Did you know the U.S. mortgage industry is one of the strongest pillars of the financial market, helping millions of people achieve their dream of homeownership each year?

With steady housing demand and evolving loan products, mortgage brokers play a key role in connecting buyers with the right lenders and loan options.

But here’s the challenge—competition in this field is intense. From big banks to online lenders, clients have plenty of choices.

To stand out, a broker needs more than experience. You’ll need a clear plan to build trust, attract clients, and grow your business.

That’s why we’ve created this mortgage broker business plan sample to help you organize your goals, target the right market, and build a strong foundation for lasting success.

Mortgage Broker Business Plan Sample

Explore this sample business plan of Lendory Financial to understand the key elements and details needed to create a clear, well-structured mortgage brokerage business plan.

1. Executive Summary

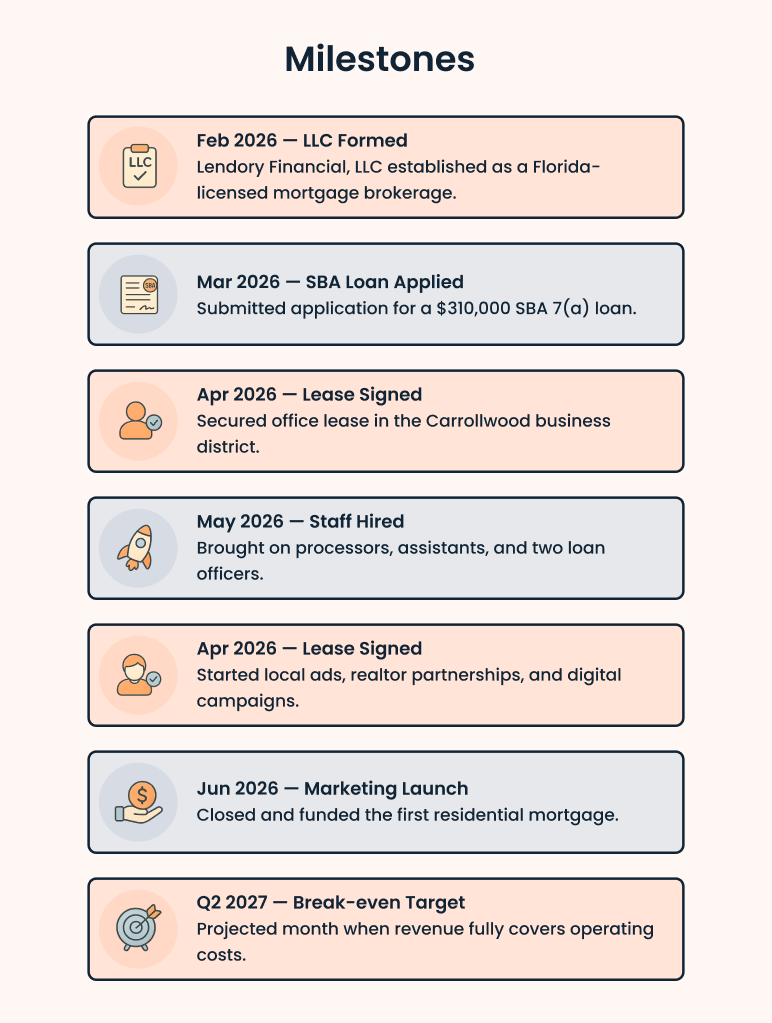

Lendory Financial, LLC plans to open in February 2026 as a local mortgage brokerage in central Tampa. The office will be located on Cypress Ridge Drive, close to key real estate and banking areas, making it easy to reach for clients and partners. The company will be led by Grayson Penn, a licensed mortgage expert with over ten years of experience in lending and loan management. Lendory’s main goal is to make the loan process easy, clear, and comfortable for homebuyers and small business owners.

Services & Experience

Lendory Financial helps people get the right kind of loan—whether to buy a home, refinance, or start a small business. The company offers many loan options like FHA, VA, USDA, Jumbo, and Non-QM, along with regular conventional loans. People who work for themselves can use their bank statements to qualify.

The team helps clients with credit checks, home equity lines, and pre-approvals so they can plan their finances better. Staff who speak both English and Spanish stay in touch and make sure each step is explained clearly and easily.

Market Opportunity

The housing market in Tampa, St. Petersburg, and Clearwater keeps moving as more people settle in the area. Homes sell fast, and new buyers enter the market every month. As noted by OriginationData (2024), local lenders handled around 73,700 mortgage loans worth $23.7 billion, with an average loan size of $321,570.

In Carrollwood, part of Tampa’s main corridor, lending stays busy. Homes change owners often, and steady demand keeps brokers active. The area sits near new neighborhoods and job centers, which helps both refinance and purchase loans grow. For local mortgage firms, it’s a reliable place to build long-term business.

Target Market

Lendory mainly serves:

- First-time buyers who want simple, step-by-step help

- Self-employed clients who need flexible loan choices

- Real estate investors buying or refinancing smaller properties

- Homeowners planning to refinance or use their home’s equity

Mission Statement

Lendory Financial’s mission is to become the most client-focused mortgage firm by making lending clear, simple, and personal for every borrower. The company strives to build trust through honest guidance, transparent communication, and reliable support throughout the entire loan process.

