You've got a great idea, a clear vision, and endless excitement to build something big. But one thing that is stopping you is funding.

We get it. Finding funding can be a real struggle. But there are a variety of ways to get financial backing without getting lost.

From traditional options like bank loans to newer ways like crowdfunding. However, each funding source offers unique opportunities and some challenges. Over here, knowing what fits your goals becomes important.

And that's where we're going to help.

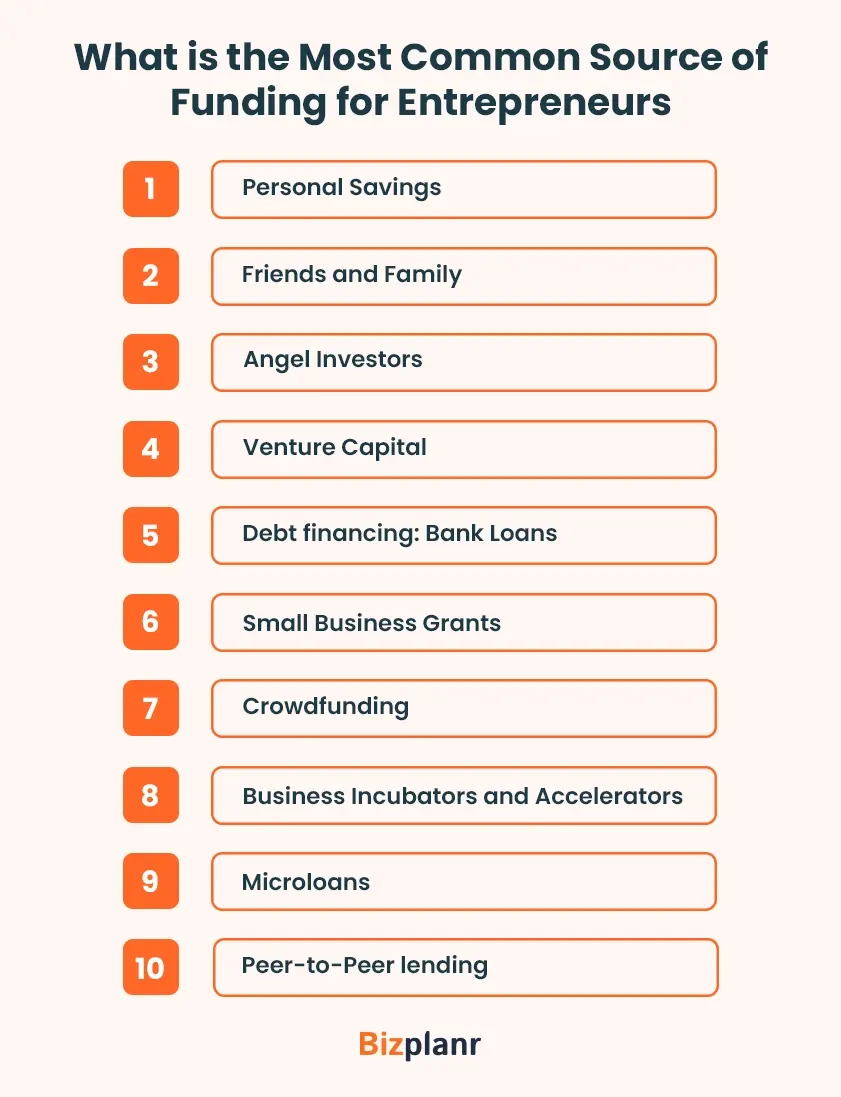

Here are some common source of funding that might be best for your business:

Personal savings

Personal savings are a common business startup capital for entrepreneurs looking to fund their businesses. Many find it appealing since it offers complete control, avoiding the need to borrow or give up any ownership in the business.

In fact, about 64.5% of entrepreneurs get their initial capital from personal funds. Covering startup costs from savings means you’re not dealing with loan interest, which can save money down the line. However, the risk is that if things go south, your personal finances could take a serious hit.

