Even minor shortcomings in your business plan can lead to major blunders—like reduced investor confidence and room for internal confusion.

While you may have checked your business plan for typos and made sure it looks the best, your plan may not be ready to be presented.

You might want to thoroughly review and critique your business plan's draft, especially if you’re a new business. But why?

A thorough business plan review can help identify any weaknesses, improve its structure and clarity, and ensure it leaves no room for doubts.

So in this article, we'll discuss how to critique a business plan and make it the absolute best.

But first, let's begin by discussing...

Why should you critique your business plan?

It’s no secret that a well-reviewed and refined business plan can do wonders–it can make a big change in attracting potential investors, guiding your direction, and avoiding pitfalls.

Your business plan, a living document, is often the first detailed communication prospective investors have with your business. According to research, entrepreneurs who write formal business plans are 16% more likely to achieve viability than those who don't.

Inconsistent or incorrect information in your business plan is a surefire way to invite confusion and mistrust. Consider the fact that 68% of consumers lose trust in local businesses if they encounter inconsistent contact details or business names online.

Similarly, investors will question the credibility of your business if they notice discrepancies in your plan. This inconsistency will also create confusion within your team, and misalign your business goals and strategies.

For example, a small business that presents a plan with overly optimistic financial projections and no clear justification. Investors are likely to view this as a red flag and question the entrepreneur's understanding of the market and financial realities. Such errors lead to a lack of investor confidence and ultimately result in failure to secure necessary capital.

That’s not all. Other benefits of critiquing or reviewing your business plan include:

- When you critique your business plan, you uncover potential flaws and risks. It leaves you with just enough time to address them before they turn into major issues.

- Regularly reviewing and updating your plan helps you adapt to changes in the market and customer needs. It keeps your business relevant and competitive, in a way.

- A well-critiqued plan is the marker of professionalism and preparedness. It enhances your credibility with potential investors and stakeholders.

Let’s now look at some actual steps to critique your business plan.