Financial Overview

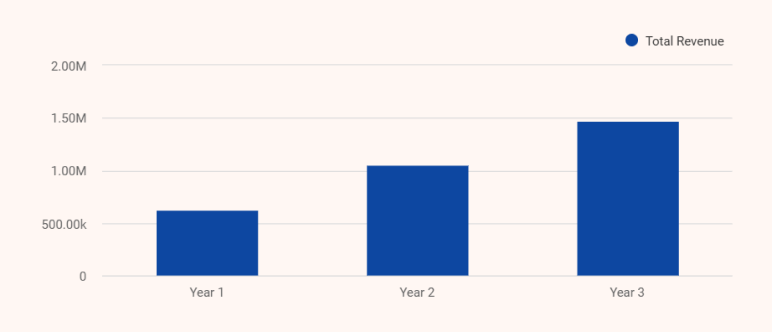

Starting Lendory Financial will cost about $400,000 for office setup, software, marketing, payroll, and daily operations. The three owners are contributing a combined $90,000 in equity, while the company will use an SBA 7(a) loan of $310,000 to cover the remaining startup costs.

In the first year, Lendory expects to close around 180 loans worth $63 million. By the third year, the goal is to fund about $147 million in loans and bring in around $1.47 million in revenue, with steady growth and solid profit margins.

| Financial Year | Number of Loans | Total Revenue ($) | Net Profit/Loss ($) |

|---|---|---|---|

| Year 1 | 180 | 630,000 | -169,400 |

| Year 2 | 300 | 1,050,000 | +47,680 |

| Year 3 | 420 | 1,470,000 | +222,880 |

Funding Requirement

Lendory Financial is requesting a $310,000 SBA 7(a) loan from Regions Bank. The funds will be used for licensing, technology, office setup, marketing, payroll, and six months of working capital. With an experienced leadership team, modern systems, and a strong local market, Lendory is ready to grow quickly and repay the loan on schedule. This investment will also support Tampa’s growing demand for accessible, education-focused home financing.

2. Business Overview

Legal Structure

Lendory Financial, LLC is registered in Florida as a limited liability company. The registration was completed in February 2025. This setup gives the owners personal protection and makes it easier to manage taxes and daily operations.

The company is finishing the last steps of its licensing. This includes the NMLS (Nationwide Multistate Licensing System) mortgage broker license, state registration, and data security checks. Everything will be ready before launch.

Location

The office is at 1074 Cypress Ridge Drive, Suite 204, in Tampa’s Carrollwood business district. This part of Tampa is active and growing, with steady home demand and regular turnover. It’s a great spot for local lending work.

Clients and partners can reach the office easily. It’s close to real estate firms and other financial offices that help with referrals. The space is about 1,800 square feet and includes desks for loan officers, a small lounge, and secure systems for client data.

Ownership

Lendory Financial, LLC is managed by three owners:

Grayson Penn – 60% (Founder & CEO, NMLS #1847319)

Grayson handles strategy, lending, and growth. He has worked in the mortgage field for over 15 years and knows compliance and regulation well.

Lexa Ruiz – 25% (COO & Operations Manager)

Lexa runs day-to-day operations and helps the team stay organized. She focuses on smooth processing, good client service, and clear communication.

Trent Lorman – 15% (CFO & Accountant)

Trent manages budgets, reports, and overall finances. He makes sure accounting stays accurate and builds trust with lenders and investors.

Together, the team brings practical experience in lending, finance, and operations. They guide the company’s growth while keeping service personal and dependable.

Long-Term Goals

Lendory’s goal is to build a trusted mortgage firm that uses simple tools and clear communication. Over the next few years, it plans to:

- Add new loan options and reach more clients

- Partner with local banks and fintech firms

- Build a strong name for fast, reliable lending services

3. Market Analysis

Global Market

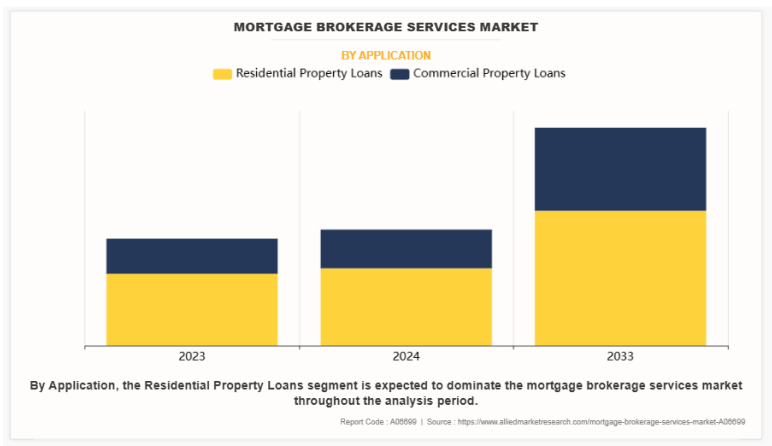

The mortgage brokerage industry was worth about $36.5 billion in 2023. It is expected to grow to nearly $74 billion by 2033, at a yearly rate of about 7%. The increase is mainly because of digital tools and online platforms that make loans faster and simpler for borrowers.

(Source)

There’s also a growing demand for personal mortgage options. Brokers now use digital systems to match clients with the right loan for their needs. As borrowers expect quicker results and honest service, tech-focused mortgage firms are taking a bigger role in the housing finance market.

