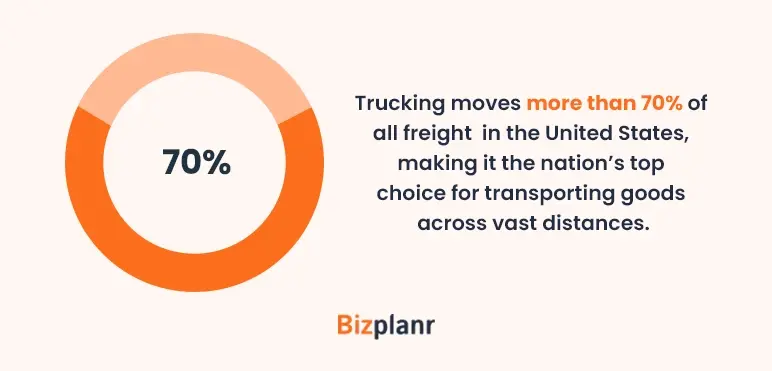

The trucking industry isn’t just about big rigs on highways—it’s the backbone of logistics, freight, and the entire U.S. economy. Moving over 70% of the nation’s freight, this sector pumps billions into the economy while employing millions of hardworking drivers, mechanics, and dispatchers.

From fresh groceries to industrial equipment, if it’s on a shelf, chances are a truck brought it there.

Now, with e-commerce booming and tech innovations like AI, electric fleets, and real-time tracking reshaping the roads, this industry’s in the middle of an exciting evolution.

In this blog, we’re unpacking the latest 2025 trucking industry statistics that include the trucking industry outlook, how much the trucking industry is worth, and important insights that you’ll want to know.

Let’s dive in.

Top Trucking Industry Statistics 2025 [Editor’s Picks]

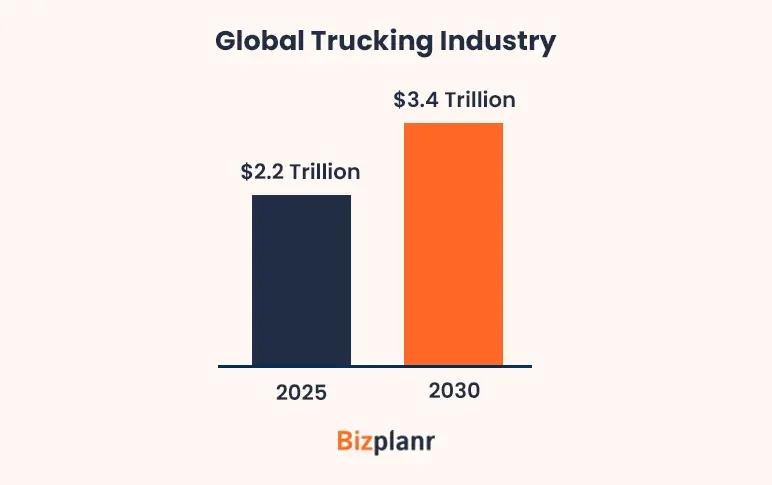

- The global trucking industry market size is estimated to be worth around $2.2 trillion in 2025 and is expected to reach $3.4 trillion by 2030.

- The U.S. trucking market alone is estimated at $532.7 billion in 2025

- There are about 3.54 million truck drivers employed in the U.S. trucking industry.

- Trucks transport 73% of total freight value and 65% of total freight weight in the U.S.

- The electric truck industry is valued at $5.92 billion in 2025 and is projected to grow to $38.76 billion by 2032.

- Over 60% of fleets using decarbonization tools reported reduced emissions, highlighting technology’s role in sustainability.

- The mean pay for heavy and tractor-trailer truck drivers was about $55,990, and for light truck drivers, $46,090.

- The U.S. has around 13 million large trucks, making up 5% of all registered vehicles.

Trucking Industry Overview

The trucking industry will remain the backbone of global logistics in 2025, moving the vast majority of goods across regions and countries. It’s valued at $2.2 trillion globally this year, and expectations are that it will hit $3.4 trillion by 2030, driven by booming e-commerce, urban logistics, and last-mile delivery demands.

