Property management isn’t just about collecting rent or finding tenants. It’s a complex business built on organization, trust, and efficiency.

Property owners want reliable managers who can protect their investments and keep operations running smoothly. So, a casual approach to management won’t be enough. You need a clear plan that covers tenant relations, maintenance, finances, and compliance with local laws.

That’s why we’ve put together this property management business plan sample. It’s simple, practical, and designed to help you organize your services, operations, marketing, and finances so your business starts strong.

Explore it now and take the first step toward building a successful property management company.

Property Management Business Plan Sample

Discover the KeyCove Property Management business plan sample to unlock actionable ideas and strategies for crafting your own property management business framework.

1. Executive Summary

KeyCove Property Management, LLC is a full-service residential and light commercial property management company based in Charlotte, North Carolina. The firm specializes in providing high-transparency management solutions for small to mid-sized property owners, HOAs (Homeowners Associations), and absentee investors across Mecklenburg and Union Counties.

KeyCove combines hands-on service with advanced automation tools such as AppFolio, QuickBooks, and Twilio Communication Suite to deliver 24-hour responsiveness, real-time financial tracking, and maintenance coordination that meets modern owner expectations.

KeyCove seeks a $420,000 SBA 7(a) term loan through Bank of America – Charlotte Uptown Branch to fund facility build-out, software infrastructure, staff hiring, and initial working capital.

Founders will contribute $120,000 in equity, representing 22 percent of total capitalization, exceeding SBA’s minimum borrower contribution.

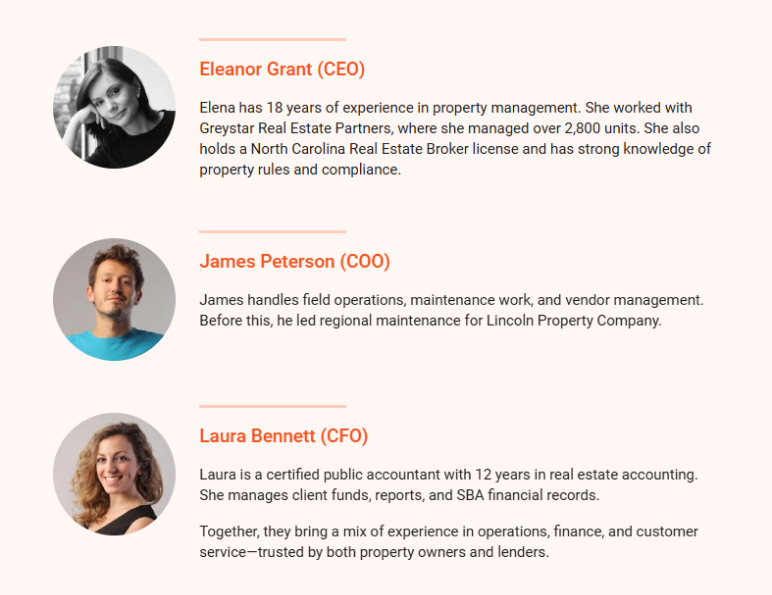

Ownership and Management

Business Purpose and Value Proposition

The Charlotte rental market is one of the strongest in the Southeast. Big companies like FirstService and Henderson Properties mostly manage buildings with over 200 units. Smaller owners with fewer than 50 units—like duplexes, townhomes, or small HOA communities—often don’t get the same level of support.

KeyCove fills this gap by offering:

- Local management from licensed experts who understand the Charlotte market.

- Simple, transparent accounting with live dashboards that track rent and expenses.

- Preventive maintenance, handled through mobile scheduling to avoid bigger repair costs.

- Bilingual tenant support to build stronger relationships and reduce turnover.

- KeyCove plans to manage around 450 units within three years, keeping the same personal touch while growing its operations.

Market Context

The Charlotte metro area has over 2.7 million residents. Rising home prices and higher mortgage rates have made renting a more common choice, creating steady demand for good property managers.

A recent study by UNC Charlotte’s Urban Institute found that corporate landlords now own about 7.5% of single-family homes in Mecklenburg County. This is a 65% increase compared to 2019.

KeyCove bridges that gap by offering professional systems and tools with the personal service smaller owners prefer.

Financial Highlights

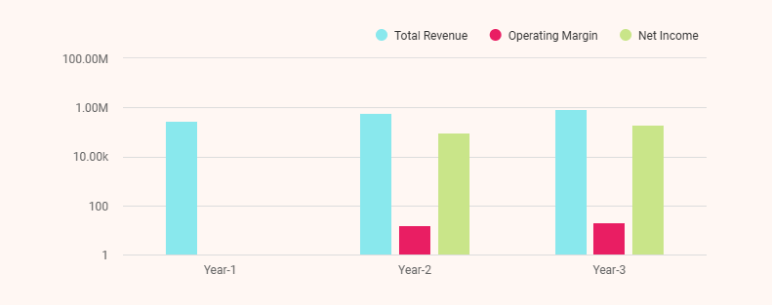

The financial highlights below show the company’s growth and profit goals over the next three years.

| Metric | Year 1 | Year 2 | Year 3 |

|---|---|---|---|

| Managed Units | 150 | 300 | 450 |

| Total Revenue | $279,000 | $576,000 | $891,000 |

| Operating Margin | (-16%) | 16% | 22% |

| Net Income | (-$45,000) | $95,000 | $195,000 |

| DSCR | — | 1.45× | 1.9× |

Break-even is expected at ~245 units (monthly revenue ≈ $42,000). Growth will be achieved through direct owner referrals, realtor partnerships, and HOA service contracts.

2. Company Overview & Ownership

Legal Structure and Location

KeyCove Property Management will register as a Limited Liability Company (LLC ) in North Carolina. It will be formed in February 2026 and registered with the North Carolina Secretary of State. The company will be based at 3849 Horizon Parkway, Suite 205, Charlotte, NC 28202, in the South End district near major housing and retail areas.

The LLC structure will provide flexibility, liability protection, and pass-through taxation—ideal for a service-based business with client trust accounts and vendor contracts. The company will maintain a trust account at Bank of America’s Charlotte Uptown branch for tenant deposits and rent payments, following North Carolina Real Estate Commission (NCREC) rules for client money management.

