Running your own accounting firm can be a great way to help businesses and individuals manage their finances better.

But before you start, it’s crucial to create a strong business plan that highlights your accounting firm goals, attracts clients and investors as well as sets you apart in the competitive marketplace.

Wondering how to craft your plan? Not to worry!

Explore this accounting firm business plan example and a free template to help you get started. It also guides you through every step of the way.

Let’s dive right in!

Accounting firm business plan sample

If you’re launching a new accounting firm or expanding an existing one, this business plan example offers practical insights and actionable steps to help you create a good foundation for success.

Let’s take AccuraTaxation Financial Solutions’ business plan as a reference and start building the key elements of your firm’s strategy.

1. Executive summary

AccuraTaxation Financial Solutions is a Chicago-based accounting firm that offers a full range of financial services. It is designed to meet the needs of small and medium-sized businesses, entrepreneurs, and individuals.

Our services include tax preparation, bookkeeping, payroll management, financial reporting, and business consulting.

Mission

To deliver precise, client-focused accounting solutions that ensure financial accuracy, regulatory compliance, and long-term business growth for our clients.

Vision

To establish AccuraTaxation as Chicago's most trusted and reliable accounting firm, known for accuracy, personalized client service, and innovative financial strategies.

Unique selling points (USPs)

Our firm excels in handling complex tax and compliance needs, creating tailored financial strategies for clients, and leveraging advanced technology for fast and accurate service.

Marketing efforts

We focus on a strong online presence, targeted campaigns, and hosting educational events to connect with small businesses and individuals seeking financial guidance.

Financial highlights

Over the next three years, we expect steady growth and profits as we gain more clients and improve operations. With initial funding, we plan to increase revenue, control expenses, and boost profits, showing the strong potential of our accounting firm.

| Year | Revenue | Net Profit | Gross Profit Margin | Operating Expenses | Initial Funding Needed |

|---|---|---|---|---|---|

| Year 1 | $220,000 | -$10,000 | 60% | $130,000 | $250,000 |

| Year 2 | $400,000 | $50,000 | 62% | $140,000 | - |

| Year 3 | $600,000 | $120,000 | 65% | $150,000 | - |

Liking the plan you're reading? It's AI generated.

Generate Your Own Using Bizplanr AI

2. Company description

Founded by

AccuraTaxation Financial Solutions was founded by Jonathan Miles, an experienced CPA, to offer reliable, client-focused financial services in Chicago.

Structure and location

An LLC based in Chicago, AccuraTaxation serves small to medium-sized businesses, startups, and individuals with essential financial services.

Background history

AccuraTaxation Financial Solutions was established by Jonathan Miles, a highly experienced Certified Public Accountant (CPA), with a mission to provide accessible and reliable financial services to small businesses and individuals in Chicago.

Jonathan saw a growing need for personalized financial guidance, especially for startups and medium-sized businesses that often struggle to navigate complex tax and compliance requirements.

With this in mind, he founded AccuraTaxation to deliver client-focused solutions, offering expertise, tailored strategies, and a trusted partnership for financial success.

Core values

- Expertise in handling complex tax and compliance requirements.

- Tailored financial strategies to address unique client needs.

- Use of advanced tools and technology to enhance service efficiency.

Goals

- Short-term: Build brand recognition, and client loyalty, and streamline operations.

- Long-term: Expand client base, deepen community ties, and consider extending services regionally.

AccuraTaxation is dedicated to providing clients with clarity, compliance, and a path to sustainable growth.

3. Industry and market analysis

In the United States, the accounting sector plays a vital role in supporting individuals and businesses, generating significant annual revenue.

Particularly among small and medium-sized enterprises, which frequently lack internal financial experience, accounting services such as payroll, tax preparation, financial planning, and business consulting are highly sought.

Reliable accounting services are still in high demand, especially for businesses that provide individualized support, due to increasingly complicated tax laws and a focus on financial transparency.

Target market

AccuraTaxation Financial Solutions targets local Chicago clients, primarily small to medium-sized businesses, entrepreneurs, and individuals looking for dependable, accessible financial services. Our core market segments include:

| Target Market Segment | Description | Primary Needs | Engagement Behavior |

|---|---|---|---|

| Small to Medium-Sized Businesses | Owners and managers needing outsourced financial support | Tax preparation, bookkeeping, payroll | Regular interaction for ongoing services |

| Startups and Entrepreneurs | New businesses seeking advice on financial setup | Business consulting, budgeting, tax planning | Frequent consultations, early-stage guidance |

| Professionals and Individuals | Individuals with complex tax needs or wealth planning | Tax planning, personal financial consulting | Seasonal or annual consultations |

| Freelancers/Contractors | Self-employed individuals needing tax support | Tax preparation, compliance, deductions advice | Regular check-ins, especially tax season |

Competitor analysis

AccuraTaxation operates in a competitive environment with established firms as well as smaller, independent accounting providers. Here’s a look at key competitors:

- Crowe LLP: Crowe LLP is known for its strong brand and full-service solutions, but its high fees and less personalized service may not suit smaller clients.