Moreover, the U.S. continues to dominate the trucking landscape, transporting everything from consumer goods and industrial supplies to perishables and hazardous materials.

The U.S. trucking market is projected to grow from $1.01 trillion in 2023 to $1.51 trillion by 2034, capturing 78.8% of the total freight transportation market.

The key segment that shapes the trucking industry across the globe are long-haul and short-haul trucking. The difference between them is as follows:

| Category | Long-Haul Trucking | Short-Haul Trucking |

|---|---|---|

| Approx. Miles | Typically 250+ miles per trip | Typically under 150-250 miles per trip |

| Types of Goods | Bulk freight, manufactured goods, perishables, and consumer products | Retail deliveries, groceries, construction materials, regional freight |

| Types of Trucks | Tractor-trailers (18-wheelers), sleeper cabs, refrigerated trucks | Box trucks, flatbeds, dump trucks, and small trailers |

| Primary Purpose | Transporting goods across states or regions over long distances | Local or regional deliveries, frequent stops, last-mile logistics |

| Estimated Revenue | $155.91 billion | $500-$750 billion |

For a clearer understanding of the trucking industry, let’s explore the table below for some quick, insightful highlights:

| Category | 2025 Value/Detail |

|---|---|

| Global Market Value | $14.14 trillion |

| U.S. Market Size | $532.7 billion |

| Global CAGR | 5.8% (2025-2032) |

| U.S. CAGR | 5.4% |

| Employment (U.S.) | 3.55 million truck drivers |

| Key Players | J.B. Hunt, Knight-Swift, Schneider National, Ryder System, Prime Inc., FedEx, UPS, XPO Logistics |

| Best Region | North America (largest market share) |

| Fastest Growing | Asia Pacific (driven by e-commerce and infrastructure) |

Top Trucking Industry Statistics

In this section, we’ll dive into a variety of trucking industry statistics, covering everything from global and U.S. market figures to tech adoption, employment trends, refrigerated trucking, and more. It’s your one-stop snapshot of the entire trucking landscape.

1) Global trucking industry statistics

The global trucking industry plays a vital role in moving goods and supporting economies worldwide. Understanding its key statistics offers valuable insight into trends, challenges, and future growth opportunities.

- The global trucking market is valued at $14.14 trillion in 2025 and is projected to reach $20.96 trillion by 2032, with a compound annual growth rate (CAGR) of 5.8% from 2025 to 2032. (Source)

- The global general freight trucking segment is estimated at $1.18 trillion in 2025, expected to grow to $2.33 trillion by 2032 with a CAGR of 10.2%. (Source)

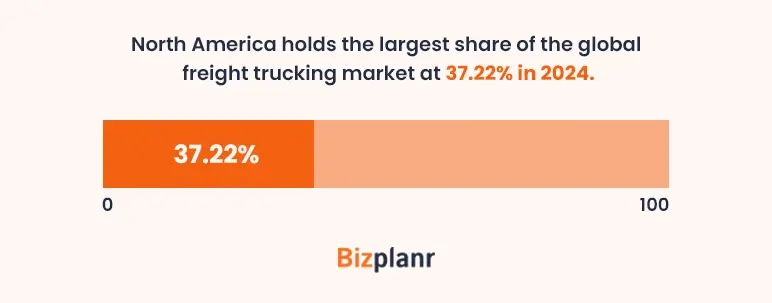

- North America holds the largest share of the global freight trucking market at 37.22% in 2024. (Source)

- The U.S. trucking industry employs 3.55 million drivers as of 2025. (Source)

- The global market for AI-powered fleet management software is expected to hit $14.4 billion by 2030. (Source)

- The industry uses approximately 54 billion gallons of fuel each year, with diesel continuing to be the primary fuel of choice. (Source)

- Truck drivers earn an average annual salary of around $50,000, though seasoned drivers can make considerably more based on the routes they cover and the types of freight they haul. (Source)

