Establishing your own insurance agency can be a rewarding venture, giving you the chance to help clients secure their future and protect their valued assets.

But before you jump in, it's crucial to have a solid business plan in place!

A well-crafted plan helps you set clear goals, secure funding, and navigate the challenges of the insurance industry with confidence.

Wondering how to draft a plan?

Not to worry! This insurance business plan sample is just for your help and inspiration.

Insurance business plan sample

Let’s explore a sample business plan of SureNest Insurance and get useful information to create each section of your plan.

1. Executive summary

SureNest Insurance is an independent insurance agency located in Charlotte, NC. It specializes in providing tailored insurance solutions for individuals, families, and businesses.

With a client-first approach, the agency offers comprehensive coverage across auto, home, life, health, and commercial insurance.

SureNest Insurance aims to make the insurance process easy, and transparent so that clients get reliable protection for their assets and peace of mind.

Mission

To provide affordable, customized, and risk-effective insurance coverage to protect our client's assets and build trust.

Vision

Our vision is to become the go-to choice for individuals and businesses by offering reliable, innovative, and outstanding customer service.

Market insights

SureNest Insurance is servicing a broad market, including families, first-time insurance buyers, small businesses, high-net-worth individuals, and retirees who are seeking long-term care coverage.

This agency, located in the growing Charlotte market, competes with big names like State Farm, Geico, and Progressive but stands out with its personal, independent approach.

Unique selling propositions (USPs)

- Tailored solutions: We create custom policies to fit the needs of individuals, families, and businesses.

- Transparent service: We provide clear, upfront information about coverage, pricing, and terms to help clients make informed choices.

- 24/7 support: Our team is available around the clock to assist with questions and claims during emergencies.

- Independent advantage: We work with multiple insurance providers to find competitive rates and more options for our clients.

Marketing efforts

SureNest Insurance will focus on:

- Creating a strong online presence through a user-friendly website and local SEO.

- Engaging customers through social media, email campaigns, and a referral program.

- Building community ties through sponsorships and events.

Financial highlights

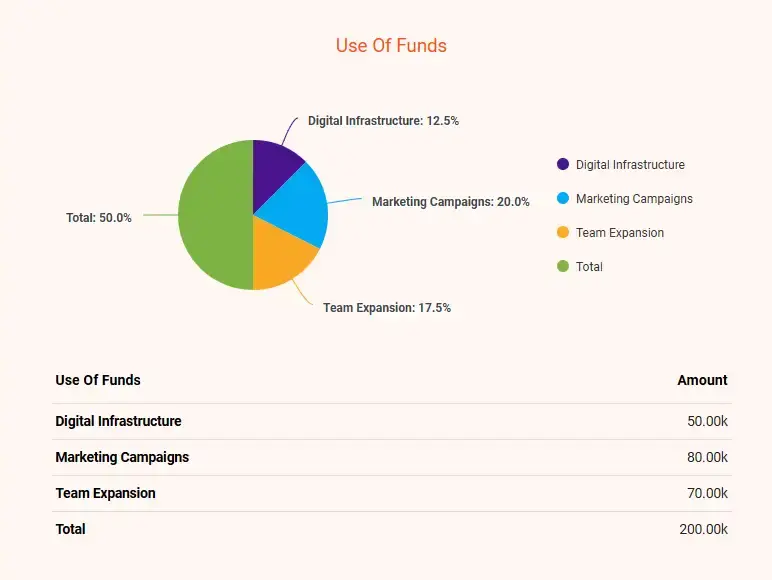

SureNest Insurance would require $200,000, which would cater to digital infrastructure, targeted marketing activities, and expand staff so that customer care can be scaled up. The agency also plans to continue an upward trajectory in revenue and profits for the next three years.

| Metric | Year 1 | Year 2 | Year 3 |

|---|---|---|---|

|

Revenue

|

$450,000 | $675,000 | $950,000 |

|

Expenses

|

$400,000 | $550,000 | $775,000 |

|

Net Profit

|

$50,000 | $125,000 | $175,000 |

|

Client Growth

|

500 clients | 750 clients | 1,200 clients |

Liking the plan you're reading? It's AI generated.

Generate Your Own Using Bizplanr AI

2. Company overview

SureNest Insurance is an independent insurance agency based in Charlotte, NC, offering personalized insurance solutions for individuals, families, and businesses.

