Establishing your own financial advisory firm can be an exciting venture that lets you empower clients to achieve their financial goals and make a real difference.

But before you start, it’s important to keep a solid business plan with you!

A well-thought-out business plan not only helps you set clear goals and secure funding, but also enables you to navigate the complexities of the financial advisory landscape successfully.

Need help drafting your plan?

No worries; here’s a financial advisory business plan sample, followed by a free template, just for your help and inspiration.

Why does a business plan matter for financial advisors?

A business plan is essential for financial advisors because it provides a clear roadmap for success, keeps the business organized, and builds credibility with investors. A few more points, about why it matters:

- It helps financial advisors set clear objectives, identify their target market, and plan how to grow their businesses.

- A business plan shows clients, partners, and investors that the advisor is professional, organized, and serious about delivering results.

- It includes detailed financial projections and a clear budget to track income, control expenses, and guide smart resource allocation.

- The plan lets you set measurable goals and benchmarks to track progress and ensure the business stays on course.

- It also helps to identify potential risks and create strategies to handle market changes or business obstacles.

Financial advisor business plan example

HorizonPath Financial Partners is a growing financial advisory firm that is achieving its goals with a clear and strategic business plan.

Let's explore the business plan sample of HorizonPath Financial Partners to gain insights and practical steps for effectively drafting every section of your plan.

Executive summary

HorizonPath Financial Partners is a financial advisory firm based in Atlanta, Georgia, specializing in personalized financial planning, investment management, and wealth-building strategies.

With a mission to guide clients toward financial independence, the firm empowers high-income professionals, families, retirees, entrepreneurs, and new investors through innovative and transparent financial solutions.

Target audience

HorizonPath operates in the growing financial advisory industry, serving a diverse clientele:

- High-income professionals optimize their investments.

- Families building wealth for future generations.

- Retirees seeking financial stability.

- Entrepreneurs looking for business growth advice.

- New investors need guidance to build a strong financial base.

Management and operations

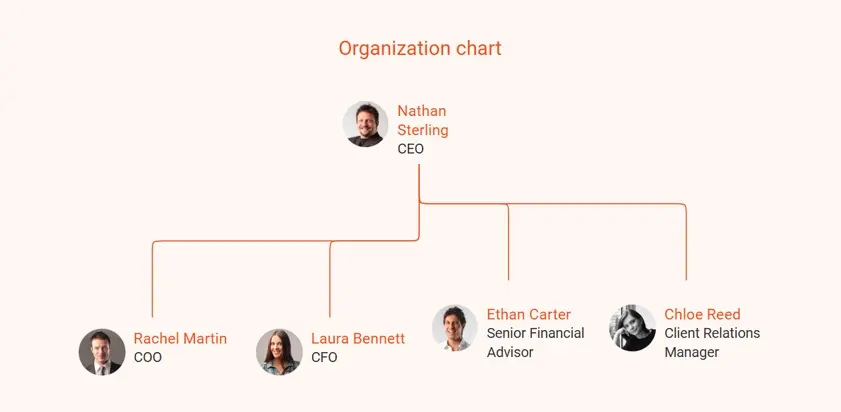

HorizonPath is structured as an LLC, owned and led by Nathan Sterling, CEO, supported by a team of experienced professionals:

- COO: Rachel Martin, managing daily operations.

- CFO: Laura Bennett, ensuring financial health and compliance.

- Senior Financial Advisor: Ethan Carter, specializing in investment and retirement planning.

- Client Relations Manager: Chloe Reed, enhancing client engagement and satisfaction.

Services offered

HorizonPath offers comprehensive services, including:

- Financial planning, investment management, and retirement strategies.

- Tax-efficient investment planning and wealth preservation.

- Estate planning and business financial advisory.

Marketing plan

The firm utilizes a multi-faceted marketing strategy:

- Digital presence: SEO-optimized website and active social media campaigns.

- Educational outreach: Webinars, workshops, and free financial resources.

- Client referrals: Rewarding existing clients for word-of-mouth promotion.

Financial projections

HorizonPath seeks $250,000 to scale operations, enhance tools, and grow its market presence. Also, the firm projects steady growth over the next three years:

| Year | Revenue ($) | Expenses ($) | Net Income ($) |

|---|---|---|---|

| Year 1 | 350,000 | 230,000 | 120,000 |

| Year 2 | 525,000 | 290,000 | 235,000 |

| Year 3 | 787,500 | 350,000 | 437,500 |

Liking the plan you're reading? It's AI generated.

Generate Your Own Using Bizplanr AI

Business description

Location: 750 Prosperity Way, Suite 310, Atlanta, Georgia, 30309, USA

Mission and vision

- Mission: To guide clients on a clear and confident path to financial freedom by providing personalized, innovative, and transparent financial advisory services.

