The retail industry is a cornerstone of the global economy, encompassing everything from giant big-box chains to local mom-and-pop shops. It’s a multi-trillion-dollar sector that touches virtually every consumer.

In the United States alone, retail is one of the largest industries by revenue and employment, reflecting its vital role in daily life. Globally, retail spans diverse categories—grocery, apparel, e-commerce, automobiles, and more, illustrating its vast diversity.

Hence, in this article, we’ll explore the latest retail industry statistics for 2025, focusing on market size, sales trends, and shifting consumer behaviors. We’ll highlight key data points (with citations) and discuss emerging trends such as AI integration, omnichannel strategies, sustainability, mobile commerce growth, and labor challenges.

Let’s get started

Top Retail Industry Statistics 2025 [Editor's Picks]

- The global retail industry market size is projected to reach $35.2 trillion in 2025, with a compound annual growth rate (CAGR) of 7.65%.

- By 2030, the industry is expected to grow to approximately $50.8 trillion.

- Total worldwide retail sales are estimated at $32.4 trillion by the end of 2025.

- Global ecommerce sales will reach $6.86 trillion in 2025, accounting for nearly 20% of total retail sales worldwide.

- The U.S. retail market remains one of the largest, with over $6 trillion in annual sales and around 4.6 million retail establishments.

- The retail industry provides around 55 million jobs in the U.S., making it the country’s largest private-sector employer.

- 87% of retailers have deployed AI technology in at least one area of their business, and 80% of retail executives expect their organizations to adopt AI automation by the end of 2025.

- AI in the U.S. retail market is projected to reach $17.76 billion by 2032.

- Retail contributes $5.3 trillion to the annual U.S. GDP.

Retail Industry Overview

The global retail industry was valued at approximately USD 32 trillion in 2023 and is projected to reach about USD 56.4 trillion by 2032, growing at a compound annual growth rate (CAGR) of around 6.5% from 2024 to 2032.

Moreover, the U.S. retail market recorded $7.26 trillion in sales in 2024 and is expected to exceed $8.29 trillion by 2030. To give you a clearer picture of how the retail industry is evolving, here’s a quick snapshot of key market figures in the table below.

| Statistic | 2024-2025 Value/Trend |

|---|---|

| Global Retail Market Size | $35.2 trillion |

| Global E-commerce Sales | $6.86 trillion |

| U.S. Retail Market Size | 7.26 trillion |

| Retail Industry CAGR (2025-2030) | 7.65% |

| U.S. Retail Jobs | 55 million 2022 |

| AI Adoption by Retailers | 80% by the end of 2025 |

| AR Market Value | $19.9 billion |

| In-store Share of U.S. Retail Revenue | 72% |

Top Retail Industry Statistics 2025

If you’re curious about where the retail industry stands today and where it’s headed, this section has you covered.

We’ve rounded up the latest global and U.S. retail industry size, employment data, and other key stats to give you a complete overview of the industry’s current landscape and future potential.

Let’s get started.

1) Global retail industry statistics

The retail industry plays a massive role in the global economy, driving trillions in sales every year. This section will break down the latest global retail market data, growth trends, and future projections. Let’s get started.

- The global retail market is expected to expand from $31983.19 billion in 2024 to $34867.41 billion in 2025, reflecting a compound annual growth rate (CAGR) of 9.0%. (Source)

- Global retail sales were estimated at $30.6 trillion in 2024, with projections to exceed $35.8 trillion by 2030. (Source)

- Walmart firmly held its position as the world’s largest retailer, generating retail revenues of more than 572 billion U.S. dollars. (Source)

- Brick-and-mortar retail represented 80.4% of worldwide retail sales in 2024, while 19.6% of global sales revenue came from e-commerce. (Source)

- By the close of 2024, total retail sales climbed to about 7.26 trillion U.S. dollars, marking an increase of roughly a quarter of a trillion dollars compared to the previous year. (Source)

- By 2027, Amazon is projected to become the world’s top retailer, narrowly surpassing the Alibaba Group in overall sales. (Source)