Our services include auto, home, life, health, and business insurance, ensuring tailored protection to meet every client’s unique needs. What makes us stand out is our commitment to making insurance simple, affordable, and reliable.

By working with multiple trusted insurance providers, we deliver competitive rates and customized policies that clients can trust.

Background information

SureNest Insurance was founded by Ethan Carter, an experienced professional, passionate about helping individuals protect what they care most about.

Knowing how discouraging the process of insurance could be, Ethan launched SureNest, aligning with the mission of simplifying the process while offering personable, high-quality solutions.

Built on the values of transparency, reliability, and a commitment to client satisfaction, SureNest Insurance aims to be more than just an insurance provider.

Short-term goals

- Develop a strong base in Charlotte, NC by contacting families and local businesses.

- Create blogs or webinars on insurance that inform first-time homebuyers about their insurance choices.

- Focus on targeted marketing and referrals as ways to attain long-term sustainable financial growth.

Long-term objectives

- Maintain client retention to be at 25% more after two years, offering personalized services with regular follow-up.

- Offer insurance carrier tie-ups and, therefore, give better rates with more policies.

- Hire more agents and customer support staff to maintain quality as we grow.

3. Market research

The insurance industry is vast and highly competitive, but it also offers significant opportunities for agencies like SureNest Insurance that focus on personalized service and tailored solutions.

Industry overview

The worldwide term insurance market reached $1.06 trillion in 2023 and is forecasted to expand by 8.9% each year until 2030.

The insurance industry in Charlotte, NC, is steadily growing as more people seek personalized and dependable coverage. Clients want trusted local agents who can guide them in protecting their financial future

Market trends and opportunities

- Digital services: Customers prefer online tools for quotes and managing policies.

- Personalized coverage: Tailored policies are in demand, moving away from one-size-fits-all options.

- Small business focus: Local businesses need customized commercial insurance solutions.

Regulatory compliance

The insurance industry has rules to protect customers and ensure businesses operate properly. SureNest Insurance follows all these regulations to provide trustworthy and reliable services.

- Licensing requirements: We are fully licensed, complete the required training, pass exams, and renew our licenses regularly.

- Customer protection: We treat customers fairly, explain policies clearly, and make the claims process easy to understand.

- Data privacy: We handle customer information carefully and follow laws to keep personal and financial details safe.

- State Compliance: We follow all state rules and submit any required reports to stay compliant.

4. Customer analysis

SureNest Insurance focuses on serving a diverse group of customers in Charlotte, NC, with personalized and affordable insurance solutions. Below is a breakdown of the main customer segments, and their needs.

| Target Segment | Description | Specific Needs | Approach by SureNest Insurance |

|---|---|---|---|

|

Families

|

Households in need of coverage for home, auto, and health insurance. | Comprehensive, bundled policies at affordable rates. | Offer customizable family bundles (e.g., home-auto discounts) and reliable support. |

|

Small Businesses

|

Entrepreneurs and small business owners in Charlotte, NC. | Liability, workers’ compensation, and commercial property insurance. | Provide tailored commercial packages and personal consultations for business needs. |

|

First-Time Insurance Buyers

|

Young professionals or new homeowners exploring insurance options. | Simple guidance, clear explanations, and budget-friendly policies. | Educate clients with beginner-friendly resources (blogs, webinars) and quick quotes. |

|

High-Net-Worth Individuals

|

Clients with high-value homes, cars, or other assets requiring extra protection. | Specialized coverage options, personalized service, and custom-tailored policies. | Offer premium policies from top providers and prioritize concierge-like services. |

|

Seniors and Retirees

|

Older individuals looking for health, life, and long-term care insurance. | Supplemental health plans, affordable long-term care, and flexible life insurance. | Provide personalized support with emphasis on security and peace of mind. |

5. Competitive analysis

SureNest Insurance operates in a competitive market with several well-known players in the insurance industry. Below is an analysis of our key competitors:

Key competitors

1. State Farm

A leading national insurance provider with a strong brand reputation and extensive agent network.

Strengths:

- Trusted brand with a large customer base.

- Offers a wide variety of insurance products.

- The extensive network of agents nationwide.

Weaknesses:

- Focuses on a single-provider model, limiting flexibility for clients.