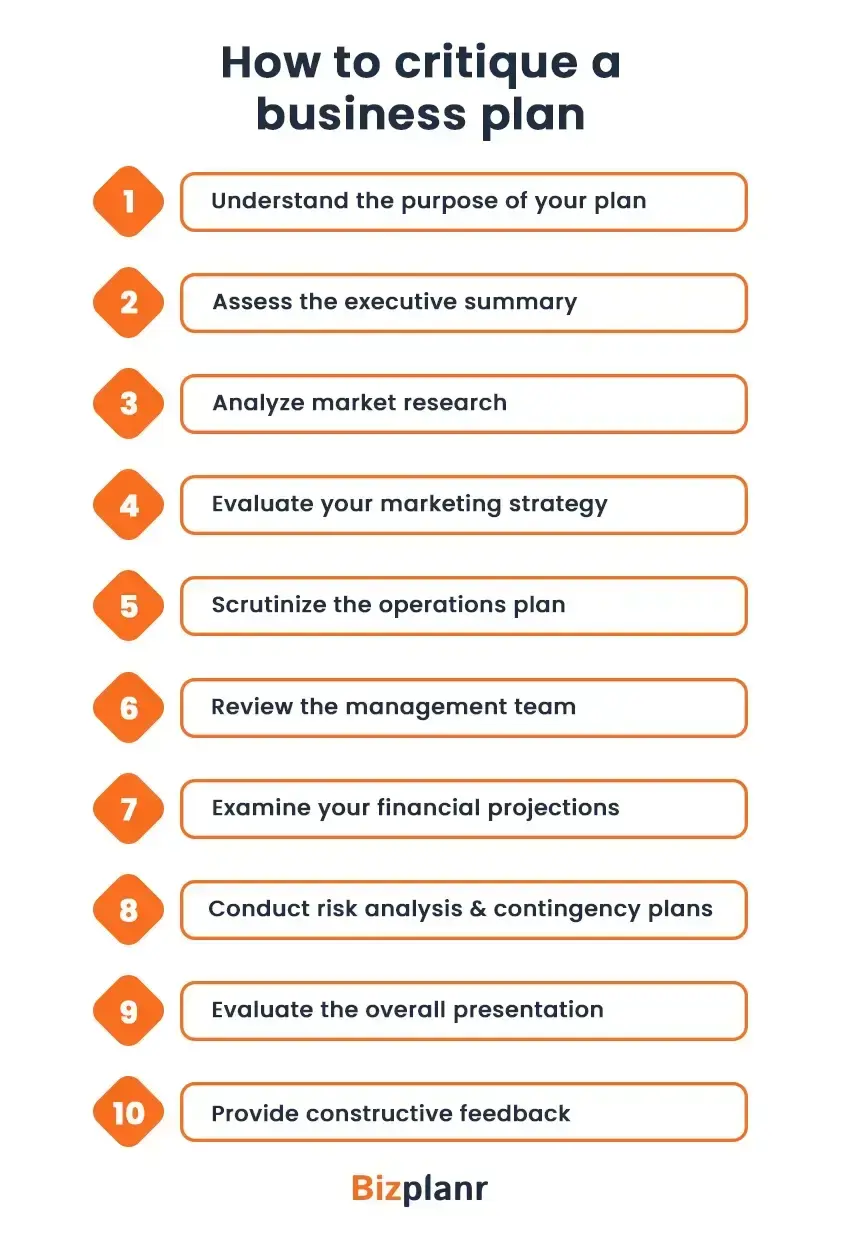

How to critique a business plan

Did you know: About 85% of business plans get tossed out right away. Of the rest, only 15% cut closer looks. And guess what? Only 5% of those actually get to talk money. You’re targeting that final 5%.

Sounds scary, but it’s doable by critiquing your business plan. Here’s how:

1. Understand the purpose of your plan

First, dissect your plan’s purpose. A business plan acts like a roadmap of a company; it should clearly outline the goals and the strategies needed to achieve them.

The best way to figure out whether the purpose is clear, is to ask questions like:

What is the primary goal of the business plan?

The answer would determine if the plan is aiming to secure capital, guide internal business strategy, or do both. For instance, startups would want to bring some investors, but established companies would want to steer long-term growth.

Does the business plan clearly state the mission and vision of the company?

The mission and vision provide context for the business’s existence and its strategic direction. For instance, a business plan might state its mission is to provide sustainable energy solutions that align with its goals.

What are the potential risks and how does the plan address them?

Risk management strategies must be practical to ensure robustness. For example, consider including contingency plans for supply chain disruptions.

2. Assess the executive summary

If there’s one page that’s guaranteed to be read and discussed, it's the executive summary. Naturally, it’s your best bet to capture the reader’s interest and persuade them that your plan’s worth reading.

For starters, your summary needs to start with a concise, to-the-point one-line statement of your business idea. Write this in a way that there’s no scope for vagueness, and the reader can immediately ‘visualize’ your business idea.

In the rest of your summary, describe the:

- The benefits your product or services brings to the table

- Market you’re aiming at

- Factors that back up your chances of success

- Stage that the business idea or venture is already in

- Monetary requirements and the purposes for which the money will be put to use

Ideally, your executive summary should be limited to just a page. Craft it as the final step, refining it until it delivers a clear, compelling vision of your business.

Ensure it answers these crucial questions: What is the business? Why will it thrive? How can the investor contribute? What returns can be expected?

Always remember that your investor is assessing the business's potential size, concept soundness, team strength, and risk-reward profile.

3. Analyze market research

Having convinced the reader that your product or idea has value, you must now ensure that a genuine market exists for it.

It’s wise to proceed in two stages:

1. Have an overview of the market that discusses:

- Its aggregate size and composition

- Demographics of target customers

- Recent trends and likely developments in the near future

It should also touch on how the market operates and the major features of competitors: pricing, quality, reputation, and service.

2. An analysis of your targeted market segment:

Break down your market into smaller groups of customers, and decide which ones to focus on.

Focus on questions like:

- Where are they located? (local, regional, national, or international)

- How big are these groups, and how quickly are they growing?

- What are their buying habits and priorities?

This market analysis will underpin all future sales predictions and financial performance. Make sure to use real numbers and data to show the potential size of the market and your share.

Your business plan must also show a strong understanding of customer needs, and preferences, and how to reach them.

4. Evaluate your marketing strategy

Next in line is your marketing strategy, your blueprint for reaching out to and converting customers. Its effectiveness hinges on a clear and compelling unique selling proposition (USP). This is where your statement differentiates the business from competitors and articulates the core value it delivers.

A well-structured marketing mix—product, price, place, and promotion—underpins the strategy. Scrutinize how these elements align with the target market and support the USP.

Ultimately, a successful marketing plan depends on customer acquisition and retention. Go through the proposed tactics for attracting new customers and cultivating long-term loyalty. Do the outlined strategies effectively leverage the business's strengths and address potential challenges?

A strong marketing strategy isn’t just about creating awareness, it must also drive sales and build a sustainable customer base.

5. Scrutinize the operations plan

The production and operations section of your business plan must outline the nuts and bolts of how a product will be created or service delivered. Your plan shouldn’t be bogged down in excessive technical detail; focus on the core elements that impact the business's viability.

Some of the key areas to scrutinize are:

- Supply chain analysis: Assess how robust your supply chain is. Evaluate reliance on specific suppliers, potential bottlenecks, and strategies for eliminating risks like supply disruptions or price fluctuations.

