, but the company does not work much with modular or affordable designs.

- Sudberry Properties: Creates large suburban communities with homes and retail spaces. Most of its work happens outside central San Diego, giving urban builders like Skyline more room in the city.

Indirect Competitors

Smaller developers, local investors, and private builders also work on urban infill and redevelopment sites. These projects are usually small and centered on a single location.

While they help fill small gaps in the market, many do not plan for long-term growth or use energy-saving methods. Skyline Ventures has an advantage here because it manages several modular and mixed-use projects that meet both investor needs and local goals.

Competitive Advantage

Skyline Ventures will focus on the mid-rise, modular, and sustainable niche within the San Diego urban core — a segment underserved by high-rise and suburban developers.

It will be differentiated by:

- Specialization in modular infill projects (5–8 stories) with 25% shorter build times.

- LEED Gold–targeted designs with energy-efficient systems and rooftop green spaces.

- Transparent investor communication and disciplined financial management.

- Strategic community integration through public art and local retail activation.

With these strengths, Skyline Ventures is ready to attract both investors and tenants in San Diego’s mixed-use real estate market.

5. Services Offered

Skyline Ventures Real Estate Development, LLC will offer a well-rounded range of real estate development, construction, and asset management services designed to serve both investors and end users. Our focus is on delivering efficient, sustainable, and community-centered development solutions that distinguish us from traditional real estate firms.

Real Estate Development

We specialize in mid-scale housing and commercial developments across San Diego and surrounding Southern California markets. Our projects are designed to balance financial return with sustainability and community value.

- Mixed-Use Mid-Rise Projects ($8M–$15M each): 5–8 story developments combining residential units with ground-floor retail in high-demand downtown corridors.

- Townhome and Multifamily Residential ($5M–$10M): Sustainable housing projects for growing urban populations and young families.

- Commercial Redevelopment ($6M–$12M): Modernization of underutilized retail and office spaces in emerging submarkets.

- Infill Land Development: Acquisition and repositioning of small parcels to support modular mid-rise construction.

Each development integrates LEED-certified design, energy-efficient systems, and modular building components to shorten delivery timelines and reduce environmental impact.

Consulting and Capital Structuring

Skyline Ventures provides development consulting and capital structuring services for private investors and joint-venture partners. Offerings include:

- Site feasibility and entitlement review.

- Financial modeling, underwriting, and pro forma development.

- Structuring of equity, mezzanine, and senior loan financing.

- Investor relations and reporting for project stakeholders.

These services ensure transparency, proper risk assessment, and disciplined capital deployment across all project phases.

Construction and Project Management

Smooth project work is key to Skyline Ventures’ success. We handle the full construction process with a focus on quality, timelines, and cost control.

- Pre-Construction: Getting permits, planning value options, and choosing contractors.

- Construction Oversight: Managing schedules, checking quality, and guiding contractors.

- Modular Building: 25% faster project delivery and 30% lower carbon use.

- Post-Construction: Final checks, handover, and asset setup.

With partners like Sundt Construction and Rick Engineering Co., Skyline makes sure every project meets top-quality and sustainability goals.

Leasing, Sales, and Asset Management

Our projects are supported by Cushman & Wakefield (San Diego) and other brokerage partners to ensure smooth lease-up and sale transactions.

Services include:

- Lease and sales marketing campaigns.

- Tenant build-out and fit-out coordination.

- Asset management for stabilized properties.

- Disposition planning or refinancing for investor exits.

This vertical integration allows Skyline Ventures to maintain control from concept to completion, ensuring consistent returns and client satisfaction.

Special Services

To distinguish Skyline Ventures from traditional developers, we provide:

- LEED Gold Certification Management: Full oversight of green building compliance.

- Community Integration Planning: Public art, green rooftops, and urban design enhancements.

- Investor Reporting Dashboards: Quarterly project and financial updates via a digital platform.

- Risk Mitigation Framework: Work early with California environmental experts, use fixed-price contracts, and plan budgets carefully to avoid extra costs.

Membership-Based Investment Opportunities

Skyline Ventures plans to introduce membership-style investor programs, allowing accredited investors to participate in specific projects with structured reporting and preferred returns. The model creates predictable recurring investment opportunities and builds long-term investor relationships.

Key Differentiators

San Diego has many real estate firms, but Skyline Ventures will stand out for a few reasons:

- Focus on modular, mid-rise projects built for local infill areas.