- By 2025, about 2% of trucks on the road will be electric, reflecting the industry's gradual shift toward more sustainable and eco-friendly operations. (Source)

- Due to improved safety technologies and tighter regulations, the rate of accidents involving trucks has dropped by 4% compared to the previous decade. (Source)

- Total truck tonnage is projected to rise from 11.3 billion tons this year to 14.2 billion tons by 2034. Trucks will continue to carry the majority of freight, accounting for 72.4% of total tonnage in 2023 and 72.6% by the end of the forecast period. (Source)

- Light-Duty Trucks (LDT) are anticipated to dominate the market in 2025, holding a 46.2% share. (Source)

- By 2026, heavy-duty electric trucks are projected to make up less than 7% of the electric truck market, primarily because of their higher costs. (Source)

- The projected employment growth rate for all occupations in the truck industry from 2023 to 2033 is 4%. (Source)

- As of May 2024, the median annual wage for heavy and tractor-trailer truck drivers was $57,440. (Source)

- Truck inflation increased by 3.4% in 2024, and fleets are expected to continue facing high truck payments in 2025 and 2026 because of financing tied to purchases made in 2022. (Source)

- Women now make up 8.1% of truck drivers, marking the seventh year in a row of continuous growth in female representation within the industry. (Source)

- Globally, just 12% of drivers are under the age of 25, and only 6% are women. (Source)

- More than 3 million truck driver positions remain unfilled across the 36 countries studied. (Source)

- A survey of over 4,700 trucking companies across the Americas, Asia, and Europe—covering 72% of global GDP—revealed that truck driver shortages worsened worldwide in 2023. (Source)

- Global truck driver shortages are projected to double within the next five years. (Source)

2) Trucking market size & growth potential

The trucking market is on the move like never before—powered by rising demand and cutting-edge technology, it’s set to drive incredible growth in the years ahead. Let’s dive into the key trends and factors shaping this dynamic industry.

- The global trucking market is estimated at $14.14 trillion in 2025 and is forecast to reach $20.96 trillion by 2032. (Source)

- Trucking moves more than 70% of all freight in the United States, making it the nation’s top choice for transporting goods across vast distances. (Source)

- The Asia-Pacific region is the fastest-growing trucking industry market in the world. (Source)

- The fastest-growing region, capturing 23.4% of the global market in 2025, is propelled by rapid economic development, industrialization, and significant investments in logistics infrastructure. (Source)

- The trucking industry boasts an impressive global valuation of $2.2 trillion, with the U.S. market alone accounting for $532.7 billion. (Source)

- Despite declining rates over the year, average operating margins remained above 6% across all sectors. Larger fleets experienced improved margins from 2021 to 2022, while smaller fleets faced a drop in their operating margins. (Source)

- North America continues to lead as the largest market, with a share of 36.2% in 2025. (Source)

- There are more than 500,000 trucking companies in the U.S., with 80% operating as small businesses. (Source)

- Sustainability efforts and the shift to alternative fuel vehicles are gaining momentum, with the electric truck market valued at $5.92 billion in 2025. (Source)

- The average truck covers approximately 9,800 miles annually. (Source)

- Trucking generates 80.7% of the total U.S. freight revenue. (Source)

- Ninety-six percent of U.S. trucking fleets run 10 or fewer trucks, while 99.7% of carriers operate with 100 or fewer trucks. (Source)

3) Trucking employment statistics

The trucking industry isn’t just about moving freight — it’s a major source of employment, supporting millions of jobs worldwide. Let’s take a look at the latest trucking employment numbers and workforce trends shaping the road ahead.