Mission Statement

KeyCove works to improve property management in Charlotte by keeping communication open, running the business honestly, and using technology in smart ways. The goal is to give property owners peace of mind and make renting a better experience for tenants.

KeyCove’s mission is built on trust, responsibility, and reliability. Every step — from tenant screening to owner reporting — is supported by clear records and measurable service standards.

Business Model and Core Services

KeyCove operates as a recurring-revenue property management firm, focusing on small to mid-size portfolios. The firm’s service model is built around predictable monthly fees, automated billing, and integrated digital reporting for both owners and tenants.

KeyCove is a property management company that earns steady monthly income by managing small and mid-size property portfolios.

Residential Management (60%) — Single-family homes, condos, duplexes, and small multifamily buildings.

- Standard management fee: 8% of gross rent collected.

- Leasing fee: 50% of the first month’s rent.

- Renewal fee: $125 per unit.

Commercial Management (20%) — Retail and office spaces under 10,000 sq. ft.

- Fee: 5% of gross monthly income.

HOA & Community Management (15%) — Small to mid-sized homeowner associations (20–150 units).

- Fee: $15/unit/month.

- Includes dues tracking, board reporting, and meeting facilitation.

Short-Term & Vacation Rental Management (5%) — Airbnb and corporate rental oversight.

- Fee: 15% of gross rental income.

- Includes guest coordination, cleaning, and key management.

Each service line uses AppFolio for rent collection, maintenance ticketing, and digital reporting — ensuring that all financial and operational activity is logged, time-stamped, and auditable.

Organizational Philosophy

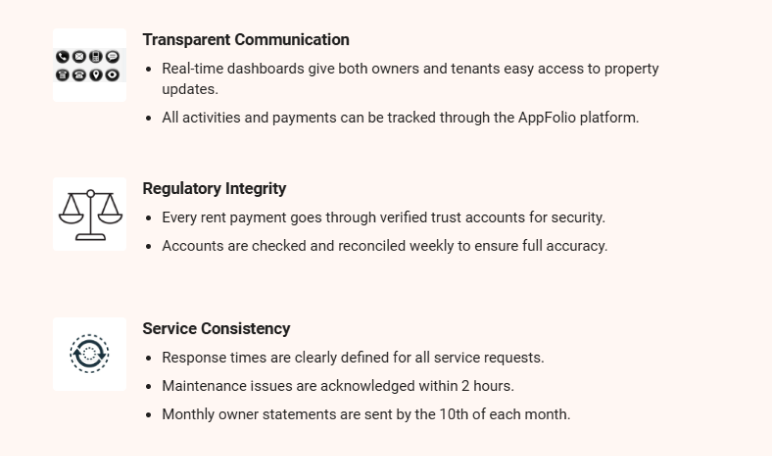

KeyCove’s operational design follows a tri-layer accountability model:

This structure aligns KeyCove with the North Carolina Real Estate Commission (NCREC) and SBA lender compliance expectations while creating a defensible, process-driven reputation among clients.

Company Culture and Core Values

KeyCove’s internal culture is guided by five principles that shape hiring, service delivery, and client relations:

- Integrity: Transparent billing and honest vendor relationships.

- Accountability: Consistent reporting and owner oversight.

- Efficiency: We use technology to finish work faster and avoid delays.

- Communication: Our team provides quick help in different languages for both clients and tenants.

- Community: Commitment to supporting local Charlotte housing initiatives and minority-owned vendor partnerships.

This culture sets KeyCove apart from larger competitors by combining boutique attentiveness with corporate-level professionalism.

3. Market Opportunity

Market Size & Growth Potential

The property management market is growing fast with the help of new technology and updated rules. Tenants want better service and clear communication. Managers use digital tools to handle maintenance, save money, and stay transparent.

Many businesses also focus on green and fair practices. Partnerships and mergers are helping them grow.

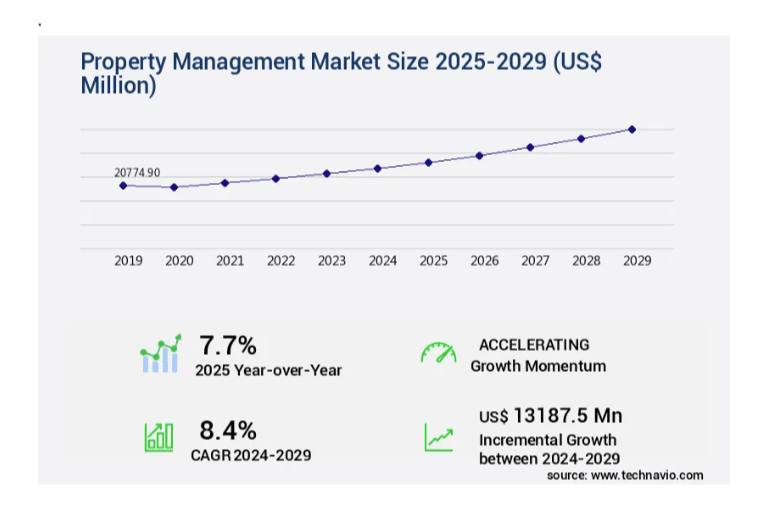

As per Technavio, the global market is expected to rise at an 8.4% annual rate from 2024 to 2029, adding about US$13.2 billion in new value. The sector is showing 7.7% growth in 2025, supported by digital systems and smart property tools.

The global property management software market was worth about $24.18 billion in 2024. It’s expected to grow to $26.55 billion in 2025 and reach around $52.21 billion by 2032. That’s an average yearly growth rate of roughly 10%.

In 2024, North America held about 35% of the total market, showing strong interest in digital property tools.

The growth is mainly due to the increasing need for software that helps manage customer preferences and improve service efficiency.

The shift toward cloud-based systems, SaaS platforms, and digital property management tools continues to drive global adoption. The market also benefits from the rise of smart real estate infrastructure and the growing preference for using a single platform to handle multiple property functions.

