The cleaning industry is undergoing a transformative shift, driven by technology, sustainability, and evolving consumer demands.

From robotics and green cleaning solutions to rising employment opportunities, this blog dives into the latest statistics and key cleaning industry trends shaping the industry in 2025.

Whether you're a business owner, investor, or simply curious, these insights will help you stay ahead in this dynamic and essential sector.

Let’s dive in.

Top Cleaning Industry Statistics 2025 (Top Findings)

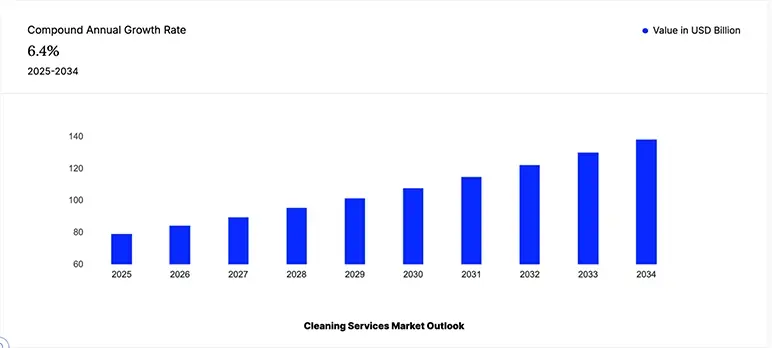

- The global cleaning services market will reach $111.49 billion by 2025.

- By 2025, the green cleaning market is expected to account for 30% of the total cleaning industry revenue.

- A 3% employment growth is expected for janitors and building cleaners from 2023 to 2033.

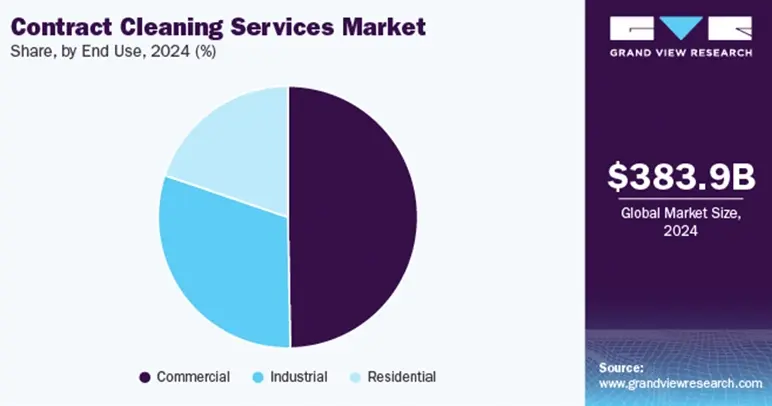

- The contract cleaning services market is expected to grow at a CAGR of 5.76%, reaching USD 286.22 billion by 2030.

- In 2023, there were 75,565 cleaning businesses in the UK, up from 73,655 in 2022.

- The U.S. employs over 900,000 cleaning workers in the house cleaning industry.

- The average yearly salary for a housekeeper in the U.S. is $29,991.

- The commercial cleaning segment will continue to dominate the industry, accounting for 60% of total revenue by 2025.

- North America dominated the cleaning services market with a share of over 32.20% in 2024.

- The contract cleaning services market is expected to grow at a CAGR of 5.76%, reaching USD 286.22 billion by 2030.

- The majority of cleaning businesses are small, with 90% employing fewer than 10 people. Additionally, 99% of these businesses are independently owned.

- Online sales of cleaning products are expected to grow by 15% annually, reaching $20 billion by 2025.

- By 2025, the Asia-Pacific and Latin America regions are projected to generate 35% of global market revenue, fueled by urbanization and increasing disposable incomes.

- China and India are experiencing rapid growth due to urbanization and rising middle-class populations.

- Brazil and Mexico are emerging as key markets for residential and commercial cleaning services.

- The U.S. leads in market size and innovation, with a strong focus on green cleaning and automation.