Friends and family

Another common source of funding for entrepreneurs is turning to friends and family for financial support. This approach often works well because it involves people who already trust and believe in the entrepreneur.

They may be willing to help based on their relationship and confidence in the business.

The biggest advantage? You can usually avoid high-interest loans or giving up ownership. Personal savings are often accessible for new business owners, allowing for flexibility without needing outside approval.

Using personal or family assets like real estate or retirement funds—as collateral can also offer larger funding options. Although this involves the risk of losing those assets if the business doesn’t succeed.

Angel investors

These investor groups are made up of experienced business leaders and former CEOs who’ve decided to back small businesses financially.

Besides funding—usually between $25,000 and $100,000—they often share valuable advice and industry expertise to help companies grow.

In exchange, they typically ask for some involvement in business oversight, like a board seat or regular updates, to stay informed on how things are managed.

These groups keep a low profile, so finding them can be a bit challenging. Checking with specialized associations or looking up their networks online is often the best way to connect.

Venture capital

Venture capital funding isn't for everyone. These firms usually focus on tech-driven businesses that show great growth potential. This is especially in areas like information technology, communication, and biotechnology.

So, what do venture capital firms do? They provide funding for startups they believe in. Just remember, taking their money often means giving away some ownership of your business. They may ask for a minor stake in your business which is also known as equity financing.

Many entrepreneurs recommend being careful about how much you accept, as too much funding can lead to losing control over your vision.

The key is to find investors who not only bring money but also relevant skills and expertise. This way, you can accelerate business development from their knowledge while keeping your vision intact and steering your business where you want it to go.

Debt financing: Bank loans

Banks do have venture capital funds, but they’re usually more cautious than angel investors or typical VC firms. That said, banks definitely finance entrepreneurs!

They like to back small to medium businesses with lower risk, especially if you can offer collateral. This can make it tough for early-stage startups to get funding from banks.

So, when should you think about going to banks or credit unions? If you can provide collateral, banks can be a solid option. They’re also great for financing things like working capital, stock purchases, or investments in buildings and equipment. But to get that you need a solid business plan.

For established companies that generate steady income, banks are worth a look for a business loan. An advantage of borrowing from a bank is that you have the 100% ownership of your business.

This is a much better option compared to getting funding from angel investors or VC firms.

Small business grants

Federal and state agencies believe it's important to support new entrepreneurs. That’s why you might find some businesses getting help through government grants or loans.

They’re designed to support specific industries and encourage growth and innovation. The best part? You don’t have to pay them back.

If your business will create jobs or is based in an economically struggling area, you have a better shot at securing funding. Plus, some grants and loans focus specifically on certain industries, like STEM. So, if you’re in tech or science, definitely look into those options!

Crowdfunding

Crowdfunding lets businesses raise money by getting many people to chip in small amounts. Typically, they offer a share in the company for that support, but remember, selling those shares later can be tougher than with larger public companies.

The cool part? Crowdfunding has looser rules compared to going public through an IPO.

Here are a few popular types:

- Equity crowdfunding: Investors get a stake in your company. Or a share of the profits for their contributions.

- Debt crowdfunding: People lend money to a business at higher interest rates. By spreading their loans across different businesses, they lower their overall risk. This way, the company gets a nice chunk of cash in small bits.

- Donation or rewards-based crowdfunding: A business sets a goal and asks for donations. In return, donors might receive a token or early access to the product or service being developed.

Business incubators and accelerators

Business incubators are fantastic for startups at different stages of their journey. They usually focus on high-tech fields like biotechnology, IT, multimedia, and industrial tech. There are also local incubators aimed at a broader range of businesses, especially those that create jobs and help revive the community.

These incubators provide shared spaces and resources—think labs, administrative support, and tech help. For instance, a new business can use the incubator’s labs to develop and test products at a lower cost before they jump into full production.

Most companies hang out in an incubator for about two years. Once their product is ready, they graduate and start running things on their own.

Thanks to the support they get, these businesses often have a better chance of success over the next five years!

