You've been watching construction crews for years, shaking your head and muttering, "I could do that better." You've mentally redesigned your neighborhood and maybe even sketched business plans on napkins.

Your garage is full of tools "for projects," but you know they're really for the construction empire you're going to build. Your family keeps asking when you'll stop talking and start hammering.

The truth? Figuring out how to start a construction company takes more than knowing your way around a drill. You’ll need licenses, insurance, a steady stream of clients, and the business sense to avoid going broke in month two.

Ready to trade your armchair contractor status for the real deal?

Let's begin.

Key Takeaways

- Starting a construction company usually costs between $50,000 for small setups and over $500,000 for larger operations.

- Before launching your construction company, it’s crucial to register your business with the state and secure proper insurance to avoid legal or financial troubles down the road.

- It’s important to craft a compelling business plan, avoid costly mistakes, and stay focused on your goals to back your construction business.

Step 1: Choose your construction niche

Before you decide what jobs to take, remember—your business model shapes everything. It affects your licenses, target clients, pricing, and how you’ll run day-to-day operations.

In the U.S., different construction business types come with their own licensing requirements, client expectations, and pricing structures.

That’s why your first step is to get crystal clear about what type of construction services your company will offer.

The construction field is broad, so narrowing down your niche will help you stay compliant, avoid unnecessary costs, and market your services more effectively.

Common types of construction companies include:

1) Residential construction

This is when you build houses, flats, bungalows, or do home renovations. It’s people’s homes you’re working on. The money comes in fairly quickly because projects are smaller, but you deal directly with homeowners.

2) Commercial construction

Now, this is bigger work—offices, hospitals, malls, hotels, schools. These projects run longer, need bigger teams, and involve dealing with architects, government departments, and big corporate clients.

3) Remodeling/Renovation

This is improving or modifying existing buildings. It could be homes, shops, or commercial places. It’s steady work and needs good planning because you’re working on old structures, which means surprises under every floorboard!

4) Specialty trades

Some people don’t build the whole thing—they focus on one trade. Like plumbing, electrical, roofing, flooring, or painting. It’s a good idea if you have a skill in one area, and you can build a name faster.

5) General contracting

This is when you manage the whole job. You hire subcontractors (like masons, carpenters, and electricians), get materials, manage deadlines, and deliver the final project.

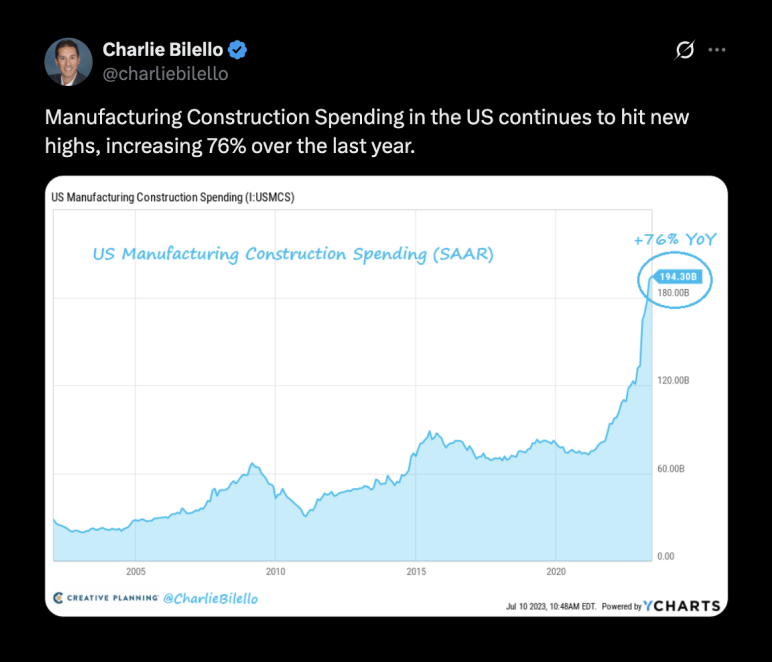

For a better sense of where the opportunities are, take a look at our blog on construction industry statistics. For instance, manufacturing construction is booming in the U.S., so if you’re skilled in industrial projects, it’s a smart market to explore.

Step 2: Check state and local requirements

Construction is a regulated industry; you’ll need to get the proper licenses, permits, insurance, and possibly bonding in place to operate legally and protect your company. Skipping this step can lead to fines or even being shut down, so prioritize compliance from day one.

Here’s what you’ll need to sort out:

- Register your business with the state.

- Get a contractor’s license—this depends on your state and the type of work you’ll do.

- General liability insurance protects against job site accidents or property damage.

- Workers’ compensation insurance if you’re hiring employees.

- Bonding—some jobs, especially government or big commercial projects, require a surety bond as a safety net.

Don’t guess this stuff. Head to your state contractor licensing board website or the Small Business Administration (SBA) portal. They have step-by-step guides for your state.