Market by Loan Type

Most mortgage activity still comes from home loans. Buying a house is one of the biggest goals for families, and many people are now better prepared to save for down payments or qualify for financing. As homeownership keeps rising, the residential loan segment continues to perform well.

Commercial loans are also expanding fast. Many small business owners need funding to open, improve, or move into new spaces. Because these loans are often larger and more detailed, most borrowers prefer working with mortgage brokers to get the right fit.

Target Market

Lendory serves four main types of clients:

- First-time homebuyers – Need step-by-step help with loan choices, payments, and credit.

- Self-employed clients – Look for flexible programs such as bank-statement or Non-QM loans.

- Real estate investors – Want fast approvals for rental and small commercial properties.

- Homeowners – Seek better terms through refinancing or home equity loans.

Competitor Analysis

Several mortgage firms operate in Tampa, but most leave clear service gaps.

| Name | Strengths | Weaknesses |

|---|---|---|

| Primary Residential Mortgage, Inc. | Wide branch network, strong brand, and loan variety | Long approval times, limited personal contact |

| Fidelity Home Group | Solid online tools, FHA loan expertise | Small team, few bilingual staff |

| CrossCountry Mortgage | National presence, broad loan options | Slow responses, limited Non-QM programs |

Lendory also faces indirect competition from local banks, credit unions, and real estate firms that help clients arrange home or investment property loans. These organizations mainly serve their own clients, but they also attract borrowers who might consider a mortgage broker.

Lendory’s Advantage

Lendory blends modern tools with personal guidance and bilingual service. The FastTrack Pre-Approval system gives loan decisions within 24 hours. Borrowers can easily view clear loan options and find programs made for self-employed clients or property investors. The company focuses on long-term relationships, not one-time transactions.

Market Trends

The mortgage industry is shifting toward digital speed and flexible documentation. Borrowers expect clear information and quick results. Many self-employed clients also want programs that don’t rely only on W-2 income.

Tampa’s growing Spanish-speaking community prefers direct, personal service in their language. Lendory’s focus on clarity, technology, and trust positions it well to meet these needs and build lasting client connections.

4. Service & Pricing

Lendory Financial works with many types of borrowers, from first-time homebuyers to small business owners. The firm offers a mix of home and commercial loan programs and focuses on clear guidance, quick approvals, and personal service. Every borrower gets fair rates, simple fees, and loan options that match their goals.

Services & Loan Programs

| Category | Service / Loan Type | Description | Average Range / Fee |

|---|---|---|---|

| Residential Loans | Conventional (Fannie Mae / Freddie Mac) | Standard home purchase loans for qualified borrowers. | 1% lender-paid commission (Included in rate) |

| FHA Loans | Flexible down payment and credit options for first-time buyers. | 1% lender-paid commission | |

| VA Loans | 0% down loans for veterans and military members. | No broker fee to borrower | |

| USDA Loans | 100% financing for eligible rural and suburban buyers. | No broker fee to borrower | |

| Non-QM & Specialty Loans | Bank-Statement Loans | Qualify using 12-24 months of deposits instead of W-2s. | -1% origination, paid by lender |

| DSCR (Debt Service Coverage Ratio) Loans | Based on rental income for investors, not personal income. | -1% origination | |

| Asset Depletion / 1099 Income Loans | For clients using assets or contract income to qualify. | -1% origination | |

| Jumbo Loans | High-value property loans over $726,200. | Tailored underwriting and competitive rates. | Negotiated case by case |

| Small Commercial Loans | Office, retail, or mixed-use properties under $2 million. | 5-25 year terms, up to 80% LTV. | 1% origination fee |

| Refinance & HELOCs | Rate and term refinance or home equity lines. | Lower monthly payment or tap home equity. | 1% lender-paid commission |

| Credit Consulting & Pre-Approval | Pre-qualification and credit review (soft pull). | Includes affordability summary and education session. | $150 flat fee |

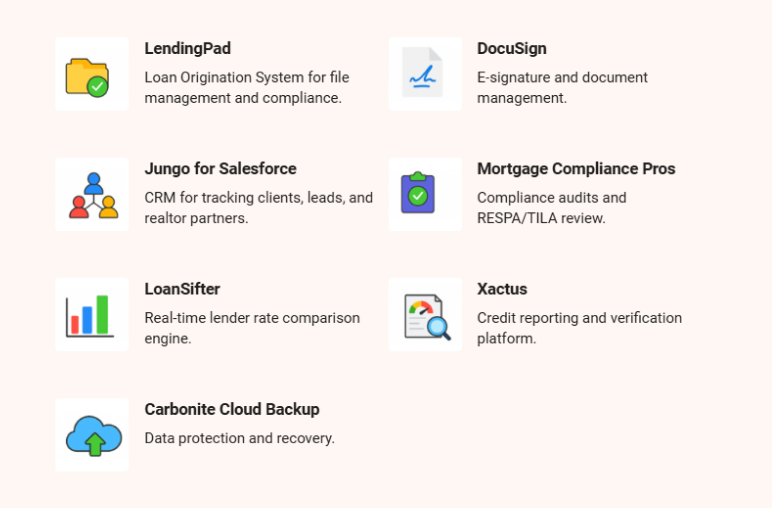

Technology & Vendor Partners

Lendory Financial uses secure, industry-approved tools for faster and more accurate loan processing.