- Baker Tilly: Baker Tilly offers specialized consulting for industries but focuses on larger clients, leaving small businesses with fewer tailored options.

- Local Firms and Online Platforms: These options are affordable and accessible but often lack the full range of services and expertise that AccuraTaxation provides.

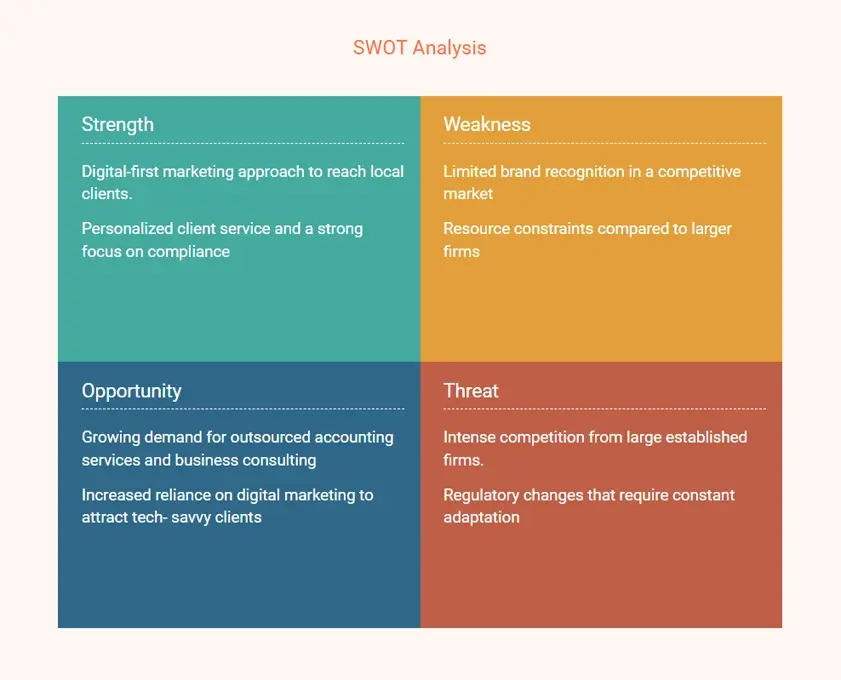

SWOT analysis

AccuraTaxation's digital approach, community focus, and commitment to personalized service position it as a trusted partner in Chicago’s accounting landscape. This focus on client-centered strategies, digital marketing, and a strong service offering sets us apart in the industry.

4. Service offerings

This section outlines AccuraTaxation Financial Solutions core services and how we expertly and carefully cater to each client's specific needs.

With comprehensive tax preparation and strategic planning services, we guarantee the accuracy and efficiency of all tax returns, assisting customers in maximizing their deductions, adhering to current laws, and avoiding expensive fines.

Here’s a list of services we offer:

Services for financial reporting and bookkeeping

By maintaining financial records current, accurate, and well-organized, our accounting services give clients peace of mind and bright ideas into their financial performance.

Payroll administration and tax compliance

We handle payroll with precision and efficiency, managing employee salaries, benefits, and tax compliance so that businesses may run smoothly. This solution guarantees that payroll is accurate, timely, and completely consistent with local and federal standards.

Business financial consulting

AccuraTaxation offers customized financial consultancy to help organizations with cash flow management, budgeting, and forecasting. This service enables our clients to manage their finances successfully, prepare for future growth, and confidently face problems.

IRS audit representation and compliance services

Our IRS audit representation and compliance services provide support and direction during an audit, assisting customers in understanding their rights and preparing responses.

Business advice for startups and expanding businesses

We specialize in advising startups and rising enterprises on structure, financial planning, and growth plans. Our objective is to assist new and expanding businesses in establishing a strong financial foundation that will support their long-term success.

5. Marketing strategy

Online marketing

- We share tax tips and financial advice on LinkedIn and Facebook to build trust with potential clients.