- Standardized policies that may not meet unique client needs.

- Service quality varies based on individual agents.

2. Geico

Known for its affordability and digital-first approach, Geico is a national leader in auto insurance.

Strengths:

- Competitive pricing, especially for auto insurance.

- Strong digital tools for quick quotes and policy management.

- Massive brand recognition through high-profile marketing.

Weaknesses:

- Limited personal interaction with fewer local agents.

- Focused primarily on auto insurance, with limited diversification into other categories.

3. Progressive

A technology-driven competitor recognized for its innovative tools and flexible options.

Strengths:

- Advanced tools like usage-based programs (Snapshot).

- Strong bundling options for home and auto insurance.

- Competitive pricing and discounts.

Weaknesses:

- Relies heavily on online tools, reducing personalized service.

- Focuses on speed and efficiency over building client relationships.

Competitive advantages

SureNest Insurance sets itself apart in the market with the following key advantages:

- Customized solutions: Tailored policies from multiple carriers to meet client's unique needs and budgets.

- Personalized service: Focus on building relationships through individualized attention and guidance.

- Educational support: Simplifies insurance with resources like blogs, webinars, and clear guidance for first-time buyers.

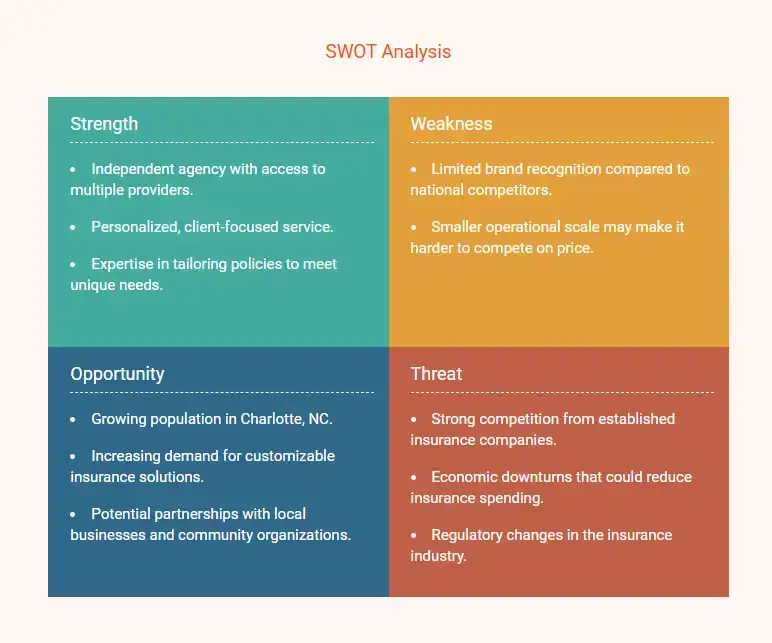

SWOT analysis

6. Marketing and sales strategy

At SureNest Insurance, our focus is on building trust and awareness while making it easy for clients to choose the right insurance solutions.

Marketing plan

- Professional website

- We’ll maintain a professional, user-friendly website where clients can learn about our services, request quotes, and get answers to their insurance questions.

- Using Search Engine Optimization (SEO), we’ll ensure that SureNest Insurance appears at the top of local searches, like "best insurance agency in Charlotte, NC."

- Social media platforms

- We’ll use platforms like Facebook, Instagram, and LinkedIn to connect with potential clients.

- By sharing useful content (like tips on choosing the right insurance) and success stories, we’ll build trust and encourage engagement with our brand.

- Email campaigns

- Regular newsletters will help us keep clients informed about new products, promotions, and helpful insurance tips.

- Personalized email outreach will allow us to follow up with clients and maintain strong relationships.

Sales strategy

- Our sales approach will focus on personal consultations to understand each client’s unique needs and offer tailored solutions.

- We’ll prioritize follow-ups with potential clients to answer their questions and ensure they feel confident in choosing SureNest Insurance.

- By combining a personalized, relationship-based sales model with easy-to-access online tools, we’ll make the sales process smooth and stress-free.