Promotional Offers

Lendory runs small seasonal and referral-based promotions to attract new clients and reward loyal ones.

- Spring – “FastTrack Homebuyer Special”: Free pre-approval consultation (value $150) for first-time buyers.

- Summer – “Self-Employed Advantage”: Reduced rate-comparison fees for business owners.

- Year-End – “Home for the Holidays”: Discounted lender fees on refinances closed in December.

These offers help bring in new clients, build trust, and keep Lendory known as a reliable local mortgage partner in Tampa.

5. Operations Plan

Daily Workflow

Lendory Financial follows a set routine to keep work organized and clients well-served.

- 8:30 AM: Team meeting to review ongoing loans and set daily goals.

- 9:00 AM – 1:00 PM: Client meetings, application reviews, and document collection.

- 1:00 PM – 2:00 PM: Lunch and team communication.

- 2:00 PM – 6:30 PM: Loan processing, underwriting updates, and coordination with real estate partners.

- End of Day: File checks, compliance reviews, and CRM updates.

Hours of Operation

The company’s schedule supports both clients and real estate partners while helping staff stay productive.

| Days | Timing |

|---|---|

| Monday – Friday | 8:30 AM – 7:00 PM |

| Saturday | 9:00 AM – 2:00 PM |

| Sunday | Closed |

These hours give clients time to meet loan officers before or after work and let agents reach the team during busy real estate hours.

Office & Facility Design

The firm works from a 1,800 sq. ft. office in Tampa’s Carrollwood business district. The space is built for efficiency and a smooth client experience.

Facility Highlights

Reception and client lounge with coffee and resource area:

- Six private offices for loan officers and managers

- Conference room for client and partner meetings

- Open workspace for processors and assistants

- Secure room for document storage and compliance

- ADA-compliant entry and restrooms

This setup creates a professional, comfortable space that supports privacy, teamwork, and client trust.

Milestones & Timeline

Compliance & Licensing

Lendory Financial will meet all state and federal mortgage regulations to ensure ethical and transparent operations.

- NMLS ID: Active and in good standing

- Florida Office of Financial Regulation Mortgage Broker License: Pending final approval

- Surety Bond: $25,000 in place

- E&O and Cyber Liability Insurance: $8,500 annually (Hiscox)

- Annual compliance audit: Managed by Mortgage Compliance Pros

- Data security: Protected under Carbonite Cloud Backup and LendingPad encryption

6. Marketing and Sales Strategy

Lendory Financial follows a simple, data-backed plan to attract new borrowers, build trust, and strengthen ties with local real estate agents.

The Year 1 marketing budget is about $3,500 per month, focused on local and online channels that bring in quality mortgage leads.

The plan uses both digital ads and community outreach to increase brand visibility and steady client growth.

The image below highlights Lendory’s core marketing channels and how each supports lead generation and brand growth.

Launch Promotions

Lendory will run simple promotional offers to bring in new clients and encourage referrals.

- Grand Opening: Free First-Time Buyer Consultation with credit check and pre-approval.

- Referral Program: $100 gift card or closing cost credit for both the referrer and the new borrower.

- Seasonal Offers: Lower broker fees for refinance loans during slower or year-end months.

Client Acquisition Goals

Lendory plans to grow through client referrals and simple online marketing.

- Year 1: 180 funded loans — around 15 each month

- Year 2: 300 funded loans — around 25 each month

- Year 3: 420 funded loans — around 35 each month

Growth will come each year by improving how loans are handled. The focus is on better systems and lasting client relationships.

Client Acquisition Cost (CAC)

In Year 1, it will cost about $350–$400 to gain a new borrower through ads, events, and local partnerships. As the brand gains recognition and more clients return or refer others, the cost should drop to around $250 by Year 3.

Sales Strategy

Lendory’s sales plan is based on trust and clear communication. Loan officers explain each loan type in simple terms so clients can choose what fits them best. Every borrower receives an easy loan comparison through LoanSifter that shows clear terms and rates.

Programs like FastTrack Pre-Approval, Self-Employed Advantage, and Investor Express are made for different types of clients. Referral offers, bilingual help, and regular check-ins keep strong ties with both customers and realtors. This approach helps Lendory build repeat clients and long-lasting trust in the community.

7. Management Team

The management team at Lendory Financial looks after daily operations, sets company goals, and keeps the business organized. The group has many years of experience in home loans, finance, and customer care.

Grayson Penn, Founder and CEO, leads business planning and makes sure rules are followed. Lexa Ruiz, COO, oversees staff, office work, and client support. Trent Lorman, CFO, manages money, reports, and overall finances. Together, they focus on steady growth and clear, honest service for clients.

| Role | Number of Staff | Pay | Job / Responsibilities |

|---|---|---|---|

| CEO (Grayson Penn) | 1 | $120,000/year + commission override | Leads company operations, builds lender relations, oversees compliance, and manages strategic growth. |

| COO (Lexa Ruiz) | 1 | $85,000/year | Oversees daily operations, loan pipeline management, vendor coordination, and staff scheduling. |

| CFO (Trent Lorman) | 1 | $70,000/year | Manages accounting, payroll, and reporting to SBA and lender partners. |

| Loan Officers | 2 (hired by Q2 2026) | $60,000/year + 50 bps per closed loan | Helps people get home/small business loans, stays in touch with clients, and updates lenders on progress. |

| Loan Processor | 1 | $50,000/year | Handles document collection, submission to lenders, and closing coordination. |

| Loan Assistant | 1 | $40,000/year | Supports processors and officers with file setup, credit pulls, and communication. |

| Receptionist / Admin (Riley Chen) | 1 | $38,000/year | Handles the front desk, books meetings, and answers client questions. |

| Marketing Contractor (Part-time) | 1 | $20,000/year | Creates digital campaigns, manages social media, and designs co-branded realtor materials. |

Shift Structure

Lendory Financial runs two main shifts to serve clients and realtors efficiently.