- Use of LEED-certified designs and green building methods.

- Full control of each project from design to completion.

Investor and Project Approach

Skyline follows a community-first plan, creating modern homes with shared spaces and green features. These projects help the company grow within Southern California’s mid-size market, mixing profit with sustainable city goals.

6. Marketing Strategy

Skyline Ventures Real Estate Development, LLC will build its brand in San Diego through community outreach, local events, and investor partnerships.

The city already has a strong property market, so Skyline will focus on being known for trusted, sustainable development and modular innovation.

Local Marketing

Skyline will connect with the San Diego business and real estate community.

The company will be known for transparency, credibility, and modern design.

Main steps include:

- Partnering with San Diego Business Journal and The Real Deal for local coverage.

- Working with ULI (Urban Land Institute) and Bisnow (a commercial real estate news and events company) on talks about modular and green building.

- Hosting small meetings with brokers and investors.

- Joining city redevelopment events to match local growth plans.

- Publishing a San Diego Infill Development Report to share market and design insights.

These initiatives ensure Skyline Ventures is seen not only as a developer but as a long-term contributor to San Diego’s urban renewal.

Digital Marketing

Skyline Ventures will build a strong online presence to earn trust from investors and partners.

- A new SEO-friendly website will show project details, investor tools, and regular updates.

- The team will stay active on LinkedIn and YouTube, sharing project stories, green design work, and industry news.

- Online ads will target simple phrases like “San Diego real estate,” “mixed-use projects,” and “modular buildings.”

- A short email update will go out every quarter to keep investors and brokers informed about progress and funding.

- The goal is to keep marketing honest and visual. Skyline will share real updates, show results, and build long-term trust with both investors and tenants.

Promotion and Investor Loyalty

Skyline Ventures will use clear plans and regular updates to build investor trust and keep them for the long run. These efforts help grow relationships, attract referrals, and keep the investor group active and informed.

The company will hold quarterly reports and online meetings to talk about project results, new work, and future goals. These meetings will help keep investors updated and confident about the company’s direction.

Skyline Ventures will also run seasonal events to keep investors involved.

- The Spring Build Preview will show project progress and next steps.

- The Fall Investor Roundtable will share new funding options and invite feedback.

- The Sustainability Series will highlight Skyline’s work on green buildings and energy-saving designs that follow LEED rules.

To thank loyal partners, Skyline Ventures will give referral rewards to those who bring new investors or tenants. They will get better terms or early access to new projects. These rewards help keep people engaged and strengthen Skyline’s name as a reliable and trusted developer.

By doing all this—sharing updates, running events, and rewarding partners—Skyline Ventures builds stronger investor ties, encourages repeat investment, and ensures steady support for all its projects.

Brand Positioning

Skyline Ventures aims to stand out as a mid-size, sustainable developer.

Unlike big firms that focus on large towers, Skyline builds smart modular projects that balance design, cost, and returns.

The brand will communicate:

- “Built faster, Built smarter. Built for the community.”

- “Core identity, sustainable design, disciplined financing, and transparent execution.

Seasonality Insights

Real estate projects move in cycles based on permits, construction, and market demand.

Knowing these cycles helps Skyline Ventures plan marketing and investor outreach.

By matching marketing to each project stage, Skyline Ventures stays visible and active all year.

7. Operations Plan

Skyline Ventures Real Estate Development, LLC handles all planning, building, and investor work from its Downtown San Diego office. The team works to keep strong coordination between staff, builders, and investors so each project runs smoothly throughout the year.

Each workday follows a simple routine:

- Morning: Meetings with teams and contractors to review goals and budgets.

- Afternoon: Site visits, investor calls, and permit follow-ups.

- Evening: Schedule checks and short progress notes for managers.

Skyline uses easy-to-track digital tools and project software to manage work, spending, and communication. This helps keep all updates clear, safe, and easy for investors to see.

The operations team also plans material buying and scheduling early in each project to control costs. Materials come from trusted local partners like Sundt Construction, LPA Design Studios, and Rick Engineering Co., which helps keep work sustainable and on time.

A cloud dashboard shows live updates on milestones, permits, and reports. This setup helps the team and investors stay informed and keeps every project on track from start to finish.