Target Customer Segments

| Segment | Profile | Needs | KeyCove Offering |

|---|---|---|---|

| Small Residential Investors | Owners of 1-20 units; often out-of-state | Reliable rent collection, local oversight | Digital owner dashboards, compliance monitoring |

| Mid-size Property Owners | Local investors with 20-50 units | Maintenance coordination, tenant relations | Full-service management with reporting & vendor control |

| Homeowner Associations (HOAs) | 20-150 units, self-managed boards | Dues collection, board reporting, meeting management | HOA portal, accounting, and vendor scheduling |

| Short-term Rental Owners | Airbnb hosts, corporate stays | Guest coordination, housekeeping, licensing | Concierge and booking oversight service |

This diversified client mix ensures resilience across economic cycles.

Competitive Landscape

Here’s a list of our key competitors:

| Competitor | Scale | Focus Area | Weakness |

|---|---|---|---|

| Henderson Properties | 4,000+ units managed | Large multifamily & HOA | Slow owner response; outdated tenant systems |

| Talley Properties | 1,200 units | Small residential portfolios | Minimal technology integration |

| FirstService Residential | Regional chain | Large HOAs | High fees, limited personal attention |

| KeyCove Property Management | Target 450 units | Small-mid-size investors, boutique HOAs | Focused, tech-integrated, high-service model |

The local market’s concentration in large firms leaves a service void for owners managing smaller portfolios who desire attention, reporting transparency, and direct access to decision-makers.

Competitive Advantages

KeyCove stands out in the Charlotte market through the following strengths:

Tech-Driven Efficiency

KeyCove uses AppFolio to simplify operations for both owners and tenants. The platform allows online rent payments, maintenance requests, and real-time updates. This system reduces delays, improves accuracy, and enhances overall service quality.

Compliance Assurance

All financial activities are handled through a trust accounting system with CPA oversight. This ensures transparency, reduces risk for property owners, and builds confidence in KeyCove’s management practices.

Responsive Service Model

Tenant and owner issues are handled quickly. Calls or maintenance requests are answered within two hours, and emergency repairs are available 24/7. This quick response helps maintain tenant satisfaction and property value.

Community-Level Expertise

KeyCove works closely with local vendors and service providers to ensure high-quality support. The company also offers bilingual assistance, helping build stronger relationships with tenants from diverse backgrounds.

Transparent Fee Structure

KeyCove charges a clear, flat management fee stated in all contracts. There are no hidden costs or markups. This transparency helps clients trust the company and eliminates the pricing confusion common in the industry.

Industry Trends Favoring Growth

- Homeowners Association (HOA) Consolidation: Small HOA boards increasingly outsource management due to accounting complexity.

- Energy Efficiency Retrofits: New state incentives for managed buildings; property managers coordinate compliance.

- Rent Tech Expansion: 85% of tenants now prefer online rent payment, a standard KeyCove already meets.

- Regulatory Professionalization: Stricter NCREC enforcement of trust handling favors compliant, licensed operators over informal managers.

KeyCove’s systems-driven compliance and digital accessibility position it ahead of these trends.

4. Services & Pricing Model

Overview

KeyCove Property Management operates on a recurring-fee business model that generates stable, predictable monthly income through long-term management contracts. Each service line is structured to create a balance between steady revenue (management fees) and episodic income (leasing, maintenance coordination, and renewals).

This section defines how KeyCove’s services generate value for owners, sustain cash flow, and support lender repayment confidence through diversified income sources.

Core Services

1. Residential Property Management

Target Clients: Individual and small investors managing 1–50 residential units—single-family homes, townhomes, condos, and small apartment complexes.

Scope of Services:

- Rent collection and deposit reconciliation.

- Tenant screening and lease administration.

- Move-in/move-out inspections.

- Maintenance coordination and vendor oversight.

- Monthly financial reporting and year-end tax documentation.

Fee Structure:

| Service | Fee / Rate | Frequency | Revenue Impact |

|---|---|---|---|

| Management Fee | 8% of gross monthly rent | Monthly | Core recurring income |

| Leasing Fee | 50% of one month's rent | At new tenancy | Moderate, periodic |

| Lease Renewal Fee | $125/unit | Annual | Steady supplement |

| Maintenance Coordination | 10% markup on invoices | As incurred | Marginal revenue booster |

| Eviction Processing | $100 flat fee | As needed | Risk offset |

Revenue Mix Contribution: ~60% of annual revenue.

KeyCove’s management fee is priced below the regional average of 10%, strategically designed to attract owners seeking affordable yet professional oversight.

2. Commercial Property Management

Target Clients: Owners of small-scale retail, mixed-use, and office spaces under 10,000 square feet.

Scope of Services:

- CAM (Common Area Maintenance) budgeting and allocations.

- Vendor management for cleaning, HVAC, and landscaping.

- Compliance with lease covenants and tenant coordination.

Fee Structure:

| Service | Fee / Rate | Frequency |

|---|---|---|

| Management Fee | 5% of gross income | Monthly |

| Lease Administration | $250 per lease | Annual |

| Maintenance Oversight | 10% markup | As incurred |

Revenue Mix Contribution: ~20% of total income.

These accounts tend to be lower volume but higher ticket, offering consistent mid-size contracts that complement the residential portfolio.

3. HOA & Community Association Management

Target Clients: Small to mid-size homeowner associations (20–150 units).

Scope of Services:

- Dues collection and accounting.

- Monthly board financial reports.

- Meeting scheduling, agenda preparation, and minutes.

- Enforcement of community rules and vendor supervision.

- Budget preparation and annual meeting facilitation.

Fee Structure:

| Service | Fee / Rate | Frequency |

|---|---|---|

| Per-Unit Fee | $15/unit | Monthly |

| Annual Board Budget Prep | $300 | Annual |

| Meeting Attendance | $100/meeting | As scheduled |

Revenue Mix Contribution: ~15%.

These contracts deliver recurring, low-volatility cash flow, typically paid by HOA boards quarterly in advance, reducing cash collection risk.