- In 2024, about 16.2 million people, representing 10.3% of the U.S. labor force, were employed in the transportation, warehousing, and related industries. (Source)

- The U.S. trucking industry employs around 3.55 million drivers, keeping goods and the economy moving across the country. (Source)

- Employment for truck drivers is expected to rise by 5% by 2032, keeping pace with the average growth rate for all occupations. (Source)

- Employment in transportation-related industries climbed to 9.6 million workers in 2024, marking a 0.8% increase from the previous year. (Source)

- Employment in the transportation and warehousing sector hit an all-time high of 6.7 million workers in 2024, up 1.0% from 2023 — the highest level since records began in 1990. (Source)

- In 2023, approximately 8.5 million people were employed in jobs connected to trucking activity across the economy, excluding self-employed workers. (Source)

- Between 2023 and 2024, ten out of eleven industries within the transportation sector grew their workforce, reflecting the sector’s steady demand and resilience. (Source)

- Workers aged 55 and older make up nearly a quarter (24.8%) of the transportation workforce, slightly higher than the 23.4% seen across all industries. Notably, the transit sector leads with almost half (42.0%) of its workforce in this age group. (Source)

- In May 2024, heavy and tractor-trailer truck drivers earned a median annual wage of $57,440. (Source)

- Canada employs approximately 324,200 truck drivers. (Source)

- The trucking industry includes about 922,854 independent owner-operators. (Source)

- Owner-operators make up 11.1% of the truck driver workforce. (Source)

- Only 15.3% of CDL holders identify as Hispanic or Latino, compared to 24.4% within the overall U.S. labor force. (Source)

4) Trucking fleet & infrastructure statistics

Behind every successful delivery is a well-maintained fleet and a robust infrastructure. Let’s explore the vital Truck fleet size statistics and infrastructure stats that keep the trucking industry running smoothly on the nation’s roads.

- In 2022, there were 14.33 million single-unit (2-axle, 6-tire or more) and combination trucks registered, making up 5% of all registered motor vehicles. (Source)

- In 2022, the trucking industry generated an impressive $940.8 billion in gross freight revenue. (Source)

- Broader estimates that include commercial and freight vehicles bring the total number of trucks in operation to over 15.5 million. (Source)

- Each year, trucks in the U.S. haul approximately 10.8 billion tons of freight across the country. (Source)

- By 2025, electric trucks are expected to make up about 2% of all vehicles on the road, reflecting the industry's shift toward greener, more sustainable practices. (Source)

- In 2023, trucks carried 66.5% of the total value of surface trade between the U.S. and Canada. (Source)

- In 2023, trucks accounted for transporting 84.5% of the value of surface trade between the U.S. and Mexico. (Source)

- In 2022, the U.S. saw sales of 476,000 commercial trucks, including more than 29,000 Class 8 heavy-duty trucks. (Source)

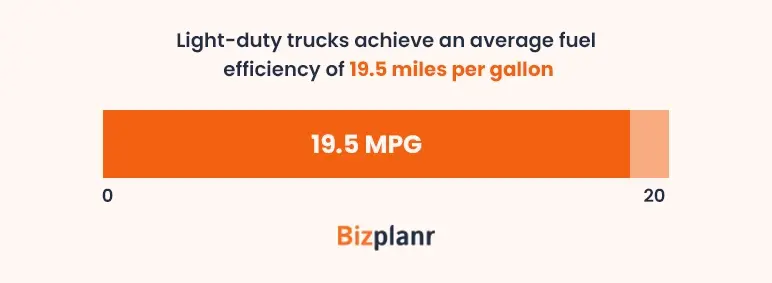

- Light-duty trucks achieve an average fuel efficiency of 19.5 miles per gallon. (Source)

- The trucking industry invests around $14 billion each year to enhance safety measures. (Source)

- Fatalities from large truck collisions rose by 2% compared to the previous year. (Source)

- In 2022, drivers of large trucks involved in fatal crashes were less likely to have prior license suspensions or revocations (6.0%) compared to drivers of motorcycles (16.3%), passenger cars (12.9%), and light trucks (10.1%). (Source)

- Seventy percent of fatalities in crashes involving large trucks are occupants of other vehicles. (Source)

- In fatal crashes, 15% of large truck occupants weren’t wearing seatbelts, and among them, the fatality rate was 40%, compared to just 8% for those who were buckled up. (Source)

- Only 3% of large truck drivers involved in fatal crashes were found to be alcohol-impaired at the time of the incident. (Source)

5) Dump truck industry statistics

The dump truck industry plays a vital role in supporting construction, mining, and infrastructure projects worldwide. Let’s dive into some key numbers that highlight this essential segment of the trucking industry.