- Worldwide online shopping revenue totaled $6.01 trillion in 2024; this is projected to exceed $8.91 trillion by 2030 (Source)

- The United States, China, and India are the largest retail markets globally, with the USA holding an 18.7% global market share. (Source)

- The annual growth rate of global retail e-commerce sales surged to 25.7% in 2020, driven primarily by the COVID-19 pandemic, which significantly accelerated the global shift toward online shopping. (Source)

- In 2022, the retail industry provided employment for 55 million full-time and part-time workers, representing 26% of the total U.S. workforce, according to a new report from the National Retail Federation. (Source)

2) USA Retail market size and growth statistics

In this section, we’ll explore the latest figures on the US retail market's overall size, its year-on-year growth, and future projections, giving you a clear view of how this industry continues to expand globally and in the U.S.

- The United States continues to hold its position as one of the world’s largest retail markets, with retail sales reaching around $5.29 trillion in 2024. (Source)

- The U.S. retail market is projected to reach around $7.4 trillion in 2025, showing a steady but modest growth of about 0.4% compared to the previous year. (Source)

- The U.S. retail sector supports roughly 18 million jobs and includes approximately 3 million business establishments. (Source)

- Industry revenue has steadily grown at a compound annual growth rate (CAGR) of 2.2% over the past five years, reaching an estimated $7.4 trillion in 2025. (Source)

- U.S. retail sales rose 5.2% year-on-year in April 2025, matching March’s growth. Since 1993, the average annual growth is 4.77%, with a high of 51.8% in April 2021 and a low of -19.7% in April 2020. (Source)

- In 2023, the U.S. had 1.07 million retail establishments, showing steady growth over recent years. (Source)

- In Q4 2024, e-commerce accounted for 16.4% of total U.S. retail sales, marking an increase from the prior quarter. (Source)

- USA Key retail players like Walmart, Amazon, CVS Health, Costco, Kroger, and JD.com are boosting market demand by investing heavily in research and development. (Source)

- In 2023, U.S. clothing and accessories store sales reached approximately $307 billion. (Source)

- In the third quarter of 2024, consumer spending in the United States exceeded $16.1 trillion. (Source)

- Black Friday 2024 set a new record with U.S. consumers spending $10.8 billion online—a 10.2% increase from $9.8 billion in 2023. (Source)

3) Retail sales statistics

In this section, we’ll break down the latest retail sales numbers, highlighting key trends, regional performance, and the ongoing shift between in-store and online shopping across major markets.

- In 2020, global retail sales declined by 2.9% due to the impact of the COVID-19 pandemic, but made a strong recovery in 2021, growing by 9.7%. (Source)

- Global retail sales are expected to reach about 32.8 trillion U.S. dollars by 2026, rising from roughly 26.4 trillion U.S. dollars in 2021. (Source)

- Online sales have become an increasingly important part of the retail industry, with e-commerce making up more than 17% of global retail sales in 2024. (Source)

- In April 2025, U.S. retail sales increased by 0.1% month-over-month, following a revised 1.7% jump in March. (Source)

- In the first quarter of 2025, total retail sales in the United States were estimated at $1,858.5 billion, marking a 0.4% increase from the previous quarter. (Source)

- In 2025, online sales are projected to make up 21% of all retail purchases, increasing to 22.6% by 2027. (Source)

- E-commerce sales are expected to exceed $6.8 trillion in 2025, with the number of global online shoppers reaching 2.77 billion. (Source)

- In April 2025, retail sales in China grew by 5.1% year-over-year, reaching RMB 3.72 trillion. (Source)

- In 2024, global brick-and-mortar store sales grew by 3.5%, while e-commerce sales experienced a stronger rise of 5.3%. (Source)

- On Black Friday 2024, 81.7 million consumers shopped in stores, up from 76.2 million the previous year, marking the highest in-person turnout since the pandemic. (Source)

4) AI in retail statistics

Artificial intelligence is rapidly transforming the retail industry, from personalized shopping experiences to smarter inventory management. In this section, we’ll uncover key retail stats showing how AI is being adopted and reshaping retail operations worldwide.