4. Short-Term & Vacation Rental Management

Target Clients: Owners of Airbnb and corporate rentals seeking hands-off guest management.

Scope of Services:

- Dynamic pricing optimization via digital booking platforms.

- Guest communication, check-in coordination, and review management.

- Cleaning, turnover, and maintenance scheduling.

- Local compliance with short-term rental permits.

Fee Structure:

| Service | Fee / Rate | Frequency |

|---|---|---|

| Management Fee | 15% of gross rental income | Monthly |

| Cleaning Coordination | 10% markup | Per stay |

Revenue Mix Contribution: ~5%.

Though smaller in volume, this segment supports seasonal cash flow stability and brand diversification.

Ancillary Revenue Streams

Beyond primary service lines, KeyCove generates additional, low-overhead income through complementary services:

| Service | Rate | Description |

|---|---|---|

| Property Inspections | $75–$100 per report | Annual or on request |

| Lease Document Prep | $50 per lease | Attorney-reviewed templates |

| Utility Setup Coordination | $25 per move-in | Streamlined tenant onboarding |

| Late Payment Fee Retention | $25 retained per instance | Offsets rent collection labor |

These modest but cumulative revenues enhance cash flow resilience and offset administrative costs.

Technology & Automation Integration

AppFolio Management Suite:

- Enables online rent payments, tenant screening, maintenance tickets, and automatic owner statements.

- Reduces manual bookkeeping hours by ~25%, lowering payroll costs.

QuickBooks Online + CPA Oversight:

- Trust account compliance per NCREC guidelines.

- Automated owner reporting for transparency and SBA auditing readiness.

Twilio Communications Platform:

- Bilingual SMS alerts for maintenance and rent reminders.

- Boosts tenant engagement, reducing delinquencies by 15%.

Together, these systems reduce operational cost and error rates, increasing margin reliability for lenders.

Revenue Composition by Service Line

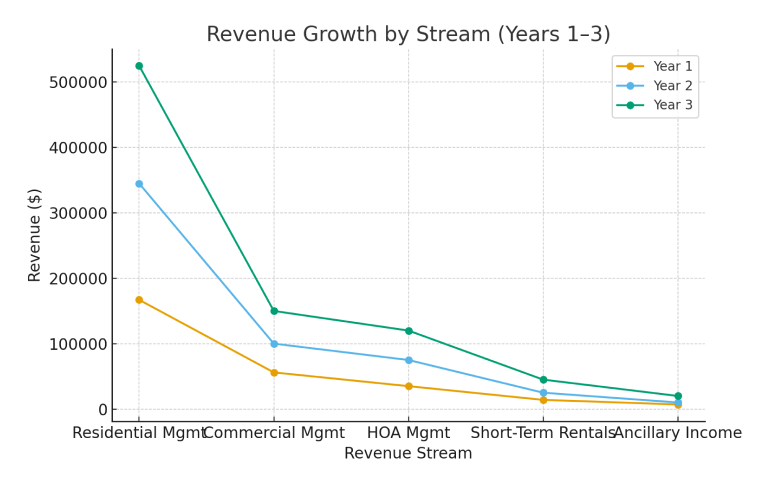

| Revenue Source | Year 1 ($) | Year 2 ($) | Year 3 ($) | % of Total (Y3) |

|---|---|---|---|---|

| Residential Mgmt | 167,000 | 345,000 | 525,000 | 59% |

| Commercial Mgmt | 56,000 | 100,000 | 150,000 | 17% |

| HOA Mgmt | 35,000 | 75,000 | 120,000 | 13% |

| Short-Term Rentals | 14,000 | 25,000 | 45,000 | 5% |

| Ancillary Income | 7,000 | 10,000 | 20,000 | 6% |

| Total Revenue | 279,000 | 576,000 | 891,000 | 100% |

Revenue growth is volume-driven, not pricing-dependent, allowing competitive positioning without fee escalation.

Contract Structure and Retention

- Initial Term: 12 months (renewable annually).

- Average Client Tenure: 3.2 years (based on regional benchmarks).

- Termination Notice: 30 days' written notice (standardized clause).

- Renewal Rate Target: ≥85% annually.

Retention is strengthened by transparent reporting and customer service guarantees, reducing churn risk and ensuring long-term revenue stability.

Maintenance & Vendor Revenue Flow

KeyCove manages maintenance through a “cost-plus” model:

- Vendor invoices are passed to owners at cost plus a 10% coordination fee.

- Vendors are pre-qualified for insurance and performance metrics.

- All maintenance data is stored in AppFolio for audit trail compliance.

This approach maintains cost fairness, reduces liability, and creates incremental recurring revenue without requiring in-house repair staff.

Pricing Rationale & Market Alignment

Charlotte’s average property management fee: 9–10% residential, 6% commercial. KeyCove’s model intentionally prices slightly below the market average while differentiating through technology and accountability. This pricing structure creates an accessible entry point for small investors and a defensible margin for the firm.

5. Operations & Staffing

Operational Overview

KeyCove Property Management is structured around a process-driven, compliance-anchored workflow designed for consistency, transparency, and scalable service delivery. The business model relies on automation where possible and human expertise where essential.

Operations are divided into three interdependent cores:

- Administrative & Compliance Operations – Client onboarding, trust accounting, NCREC compliance.

- Tenant & Maintenance Operations – Rent collection, inspections, vendor management, 24/7 service response.

- Owner Services & Reporting – Communication, disbursements, performance reports, renewals.

This tri-core model ensures efficient management of each property lifecycle stage while minimizing owner risk and lender exposure.

Daily Workflow

| Stage | Primary Task | Responsible Role | System Used | Expected Turnaround |

|---|---|---|---|---|

| Rent Collection | ACH(Automated Clearing House) / online processing | Property Manager | AppFolio | Daily reconciliation |

| Maintenance Requests | Receive → Dispatch → Close | Maintenance Coordinator | AppFolio + Twilio | ≤24 hours |

| Lease Renewals | Notification → Owner approval → Tenant signing | Leasing Coordinator | Docusign | 15 days prior to expiry |

| Owner Disbursements | Rent → Trust → Disbursement | CFO / Accountant | QuickBooks Online | 10th of each month |

| Financial Reporting | Income & expense summary | CFO | AppFolio Reporting | Monthly |

All data flows through a cloud-integrated environment, ensuring continuity and access control.