Morning Shift (8:30 AM – 5:00 PM):

The admin and processing team handle paperwork, update files, and send forms to lenders.

Afternoon Shift (10:00 AM – 7:00 PM):

Loan officers meet clients, speak with realtors, and manage new loan applications.

This schedule allows faster responses, fewer loan delays, and extended service hours for busy buyers and partners.

8. Financial Plan

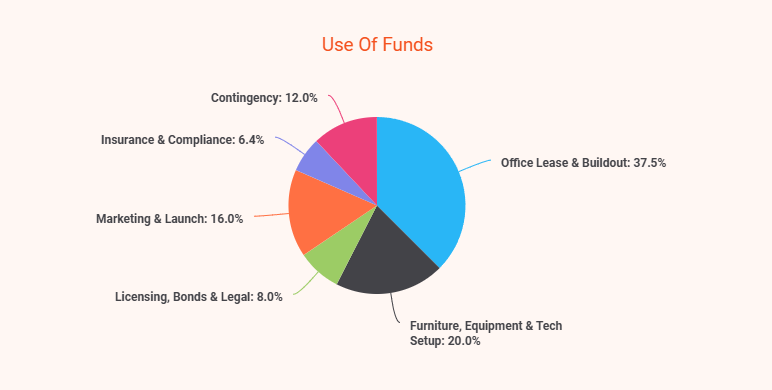

Lendory Financial, LLC needs $169,800 in startup funding to cover setup and operations. The budget includes licenses, technology, marketing, hiring, and working capital. The table below shows how funds are divided across these categories.

| Category | Amount ($) |

|---|---|

| Office Lease & Buildout | $46,800 |

| Furniture, Equipment & Tech Setup | $25,000 |

| Licensing, Bonds & Legal | $10,000 |

| Marketing & Launch | $20,000 |

| Insurance & Compliance | $8,000 |

| Working Capital Reserve (6 months) | $45,000 |

| Contingency | $15,000 |

| Total Startup Investment | $169,800 |

Basic Assumptions

| Assumption | Year 1 | Year 2 | Year 3 |

|---|---|---|---|

| Owner Equity Injection | $90,000 | - | - |

| SBA Loan | $310,000 | - | - |

| Average Loan Size | $350,000 | $350,000 | $350,000 |

| Loans Closed (Units) | 180 | 300 | 420 |

| Loan Volume | $63.0M | $105.0M | $147.0M |

| Avg. Revenue per Loan (1%) | $3,500 | $3,500 | $3,500 |

| Tax Rate | - | - | 20% |

| Rent | $46,800 | $46,800 | $46,800 |

| Marketing Budget | $42,000 | $45,000 | $48,000 |

| Payroll & Benefits | $330,000 | $350,000 | $380,000 |

| Variable Costs (% of Revenue) | 20% | 20% | 20% |

Revenue Forecasts

| Year | Loans Closed | Avg. Loan Size ($) | Loan Volume ($) | Net Revenue (1%) ($) | EBITDA ($) |

|---|---|---|---|---|---|

| 1 | 180 | 350,000 | 63,000,000 | 630,000 | -40,000 |

| 2 | 300 | 350,000 | 105,000,000 | 1,050,000 | +160,000 |

| 3 | 420 | 350,000 | 147,000,000 | 1,470,000 | +335,000 |

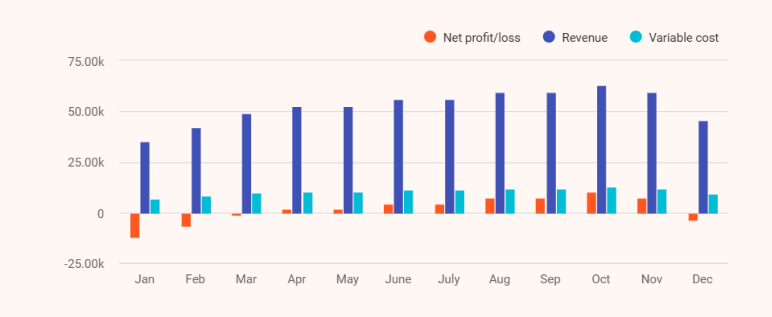

Monthly Projections (Year 1)

| Month | Loans Closed | Revenue ($) | Variable Cost (20%) ($) | Payroll ($) | Overhead ($) | Loan Payment ($) | Net Profit/Loss ($) |