Staffing Plan

| Role | Number of Staff | Pay | Main Duties |

|---|---|---|---|

| Director (Jordan Mitchell) | 1 | $180,000/year | Oversees company operations, acquisitions, and investor relations |

| Finance Manager (Casey Harper) | 1 | $130,000/year | Manages capital structure, budgets, loans, and investor reporting |

| Project Manager (Taylor Lawson) | 1 | $115,000/year | Supervises construction, schedules, and site coordination |

| Legal Advisor (Morgan Blake) | 1 | $95,000/year + $25,000 retainer | Handles contracts, CEQA, and compliance |

| Business Development Manager (Samantha Reed) | 1 | $90,000/year | Manages marketing, partnerships, and broker relations |

| Administrative Coordinator | 1 | $55,000/year | Provides office support, scheduling, and documentation |

| Marketing & Design Intern | 1 (part-time) | $22/hour | Manages digital marketing and investor media |

To keep operations smooth, Skyline Ventures will use a small but skilled team. Each member works across development, finance, law, and marketing.

From February to November, the firm will hire extra help, such as engineers, inspectors, and environmental experts. From December to January, the focus will shift to planning, audits, and new project sourcing.

On-site work will slow down, but planning and finance work will continue to keep progress steady.

This schedule helps Skyline Ventures stay efficient in slow months and fully active during busy ones, keeping a good balance between cost and productivity.

8. Management Team

Skyline Ventures Real Estate Development, LLC is led by a small, skilled team with deep experience in development, construction, finance, and compliance.

Each team member brings hands-on knowledge and a shared goal — creating sustainable, high-quality projects across San Diego. The focus stays on simple, smart design that fits community needs.

Jordan Mitchell – Founder and Director

Jordan Mitchell owns 55% of Skyline Ventures and leads daily operations. He has over 15 years of experience in California’s real estate field. Before starting Skyline, he worked with Lennar Urban, managing projects that built more than 400 multifamily homes. His work in large-scale housing gave him strong skills in planning, execution, and investor development. At Skyline, Jordan handles acquisitions, planning, and project delivery.

He manages investor relations and maintains careful control over company finances.

Casey Harper – Finance Manager and Co-Founder

Casey Harper serves as the company’s Finance Manager. Formerly a finance manager at Kilroy Realty, Casey brings extensive experience in capital structuring, pro forma modeling, and investor relations.

He is responsible for financial planning, debt management, and equity reporting. Casey also manages relationships with lenders such as First Republic Bank and private investment partners.

Taylor Lawson – Project Manager

Taylor Lawson is a civil engineer turned development project manager. With a background in large-scale construction oversight, Taylor ensures projects are delivered on schedule, within budget, and to the highest quality standards.

His role includes coordination with contractors, architects, and engineers, as well as managing site inspections and city approvals.

Morgan Blake – Legal Advisor

Morgan Blake serves as the company’s Legal Advisor. A licensed attorney specializing in land use, CEQA compliance, and real estate law, Morgan ensures Skyline Ventures maintains all required permits and legal documentation.

He oversees risk mitigation, contract drafting, and regulatory alignment for every project phase.

Samantha Reed – Business Development Manager

Samantha Reed manages business development and marketing operations. With eight years of experience at CBRE San Diego, she brings strong expertise in commercial leasing, investor communication, and branding.

Samantha oversees partnership growth, project marketing, and public relations efforts to keep Skyline Ventures visible and competitive in the San Diego market.

Organization Chart

Advisors/Consultants

In addition to its leadership team, Skyline Ventures will rely on several strategic partners and advisors:

- Blake & Murray LLP – Legal partners for contracts, compliance, and real estate.

- CliftonLarsonAllen LLP – Accounting team handling audits, tax, and financial reviews.

- Dudek Environmental – Environmental consultant managing CEQA reports and sustainability certification.

- Rick Engineering Co – Civil engineering and site design partner, ensuring structural efficiency and safety.

Together, this management team covers all critical areas of business—development, finance, law, construction, and marketing—ensuring Skyline Ventures is positioned for steady growth, operational excellence, and long-term investor confidence.

9. Financial Plan

The financial plan of Skyline Ventures Real Estate Development, LLC is built on conservative growth projections, realistic cost estimates, and institutional-level financial discipline.

The firm’s funding model balances equity, mezzanine capital, and senior construction debt to ensure strong liquidity and investor confidence.

The total development cost for the company’s first project, the Elm Street Residences, is estimated at $10.5 million, financed through a mix of developer equity and external investment.