- Vision: To be Atlanta’s most trusted financial advisory firm, recognized for integrity, expertise, and lasting financial partnerships.

Business background

HorizonPath Financial Partners was founded to meet the growing need for personalized financial planning and wealth-building in Atlanta. The firm understands that clients want more than just basic services—they need a trusted advisor to help manage their finances.

By combining expertise with modern tools, HorizonPath helps clients reach their long-term financial goals.

Core values

- Client-centric approach: Building trust through personalized, transparent, and ethical practices.

- Innovation: Leveraging cutting-edge tools and strategies to deliver superior results.

- Education: Empowering clients with knowledge to make informed decisions.

Future goals

- Expand service offerings to include more personalized financial solutions.

- Invest in technological innovations to enhance service delivery and client experience.

- Build a larger team of financial experts to cater to a growing client base.

- Strengthen relationships with existing clients while attracting new ones through targeted marketing.

- Achieve recognition as a leading financial advisory firm in the region.

Market analysis

The financial advisory industry is growing steadily, with demand for personalized financial planning and investment services on the rise. As financial products become more complex and people recognize the importance of financial literacy, more clients are seeking expert help.

In the U.S., the financial advisory market is expected to reach $178 billion by 2029. Cities like Atlanta present great opportunities for firms like HorizonPath Financial Partners to serve a wide range of financial needs.

Key trends influencing the industry:

- Growing interest in personalized and goal-based financial services.

- Rising adoption of digital tools for financial management.

- An increasing emphasis on education-focused advisory services.

Target market description

HorizonPath Financial Partners serves a broad yet focused audience, including:

- High-income professionals: Doctors, lawyers, executives, and other professionals seeking tax-efficient strategies and optimized investment portfolios.

- Families building generational wealth: Dual-income households aiming to secure and grow wealth for future generations.

- Retirees: Individuals preparing for or in retirement, prioritizing sustainable income and financial stability.

- Entrepreneurs and small business owners: Business clients seeking strategic advisory and growth planning.

- New investors: Young professionals and individuals new to investing, need education and foundational strategies.

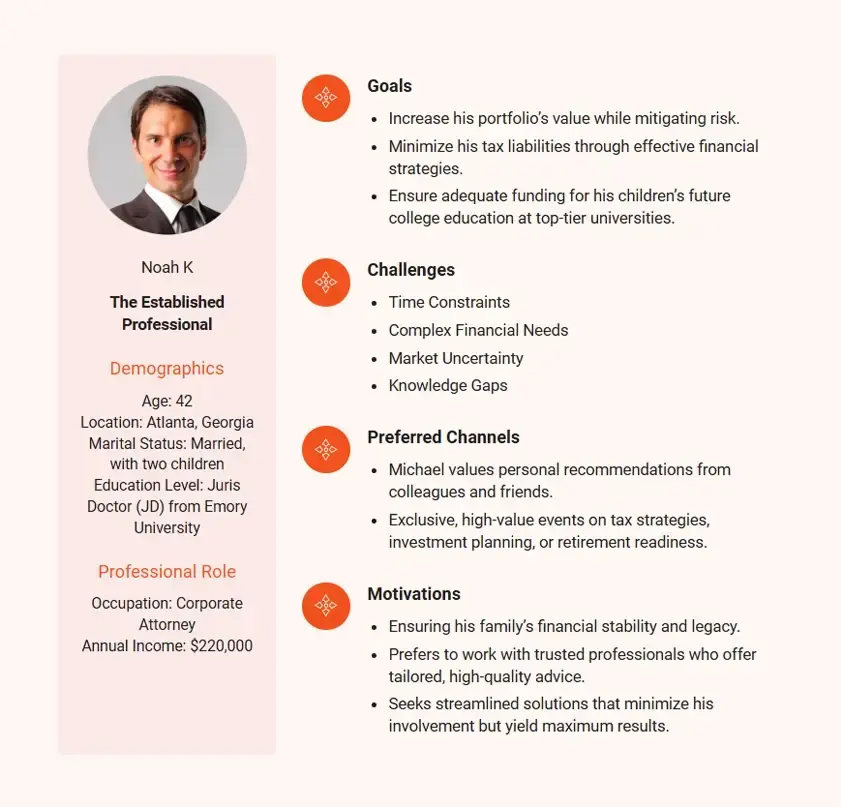

Buyer persona

To better connect with its target audience, HorizonPath has identified key buyer personas. This helps tailor strategies to meet their specific needs effectively:

Competitor analysis

The financial advisory market in Atlanta is highly competitive, with notable players such as Brightworth Financial, TrueWealth, Fisher Investments, Buckhead Financial Advisors, and Northwestern Mutual. HorizonPath differentiates itself through:

- Personalized services: Tailored financial solutions for each client’s unique circumstances.

