Starting a nonprofit organization is a rewarding way to make a difference in your community. However, the process involves several detailed steps and legal requirements.

In the United States alone, about 1.9 million nonprofits are actively making an impact. Thus, this guide will explain how to start a nonprofit organization step by step in clear, beginner-friendly terms.

We’ll cover everything from defining your mission to filing for 501(c)(3) tax-exempt status. Even if you’re wondering how to start a nonprofit with no money, don’t worry – many steps are low-cost or free, and with the right plan and tools, you can launch your nonprofit on a shoestring budget.

Let’s dive into the ten essential steps.

Key Takeaways

- Starting a nonprofit business usually costs between $50 and $500, depending on your state’s fees and your chosen IRS filing form.

- Your mission, planning, and board members play crucial roles in your nonprofit organization's success and long-term impact.

- In this blog, you’ll learn the complete process on how to start a nonprofit organization from scratch.

Step 1: Define your mission

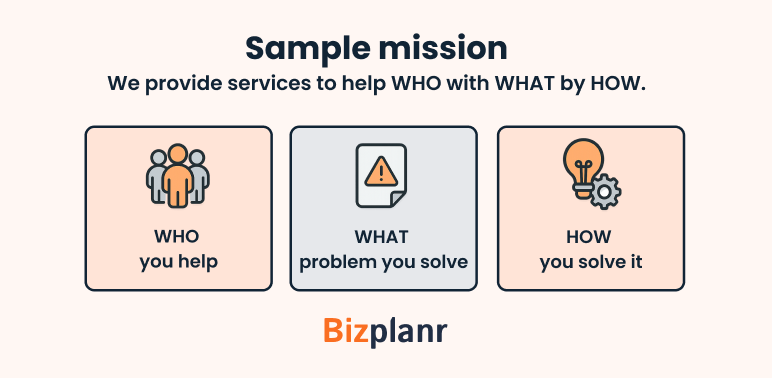

A mission isn’t just a nice sentence you put on your website. It’s the reason your nonprofit exists. It answers three simple but powerful questions:

- Who are you helping?

- What problem are you solving?

- How are you going to solve it?

The more specific you are, the easier your life will be down the road. Why is this so important?

Because this mission becomes the backbone of everything else you’ll do:

- It’s what you’ll submit when you file for tax-exempt status with the IRS (or your country’s charity regulator).

- It’s what you’ll share with donors and volunteers when they ask, “So what do you do?”

- It guides which programs you run and which opportunities you say no to.

A weak mission leads to scattered efforts and confusion. A clear mission keeps your focus sharp and helps others rally around your cause.

Step 2: Pick a name and legal structure

Your nonprofit's name needs to work on multiple levels: It should capture your mission, sound professional, and actually be available for use. Start with the practical stuff first.

- Check if it’s available in your state’s nonprofit registration database. You don’t want legal trouble later because someone else is already using it.

- Check if the website domain is available. Even if you’re not building a site right now, grab the domain. It’s cheap insurance for your brand’s future.

I’ve seen people skip this and later have to rebrand everything—it’s a headache you don’t need.

For legal structure, most nonprofits follow the same path: Forming a nonprofit corporation at the state level, then applying for federal tax-exempt status. This structure gives you several advantages:

- Limited liability protection for your board members

- The ability to enter into contracts

- Eligibility for 501(c)(3) status.

You'll need to draft bylaws as part of this process. Think of bylaws as your organization's rulebook—they outline how decisions get made, how board meetings run, and what happens if conflicts arise. Many states provide bylaws templates for nonprofits, saving you time and legal fees.