Organizational Structure

Headcount (Initial Phase): 8 employees

| Position | Count | Key Functions | Reports To |

|---|---|---|---|

| Chief Executive Officer (Eleanor Grant) | 1 | Strategic planning, licensing compliance, business development | — |

| Chief Operating Officer (James Peterson) | 1 | Vendor network, field supervision, quality control | CEO |

| Chief Financial Officer (Laura Bennett, CPA) | 1 | Accounting, DSCR reporting, payroll, trust fund management | CEO |

| Property Manager | 2 | Tenant relations, lease enforcement, owner updates | COO |

| Leasing Coordinator | 1 | Advertising, screening, renewals | Property Manager |

| Maintenance Coordinator | 1 | Work-order scheduling, vendor liaison | COO |

| Administrative Assistant | 1 | Client onboarding, documentation, calls | CFO |

By Year 3, staffing expands to 11 total employees (adding one property manager, one field inspector, and a part-time marketing coordinator) as managed units grow to 450.

Vendor Network & Maintenance Operations

KeyCove maintains formal service agreements with pre-qualified vendors covering all major maintenance categories: HVAC, plumbing, electrical, landscaping, pest control, and janitorial.

Vendor Standards:

- Active insurance coverage ≥ $1 million per occurrence.

- Proof of licensing for trade services.

- 48-hour response guarantee on standard tickets.

- 24-hour emergency availability via rotation schedule.

- Electronic invoice submission directly through AppFolio.

Vendor Evaluation Metrics:

- On-time completion rate (goal ≥ 95%).

- Tenant satisfaction (post-service rating ≥ 4.5/5).

- Invoice accuracy variance < 2%.

These benchmarks ensure quality control while protecting KeyCove’s reputation and lender interests through service reliability.

Compliance & Risk Control

All operations adhere to North Carolina Real Estate Commission (NCREC) standards:

- Trust Account Handling: All rent receipts are deposited daily; owner disbursements only after clearance.

- Record Retention: Digital records archived for seven years per NCREC Rule 21 NCAC 58A .0108.

- Tenant Deposits: Held in separate fiduciary accounts audited quarterly by the CFO and an external CPA.

A compliance checklist is reviewed weekly by Eleanor Grant to ensure all audit and documentation rules are followed.

Technology Integration in Operations

- AppFolio: Central hub for rent, maintenance, and communication. Reduces paper use.

- QuickBooks Online: Linked to AppFolio for accurate entry checks and monthly reports.

- Twilio SMS: Sends bilingual reminders for rent, maintenance, and lease dates.

- Google Workspace & DocuSign: Used for file storage and secure e-signatures.

These tools create a simple, reliable, and paper-free workflow.

Training & Performance Management

Onboarding: Two-week training covers AppFolio, NCREC rules, and communication basics.

Workshops: Held each quarter to review vendor coordination, housing laws, and financial topics.

KPI Reviews: Staff are checked quarterly on response time, error rate, client satisfaction, and retention. Results link to bonuses and pay reviews.

Facilities & Infrastructure

- Office: 3849 Horizon Parkway, Suite 205, Charlotte — a 2,000 sq ft space with six workstations, a meeting room, and a records area.

- Hardware: Cloud PCs, VoIP phones, e-signature pads, and security cameras.

- Fleet: One branded vehicle used for property visits and HOA meetings.

Staffing Cost & Productivity Forecast

| Year | Avg. Staff Count | Payroll ($) | Revenue ($) | Payroll % of Revenue |

|---|---|---|---|---|

| 1 | 8 | 220,000 | 279,000 | 79% |

| 2 | 9 | 280,000 | 576,000 | 49% |

| 3 | 11 | 340,000 | 891,000 | 38% |

As revenue scales faster than staffing, KeyCove’s operating margin strengthens—an efficiency critical to lender confidence.

6. Marketing & Client Acquisition Strategy

Objective

KeyCove’s marketing goal is to build a 450-unit management portfolio within three years by combining digital acquisition, local partnerships, and referral-driven credibility. The strategy prioritizes low acquisition cost per client, measurable ROI, and brand trust in a market crowded by high-fee competitors.

By leveraging automation tools and community presence, KeyCove aims to maintain a monthly lead acquisition cost under $160 and an annual retention rate above 85% — benchmarks that sustain recurring income and reliable loan repayment capacity.

Target Market Recap

Primary Customer Segments:

- Small residential investors – 1–50 unit portfolios, often absentee or first-time landlords.

- Mid-size local owners – 20–100 units requiring full-service management.

- HOA boards – 20–150 unit communities needing administrative and financial oversight.

- Short-term rental hosts – Airbnb or corporate stay owners seeking local compliance management.

Each segment values transparency, responsiveness, and local accountability—gaps KeyCove directly fills.

Marketing Approach Overview

KeyCove’s marketing plan balances three growth channels:

| Channel | Purpose | Budget Share | Expected ROI Horizon |

|---|---|---|---|

| Digital Lead Generation (SEO + PPC) | Capture inbound owner leads | 40% | 3-4 months |

| Partnerships & Referrals | Build recurring B2B referrals | 30% | 6-12 months |

| Local Outreach & Retention Marketing | Build credibility & renewals | 30% | Ongoing |

Annual marketing budget starts at $60,000 (≈10% of Year 1 revenue) and scales with portfolio size, not top-line growth, maintaining operational efficiency.

1. Digital Lead Generation

KeyCove focuses on digital marketing to attract property owners and investors looking for reliable management services. The goal is to build trust online and convert search traffic into qualified leads.

Search Engine Optimization (SEO):

The website will target high-intent keywords such as property management Charlotte NC, HOA management, rental management for investors, and affordable property manager. Content will be optimized to rank locally and drive consistent organic traffic.