- The global dump truck market is valued at USD 63.75 billion in 2025 and is projected to surge to approximately USD 134.78 billion by 2034, growing at a strong CAGR of 8.65% over the forecast period. (Source)

- There were 29,831 dump truck service businesses operating in the U.S. as of 2023, marking a slight decline of 1.7% compared to 2022. (Source)

- Asia Pacific leads the global dump truck market, holding a commanding 71% share in 2024. (Source)

- The Asia Pacific dump truck market is set to exceed USD 45.26 billion in 2025, advancing steadily with a CAGR of 8.72% throughout the forecast period. (Source)

- Articulated dump trucks dominated the market in 2024, contributing over 40% of total revenue, due to their adaptability and superior off-road performance. (Source)

- Key industry players include Hitachi Construction Machinery, Komatsu Ltd., Terex Corporation, Liebherr Group, OJSC Belaz, Sany Group, Deere & Company, HD Hyundai Infracore, Caterpillar, and AB Volvo. (Source)

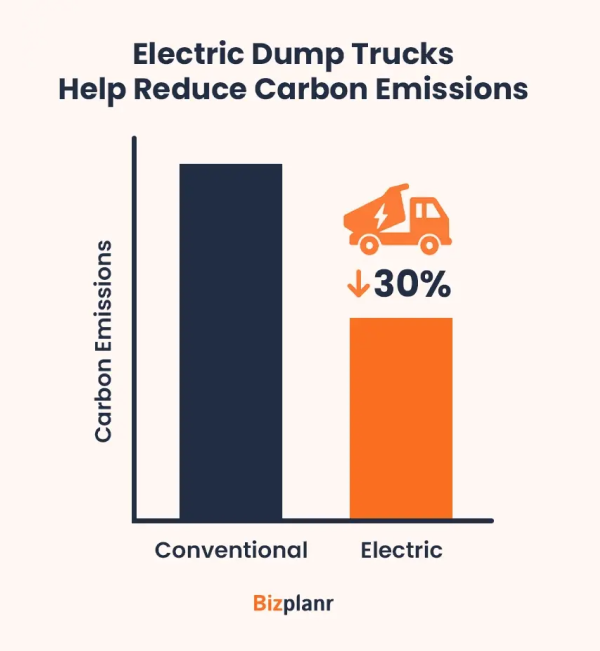

- Electric dump trucks help reduce carbon emissions by up to 30%, making them a greener choice for heavy-duty hauling. (Source)

- Automation technology can boost dump truck capabilities by up to 40%, enhancing efficiency and productivity on job sites. (Source)

6) Refrigerated trucking industry statistics

The refrigerated trucking industry is a critical link in the cold chain, ensuring perishable goods stay fresh from farm to table. As demand for temperature-controlled transport grows, this sector is evolving with advanced technologies to meet the needs of food, pharmaceutical, and other sensitive cargo markets.

- The global refrigerated transport market is valued at USD 50.45 billion in 2025 and is projected to skyrocket to approximately USD 398.63 billion by 2034, reflecting rapid growth driven by rising demand for temperature-sensitive goods. (Source)

- The U.S. refrigerated trucking market was valued at USD 10.32 billion in 2023 and is projected to grow to USD 13.65 billion by 2029, expanding at a steady CAGR of 4.77%. (Source)

- Within the U.S. refrigerated trucking market, dedicated Full Truckload (FTL) services are experiencing remarkable growth, boasting the fastest CAGR of 7.07%. (Source)

- Based on mode of transport, the refrigerated transport market is divided into road, air, sea, and railway segments, with road transportation capturing the largest market share in 2023. (Source)

- Refrigerated trucks consume more fuel and are less efficient compared to standard box trucks. Additionally, their cooling systems can reduce electric battery range by more than 23 kilometres per charge. (Source)

- Asia Pacific takes the lead in the refrigerated trucking market with a size of $19.17 billion in 2025, expanding rapidly at a CAGR of 26.21%. (Source)