Cleaning Industry Overview

As we look forward to 2025, the industry is being reshaped by technological innovations, growing environmental awareness, and changing consumer expectations. Let’s take an overview of the cleaning services industry to stay informed and ahead of the curve.

| Component | Statistics & Insights |

|---|---|

| Global Market Size (2025) | Expected to reach $468.2 billion |

| CAGR (2023-2030) | Projected growth at 6.3% annually |

| Commercial Cleaning Revenue | Expected to exceed $100 billion by 2025 |

| Residential Cleaning Market | Valued at $40 billion+ and growing |

| Number of Cleaning Businesses | Over 2.5 million registered businesses |

| Employment in Cleaning Industry | More than 4 million workers are employed in Europe |

| Small Business Dominance | 90% of cleaning companies have fewer than 10 employees |

| Self-Employment Rate | 55%+ of cleaning businesses are self-employed |

| Green Cleaning Products Market | Expected to surpass $11 billion by 2025 |

| Most Profitable Cleaning Segment | Commercial cleaning services dominate revenue |

| Growth in Robotic Cleaning | Market for robotic cleaning is projected at $24 billion by 2028 |

| Top Cleaning Companies | ISS, ABM Industries, Cintas, Sodexo |

| Market Share of Independent Companies | 99% of cleaning businesses are independently owned |

| Cleaning Wages | Average wage of $14-$18 per hour for janitors and cleaners |

Top Cleaning Industry Statistics 2025

The janitorial services are rapidly growing due to the continuously rising demand for residential, commercial, and eco-friendly cleaning solutions. Hence, in this section, we’ll discover the key statistics in cleaning services to help you navigate the opportunities and challenges that lie ahead in this ever-expanding market. Let’s explore:

1) Global Cleaning industry statistics

These global statistics provide insights into the potential market growth of janitorial services and the key trends driving the industry, helping you make informed decisions:

- The global cleaning services market size was valued at approximately USD 415.93 billion in 2024 and is projected to expand at a 6.9% CAGR from 2025 to 2030. (Source)

- The North American cleaning industry is expected to account for 45% of total revenue by 2037, making it the largest market share holder. (Source)

- The global window cleaning services market was valued at $102.54 billion in 2023 and is projected to grow further in the coming years. (Source)

- The employment of janitors and building cleaners is expected to increase by 3% from 2023 to 2033, aligning with the average growth rate for all occupations. (Source)

- The global cleaning service software market is projected to reach USD 2.65 billion by 2028, expanding at a CAGR of 10.3%. (Source)

- The global contract commercial cleaning sector holds the largest revenue share, accounting for 49.7% of the market. (Source)

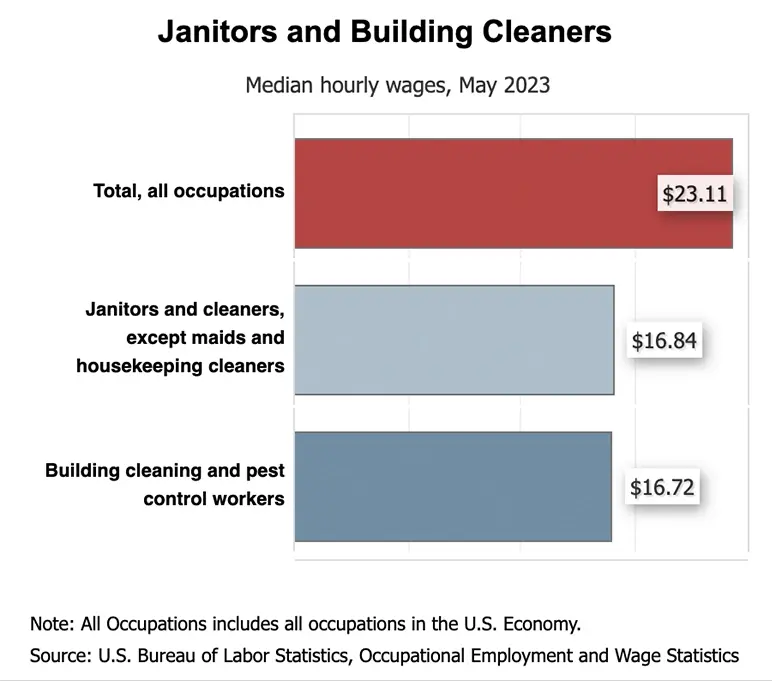

- As of May 2023, the median hourly wage for janitors and building cleaners was $16.84. (Source)