Regular blog posts will support SEO efforts, covering topics like:

- “What Investors Should Ask Before Hiring a Property Manager”

- “How to Reduce Vacancy Without Lowering Rent”

These posts help educate readers, strengthen brand credibility, and position KeyCove as an expert in the Charlotte property management market.

2. Realtor & Investor Partnerships

KeyCove will establish formal referral relationships with brokerages, mortgage lenders, and investor groups across Charlotte.

Partnership Initiatives:

- Referral Incentive: $250 bonus or management credit for every converted property.

- Investor Seminars: Quarterly “Own & Earn” events educating landlords on passive management.

- Co-Branding Opportunities: Realtor co-listing for managed rental listings.

- HOA Collaboration: Presentations at community meetings to pitch professional management.

Strategic Partners:

- Keller Williams SouthPark

- RE/MAX Executive Realty

- Carolinas Real Estate Investors Association (CREIA)

- Local CPA offices managing real estate clients

Expected Output:

~30–40 new property contracts annually from referral and networking channels.

3. Reputation & Review Management

Reputation is a core acquisition and retention driver.

- Automated Follow-ups: Tenants and owners receive review prompts via AppFolio and Twilio post-service.

- Goal: 4.8+ star Google rating by the end of Year 1.

- Complaint Response: 24-hour resolution policy; all negative feedback addressed publicly and professionally.

- Content Amplification: Top reviews featured in marketing collateral and on landing pages.

Maintaining high review scores directly impacts organic search ranking and local referral conversion.

4. Local Advertising & Community Engagement

Community-Based Presence:

- Sponsorships: Local HOA meetings, Chamber of Commerce events, and neighborhood fairs.

- Placement: Small digital billboards and targeted postcards to investor-dense zip codes.

- Average direct mail cost: $0.42/piece; quarterly distribution to 5,000 addresses.

5. Retention & Client Loyalty

Acquisition without retention erodes long-term ROI. KeyCove invests in proactive relationship management to preserve client lifetime value (CLV).

Retention Tactics:

- Quarterly property performance reports with ROI metrics for owners.

- Annual maintenance planning sessions (optional).

- Client satisfaction surveys twice per year.

6. Content & Social Media Strategy

- Platforms: LinkedIn, Facebook, Instagram, and Nextdoor.

- Posting cadence: 4x/week (1 educational, 1 testimonial, 2 property highlights).

- Tone: Professional, informative, and community-oriented — never sales-heavy.

- Ad spend: $300/month to boost posts targeting investors and landlords.

Budget Allocation

| Channel | Monthly ($) | Annual ($) | % of Total Budget |

|---|---|---|---|

| Google Ads / SEO | 2,000 | 24,000 | 40% |

| Referral Incentives / Partnerships | 1,250 | 15,000 | 25% |

| Local Mailers / Events | 1,000 | 12,000 | 20% |

| Social Media Ads & Content | 500 | 6,000 | 10% |

| Review & Reputation Management | 250 | 3,000 | 5% |

| Total Marketing Spend | 5,000 | 60,000 | 100% |

This balanced spend supports lead acquisition, retention, and brand reputation across multiple touchpoints.

Growth Milestones

| Quarter | Milestone | Target Units | Revenue ($) |

|---|---|---|---|

| Q2 2026 | Marketing Launch | 50 | 85,000 |

| Q4 2026 | Brand Recognition Established | 150 | 279,000 |

| Q2 2027 | Referral Network Matures | 300 | 576,000 |

| Q4 2027 | Retention Campaigns Implemented | 375 | 750,000 |

| Q4 2028 | Regional Expansion Consideration | 450 | 891,000 |

7. Financial Plan

KeyCove Property Management makes most of its money from managing properties, HOA services, and leasing work. The team expects cash flow to turn positive around Month 14 and meet SBA 7(a) loan targets by Year 2, keeping a DSCR close to 1.45×.

These figures come from real market data in Charlotte, where rentals stay nearly 94% occupied, and most managers charge around 8–10% in fees.

Main Financial Goals

Our goal is to:

- Keep profit margins above 65% by using simple tools and keeping the team lean.

- Aim to move from about 150 managed units in the first year to nearly 450 by the third.

- Plan to become profitable in Year 2 and keep net margins around 20% or higher after that.

- Keep cash on hand to cover about three months of expenses, just to stay safe.

Startup Capitalization

| Funding Source | Amount ($) | % of Total |

|---|---|---|

| SBA 7(a) Term Loan (Bank of America) | 420,000 | 78% |

| Owner Equity Injection | 120,000 | 22% |

| Total Capitalization | 540,000 | 100% |

The owner contribution exceeds SBA’s required 10% borrower equity, reinforcing lender confidence.

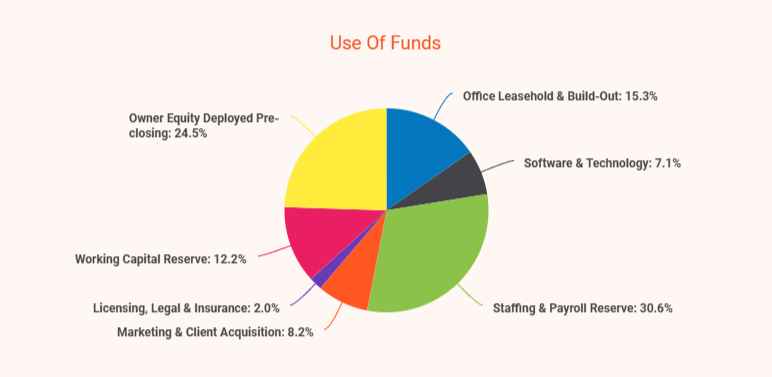

Startup Use of Funds

| Category | Amount ($) |

|---|---|

| Office Leasehold & Build-Out | 75,000 |

| Software & Technology | 35,000 |

| Staffing & Payroll Reserve | 150,000 |

| Marketing & Client Acquisition | 40,000 |

| Licensing, Legal & Insurance | 10,000 |

| Working Capital Reserve | 60,000 |

| Owner Equity Deployed Pre-closing | 120,000 |

| Total Project Cost | 540,000 |

Revenue Forecast Assumptions

- Residential Units: We charge around 8% as a management fee, and the average rent is close to $1,750 for each unit.