- North America holds the position as the largest refrigerated trucking market, while Europe is emerging as the fastest-growing region. (Source)

- North America holds the largest share of the global market and is projected to grow at a CAGR of 7.3% between 2025 and 2033. (Source)

- The refrigerated road transport market is valued at $21.56 billion in 2025 and is projected to reach $33.24 billion by 2032, growing at a CAGR of 6.38%. (Source)

- In 2023, the Full Truckload (FTL) service segment dominated the U.S. refrigerated trucking market, capturing over 79% of the market share. (Source)

- Within the Full Truckload (FTL) service category, dedicated FTL is experiencing notable expansion, boasting the fastest CAGR of 7.07% in the U.S. refrigerated trucking market. (Source)

- Worldwide online food delivery is projected to hit USD 1.39 trillion in 2025, underscoring the increasing dependence on cold chain logistics. (Source)

7) AI & technology in trucking

AI and advanced technologies are rapidly transforming the trucking industry, boosting efficiency, safety, and sustainability. From smart fleet management to autonomous driving, innovation is steering the future of trucking.

- The global market for AI-powered fleet management software is expected to grow to $14.4 billion by 2030. (Source)

- By 2032, the electric truck market is anticipated to grow from USD 1,091.6 million in 2024 to USD 13,045.4 million by 2032. (Source)

- Currently, 54% of large fleets, 51% of medium fleets, and 37% of small fleets are adopting the technology to enhance efficiency, reduce costs, and improve safety. (Source)

- By the end of 2025, 1 in every 10 new trucks sold is anticipated to be a semi-autonomous vehicle. (Source)

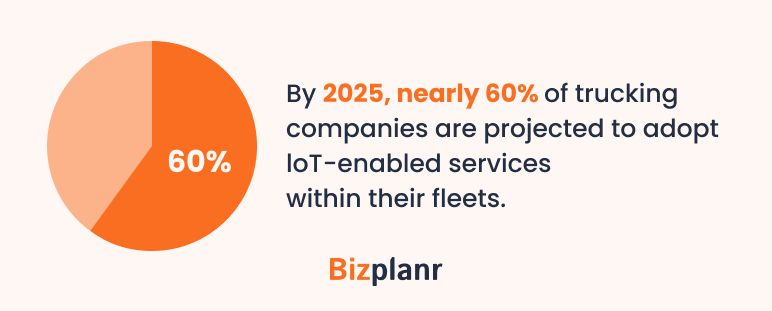

- By 2025, nearly 60% of trucking companies are projected to adopt IoT-enabled services within their fleets. (Source)

- EV adoption among Geotab-connected fleets is gradually rising, with Europe leading at an average adoption rate of 2.03% compared to just 0.45% in North America. (Source)

- 19% of companies leverage location data, IoT, and sensor technology to enhance supply chain visibility. (Source)

- Only 17% of organizations use basic data analytics tools to monitor and assess supply chain performance, while 15% leverage analytics to identify inefficiencies and optimize their processes. (Source)

Top Trucking Industry Trends to Consider in 2025

The trucking industry is shifting gears in 2025, driven by rising fuel costs, stricter regulations, and rapid tech adoption. From electric rigs to AI-powered logistics, here’s what’s steering the future of freight. Here’s what the future holds for the trucking industry:

Nearly 60% of trucking companies are expected to use IoT-enabled fleet management and delivery management software by 2025. (Source)

If you’re serious about getting into trucking, you can’t ignore this. Why? Because it shows you where your trucks are, how they’re running, when they’ll need repairs, and how to cut wasted miles and fuel. It’s not a fancy extra—it’s how you stay profitable when margins are tight. If you’re not planning to invest in this from the start, you’ll be chasing everyone else

The electric truck market is projected to grow from $2.48 billion in 2024 to $40 billion by 2030. (Source)

The electric truck wave isn’t a trend, it’s a shift. The market’s jumping from $5.9 billion in 2025 to nearly $39 billion by 2032. Why? Lower fuel costs, cleaner emissions, and soon, strict regulations will leave diesel rigs struggling. Early movers will grab the best routes, contracts, and incentives. If you're starting out, plan how electric rigs fit into your future fleet now—don’t wait till you’re forced.