- The contract cleaning services market in Asia-Pacific is expected to expand at a CAGR of 7.5% from 2025 to 2030. (Source)

- The carpet and upholstery segment is the most profitable, experiencing the fastest growth from 2023 to 2030. (Source)

- The Asia-Pacific cleaning market is the fastest-growing region and is expected to reach USD 156.58 billion by 2030. (Source)

2) Commercial cleaning industry statistics

The commercial cleaning industry is a cornerstone of the broader cleaning sector, serving businesses, institutions, and public spaces. Below, we explore the most important statistics that define the commercial cleaning industry, its current trends, and future outlook.

The commercial segment dominated the janitorial services market, capturing 90.3% of total sales. (Source)

The residential sector is expected to grow at a CAGR of 3.6% from 2022 to 2028, driven primarily by high-net-worth individuals seeking janitorial services. Heading into 2025, commercial spending on cleaning services is projected to remain dominant, driven by an increasing emphasis on enhancing indoor air quality (IAQ).

Global commercial cleaning industry statistics indicate that it dominated the contract market, accounting for the largest revenue share at 49.7%. (Source)

The key commercial cleaning sectors include office buildings, hospitals, and healthcare facilities. As businesses prioritize hygiene and sanitation, the demand for commercial cleaning services continues to rise.

The global commercial cleaning services market was valued at approximately $182 billion in 2023 and is projected to grow to $277 billion by 2032. (Source)

Moreover, the global commercial cleaning services market is expected to grow at an annual rate of approximately 4.5% from 2024 to 2032.

Asia-Pacific, accounting for 40% of global commercial cleaning revenue in 2023, is set to lead the market for the next decade. (Source)

The steady market growth in APAC is driven by rapid urbanization in India and China, alongside the increasing adoption of commercial cleaning solutions in retail, supermarkets, office buildings, and hypermarkets across the region.

Professional cleaning services employ over 1.7 million people in the U.S. (Source)

However, commercial franchise cleaning agencies have a low annual employee turnover rate of just 2%. A key challenge in the cleaning industry is that quality work often goes unnoticed.

Commercial cleaning companies lose up to 55% of customers annually due to poor service quality or non-performance. (Source)

Notably, office buildings dominate the commercial cleaning industry, making up 31% of total contracts.

3) Residential cleaning industry statistics

The residential cleaning industry is a significant segment of the broader cleaning sector, catering to households and individual clients. Here are the most important house cleaning statistics that define the residential cleaning industry, its current trends, and its future outlook.

- The global household cleaners market is expected to reach $41.15 billion in revenue by 2025. (Source)

- General interior cleaning services dominate the industry, generating over half of total revenue. (Source)

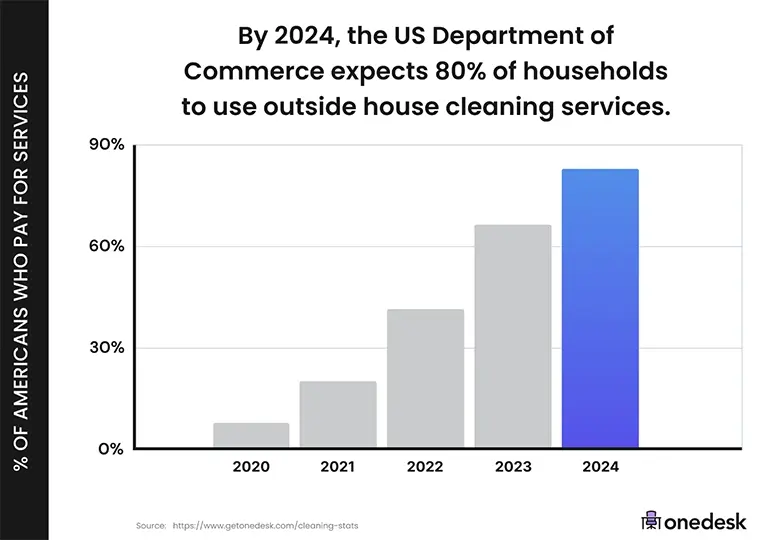

- Almost 80% of dual-income households in the U.S. are expected to use professional cleaning services within the next two years. (Source)