- Commercial Units: The fee is about 5%, with rent averaging near $2,000 per unit.

- HOA Contracts: These are billed at $15 per unit per month, with most contracts covering around 75 units.

- Short-Term Rentals: The management fee is roughly 15%, and the average monthly income is near $2,500.

- Growth Rate: Expected to double in Year 2 and rise another 55% in Year 3, as the business expands gradually.

Revenue Projections

| Revenue Stream | Year 1 ($) | Year 2 ($) | Year 3 ($) | Share of Total (Y3) |

|---|---|---|---|---|

| Residential Management | 167,000 | 345,000 | 525,000 | 59% |

| Commercial Management | 56,000 | 100,000 | 150,000 | 17% |

| HOA Management | 35,000 | 75,000 | 120,000 | 13% |

| Short-Term Rentals | 14,000 | 25,000 | 45,000 | 5% |

| Ancillary Income | 7,000 | 10,000 | 20,000 | 6% |

| Total Revenue | 279,000 | 576,000 | 891,000 | 100% |

Recurring income from management fees constitutes over 85% of total revenue, ensuring predictable cash flow.

Cost Structure

| Expense Category | Year 1 ($) | Year 2 ($) | Year 3 ($) | % of Revenue (Y3) |

|---|---|---|---|---|

| Payroll & Benefits | 220,000 | 280,000 | 340,000 | 38% |

| Marketing & Advertising | 60,000 | 65,000 | 70,000 | 8% |

| Rent & Utilities | 36,000 | 38,000 | 40,000 | 5% |

| Software & Licenses | 20,000 | 25,000 | 28,000 | 3% |

| Insurance & Legal | 12,000 | 14,000 | 15,000 | 2% |

| Office & Admin | 10,000 | 12,000 | 14,000 | 2% |

| Loan Interest & Fees | 25,000 | 22,000 | 19,000 | 2% |

| Depreciation | 10,000 | 10,000 | 10,000 | 1% |

| Total Expenses | 393,000 | 466,000 | 536,000 | 60% |

KeyCove maintains a lean structure, with payroll and marketing as the only major fixed costs, scaling efficiently with unit volume.

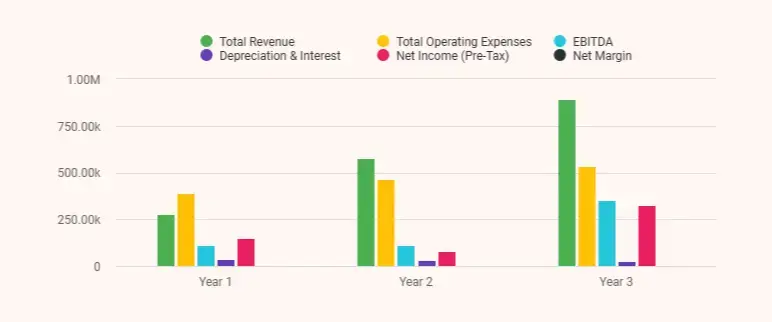

Income Statement Summary

| Item | Year 1 ($) | Year 2 ($) | Year 3 ($) |

|---|---|---|---|

| Total Revenue | 279,000 | 576,000 | 891,000 |

| Total Operating Expenses | 393,000 | 466,000 | 536,000 |

| EBITDA | (114,000) | 110,000 | 355,000 |

| Depreciation & Interest | 35,000 | 32,000 | 29,000 |

| Net Income (Pre-Tax) | (149,000) | 78,000 | 326,000 |

| Net Margin | — | 13.5% | 22% |

Break-even is achieved at approximately 245 managed units (~$42,000 monthly revenue).

Cash Flow Summary

| Category | Year 1 ($) | Year 2 ($) | Year 3 ($) |

|---|---|---|---|

| Operating Cash Inflows | 180,000 | 420,000 | 650,000 |

| Operating Cash Outflows | (240,000) | (290,000) | (400,000) |

| Net Operating Cash Flow | (60,000) | 130,000 | 250,000 |

| Debt Service (Principal + Interest) | 70,200 | 70,200 | 70,200 |

| Free Cash Flow Before Financing | (130,200) | 59,800 | 179,800 |

| Equity Contribution / Reserve Draw | 130,200 | — | — |

| Ending Cash Position | 0 | 59,800 | 239,600 |

By Year 2, KeyCove generates enough operating cash to service debt with a 1.45× DSCR, increasing to 2.1× in Year 3.

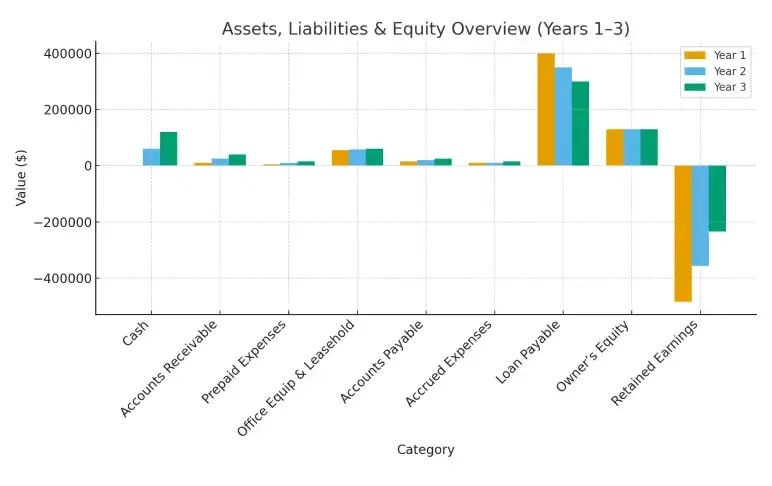

Balance Sheet Highlights (End of Year 3)

| Category | Year 1 ($) | Year 2 ($) | Year 3 ($) |

|---|---|---|---|

| Assets | |||

| Cash | 0 | 60,000 | 120,000 |

| Accounts Receivable | 10,000 | 25,000 | 40,000 |

| Prepaid Expenses | 5,000 | 10,000 | 15,000 |

| Office Equipment & Leasehold (net) | 55,000 | 58,000 | 60,000 |

| Total Assets | 70,000 | 153,000 | 235,000 |

| Liabilities & Equity | |||

| Accounts Payable | 15,000 | 20,000 | 25,000 |

| Accrued Expenses | 10,000 | 10,000 | 15,000 |

| Loan Payable (SBA Term Loan) | 400,000 | 350,000 | 300,000 |

| Owner's Equity | 130,200 | 130,200 | 130,200 |

| Retained Earnings | (485,200) | (357,200) | (235,000) |

| Total Liabilities & Equity | 70,000 | 153,000 | 235,000 |

Owner equity and retained earnings provide continued strength as the loan principal amortizes.