|---|---|---|---|---|---|---|---|

| Jan | 10 | 35,000 | 7,000 | 27,500 | 8,500 | 4,200 | -12,200 |

| Feb | 12 | 42,000 | 8,400 | 27,500 | 8,500 | 4,200 | -6,600 |

| Mar | 14 | 49,000 | 9,800 | 27,500 | 8,500 | 4,200 | -1,000 |

| Apr | 15 | 52,500 | 10,500 | 27,500 | 8,500 | 4,200 | +1,800 |

| May | 15 | 52,500 | 10,500 | 27,500 | 8,500 | 4,200 | +1,800 |

| Jun | 16 | 56,000 | 11,200 | 27,500 | 8,500 | 4,200 | +4,600 |

| Jul | 16 | 56,000 | 11,200 | 27,500 | 8,500 | 4,200 | +4,600 |

| Aug | 17 | 59,500 | 11,900 | 27,500 | 8,500 | 4,200 | +7,400 |

| Sep | 17 | 59,500 | 11,900 | 27,500 | 8,500 | 4,200 | +7,400 |

| Oct | 18 | 63,000 | 12,600 | 27,500 | 8,500 | 4,200 | +10,200 |

| Nov | 17 | 59,500 | 11,900 | 27,500 | 8,500 | 4,200 | +7,400 |

| Dec | 13 | 45,500 | 9,100 | 27,500 | 8,500 | 4,200 | -3,800 |

| Total | 180 | 630,000 | 126,000 | 330,000 | 102,000 | 50,400 | ≈ +21,600 |

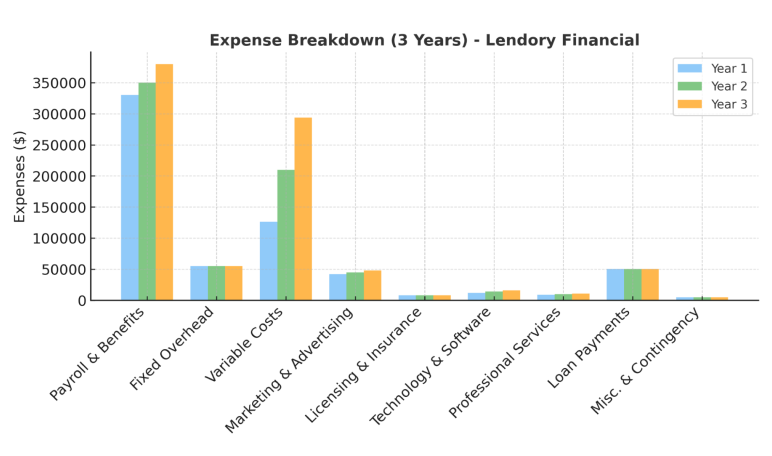

Expense Breakdown

| Expense Category | Year 1 ($) | Year 2 ($) | Year 3 ($) |

|---|---|---|---|

| Payroll & Benefits | 330,000 | 350,000 | 380,000 |

| Fixed Overhead (Rent, Utilities) | 55,000 | 55,000 | 55,000 |

| Variable Costs (20%) | 126,000 | 210,000 | 294,000 |

| Marketing & Advertising | 42,000 | 45,000 | 48,000 |

| Licensing & Insurance | 8,000 | 8,000 | 8,000 |

| Technology & Software | 12,000 | 14,000 | 16,000 |

| Professional Services | 9,000 | 10,000 | 11,000 |

| Loan Payments (Principal + Interest) | 50,400 | 50,400 | 50,400 |

| Miscellaneous & Contingency | 5,000 | 5,000 | 5,000 |

| Total Annual Expenses | 637,400 | 747,400 | 867,400 |

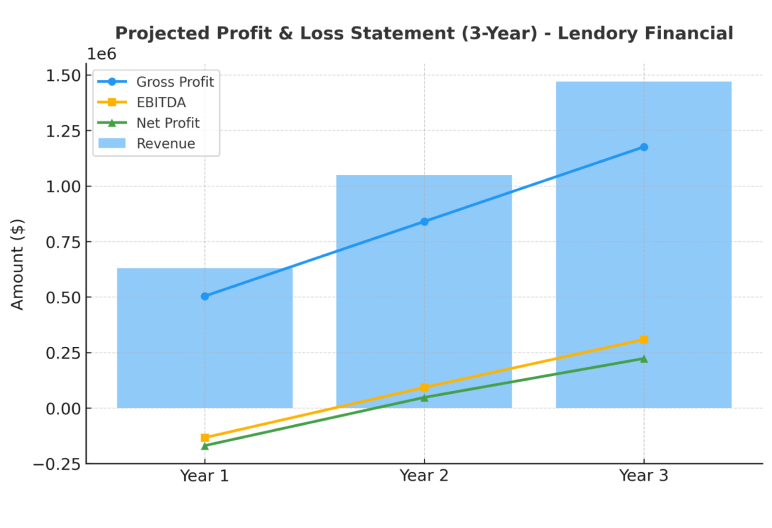

Projected Profit & Loss Statement (3-Year)

| Category | Year 1 ($) | Year 2 ($) | Year 3 ($) |

|---|---|---|---|

| Revenue | 630,000 | 1,050,000 | 1,470,000 |

| Cost of Goods Sold (20%) | 126,000 | 210,000 | 294,000 |

| Gross Profit | 504,000 | 840,000 | 1,176,000 |

| Operating Expenses | 637,400 | 747,400 | 867,400 |

| EBITDA | -133,400 | +92,600 | +308,600 |

| Depreciation | 8,000 | 8,000 | 8,000 |

| Interest Expense | 28,000 | 25,000 | 22,000 |

| Earnings Before Tax | -169,400 | +59,600 | +278,600 |

| Taxes (20%) | - | 11,920 | 55,720 |

| Net Profit (After Tax) | -169,400 | +47,680 | +222,880 |

| Net Margin (%) | -27% | 5% | 15% |

Projected Cash Flow (3 Years)