- A survey found that individuals spend between 2 to 4 hours per week cleaning their homes. (Source)

- The residential cleaning sector is projected to grow at a 3.10% CAGR from 2025 to 2029. (Source)

- Last year, nearly 10% of U.S. households hired a house cleaning service. The U.S. Department of Commerce predicts that in the coming years, 80% of dual-income households will rely on professional cleaning services. (Source)

- The residential housecleaning market is nearing $20 billion in annual sales, with a projected 20% yearly growth rate. (Source)

- The average person spends 12,896 hours cleaning over a lifetime, equivalent to 1.5 years or 77 weeks. (Source)

- A survey indicates that 7 in 10 people feel they don’t have enough time to clean their homes. (Source)

- On average, 20% of men admit to never thoroughly cleaning their homes. (Source)

4) Employment in cleaning industry statistics

The cleaning industry is one of the largest employers globally, providing millions of jobs across residential, commercial, and industrial sectors. Let's explore the most important statistics related to employment in the cleaning industry, including job growth, workforce demographics, and future trends.

- As of May 2023, janitors and building cleaners earned a median hourly wage of $16.84. (Source)

- The bottom 10% earned under $12.39 per hour, while the top 10% made over $23.18. (Source)

- Two-thirds of cleaning companies in Germany, France, and Spain operate with 2 to 9 employees. In Italy and the UK, this share exceeds 75%. (Source)

- More prevalent in France and Spain, cleaning companies make up 16-17% of the industry employment, compared to 12-13% in Germany, Italy, and the UK. (Source)

- In the UK, women make up 56% of the cleaning workforce, while men account for 44%. (Source)

- In 2023, over 2.1 million workers in the U.S. were employed as janitors and cleaners, making up the majority of cleaning industry jobs. (Source)

- Maids and housekeeping cleaners formed the second-largest group in the industry, with approximately 836,000 workers. (Source)

- In the UK, 21% of the cleaning workforce is foreign-born, rising to 60% in London. (Source)

- The cleaning, hygiene, and waste disposal sector accounts for approximately 5% of the UK’s workforce, employing 1.47 million people. (Source)

- The British Cleaning Council (BCC) projected the UK cleaning industry would create 93,000 new jobs by 2024, with 29% classified as 'hard to fill.' (Source)

- The average age of house cleaners and maids in the U.S. is 44 years, with the 45-59 age group making up 36.4% of the workforce. (Source)

Green Cleaning industry statistics

As businesses and households prioritize eco-friendly solutions, the green cleaning market is set to expand significantly. Let's explore the most important statistics that define the green cleaning industry, its current trends, and its future outlook.