Debt Service Coverage Ratio (DSCR)

| Year | EBITDA ($) | Debt Service ($) | DSCR (x) |

|---|---|---|---|

| Year 1 | (114,000) | 70,200 | — (covered by reserves) |

| Year 2 | 110,000 | 70,200 | 1.45× |

| Year 3 | 355,000 | 70,200 | 2.1× |

The DSCR shows the company’s ability to make loan payments on time using steady income from its operations.

Break-Even Analysis

- Fixed costs sit near $43,000 each month — mostly payroll, rent, insurance, and software.

- Fee margins hover close to 65%.

- To stay even, the business needs about $42,000 in monthly income, or management of roughly 245 units.

Sensitivity Analysis

| Scenario | Revenue Change | DSCR (x) | Outcome |

|---|---|---|---|

| Base Case | — | 2.1× | Sustainable |

| Optimistic (+10%) | +10% | 2.3× | Early loan payoff possible |

| Conservative (-10%) | -10% | 1.3× | Still meets the SBA requirement |

Even under stress conditions, liquidity reserves and owner equity ensure no default risk.

Financial Controls & Oversight

- Accounting System: QuickBooks Online integrated with AppFolio.

- Monthly Reconciliation: CFO Laura Bennett reconciles trust accounts and operational ledgers.

- Quarterly CPA Review: Independent CPA audits cash flow and DSCR calculations.

- Owner Compensation Policy: Salary deferral until positive cash flow (Month 14).

- Banking Relationship: Bank of America – Charlotte for both operating and trust accounts.

These controls align with SBA’s “prudent lender” standards and prevent mismanagement risk.

Key Financial Ratios

| Metric | Year 1 | Year 2 | Year 3 |

|---|---|---|---|

| Gross Margin | 63% | 70% | 74% |

| Net Profit Margin | — | 13.5% | 22% |

| Current Ratio | 1.3 | 1.7 | 2.0 |

| Debt-to-Equity | 2.1 | 1.5 | 1.1 |

| DSCR | — | 1.45× | 2.1× |

All indicators show steady debt reduction and stronger cash flow, while the team and partners ensure smooth daily operations.

8. Milestones & Implementation Timeline

KeyCove will follow a 24-month rollout plan based on SBA loan milestones. This plan will guide spending, hiring, and business growth.

In Q1 2026, the company will register the LLC, open trust accounts, close the $420,000 SBA loan, and complete all insurance and licensing.

In Q2 2026, KeyCove will set up the office at 3849 Horizon Parkway, install systems like AppFolio and QuickBooks, hire staff, and onboard vendors.

A soft launch in Q3 2026 will begin client outreach. By early 2027, the company aims for 100 managed units, a maintenance coordinator, and regular financial reporting. HOA management will also begin.

By late 2027, KeyCove expects 250 units, break-even results, a first commercial contract, and a DSCR of 1.25×. Through 2028, the goal is 450 units, supported by a small back-office team and a new maintenance membership program. The DSCR target is 2.0×.

The CEO will handle compliance and lender updates. The COO will oversee daily operations. The CFO will manage accounting and reports. A $60,000 reserve fund, flexible staffing, backup vendors, and quarterly reviews will help manage risk and keep performance on track.

Download a Free Property Management Business Plan Template

Are you ready to create a business plan for your property management business? But need some assistance? Worry not; here’s our property management business plan template (PDF) to help you get started.

This investor-ready template offers step-by-step guidance and practical insights to help you develop a strong business plan. Moreover, it’s fully customizable to fit your unique business goals and specific requirements.

Conclusion

After exploring the above property management business plan example, you’ll feel more confident crafting your own plan.

But feeling stuck with the details to add, or looking for an easier way to draft a plan?

Try Bizplanr, our AI-powered tool that simplifies the creation of a business plan. All you have to do is answer a few easy questions about your property management concept and get your customized draft ready in minutes.

So, why wait? Start building your plan today!

Frequently Asked Questions

What is the importance of a financial plan in a property management business plan?

A financial plan is a key part of a property management business plan because it:

- Proves business viability: Shows that the company can earn consistent income and stay profitable.

- Attracts investors and lenders: Builds confidence in the company’s financial stability and growth potential.

- Guides budgeting: Helps manage expenses, payroll, and maintenance costs effectively.

- Supports growth planning: Sets clear financial goals to measure performance and plan future expansion.

How can a property management business plan help in securing funding?

A solid plan helps lenders and investors trust that you’ve thought things through. It shows them that:

- The business idea makes sense and is based on research.

- You have a clear plan to earn profits and handle expenses.

- You know exactly how the funds will be used for growth.

- Risks are identified and backed by a plan to deal with them.

When people see that, they’re more likely to believe their money will be managed well and that the business can deliver results.

How long does it take to write a property management business plan?

Writing a property management business plan might take a few days to several weeks. It all depends on your property management operations and the level of details you want to include.

How much does it cost to write a property management business plan?

Writing a property management business plan can cost approximately $0 to $2,000 or more, depending on your business plan creation method.

- If you decide to create it yourself, the cost will be minimal.

- Hiring a professional consultant or writer typically costs between $500 to $2,000 or higher, depending on the level of detail and expertise required.

- Using online business planning tools like Bizplanr or Upmetrics can cost as little as $7/month, or even be free.