Step 3: Form your board of directors

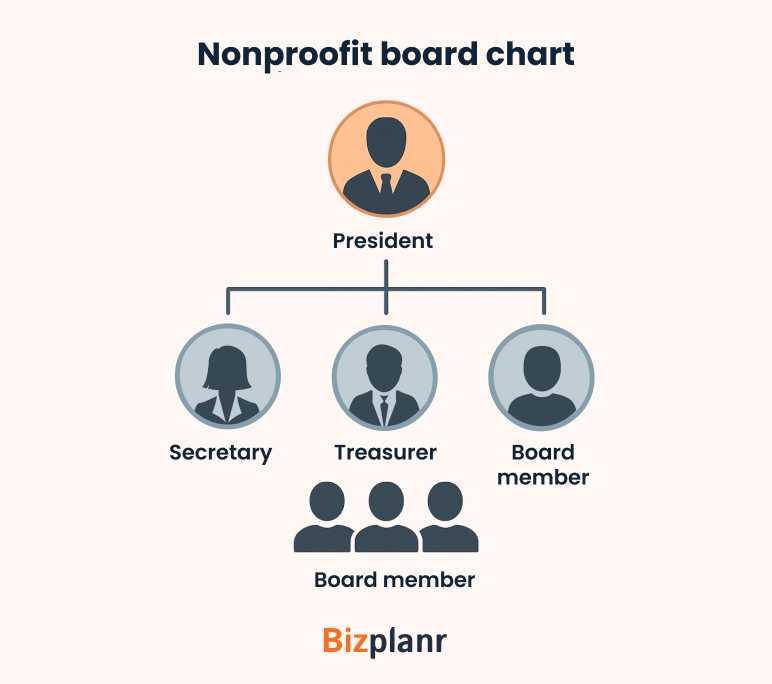

Your board isn't just a legal requirement—these people become your organization's strategic backbone and accountability system. Most states require at least three board members to register a nonprofit—usually a President, Secretary, and Treasurer.

Some states allow you to fill multiple roles, but it’s smarter to have separate people. It keeps things clean and credible.

Now, who should you pick?

Don’t just grab a couple of buddies to fill seats. You want people who believe in your mission—if they don’t care about what you’re doing, they’ll vanish when things get tough.

You also want people who bring different skills to the table. Someone:

- Good with numbers

- Connected in the community

- With legal or nonprofit experience

- Strong in fundraising or donor relations

Step 4: Write a nonprofit business plan

Yes, even though you’re not chasing profits, you still need a clear, organized plan to run your nonprofit with intention and secure funding. Your nonprofit business plan doesn't have to be a 30-page academic document, but it should answer:

- What do you do, and why does it matter?

- Who benefits from your work?

- How you’ll fund your programs?

- Your estimated operating costs.

- Your short-term and long-term goals.

If you’re wondering why you need a business plan, here’s the reason. When you apply for 501(c)(3) status, grants, or partnerships, it’s one of the first things they’ll ask for to understand your mission and long-term sustainability.

A solid, well-documented plan shows funders and regulators you’re serious about your mission and prepared for the long run.

👉 Use this nonprofit business plan template to get a head start for free.

Get Your Custom Business Plan Ready in Minutes

Bizplanr’s AI business plan generator creates personalized business plans based on your specific industry

Step 5: File your formation documents

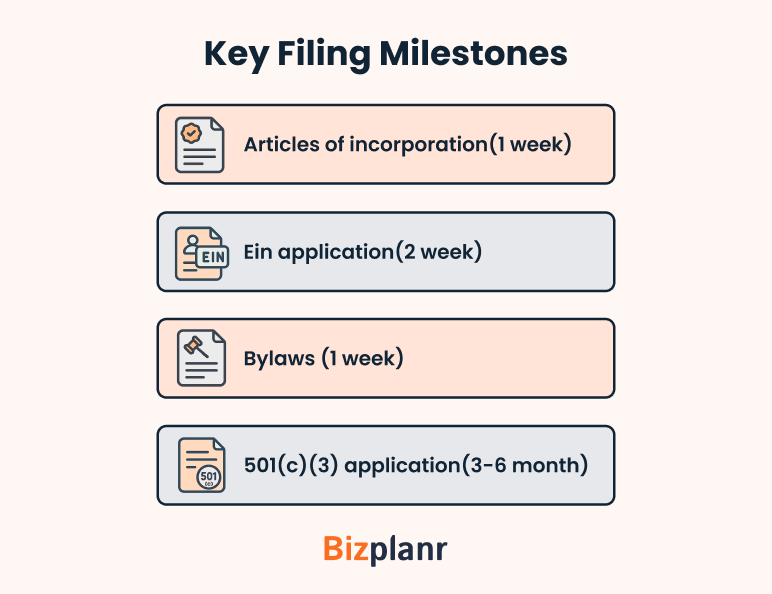

Now comes the paperwork that makes your nonprofit official. You'll need three essential documents:

Articles of incorporation

It’s a process to make your non-profit organization official with your state or local government. You’ll file this with your state’s business division, paying filing fees between $50-$150.

EIN (Employer Identification Number)

Even if you won’t have employees immediately, you need an EIN from the IRS—it’s like your nonprofit’s Social Security number. You need this to open bank accounts, apply for grants, and file tax returns. The good news? It's completely free to get directly from the IRS website.

Bylaws

These aren’t usually filed with the state, but you need them for internal use and to submit with certain applications later (like your 501(c)(3) tax exemption). Additionally, Bylaws cover board structure, meeting procedures, conflict of interest policies, and amendment processes.