- Educational approach: Prioritizing client education to empower confident decision-making.

- Innovative tools: Real-time tracking and transparent management of financial plans.

- Accessibility: Catering to new investors, a market often overlooked by established firms.

Organization and management

Legal structure

HorizonPath Financial Partners operates as a Limited Liability Company (LLC), providing a flexible and professional structure that protects the owner while allowing for efficient management of the business.

Ownership structure

The firm is solely owned by Nathan Sterling, who also serves as the CEO.

Management team

The leadership team at HorizonPath Financial Partners comprises highly skilled professionals with diverse expertise, ensuring the firm’s operations are efficient and client-focused.

Nathan Sterling – CEO (Owner)

Nathan Sterling brings over 15 years of experience in financial planning and wealth management. His visionary leadership focuses on aligning innovative strategies with the unique needs of HorizonPath’s clients. As CEO, Nathan oversees all strategic decisions, business development, and client relationships.

Rachel Martin – COO (Operations Manager)

Rachel Martin manages HorizonPath’s daily operations, ensuring seamless service delivery and operational efficiency. With over a decade of experience in business management, Rachel is instrumental in implementing systems and processes that enhance both internal workflows and client experience.

Laura Bennett – CFO (Accountant)

Laura Bennett is responsible for HorizonPath’s financial health, overseeing budgets, forecasts, and compliance. Her expertise in corporate accounting and financial analysis ensures that the firm’s financial operations align with its growth objectives.

Ethan Carter – Senior Financial Advisor

Ethan Carter specializes in retirement planning and investment management. His analytical skills and ability to build strong client relationships make him a key player in delivering customized financial solutions that align with clients’ long-term goals.

Chloe Reed – Client Relations Manager

Chloe Reed leads the firm’s client engagement efforts, focusing on providing exceptional customer service and building lasting relationships. Her expertise in communication and relationship management ensures that clients receive consistent support and transparency in all interactions.

Organizational chart

The organizational structure of HorizonPath Financial Partners is designed for efficiency and collaboration. Here it is:

Products or services

HorizonPath Financial Partners offers a diverse range of financial advisory services tailored to meet the unique needs of its clients.

Core services

| Service | Description | Key Features |

|---|---|---|

| Financial Planning | Personalized plans for short- and long-term goals. | Budgeting, cash flow, debt reduction, goals. |

| Investment Management | Tailored, diversified portfolios to minimize risks. | Regular reviews, rebalancing, risk management. |

| Retirement Planning | Sustainable income plans for retirees. | Social Security guidance, healthcare planning. |

| Tax-Efficient Strategies | Reduce taxes and grow wealth. | Tax-efficient investments, charitable giving. |

| Estate & Legacy Planning | Secure wealth transfer to heirs and organizations. | Wills, trusts, estate tax minimization. |

| Business Financial Advisory | Strategies for entrepreneurs and small businesses. | Succession planning, cash flow, growth focus. |

Unique selling points

- Personalized services: Each financial solution is customized to meet the individual needs and goals of clients.

- Education-first approach: HorizonPath prioritizes financial literacy, ensuring clients understand their plans and investments.

- Advanced tools: Integration of cutting-edge financial planning software to provide real-time tracking and insights.

- Comprehensive approach: Holistic services that encompass all aspects of a client’s financial life, from investments to legacy planning.

Value-added services

- Offering value-added services to enhance client experience.

- Conducting financial literacy workshops to educate and empower clients.

- Providing online resources and tools for easy financial management.

- Delivering regular reports and updates to keep clients informed.

Marketing and sales strategy

Marketing plan

Digital marketing

- A professional, SEO-optimized website showcasing services, testimonials, and educational resources.

- Active social media campaigns on LinkedIn and Facebook to share financial tips and success stories.

Educational content

- Free resources like blogs, e-books, and webinars on financial topics to engage and educate clients.

- Hosting workshops and local events to build trust and visibility in the community.

Referral program

- Incentives for clients to refer new customers through discounts or bonuses, leveraging word-of-mouth marketing.

Sales strategy

Client-centric approach

- Personalized consultations focused on understanding client needs and building trust.

- Transparent presentation of tailored financial plans and services.

Lead generation

- Capturing leads through the website, workshops, and social media.

- Following up with qualified leads to convert them into clients.

Pricing strategy

- Clear and competitive pricing with options for fixed fees, hourly rates, or percentage-based fees.

- Introductory offers to attract new clients.

Distribution channels

- In-person consultations at the Atlanta office or preferred client locations.

- Virtual services via secure video conferencing and online tools.