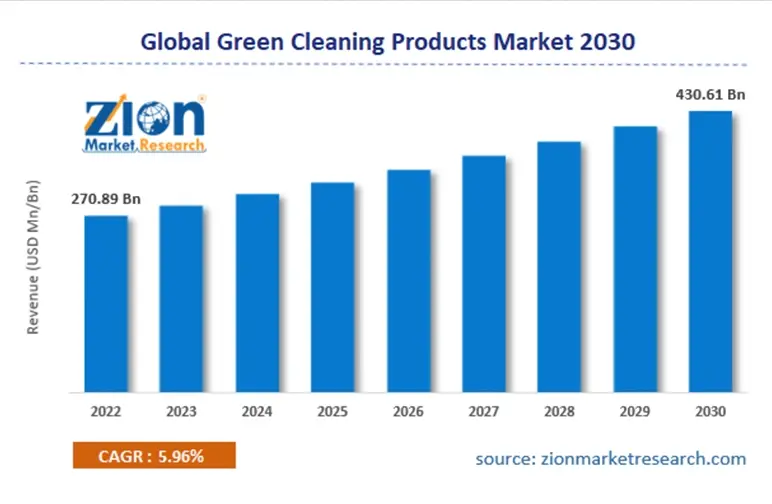

The global green cleaning products market is expected to reach USD 430.61 billion by 2030, growing at a compound annual growth rate (CAGR) of approximately 5.96% from 2023 to 2030. (Source)

- Chemical cleaners are a leading cause of poisoning, with 89% of poison exposures occurring in households. (Source)

- North America leads the Natural Household Cleaners Market, holding the largest market share. (Source)

- Green cleaning solutions typically have a higher upfront cost, ranging 20-30% more than traditional chemical cleaners. (Source)

- Green cleaning enhances indoor air quality, leading to fewer employee sick days and an estimated indirect cost savings of $30 to $170 per employee annually. (Source)

- Producing conventional cleaners requires 6.2 billion pounds of chemicals and consumes 30 million trees annually. (Source)

- Training a cleaning team in green cleaning techniques can cost between $200 and $500. (Source)

- The demand for eco-friendly cleaning products is increasing, with 46% of consumers actively choosing natural cleaning solutions. (Source)

Robotics and next-gen cleaning industry statistics

From autonomous floor care services to AI-powered disinfection systems, these innovations are reshaping how cleaning services are delivered. Here are the most important statistics that define the robotics and next-gen cleaning industry, its current trends, and future outlook:

- The cleaning robot market is forecasted to expand from USD 9.8 billion in 2022 to USD 25.9 billion by 2027, with a compound annual growth rate (CAGR) of 21.5%. (Source)

- In 2023, Asia-Pacific led the cleaning robot market, holding the largest 31% market share. (Source)

- The floor cleaning robots market is expected to capture over 44% of the total market share by 2025. (Source)

- In 2022, global unit sales of personal and domestic cleaning robots reached 48.6 million. (Source)

- The robotic window cleaners market is projected to grow by USD 4.34 billion from 2024 to 2029, with a CAGR of 29.4% during the forecast period. (Source)

- The pool-cleaning robot segment is anticipated to expand at a double-digit CAGR of 24.42% between 2024 and 2033. (Source)

- In 2023, the residential segment held the largest share of the robotic cleaning market by end-use. (Source)

- The top five global cleaning robot companies leading the market are iRobot, Samsung Group, Neato Robotics, ECOVACS, and Diversey, dominating the industry with cutting-edge innovations. (Source)

The bottom line

These cleaning statistics highlight the strong and growing demand for cleaning services across both residential and commercial sectors. Further, with increasing population and growing infrastructure across the world the cleaning service industry will be in demand and growing.

Hence, these statistics provide valuable insights to help you stay ahead in the fast-growing cleaning services industry. Whether you're a startup, an established business, or conducting market analysis, these figures keep you informed and prepared for the industry's future trends.

With that, we wish you success in navigating the ever-evolving cleaning services industry and growth.

Frequently Asked Questions

How many cleaning companies in the US are there?

The U.S. has over 1.2 million cleaning businesses, ranging from small residential services to large commercial cleaning companies.

What is the growth rate of commercial cleaning businesses?

The commercial cleaning industry is growing at a CAGR of 6-7%, driven by increasing demand for office sanitation and facility maintenance.

How are advanced cleaning technologies changing the industry?

AI-powered robotics, IoT-enabled equipment, and eco-friendly solutions are making cleaning more efficient, cost-effective, and sustainable.

Why is commercial cleaning essential for businesses?

Clean commercial spaces improve employee productivity, reduce health risks, and enhance customer experience, making professional cleaning a priority.

What is the most profitable cleaning service in 2025?

Commercial janitorial services and specialized disinfection are among the most lucrative, with rising demand from corporate offices and healthcare facilities.