| Category | Year 1 ($) | Year 2 ($) | Year 3 ($) |

|---|---|---|---|

| Operating Cash Flow | -150,000 | +60,000 | +230,000 |

| Investing Activities | -65,000 | - | - |

| Financing Activities | +400,000 | -50,000 | -50,000 |

| Net Increase (Decrease) in Cash | +185,000 | +10,000 | +180,000 |

| Closing Cash Balance | 185,000 | 195,000 | 375,000 |

Break-even Analysis

| Metric | Value |

|---|---|

| Average Revenue per Loan | $3,500 |

| Variable Cost per Loan | $700 |

| Contribution Margin per Loan | $2,800 |

| Annual Fixed + Payroll Costs | $385,000 |

| Break-even Volume (Loans/Year) | ≈ 138 loans |

| Break-even Volume (Loans/Month) | ≈ 12 loans |

Business Ratios

| Metric | Year 1 | Year 2 | Year 3 |

|---|---|---|---|

| Gross Margin | 80% | 80% | 80% |

| Net Margin | -27% | 5% | 15% |

| Current Ratio | 1.3 | 1.5 | 1.7 |

| Debt-to-Equity | 3.4 | 2.8 | 2.2 |

| Return on Equity | -95% | 25% | 75% |

| Asset Turnover | 0.9 | 1.4 | 1.8 |

9. Funding Request

Lendory Financial expects to break even by Q2 2027. The plan shows steady income growth, lower costs, and better profits as the company expands and gains more referrals

Lendory Financial, LLC is applying for an SBA 7(a) loan of $310,000 from Regions Bank. The money will cover startup costs, technology setup, and early expenses.

The loan will run for 10 years at around 11.25% interest (Prime + 2.75%), with monthly payments of about $4,200.

The owner will put in $90,000 of personal money to show commitment and reduce risk for the lender. The full startup cost of $400,000 will cover office setup, equipment, software, marketing, hiring, licensing, and six months of working funds.

All business assets bought with the loan will be used as collateral. The owner will also give a personal guarantee backed by savings and property.

This loan will help Lendory set up operations, onboard vendors, and stay funded until it reaches break-even. The target is about 12 loans per month by Q2 2027.

By the third year, the company projects $1.47 million in revenue and a net profit of about $222,880.

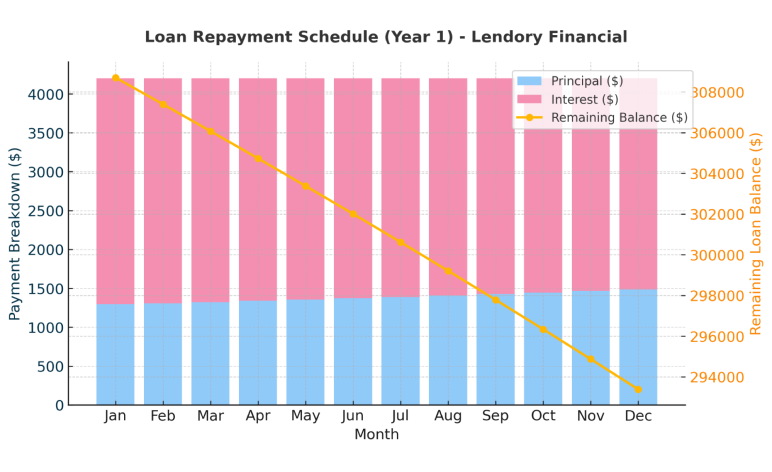

Loan Repayment Schedule

| Year | Month | Payment ($) | Interest ($) | Principal ($) | Remaining Balance ($) |