Step 3: Write a business plan

Every successful business starts with a solid plan, and writing it isn’t about preparing a fat book. It’s about having a clear, simple plan so you know where you’re going and how you’ll get there.

Plus, if you ever seek financing or investors, a well-crafted business plan will be essential.

When creating your construction company business plan, cover the following components:

- Services & niche: Define exactly what you’ll offer and where—e.g., “Residential kitchen remodeling in Dallas”.

- Target clients: Identify who you’ll work for—homeowners, developers, businesses, or subcontracting for bigger firms.

- Pricing structure: Decide how you’ll price jobs, fixed bid, time & materials, or cost-plus, and how you’ll calculate rates and margins.

- Startup budget & finances: Estimate startup and monthly costs. Plan where your funding’s coming from: Savings, loans, investors, or deposits.

- Tools & equipment: List the tools, vehicles, and machinery you’ll need to start and handle your type of projects.

- Hiring plan: Will you start solo, with a partner, hire staff, or subcontract? Map out team roles and when to hire.

- Marketing & sales strategy: How will you land jobs? Word-of-mouth, online ads, social media, local networking, or job platforms.

Remember, keep the business plan practical and concise—it doesn’t need to be a 50-page thesis. Create a clear guide that you can use to run and grow your business.

You might be overwhelmed by the business plan writing process. However, you don’t have to start from scratch. Consider using our ready-to-use construction business plan template to speed up the writing process. It will help you spark ideas for your plan and ensure you’re not missing any important sections.

Get Your Business Plan Ready In Minutes

Answer a few questions, and AI will generate a detailed business plan.

Step 4: Estimate your startup costs

Starting a construction company requires capital, and understanding your costs upfront helps you avoid unexpected expenses down the road.

Here’s a list of common costs you’ll likely face when launching your construction business.

| Expense Category | Estimated Cost | Notes |

|---|---|---|

| Licensing & Legal | $500 – $2,000 | Registration, permits, testing & legal assistance |

| Insurance | $1,000 – $5,000 annually | Liability coverage + Workers' comp if hiring employees |

| Tools & Equipment | $5K – $100K varies by size | Largest variable cost Solo: $5K-$15K | Team: $50K-$100K |

| Vehicle & Transport | $15,000 – $30,000 | Work truck, trailer & hauling equipment |

| Marketing & Branding | $2,000 – $5,000 | Website, business cards, vehicle wraps, online ads |

| Working Capital | 3–6 months expenses | Covers personal & business expenses during startup |

Step 5: Set up your business legally

You can’t just grab your tools and start working. You need to make it official, and it’s easier than people think if you know what to do.

Here’s the practical stuff you’ll need. First, establish your business foundation:

1) Form an LLC or Corporation

Most contractors go with an LLC because it protects your personal assets if something goes wrong. LLCs are simpler to manage than corporations while still giving you the legal protection you need.

2) Get an EIN (Employer Identification Number)

It’s like a Social Security number for your business. You can get it free on the IRS website in minutes.

3) Open a business bank account

Keep your business and personal money completely separate. This isn't just good organization, it's essential for maintaining your legal protection and avoiding tax headaches.

4) Apply for your contractor's license

Go to your state contractor board website for the specific forms and fees. Don't guess at requirements; each state is different. Approval typically takes 2-8 weeks, so start this process early.

5) Secure your insurance coverage

Even if you're just doing estimates, you need liability protection. One slip-and-fall lawsuit can destroy an uninsured contractor. Get both general liability and workers' compensation coverage from day one.

6) File for any additional permits or bond

Some municipalities require local contractor registrations beyond state licensing. Check with your city and county offices; don't assume that state licensing covers everything.

Timeline expectations: Business formation typically takes 1-2 weeks, licensing can take 2-8 weeks, and insurance setup usually happens within days once you have your business documents ready.

Step 6: Buy or rent the right tools and equipment

You don’t need a warehouse full of gear on day one. Start simple, get what you need to land those first few jobs. Here’s what you should focus on:

- Basics: Trucks, ladders, saws, drills, tool belts, and safety gear like helmets, gloves, and boots.

- Rent big-ticket items: Things like excavators, lifts, or concrete mixers—rent them per job. No point in buying expensive machines that’ll sit idle most of the time.

Step 7: Hire your first crew (or line up subcontractors)

It’s crucial to understand the difference between employees and subcontractors. This isn’t just paperwork stuff—it affects your taxes, insurance, and how you run your jobs.

W-2 employees

These folks work directly under you, use your tools, and follow your schedule while you’re responsible for:

- Payroll taxes

- Workers’ comp insurance

- Unemployment insurance

The advantage of hiring W-2 employees? You have total control and consistent quality on your projects. Though it can have higher overhead and more responsibilities.

1099 Subcontractors

These are independent professionals, including plumbers, electricians, roofers, who use their own tools, set their own hours, and you pay them per job.

With them, you don't have to pay payroll taxes or no insurance for them. However, you have less control over them, and you’ve got to be careful—if they work like full-time employees, the IRS can fine you for misclassification.