Microloans

Microloans are small loans for those entrepreneurs that fail to get traditional bank loans. They’re especially useful for small business owners in developing countries or those starting with limited funds.

These loans help cover essential costs like buying supplies or equipment. Non-profit organizations and specialized microfinance institutions often provide them, focusing on giving newcomers the support they need to bring their business ideas to life.

In short, microloans are all about helping people get that crucial boost when they're starting out.

Peer-to-peer lending

P2P lending lets people borrow money directly from other people—no banks involved. It’s gained a lot of attention lately as a different way to borrow or invest, thanks to a growing number of websites making the process simple.

Here’s how it plays out:

- Borrowers post their loan requests on a P2P platform with their credit and financial profiles.

- Investors choose which loans to fund, often with a wide range of interest rates set by the platform.

- The platform handles the money transfers, repayment schedules, and any required documentation.

For borrowers:

- Borrowers might get several loan offers, which they can compare and accept.

- Some borrowers even split their requests, taking small portions from multiple lenders to meet their full loan amount.

For lenders:

- Lenders can browse profiles and decide which borrowers they want to support.

- Since this is a direct form of lending, it usually offers higher returns. However, these returns come with a greater risk compared to traditional loans.

P2P lending is good for small businesses who don’t qualify for bank loans.

It’s easier to access. But borrowers usually face higher fees and interest rates. On the other hand, lenders risk potential defaults. Checking out each platform’s terms helps avoid surprises down the line.

Bootstrapping

Bootstrapping means starting your business with your own money. You take no help from bank loans, investors, and friends and family.

But what makes bootstrap different?

- Since you’re not taking on outside help, you keep complete control over your business.

- No need to give away shares or take on loans—you’re your own investor.

Bootstrapping can look different for everyone. Some pull from their savings, use money from another job, or go with a ROBS (Rollover for Business Startups).

With a ROBS, you can use money from your 401(k) to start your business, which many older entrepreneurs are finding useful.

Guidant Financials' 2023 survey even found that 52% of small business owners used ROBS to get going, while only 19% relied on their own cash. So, bootstrapping doesn’t mean you need a big cash reserve to get started.

Credit cards

Credit cards are convenient because many people already use them when cash is tight. It helps them keep their savings intact and cover their expenses.

But, you have to use them carefully. The interest rates can get high, if you don't pay off your balance quickly. Relying on personal credit cards for business can create issues like complicated accounting and limited credit capacity.

Business credit cards are a better option for managing expenses. They usually offer higher credit limits, rewards for business purchases, and help build business credit. Plus, they provide liability protection that personal cards don’t. While personal cards can be useful in a pinch, business credit cards are often the smarter choice for growth.

Conclusion

New entrepreneurs have many options when it comes to funding their businesses. Familiarizing yourself with these different sources can really pay off. It helps you pinpoint the best fit for your situation and where your business currently stands. The right choice can make a big difference in successfully raising the funds you need.

A solid business plan is key when you're looking for funding. That's where Bizplanr comes into play. With our AI business plan generator, you can easily craft a persuasive plan that speaks directly to banks, investors, or grant providers. It allows you to clearly outline your financial needs and potential, helping your plan stand out.

Get Your Business Plan Ready In Minutes

Answer a few questions, and AI will generate a detailed business plan.

Frequently Asked Questions

Are grants realistic for most entrepreneurs?

Grants often come with strict requirements. It’s competitive, so you need a solid proposal to stand a chance.

What’s a good option if I need money as an entrepreneur quickly?

If you need cash fast, consider using a credit card or looking into personal loans. Short-term funding options, like payday loans, are available but can have high interest rates, so be careful.

Are small business grants hard to get?

Yes, the application process can be lengthy and competitive, with many applicants for limited funds.

What is the difference between an angel investor and venture capitalists?

Angel investors use their own money to support early-stage businesses and often offer mentorship.

In contrast, venture capitalists invest pooled funds and typically seek more established companies that promise quick returns.