Key Assumptions

- Project Value: $10.5 million (Elm Street Residences, San Diego)

- Gross Margin: 20% net project profit at full lease-up/sale

- Revenue Growth: 8–10% annually through 2028 via pipeline expansion

- Equity IRR: 18–20% projected

- Investor ROI: 1.85x over 3.5 years

Revenue Forecast

| Year | Project Phase | Revenue ($) | Net Profit ($) |

|---|---|---|---|

| 2026 | Land purchase & entitlement | – | -300,000 |

| 2027 | 50% construction, pre-leasing | 2,200,000 | -200,000 |

| 2028 | Full completion & lease-up | 12,800,000 | +2,100,000 |

|

Total (3-Year) |

– | 15,000,000 | +1,600,000 |

Expense Forecast

| Category | Estimated Cost ($) | Notes |

|---|---|---|

| Land Acquisition | 2,800,000 | 1.4-acre parcel downtown San Diego |

| Hard Construction | 5,400,000 | Modular + concrete podium structure |

| Soft Costs (Design, Permits, Consultants) | 900,000 | Architecture, CEQA, and entitlement costs |

| Financing & Carrying Costs | 800,000 | Loan interest, insurance, legal |

| Marketing & Sales | 300,000 | Renderings, PR, and brokerage |

| Contingency | 300,000 | 3% of total cost |

| Total Development Cost | 10,500,000 | Fully funded with equity + debt |

Monthly P&L Breakdown (For Year 1 – 2026)

| Month | Activity | Net Cash Flow ($) |

|---|---|---|

| Jan-Mar | Land acquisition, permits, design | -150,000 |

| Apr-Jun | CEQA & entitlement submission | -75,000 |

| Jul-Sep | Lender due diligence & pre-construction | -50,000 |

| Oct-Dec | Initial marketing & investor reporting | -25,000 |

| Total (Year 1) | – | -300,000 |

Projected Profit & Loss (3-Year Annual)

| Year | Revenue ($) | Expenses ($) | Net Profit ($) |

|---|---|---|---|

| 2026 | – | 300,000 | -300,000 |

| 2027 | 2,200,000 | 2,400,000 | -200,000 |

| 2028 | 12,800,000 | 10,700,000 | +2,100,000 |

| Total (3-Year) | 15,000,000 | 13,400,000 | +1,600,000 |

Projected Balance Sheet (3 Years)

| Category | Year 1 ($) | Year 2 ($) | Year 3 ($) |

|---|---|---|---|

| Assets | |||

| Cash | 150,000 | 450,000 | 1,200,000 |

| Accounts Receivable | 250,000 | 600,000 | 1,200,000 |

| Property (Work in Progress) | 8,500,000 | 9,800,000 | – |

| Total Assets | 8,900,000 | 10,850,000 | 2,400,000 |

| Liabilities & Equity | |||

| Senior Construction Loan | 6,000,000 | 6,000,000 | – |

| Mezzanine Financing | 1,500,000 | 1,500,000 | – |

| Equity & Retained Earnings | 1,400,000 | 3,350,000 | 2,400,000 |

| Total Liabilities & Equity | 8,900,000 | 10,850,000 | 2,400,000 |

Projected Cash Flow (3 Years)

| Year | Cash Inflow ($) | Cash Outflow ($) | Net Cash Flow ($) |

|---|---|---|---|

| 2026 | 1,000,000 (developer equity) | 1,300,000 | -300,000 |

| 2027 | 5,000,000 (investor + mezzanine) | 5,200,000 | -200,000 |

| 2028 | 12,800,000 (lease/sales) | 10,700,000 | +2,100,000 |

Break-Even Analysis

From the projected income and lease-up assumptions:

- Total Fixed Costs: $2,000,000

- Contribution Margin Ratio (CMR): 0.30 (30%)

- Break-Even Revenue = Fixed Costs / CMR

= 2,000,000 / 0.30 = $6,666,667

Skyline Ventures must generate approximately $6.7 million in gross revenue to break even on the Elm Street Residences project.

With Year 3 revenue at $12.8 million, the firm comfortably surpasses the break-even point, producing a 20% net profit margin.