7. Operations plan

SureNest Insurance focuses on delivering efficient and client-centric services through daily operations that prioritize personalized care, policy management, and the use of advanced technology. Below is a clear breakdown of our main operational activities.

| Category | Key Activities | Responsible Team/Person | Frequency |

|---|---|---|---|

| Daily Client Operations | - Provide consultations to understand client needs and offer tailored quotes. | Sales Team | Daily |

| - Assist clients in selecting policies and completing sign-ups. | Customer Support Team | Daily | |

| - Address inquiries about existing policies or coverage updates. | Customer Support Team | Ongoing | |

| Policy & Claims Management | - Monitor and process policy renewals, ensuring timely reminders are sent. | Customer Support Team | Monthly |

| - Assist clients in filing and managing claims, providing regular updates. | Claims Specialist | As Needed | |

| Technology & Tools | - Maintain and update CRM systems for seamless client and policy management. | IT Support | Ongoing |

| - Use online tools to provide quick quotes and streamline customer interactions. | IT Support | Ongoing |

Key focus areas

- We help clients with questions, quotes, and sign-ups quickly and efficiently.

- We make policy renewals and claims easy to manage for a stress-free experience.

- We use modern tools to keep things simple and work smarter for our clients.

8. Management team

SureNest Insurance has a team of professionals who run the company to ensure excellent services and maintain mutual relationships with customers. Their professionalism and expertise in various services will, therefore, ensure that business activities are fulfilled quite effectively.

Owners and key managers

Ethan Carter – CEO (Owner)

Ethan is the founder of SureNest Insurance. He leads the overall strategy of the company, ensuring everything works well.

Sarah Bennett – COO

Sarah runs the day-to-day operations of the company. She ensures everything from client services to internal procedures runs efficiently.

Rachel Hayes – CFO

Rachel oversees the financial side of the business being the Chief Financial Officer. She focuses on budgeting, financial planning, and helping make the company set toward sustainable growth.

Chloe Reed – Marketing Lead

Chloe takes over the company's marketing. In her position, she grows the brand, sets up online campaigns, and can also come up with innovative ways for the company to reach out to potential clients.

Organization chart

Board of advisors

SureNest Insurance's Board of Advisors provides expert guidance in insurance, financial planning, and business strategies to support growth and improve services.

Michael Thompson: Former Regional Manager with 20+ years of experience, helps with market trends and business strategies.

Linda Parker: Certified Financial Planner (CFP) with financial planning expertise, advises on product options and client needs.

9. Financial Plan

SureNest Insurance’s financial plan provides a detailed overview of the company’s expected profitability, cash flow, and financial position over the first three years

Profit and loss statement

It has revealed cash inflow and cash outflow for three years and further indicates that adequate liquidity would always be available for caring operations and growth in the business enterprise.

| Category | Year 1 | Year 2 | Year 3 |

|---|---|---|---|

|

Revenue

|

$450,000 | $675,000 | $950,000 |

|

Cost of Goods Sold (COGS)

|

$225,000 (50%) | $337,500 (50%) | $475,000 (50%) |

|

Gross Profit

|

$225,000 | $337,500 | $475,000 |

|

Operating Expenses

|

|||

| - Salaries and Wages | $80,000 | $120,000 | $150,000 |

| - Marketing Costs | $50,000 | $65,000 | $80,000 |

| - Technology and Tools | $25,000 | $10,000 | $15,000 |

| - Office Expenses | $10,000 | $15,000 | $20,000 |

| - Miscellaneous Expenses | $10,000 | $15,000 | $35,000 |

|

Total Operating Expenses

|

$175,000 | $225,000 | $300,000 |

|

Operating Profit

|

$50,000 | $112,500 | $175,000 |

|

Interest Expense

|

$5,000 | $10,000 | $10,000 |

|

Taxes (Estimated at 20%)

|

$9,000 | $20,500 | $33,000 |

|

Net Profit

|

$36,000 | $82,000 | $132,000 |

|

Net Profit Margin (%)

|

8% | 12% | 14% |

Cash flow statement

This indicates cash inflows and cash outflows for the first three years and signifies that there would be adequate liquidity to take care of the operations and growth.