|---|---|---|---|---|---|

| 1 | Jan | 4,200 | 2,906 | 1,294 | 308,706 |

| 1 | Feb | 4,200 | 2,892 | 1,308 | 307,398 |

| 1 | Mar | 4,200 | 2,877 | 1,323 | 306,075 |

| 1 | Apr | 4,200 | 2,861 | 1,339 | 304,736 |

| 1 | May | 4,200 | 2,845 | 1,355 | 303,381 |

| 1 | Jun | 4,200 | 2,828 | 1,372 | 302,009 |

| 1 | Jul | 4,200 | 2,810 | 1,390 | 300,619 |

| 1 | Aug | 4,200 | 2,792 | 1,408 | 299,211 |

| 1 | Sep | 4,200 | 2,773 | 1,427 | 297,784 |

| 1 | Oct | 4,200 | 2,754 | 1,446 | 296,338 |

| 1 | Nov | 4,200 | 2,734 | 1,466 | 294,872 |

| 1 | Dec | 4,200 | 2,713 | 1,487 | 293,385 |

| Year 1 Total | $50,400 | $33,785 | $16,615 | $293,385 | |

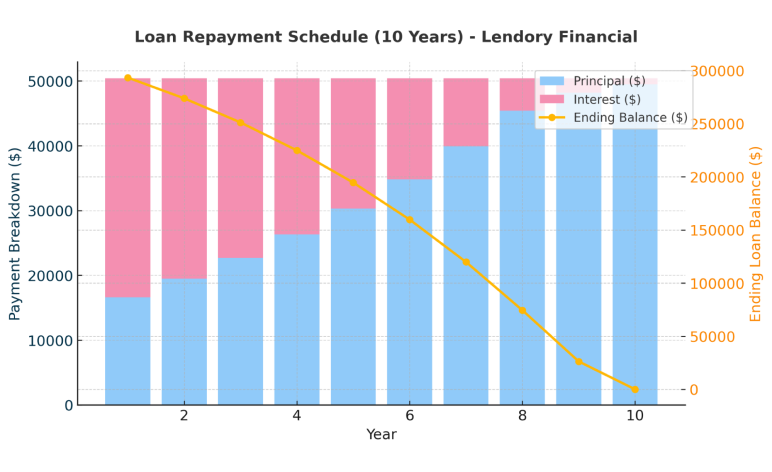

| Year | Annual Payment ($) | Interest ($) | Principal ($) | Ending Balance ($) |

|---|---|---|---|---|

| 1 | 50,400 | 33,785 | 16,615 | 293,385 |

| 2 | 50,400 | 30,900 | 19,500 | 273,885 |

| 3 | 50,400 | 27,700 | 22,700 | 251,185 |

| 4 | 50,400 | 24,100 | 26,300 | 224,885 |

| 5 | 50,400 | 20,100 | 30,300 | 194,585 |

| 6 | 50,400 | 15,600 | 34,800 | 159,785 |

| 7 | 50,400 | 10,500 | 39,900 | 119,885 |

| 8 | 50,400 | 5,000 | 45,400 | 74,485 |

| 9 | 50,400 | 2,200 | 48,200 | 26,285 |

| 10 | 50,400 | 900 | 49,500 | 0 |

| Total (10 Years) | $504,000 | $181,685 | $310,000 | — |

10. Risk & Mitigation

Every new mortgage business faces some early challenges. Lendory Financial has found the main risks and set up simple ways to manage them. These steps will help the company stay steady and grow.

One key risk is interest rate changes, since higher rates can make loans harder to get and reduce demand. To handle this, Lendory will promote refinance, HELOC, and non-QM loans during rate hikes to keep loan activity stable.

Another issue is low leads in the first few months, which could slow income and delay the break-even point. To fix this, the company will run Google Ads, work with local realtors, and use bilingual outreach and small workshops to reach more clients.

Rule or compliance changes can also raise costs or add extra work when new laws come from the CFPB (Consumer Financial Protection Bureau)or state offices. To stay on track, Lendory will complete yearly audits with Mortgage Compliance Pros and hire a consultant for updates.

Relying too much on realtor referrals can limit growth. Lendory will build its own inbound leads through SEO, webinars, and client feedback to create a steady and self-sufficient source of new business.

Lastly, data and technology risks like system crashes or data leaks could harm operations or client security. To prevent this, Lendory will use safe cloud storage (Carbonite), two-step verification, and regular data backups to protect all records.

Download a Free Mortgage Broker Business Plan Template

Ready to write your mortgage broker business plan, but not sure how to start? You’re in the right place. Download our free mortgage broker business plan template (PDF) and start shaping your plan today.

This ready-to-use guide gives simple steps and real examples to help you write a solid business plan. Plus, you can adjust it easily to fit your goals and the services you offer.

Conclusion

After going through this Lendory Financial mortgage business plan sample, you should now have a clear idea of how to write one for your own mortgage firm.

If you want a quicker way to build your plan or need extra help, try using an AI business plan generator.

It makes planning smoother and helps you draft a complete, investor-ready plan faster. You just need to answer a few basic questions regarding your business idea and get your plan ready in minutes!

Get Your Business Plan Ready In Minutes

Answer a few questions, and AI will generate a detailed business plan.

Frequently Asked Questions

What is a mortgage loan business plan?

A mortgage loan business plan is a document that outlines your goals, services, target market, financial projections, and strategies for running a successful mortgage brokerage. It helps you stay focused, manage your operations, and attract lenders, partners, or investors.

Is it important to write a business plan for mortgage brokers?

Yes. A business plan helps mortgage brokers map out how to get clients, work with lenders, and stay up to date with licensing and compliance. It also shows others, like banks, partners, or regulators, that you’re serious and well-prepared to grow your business.

How will you charge for your mortgage services?

Mortgage brokers are paid through lender or client fees:

- A commission is usually paid by the lender after the loan closes

- If not, the client may pay a fixed fee

- All fees are explained upfront

- Charges follow legal rules and guidelines

Why do I conduct market analysis before business planning?

Market analysis helps you understand your industry, local housing trends, and competitors. It also helps you:

- Showcase who your ideal clients are and what other brokers offer

- Set clear goals and choose services that fit your market

- Reduce the risk of costly mistakes and prove to lenders and investors that your plan is based on real data.

How long does it take to complete a mortgage business plan?

Writing a business plan usually takes one to four weeks, depending on how much research and detail you include. If you already have a clear idea of your services, target market, and goals, it can go faster. Also, using pre-made business plan templates or online planning tools can save time and help you organize your plan with the right structure, including financial projections.