- Manufacturing process: Your plan should clarify how you will manufacture your product and how the production process goes along.

- Asset investment: Evaluate the financial implications of purchasing versus leasing equipment. The equipment must align with production needs and capacity plans

- Cost management: Look for evidence of a clear understanding of cost drivers and strategies for cost reduction.

- Quality assurance: Examine the quality control measures in place. Ensure that the plan addresses how quality will be maintained as production scales up.

Lastly, confirm what stage has production reached: design, prototype, pre-production? How do you plan to manage the smooth transition from producing a prototype to producing in volume? Not all aspects of the operations process will be equally critical.

6. Review the management team

The people behind the business are no less important than the idea itself. When you’re working on a business plan, take a good hard look at your management team.

Are they the right people for the job? Do you think they have the skills, experience, and passion to take your business in the intended direction and convince investors? Is everybody ‘still’ relevant?

Ideally, you’d want a small management team with the power of taking independent decisions.

Since it’s a critical aspect of your business plan, do ponder about the backgrounds, roles, and expertise of your team during the review process. Is there a clear leadership structure? Is there clarity in terms of responsibilities?

Weed out any internal issues before you present your business plan to external parties.

7. Examine your financial projections

The financial section of a business plan is where the rubber meets the road. Understand the numbers, but don't get lost in the weeds. Focus on the big picture and ask yourself if the numbers tell a realistic story.

Revenue forecasts

Are the revenue projections based on solid market research and assumptions? Do they make sense given the industry, competition, and target market? Be wary of overly optimistic numbers. It’s okay to aim high, but make sure the forecasts are grounded in reality.

Cost structure

Make sure that the costs are reasonable and well-defined. Check if there are any glaring omissions. Pay attention to both fixed and variable costs.

Break-even analysis

The break-even point tells you when a business starts making a profit. Does the business plan provide a clear break-even analysis? Does it seem achievable based on the revenue and cost projections?

8. Conduct risk analysis and contingency plans

A convincing business plan acknowledges that things don’t always happen as planned. When critiquing a business plan, you want to see if it addresses all potential pitfalls.

- Identify the risks. Are they realistic? From financial and operational to market-related–consider every possibility.

- Scrutinize the contingency plans. Check if the backup plans are specific, actionable, and aligned with the identified risks.

- Consider testing the plan. Make up a worst-case scenario. Does the contingency plan hold up?

Risk analysis isn’t about scaring people off. Instead, it shows that you’ve a mature understanding of the business environment and a proactive approach to problem-solving.

9. Evaluate the overall plan presentation

First impressions matter, and the overall presentation of a business plan is often the first impression. It should be clear, concise, and professional.

Clarity and coherence should be your top priority.

Is the plan well-structured and easy to follow? Is the writing clear and free of jargon? Is the formatting of the business plan to-the-point? Can you easily understand the business concept and the value proposition?

Professionalism is equally important. The plan should look polished and should be free of any typos or grammatical errors. The visual appeal should also be consistent throughout.

Lastly, check for completeness and persuasiveness. Does the plan cover all the essential elements? Is there enough detail without being overly verbose?

Once the answers to these questions are a ‘yes’, you’re good to go.

10. Provide constructive feedback

Now that you’ve critiqued and reviewed the business plan, all that’s left is to provide your honest feedback. Your goal here is to help improve the business plan and increase its chances of success.

While offering feedback, be specific. Rather than saying "The profit projections are weak," explain why. What specific information is missing? Focus on the business, not the person. Avoid personal criticism. Lastly, be positive. Don't just point out problems but always suggest potential solutions or improvements.

Transform Your Business Plans into Winning Documents

Critiquing your business plan is critical to secure investor buy-ins, and weed out any errors. It’s a thorough process that involves a step-by-step approach of review that focuses on each individual section, from its purpose to finances.

Bizplanr brings you an AI-powered business plan generator that will craft a detailed, completely tailored business plan for you in just minutes. Whether you’re validating an idea or launching a startup, the AI can craft an expert-level business plan for you without any financial commitment!

Get Your Business Plan Ready In Minutes

Answer a few questions, and AI will generate a detailed business plan.

Frequently Asked Questions

What does critiquing a business plan mean?

Critiquing a business plan is a thorough process to check it for errors and inconsistencies. It ensures that the business plan presents your vision and planning in the best possible way.

Why is it important to critique your business plan?

Critiquing a business plan is important because it helps cut down on accuracy, boost investor confidence, and increase your chances of securing capital. Business plans with even one flaw could dampen your business reputation.

Who critiques a business plan?

You can critique the business plan yourself as an entrepreneur or business owner. You can also hire a team of experts to professionally critique and review your plan.