Step 8: Price your services right

This is where many new contractors fail. They underprice to win work, then wonder why they're working 70 hours a week and barely breaking even. Fix that before you start.

Understand markup vs. margin. If materials cost $100 and you charge $150, your markup is 50%, but your margin is 33%. Margin is what matters for profitability; it's your gross profit divided by your selling price.

Factor in everything: Direct labor costs, materials, equipment usage, truck expenses, insurance, taxes, overhead, and profit. Miss any category and you're working for free.

Use this basic formula: (Labor + Materials + Equipment) × Overhead Factor × Profit Margin = Your Price

The overhead factor typically ranges from 1.3-1.7, depending on your business costs. A 1.5 factor means your overhead adds 50% to your direct costs.

Profit margins in construction typically range from 10-20% for competitive work to 25-40% for specialized or premium services.

Example calculation:

| Category | Amount ($) |

|---|---|

| Labor | 2,000 |

| Materials | 3,000 |

| Equipment | 500 |

| Subtotal (Direct Costs) | 5,500 |

| Overhead (1.5x multiplier) | 2,750 |

| Total Before Profit | 8,250 |

| Profit (20%) | 2,050 |

| Final Total Price | 10,300 |

Always use a clear breakdown like this when estimating jobs—it keeps your pricing transparent, covers your costs properly, and protects your profit.

Step 9: Get your first projects

You don’t need a huge ad budget to land those early jobs. Here’s how you start smart, keep costs down, and get your name out there.

- Word of mouth: Let friends, family, neighbors, and old contacts know you’re open for business. A personal recommendation is worth more than any ad.

- Job platforms: Sign up on sites like Thumbtack, Houzz, and Angi. Homeowners and businesses use these to hire contractors for small-to-mid projects.

- Direct outreach: Connect with realtors, property managers, and small business owners. They constantly need reliable contractors and can become steady referral sources.

Moreover, you can use online platforms like Google My Business to create your profile for free and get your projects. Lastly, you can create a one-page website, list your services, photos of projects, contact forms, and Google review links.

Mistakes to avoid (with fixes)

Most new contractors don’t fail because of bad work; they fail because of bad decisions. Let’s cover the common mistakes that sink businesses early and how you can steer clear of them.

Mistake 1: Underestimating startup costs

New contractors budget for tools and licenses, but forget about cash flow gaps, unexpected expenses, and the time it takes to get paid.

Fix: Build a realistic, lean budget with a financial buffer for unexpected expenses. Plan for 3–6 months of operating cash on hand.

Mistake 2: Working without insurance

I'll get insurance after I land my first job," is how contractors end up bankrupt after one accident. A single injury or property damage claim can destroy years of work.

Fix: Don’t risk it. Get general liability insurance and workers’ comp from day one—it protects you, your business, and your clients.

Mistake 3: Hiring too fast

Landing one big project and immediately hiring full-time employees creates massive overhead.

Fix: Start lean. Use subcontractors or part-timers until you’ve got steady, reliable work coming in. Build your team gradually.

Mistake 4: Underpricing jobs

Bidding jobs at cost (or below) to beat competitors. You'll stay busy but go broke working for free.

Fix: Always calculate your true costs—labor, materials, overhead—and price with healthy margins. Don’t chase cheap jobs just to stay busy.

Mistake 5: Ignoring licenses or permits

Assuming you can "figure out" permit requirements after winning a job. Getting caught working without proper permits can result in fines.

Fix: Check every city and county requirement before quoting or starting work. Getting caught without proper paperwork can shut you down.

Conclusion

Congratulations! You've officially graduated from "person who complains about contractors" to "person who might actually become one." That's progress.

You've got your roadmap: Business plans, licenses, insurance, and the thrilling adventure of finding clients who won't haggle over every nail.

Additionally, leverage the tools available to you. A business plan builder like Bizplanr can help you draft a clear, professional plan quickly, making it easier to secure permits, partnerships, or funding.

Now stop reading and start building. Your construction empire awaits!

Get Your Business Plan Ready In Minutes

Answer a few questions, and AI will generate a detailed business plan.

Frequently Asked Questions

How much does it cost to start a construction company?

Can I start a construction company with no experience?

Yes—but you’ll need to hire experienced workers, subcontract key tasks, and start with smaller, manageable projects.

What licenses do I need to start a construction business?

Most states require a contractor’s license, business license, and tax registration. Requirements vary by state and job type.

Do I need insurance to start a construction company?

Absolutely—general liability, workers’ compensation, and equipment insurance are essential to protect your business.

How can I find my first few clients?

Start by tapping into personal contacts, networking with local contractors, joining trade groups, and listing services on online directories.

How can I start a construction company with no money?

Start small by offering subcontracting services, partnering with suppliers for payment terms, or managing projects for a commission until you build capital.

How can I start a construction company with no experience?

Focus on small, manageable jobs, hire experienced workers, and lean on mentors or local contractors for guidance while learning the business side.