The global AI fleet management software market will reach $14.4 billion by 2030. (Source)

AI in fleet management isn’t some fancy add-on anymore; it’s becoming the backbone of smart trucking businesses. It optimizes routes, cuts fuel waste, predicts maintenance before breakdowns, and keeps deliveries on time. The companies using this tech will run leaner, safer, and way more profitably. If you're serious about building a future-ready trucking business, make AI-driven management part of your plan from day one.

The global autonomous truck market is set to surge, with its value expected to rise from USD 42.91 billion in 2025 to USD 86.78 billion by 2032. (Source)

The autonomous truck market is set to grow rapidly because major fleets and logistics giants are seeking lower labour costs, reduced accidents, and 24/7 delivery capacity. These trucks utilise AI, sensors, and cameras to drive on highways and controlled routes autonomously. The tech’s improving fast, and by 2032, it’ll be a $86.7B industry. If you’re starting a trucking business, keep an eye on autonomous partnerships or retrofit tech — it’ll reshape freight hauling sooner than you think.

80% of consumers prioritize fast, hassle-free, and friendly delivery experiences above all else. (Source)

Over the next 10 years, we’ll see big moves in last-mile tech — think electric cargo bikes, drones, and delivery bots zipping through traffic. These innovations won’t just cut through congestion; they'll slash emissions and speed up deliveries. That’s the kind of edge modern consumers expect, and it’s where smart trucking businesses will need to adapt.

The bottom line

With these statistics, it has been proven that America runs on wheels, and the trucking industry keeps those wheels turning—hauling goods, connecting businesses, and powering industries coast to coast.

But it’s not business as usual—rising labor costs, fuel price swings, and stricter safety measures are reshaping the road ahead. Technology’s taking the wheel too, with AI, telematics, and electric trucks quickly moving from ideas to investments.

For entrepreneurs, fleet owners, and industry decision-makers, keeping a close eye on these shifts isn’t optional anymore—it’s survival. Because Automation and EV adoption will accelerate. Cold chain and specialized trucking will see huge growth with e-commerce and data-driven operations separating the winners from the rest.

Hence, stay updated and ready for the next.

That’s a wrap on the latest trucking industry insights — until next time, drive smart and stay ahead of the curve!

Frequently Asked Questions

How big is the trucking industry in 2025?

The global trucking industry is valued at $14.14 trillion in 2025, with the U.S. market alone worth $532.7 billion.

How many trucking companies are there in the U.S.?

There are about 339,220 motor carriers with operating authority in the U.S. as of 2024, following a slight decline from the previous year.

How many truck drivers are there in the U.S.?

In 2023, 3.55 million truck drivers were employed in the U.S., marking a 0.3% increase from the previous year.

What are the major trends in the trucking industry?

Key trends include digitalization, automation, sustainability initiatives, adoption of electric vehicles, and increased use of AI and telematics for fleet management.

How is AI used in trucking and logistics?

AI powers fleet management, predictive maintenance, route optimization, driver safety monitoring, and decarbonization tools, with the AI fleet management market projected to reach $14.4 billion by 2030.

What’s the average salary for truck drivers in 2025?

In May 2024, the median annual wage for heavy and tractor-trailer truck drivers was $57,440, or $27.62 per hour, meaning half of the drivers earned more than this amount and half earned less.

Which states have the largest truck fleets?

Texas, California, and Florida have the largest number of registered trucks and trucking companies, reflecting their major roles in freight movement.

What are the main challenges trucking companies face today?

The industry faces driver shortages, fluctuating fuel costs, regulatory pressures, and economic uncertainty, though technology adoption is helping address some of these issues.

How many semi-trucks are in operation in the U.S.?

In 2022, the U.S. had 14.33 million registered single-unit (2-axle, 6-tire or more) and combination trucks, accounting for 5% of the nation’s total registered vehicles.