Business Ratios

| Metric | Value |

|---|---|

| Gross Margin | 20% |

| ROI | 1.85x |

| IRR | 18.4% |

| Debt-to-Equity Ratio | 1.7:1 |

| Current Ratio | 1.4 |

| Net Profit Margin | 20% |

| Payback Period | 3.5 years |

Funding Needs

Skyline Ventures requires $5.0 million in total equity and mezzanine financing to fund its first project and working capital. This funding ensures the company can complete the Elm Street Residences development while maintaining liquidity for future projects.

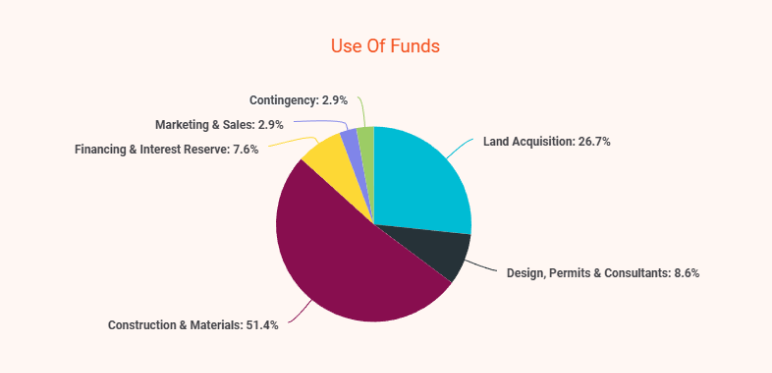

Use of Funds

| Category | Amount ($) |

|---|---|

| Land Acquisition | 2,800,000 |

| Design, Permits & Consultants | 900,000 |

| Construction & Materials | 5,400,000 |

| Financing & Interest Reserve | 800,000 |

| Marketing & Sales | 300,000 |

| Contingency | 300,000 |

| Total Uses | 10,500,000 |

Loan Repayment Plan

Skyline Ventures’ construction phase will be financed partly through a $6 million senior construction loan provided by First Republic Bank, structured with a 70% Loan-to-Cost ratio (LTC).

Loan Assumptions:

- Loan Amount: $6,000,000

- Term: 3.5 years (construction + stabilization)

- Interest Rate: 7% APR

- Monthly Payment (Interest Only): ≈ $35,000

- Total Interest Over Term: ≈ $1,470,000

Repayment will be made upon project sale or refinancing (Q4 2028), at which point investors receive their principal plus return based on the equity waterfall model.

Download a Free Real Estate Business Plan Template

Ready to create your real estate business plan, but need a bit of help? Download our free real estate business plan template PDF now and get started!

This template is designed specifically for real estate ventures as well as includes clear guides and examples to help you build a strong plan for your business. Start planning today and set your real estate business up for success!

Conclusion

We hope you now have a clear idea of all the key parts of a real estate business plan, including a strong executive summary, detailed market analysis, well-defined marketing strategy, and accurate financial projections.

With this understanding, you can start creating a professional business plan for your real estate venture.

If you still find the process difficult or need help structuring your plan, try using an AI-powered business plan generator. It helps you build complete, ready-to-use business plans in minutes. Just answer a few simple questions, and the AI assistant will create a plan for you.

So why wait? Start planning your real estate business today.

Get Your Business Plan Ready In Minutes

Answer a few questions, and AI will generate a detailed business plan.

Frequently Asked Questions

What are the main challenges in the real estate market, and how do you address them?

Major challenges in the real estate world include market volatility, competition, regulatory changes, and economic fluctuations.

You can address these by staying informed about market trends, adapting our strategies accordingly, and maintaining strong relationships with industry professionals. You should also continuously enhance your services to address challenges and meet evolving client needs.

Can I use my business plan to secure funding?

Yes, you can use your business plan to secure funding by following these steps:

- Summarize the market potential, your financial forecasts, and how your business is poised for success.

- Highlight your unique selling proposition, growth potential, and revenue model to demonstrate your business’s distinctive advantages and prospects.

- Present a compelling pitch to potential investors or lenders, showcasing how your business plan addresses market needs and offers a clear path to profitability.

Can I use free business plan templates for my real estate business plan?

Yes, you can use free business plan templates for your real estate business plan. It offers a structured framework and can help ensure you cover all the necessary components.

How long should my real estate business plan be?

A real estate business plan is typically 15–25 pages long. It should cover the key sections—executive summary, market analysis, marketing strategy, and financial projections—while keeping the content clear and practical. The length may vary based on your project type and how much detail you include.