- Our website will include blogs, tools, and easy appointment scheduling to increase client interaction.

- Targeting local searches like “Chicago tax preparation” will drive website traffic and boost visibility.

Offline marketing

- We network with local business associations to build relationships and establish AccuraTaxation as a trusted partner in Chicago.

- A referral program will encourage clients to recommend us, growing our client base organically.

- Webinars and tax-saving workshops will highlight our expertise and attract clients seeking professional guidance.

6. Management team

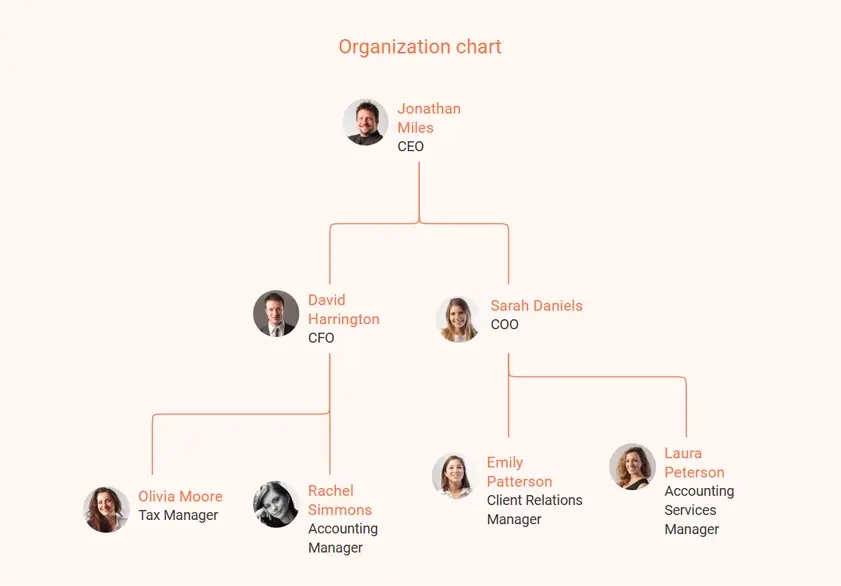

This section introduces the key members of the AccuraTaxation Financial Solutions management team, showcasing their roles, responsibilities, and expertise. Our leadership team is composed of highly skilled professionals dedicated to ensuring the firm's success and delivering exceptional client service.

Key people

Jonathan Miles (CEO and Owner)

He oversees the overall strategic direction and vision of the firm.

- Background: A Certified Public Accountant (CPA) with over 15 years of experience in tax planning, business consulting, and financial strategy.

- Expertise: Specializes in personalized financial solutions and regulatory compliance.

Sarah Daniels (COO, Operations Manager)

She manages day-to-day operations, streamlining processes to improve efficiency.

- Background: Experienced in business operations and client management.

- Expertise: Known for optimizing workflows and ensuring seamless client experiences.

David Harrington (CFO, Chief Accountant)

He is responsible for financial oversight, including reporting, budgeting, and financial planning.

- Background: Extensive experience in corporate accounting and financial analysis.

- Expertise: Skilled in complex financial reporting and compliance with financial regulations.

Olivia Moore (Tax Manager)

She leads the tax department, ensuring accurate and compliant tax preparation for clients.

- Background: Certified tax professional with deep knowledge of federal and state tax regulations.

- Expertise: Specializes in handling intricate tax scenarios for businesses and individuals.

Emily Patterson (Client Relations Manager)

She manages client communication and ensures high satisfaction rates.

- Background: Strong experience in customer service and account management.

- Expertise: Excels in building client relationships and addressing client needs proactively.

Organizational chart

7. Financial plan

The revenue projections for the next three years are based on anticipated growth from increased operations, new client campaigns, and enhanced technology.

| Year | Year 1 | Year 2 | Year 3 |

|---|---|---|---|

| Tax Preparation Services | $200,000 | $300,000 | $400,000 |

| Bookkeeping Services | $150,000 | $250,000 | $350,000 |

| Payroll Management | $100,000 | $150,000 | $200,000 |

| Business Consulting | $80,000 | $120,000 | $180,000 |

| IRS Audit Representation | $50,000 | $70,000 | $90,000 |

| Total Revenue | $580,000 | $890,000 | $1,220,000 |

Income statement

The income statement shows AccuraTaxation Financial Solutions profitability, including revenue, expenses, and net profit estimates for the following three years.