| Category | Year 1 | Year 2 | Year 3 |

|---|---|---|---|

|

Cash Inflows

|

|||

| - Customer Payments | $450,000 | $675,000 | $950,000 |

| - Loan or Funding Proceeds | $200,000 | $0 | $0 |

|

Total Cash Inflows

|

$650,000 | $675,000 | $950,000 |

|

Cash Outflows

|

|||

| - Operating Expenses | $175,000 | $225,000 | $300,000 |

| - Marketing Costs | $50,000 | $65,000 | $80,000 |

| - Technology Investments | $25,000 | $10,000 | $15,000 |

| - Staff Expansion | $50,000 | $70,000 | $90,000 |

| - Loan Repayment (if applicable) | $15,000 | $20,000 | $20,000 |

|

Total Cash Outflows

|

$315,000 | $390,000 | $505,000 |

|

Net Cash Flow

|

$335,000 | $285,000 | $445,000 |

|

Ending Cash Balance

|

$335,000 | $620,000 | $1,065,000 |

Balance sheet

The balance sheet is the snapshot of the financial position of SureNest Insurance at the end of each year. It presents assets, liabilities, and equity, which signify the stability and growth of the company.

| Category | Year 1 | Year 2 | Year 3 |

|---|---|---|---|

|

Assets

|

|||

| - Cash and Cash Equivalents | $335,000 | $620,000 | $1,065,000 |

| - Accounts Receivable | $30,000 | $45,000 | $65,000 |

| - Office Equipment & Tech | $25,000 | $35,000 | $45,000 |

|

Total Assets

|

$390,000 | $700,000 | $1,175,000 |

|

Liabilities

|

|||

| - Loan Payable | $185,000 | $165,000 | $145,000 |

| - Accounts Payable | $20,000 | $25,000 | $30,000 |

|

Total Liabilities

|

$205,000 | $190,000 | $175,000 |

|

Equity

|

|||

| - Retained Earnings | $185,000 | $510,000 | $1,000,000 |

|

Total Equity

|

$185,000 | $510,000 | $1,000,000 |

|

Total Liabilities and Equity

|

$390,000 | $700,000 | $1,175,000 |

Funding request

SureNest Insurance is seeking $200,000 to invest in key areas that will drive growth and improve client services. This funding will help enhance our technology, expand marketing efforts, and grow our team to better meet customer needs.

Download free insurance business plan template

Are you ready to create a business plan for your insurance company but need a little help? Don’t worry! Here’s our sample insurance business plan pdf to help you get started.

This investor-ready template provides step-by-step guidance and actionable insights, ensuring you develop a strong and professional business plan. Download it and customize it to align with your business needs.

Conclusion

After exploring this insurance business plan sample, creating your own plan becomes a lot easier.

But if you're still unsure about what to include or want a simpler way to put your plan together, give Bizplanr a try. It's an AI-powered tool that helps you create a plan that stands out to investors.

Just answer a few simple questions about your insurance business, and you'll have your first draft ready in minutes!

Get Your Business Plan Ready In Minutes

Answer a few questions, and AI will generate a detailed business plan.

Frequently Asked Questions

Why do you need a business plan for your insurance company?

A business plan is essential for your insurance company as it helps you outline your goals, operations, and strategies for success. A well-written business plan for an insurance company also enables you to stay organized and focused, ensuring you make informed decisions.

How do I get funding for my insurance agency business?

Follow these steps to get funding for your insurance agency business:

- Create a solid business plan including business model, target market, and financial projections.

- Explore different funding options (such as bank loans, investors, and crowdfunding).

- Highlight your unique value propositions (USPs).

- Show how you’ll make money and reach a break-even point.

- Improve your credit score and gather necessary legal documents.

What are the key financial projections included in an insurance business plan?

Financial projections provide a clear roadmap for your business’s financial health and are crucial for securing funding. Key financial projections are:

- Revenue forecasts

- Expense budget

- Cash flow statements

- Profit and loss statement

- Balance sheet

- Break-even analysis

- Funding needs

Where can I get an insurance agency business plan PDF?

There are plenty of online platforms where you can find downloadable business plan templates made just for insurance agencies. Websites like Upmetrics, Upwork, Fiverr, Bizplanr, or PlanGrow Lab offer customizable templates that you can easily tweak to fit your needs.

What are the main services of insurance companies?

Insurance companies provide a range of services to help individuals and businesses protect themselves from financial risks. Here are the main services they offer:

- Personalized insurance solutions

- Efficient claims processing

- Risk assessment and underwriting

- Advisory services