This is the paperwork that turns your idea into a legal organization. It might feel tedious, but it’s the foundation for everything you’ll build.

Step 6: Apply for 501(c)(3) tax-exempt status

Now comes the big one: Applying for 501(c)(3) tax-exempt status.

This is what officially makes your nonprofit tax-exempt in the eyes of the IRS and allows donors to make tax-deductible contributions. Now you have two application options: Form 1023-EZ and Form 1023. What are these forms, and how it work?

Let’s find out in the table below:

| Feature | Form 1023-EZ | Form 1023 |

|---|---|---|

| Approval Time | 2-4 weeks | 3-6 months |

| Purpose | For smaller, simple nonprofits | For larger or complex nonprofits |

| Eligibility | Gross receipts ≤ $50,000/year (first 3 years) and assets ≤ $250,000 | No income or asset limits |

| Application Fee | $275 | $275 |

| Application Length | Short, streamlined form (online only) | Detailed, including program descriptions and financial projections |

| Common Uses | Local charities, community groups, small educational or religious organizations | National programs, grant-funded orgs, nonprofits with big plans or property |

| Tax-Exempt Purposes | Charitable, religious, educational, scientific, literary, public safety, amateur sports, or preventing cruelty to children/animals | Same as Form 1023-EZ |

Step 7: Open a bank account and set up finances

Now that your nonprofit is official, it’s time to open a bank account and set up your finances properly. It's essential for maintaining your tax-exempt status and donor trust.

How to open a nonprofit bank account?

Head to a bank with your:

- Articles of Incorporation

- EIN (from the IRS)

- Bylaws

- Board resolution authorizing the account (some banks ask for this)

Additionally, it’s important to track your nonprofit’s finances accurately. Even if you’re starting small, having a proper system in place matters.

Why? Because the IRS requires it for annual reports, donors expect transparency, and it makes grant applications and audits a whole lot smoother.

Set up separate tracking for restricted and unrestricted funds from day one. You can use financial tools to keep track of your nonprofit's money. Here’s a list of tools that help you stay organized and track your money:

- Wave: Free and simple for small nonprofits.

- QuickBooks: More features for growing organizations, especially if you’re handling grants and donations.

- Google Sheets: Great if you’re just starting out and need a clean, easy way to track income and expenses.

Step 8: Plan your programs and fundraising

Here's where strategic thinking pays off. Plan one or two solid programs—that’s it. Don’t try to save the whole world at once. Pick programs that directly connect to your mission and that you can realistically manage with the people, time, and money you have.

Why?

Limited programs done excellently build credibility faster than multiple mediocre efforts. They're easier to measure, simpler to explain to funders, and allow you to learn what works before expanding.

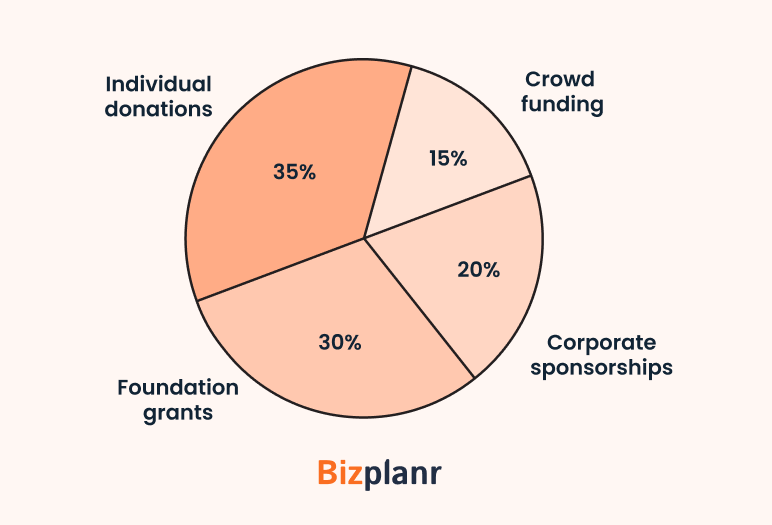

For fundraising, think diversification from the beginning. Relying on a single funding source—whether that's one major donor, a specific grant, or a particular fundraising event, creates dangerous vulnerability.

Hence, consider smart ways to begin:

- Donations from friends, family, and your local community

- Small local grants (many cities and foundations offer starter grants)

- Corporate sponsorships work especially well if your mission aligns with a company's values or serves their employees/customers.

- Crowdfunding campaigns (works great for specific projects or causes)

Start where you have existing relationships and expand outward. Your first donors are often people who already know and trust you—they become the foundation for attracting others.