| Income Statement | Year 1 | Year 2 | Year 3 |

|---|---|---|---|

| Total Revenue | $580,000 | $890,000 | $1,220,000 |

| COGS (Staff & Services) | $290,000 | $445,000 | $610,000 |

| Gross Profit | $290,000 | $445,000 | $610,000 |

| Operating Expenses | $150,000 | $220,000 | $300,000 |

| Net Profit Before Tax | $140,000 | $225,000 | $310,000 |

| Taxes (30%) | $42,000 | $67,500 | $93,000 |

| Net Profit After Tax | $98,000 | $157,500 | $217,000 |

Cash flow statement

The cash flow statement outlines the inflow and outflow of cash, highlighting how the firm plans to manage its operations, investments, and financing activities to maintain a healthy cash balance.

| Cash Flow Statement | Year 1 | Year 2 | Year 3 |

|---|---|---|---|

| Net Profit After Tax | $98,000 | $157,500 | $217,000 |

| Depreciation | $20,000 | $25,000 | $30,000 |

| Changes in Working Capital | -$10,000 | -$20,000 | -$30,000 |

| Net Cash from Operating Activities | $108,000 | $162,500 | $217,000 |

| Capital Expenditures | -$80,000 | -$100,000 | -$120,000 |

| Net Cash from Investing Activities | -$80,000 | -$100,000 | -$120,000 |

| Financing Activities (Funding) | $300,000 | $0 | $0 |

| Net Increase in Cash | $328,000 | $62,500 | $97,000 |

| Beginning Cash Balance | $0 | $328,000 | $390,500 |

| Ending Cash Balance | $328,000 | $390,500 | $487,500 |

Balance sheet

The balance sheet illustrates AccuraTaxation's financial status over the last three years, highlighting its assets, liabilities, and equity to reflect the company's stability and expansion.

| Balance Sheet | Year 1 | Year 2 | Year 3 |

|---|---|---|---|

| Assets | |||

| Current Assets | $350,000 | $450,000 | $550,000 |

| Fixed Assets (Net) | $150,000 | $250,000 | $350,000 |

| Total Assets | $500,000 | $700,000 | $900,000 |

| Liabilities | |||

| Current Liabilities | $100,000 | $150,000 | $200,000 |

| Long-term Debt | $300,000 | $300,000 | $300,000 |

| Total Liabilities | $400,000 | $450,000 | $500,000 |

| Equity | |||

| Owner's Equity | $100,000 | $250,000 | $400,000 |

| Total Liabilities and Equity | $500,000 | $700,000 | $900,000 |

Download accounting firm business plan template

Are you looking to create an accounting firm business plan but need some guidance? Download our free accounting firm business plan template PDF and get started today.

This template is specially crafted for accounting firms. It includes detailed guides and examples to help you develop a solid, professional business plan. Just download it and customize it as per your specific needs and requirements.

Conclusion

This accounting firm business plan sample provides a structured approach to outlining your goals, strategies, and financial projections, setting the foundation for your firm’s success.

If you need further assistance in presenting your plan more professionally, a business planning tool like Bizplanr can be invaluable.

It helps you create a detailed yet customized business plan quickly and effectively. You’ll have to simply answer a few easy questions related to your idea and get your plan ready in minutes.

Get Your Business Plan Ready In Minutes

Answer a few questions, and AI will generate a detailed business plan.

Frequently Asked Questions

What is the purpose of an accounting firm business plan?

Accounting firm business plan helps you:

- Outline your firm’s key objectives and long-term vision to keep the business focused.

- Provide a step-by-step plan to manage and grow your business.

- Build trust among clients and investors by showing expertise and financial stability.

- Secure funding from potential investors or lenders by presenting clear financial projections and strategies.

What financial documents do I need for an accounting Firm Business Plan?

Here is the list of financial documents that you’ll need for the accounting firm business plan:

- Revenue projections

- Income statement (profit and loss statement)

- Cash flow statement

- Balance sheet

- Break-even analysis

- Funding requirements and use of funds

- Expense budget

- Startup costs

How long should an accounting firm business plan be?

An accounting firm business plan is typically 15–20 pages long. The exact length may vary based on the complexity of the business and its objectives.

Do I need to hire a professional to create my accounting firm business plan?

It’s not necessary to hire a professional to create your accounting firm’s business plan, but working with experts can make it easier and more effective. Their experience ensures your plan is clear, strategic, and according to your business goals.

How often should I update my accounting firm business plan?

You should review and update your accounting firm business plan at least once a year or whenever significant changes occur in your business or the market. Regular updates ensure your plan stays aligned with your firm’s growth, new goals, or market conditions.