Financial plan

Revenue projections

HorizonPath Financial Partners anticipates revenue growth based on its targeted client base and marketing efforts. Below is a projection for the first three years:

| Year | Revenue ($) | Growth Rate |

|---|---|---|

| Year 1 | $350,000 | - |

| Year 2 | $525,000 | 50% |

| Year 3 | $787,500 | 50% |

Expense projections

Projected annual expenses include operational costs, marketing, salaries, and technology investments.

| Category | Year 1 ($) | Year 2 ($) | Year 3 ($) |

|---|---|---|---|

| Salaries and Benefits | 120,000 | 150,000 | 180,000 |

| Marketing | 50,000 | 60,000 | 70,000 |

| Technology and Tools | 30,000 | 40,000 | 50,000 |

| Office Expenses | 20,000 | 25,000 | 30,000 |

| Miscellaneous/Reserves | 10,000 | 15,000 | 20,000 |

| Total Expenses | 230,000 | 290,000 | 350,000 |

Profit and loss statement

The firm projects profitability starting in Year 1, with net income increasing significantly as the business scales.

| Year | Revenue ($) | Expenses ($) | Net Income ($) |

|---|---|---|---|

| Year 1 | 350,000 | 230,000 | 120,000 |

| Year 2 | 525,000 | 290,000 | 235,000 |

| Year 3 | 787,500 | 350,000 | 437,500 |

Break-even analysis

HorizonPath expects to break even within the first 8 months of operation due to a lean cost structure and strong client acquisition through marketing initiatives.

| Metric | Value |

|---|---|

| Fixed Costs ($) | 160,000 annually |

| Average Revenue/Client | 5,000 annually |

| Break-Even Clients | 32 |

Key financial assumptions

- Client acquisition grows by 15% each quarter in the first two years.

- Average client annual fee is $5,000, adjusted for service scope.

- Operating margins improve as the firm scales due to economies of scale.

Funding request

HorizonPath Financial Partners is seeking $250,000 in funding to support its growth and expansion initiatives. The funds will be allocated strategically to enhance operations, develop tools, and strengthen marketing efforts, ensuring sustainable growth and client satisfaction.

Use of funds

| Category | Amount ($) | Purpose |

|---|---|---|

| Development of Proprietary Financial Tools | 75,000 | Create innovative tools for real-time financial tracking and management. |

| Marketing and Client Acquisition | 50,000 | Boost SEO, social media campaigns, and community engagement workshops. |

| Recruitment and Training | 60,000 | Hire additional advisors and support staff; provide professional training. |

| Office Expansion and Upgrades | 40,000 | Upgrade infrastructure and enhance client experience. |

| Operational Reserve | 25,000 | Maintain financial stability and address unforeseen needs. |

Download the financial advisor business plan template

Ready to create your financial advisor business plan but need some help? Download our free financial advisor business plan PDF template and get started today!

This easy-to-use template has helped many entrepreneurs build successful businesses. With clear examples and helpful tips, it’s perfect for turning your ideas into a strong plan.

Conclusion

With this business plan example, you now have a solid understanding of how to write a detailed and effective business plan for your financial advisory firm.

If you’re still unsure or need assistance creating a professional, investment-ready business plan, Bizplanr can be your ultimate solution. It simplifies the process and helps you craft a winning plan for your venture.

All you have to do is simply fill in a few blanks, and get your plan ready in minutes!

Get Your Business Plan Ready In Minutes

Answer a few questions, and AI will generate a detailed business plan.

Frequently Asked Questions

What are the key elements of a financial advisor business plan?

The key elements of a financial advisor business plan include:

- Executive summary

- Business description

- Market analysis

- Organization and management

- Service offerings

- Marketing and sales strategy

- Financial projections

- Appendix (optional)

How much money do you need to write a financial advisor business plan?

The cost of writing a business plan can vary depending on the method you choose and the level of details you include in your financial advisor plan.

- Creating it on your own is cost-effective, with expenses limited to research and any tools you might need.

- Hiring a consultant or writer can range from $500 to $2,000 or higher.

- Platforms like Bizplanr offer affordable plans starting at $7/month, providing templates and guidance to build the plan successfully.

What are common challenges in creating a financial advisor business plan?

Here are a few challenges that can be encountered, while creating a financial advisor business plan:

- It can be tricky to clearly outline your objectives and long-term vision.

- Understanding your target audience and competition requires time and effort.

- Accurately estimating revenue and expenses is often challenging but it's important.

- Writing a thorough and professional plan takes more time than most expect.

Is a business plan necessary for individual financial advisors?

Yes, it is necessary for individual financial advisors as it helps:

- Define clear goals and target audience.

- Develop effective strategies for marketing, operations, and finances.

- Measure performance and track progress toward your objectives.

- Identify potential challenges and create solutions in advance.