Step 9: Launch and promote your nonprofit

You've done the legal groundwork—now it's time to tell the world about your mission and start making an impact.

- Build a simple website with your mission, programs, board details, and donation options using platforms like Wix or Notion.

- Create essential content like a clear mission statement, elevator pitch, and authentic program photos.

- Set up social media profiles on platforms where your audience is active, like Facebook, Instagram, or LinkedIn.

- Launch an online donation page with giving options, impact details, and prompt donor acknowledgments.

- Share early wins and stories through testimonials, program photos, and initial impact data to build credibility.

Launch doesn't mean everything has to be perfect. Start with the basics and improve over time based on what you learn about your audience and community needs. If your nonprofit runs educational programs or volunteer training, an LMS for a non profit can help manage learning materials and track participation as those programs grow.

Step 10: Stay compliant and grow

As you've officially launched a nonprofit, now comes the ongoing work of staying compliant while building sustainable impact.

Here are a few common compliance tasks that you shouldn’t skip:

1) File IRS Form 990-N (or 990-EZ/990) every year

Even if you make no money, the IRS expects this. It’s basically your nonprofit’s annual report.

Small nonprofits under $50,000 can file the short, easy 990-N online.

2) Renew your state registration annually

Most states require you to renew your nonprofit’s registration or charitable solicitation license each year.

3) Send donation receipts to your donors

It’s not just polite—it’s required. Any donation over $250 legally needs a written acknowledgment for the donor’s tax records.

Importantly, for consistent growth, you need to focus on two important aspects:

- Delivering real, measurable impact through your programs.

- Building genuine relationships with your community, donors, and volunteers.

Money follows impact, not the other way around. You can now launch your nonprofit with confidence, make a real difference, and build a community that believes in your mission.

5 Mistakes to Avoid When Starting a Nonprofit

Before you dive in, it’s smart to know where most new construction businesses slip up. Avoiding these common mistakes can save you time, money, and a lot of headaches down the road.

1) Writing a vague mission statement

"We help people in need" tells nobody what you actually do. Vague missions confuse the IRS, frustrate donors, and make program planning impossible.

The Fix: Get specific about who you serve, what problem you solve, and how you solve it. "We provide job training and placement services to formerly incarcerated individuals in Detroit" immediately clarifies your purpose.

2) Choosing board members out of convenience

Asking friends and family to fill board seats might seem easier, but disengaged board members hurt your organization's credibility and effectiveness.

The Fix: Recruit people who genuinely care about your mission and bring valuable skills. A smaller, engaged board outperforms a larger, disconnected one every time.

3) Skipping the business plan

"We'll figure it out as we go" doesn't work when grant applications ask for detailed program descriptions and financial projections.

The Fix: Write your business plan before you need it. Grant funders, major donors, and the IRS all expect clear documentation of your strategy and financial planning.

4) Poor donation tracking from day one

Mixing restricted and unrestricted funds, losing donor receipts, or using personal accounts for nonprofit business creates compliance nightmares and destroys donor trust.

The Fix: Set up proper financial systems immediately. Use nonprofit accounting software, separate business banking, and establish clear policies for expense approval and documentation.

5) Waiting for the "perfect" launch

Perfectionist founders spend months refining websites, materials, and programs while their community continues facing the problems they want to solve.

The Fix: Launch with the basics and improve over time. Your first donors and program participants would rather see you taking action than waiting for everything to be flawless.

Bottom line

You’ve made it through the steps, and that’s no small thing. Most people dream about starting a nonprofit, but you’re doing it.

Now it’s time to turn that plan into action. If you need a little help organizing those next moves, tools like Bizplanr AI business plan generator can make the process smoother.

All you need is to stay focused, stay passionate—your mission matters, and the world’s waiting for you.

Get Your Business Plan Ready In Minutes

Answer a few questions, and AI will generate a detailed business plan.

Frequently Asked Questions

How much does it cost to start a nonprofit organization?

It typically costs between $50-$500, depending on state fees and your IRS filing form.

Can I start a nonprofit without a lawyer?

Yes, many people do it themselves using state guides and online templates, though legal advice can help avoid mistakes.

How long does it take to start a nonprofit?

It can take 2 weeks to 6 months, depending on your state’s processing time and whether you file Form 1023 or 1023-EZ.

How to start a nonprofit organization with no money ?

You can start small by applying for an EIN, creating free online tools, and focusing on community fundraising and volunteers.

Do I need a business plan for a nonprofit?

Yes, it keeps your mission clear, guides your programs and finances, and is often required for grants and 501(c)(3) approval.