- With the global AI in retail market expected to reach an impressive $45.74 billion by 2032, it’s clear that artificial intelligence and the retail industry are advancing hand in hand. (Source)

- The global artificial intelligence (AI) in retail market was valued at USD 11.83 billion in 2024 and is projected to grow to approximately USD 62.64 billion by 2034, expanding at a CAGR of 18.14% between 2025 and 2034. (Source)

- By 2028, 33% of eCommerce businesses are expected to integrate agentic AI into their operations. (Source)

- A survey of shoppers in the United States revealed that 74% felt artificial intelligence (AI) improved their shopping experience. (Source)

- According to Salesforce, AI influenced 17% of U.S. online purchases during the 2024 holiday season. (Source)

- More than 80% of retailers plan to increase AI capabilities in their operations in 2025, with 35% of major retailers intending to significantly boost AI investment. (Source)

- Among Amazon sellers, 34% primarily use AI for writing and optimizing product listings, while 14% leverage it to create marketing and social media content. Additionally, 7% utilize AI for keyword research and SEO enhancement. (Source)

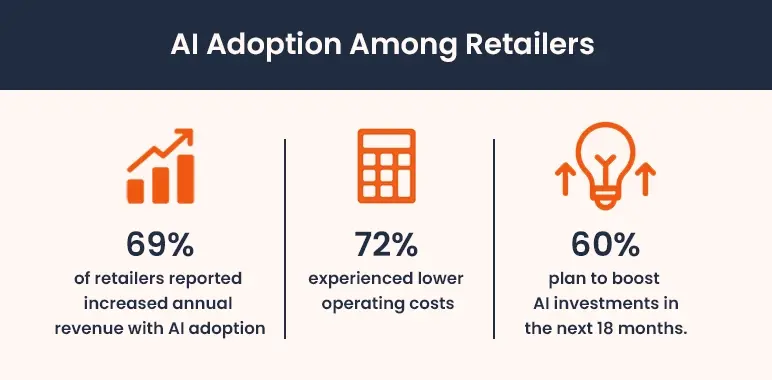

- 69% of retailers reported increased annual revenue with AI adoption, 72% experienced lower operating costs, and over 60% plan to boost AI investments in the next 18 months. (Source)

- Major retailers like Amazon Go, Sephora, Walmart, Zara, and Starbucks are leveraging AI for personalized recommendations, inventory management, dynamic pricing, and loyalty programs. (Source)

- 93% of eCommerce businesses view AI agents as a key competitive advantage. (Source)

- The AI-enabled eCommerce solutions market is projected to be valued at USD 16.8 billion by 2030. (Source)

5) Retail theft statistics

Retail theft remains a significant challenge for businesses worldwide, impacting profits and security. In this section, we’ll explore the latest data on theft trends and their effects on the retail industry.

- In 2023, the nation saw 1.15 million reported shoplifting cases, marking the highest level since 2019. (Source)

- Shoplifting statistics reveal that 88% of retailers believe shoplifters have become at least somewhat more aggressive and violent compared to the previous year. (Source)

- Shoplifting accounts for 36% of total retail shrinkage annually. (Source)

- The average value of merchandise stolen in each shoplifting incident is $125. (Source)

- 65% of retailers have taken products off their sales floors in certain locations to prevent theft. (Source)

- Survey data indicates that about 27 million Americans—roughly 1 in 11 people–have committed shoplifting. (Source)

- Theft rates for technology items such as wireless earbuds and smartwatches have risen by 25% compared to the same period last year. (Source)

- The vast majority of small business retailers nationwide—90%—have encountered theft in their stores, and 83% consider retail theft to be at least a somewhat significant problem. (Source)

- Over 20% of Americans have shoplifted, with juveniles aged 12 to 16 being the most likely to do so—about 1 in 4 in this age group. (Source)

6) E-commerce vs. retail statistics

The retail world is rapidly changing, and the line between online and offline shopping is blurrier than ever. In fact, both channels are evolving to meet modern consumer expectations.

Let’s dive into the latest numbers revealing how shoppers split their time, trust, and money between digital carts and in-store checkouts.

- Even with the hit from the 2020 pandemic, both the retail and ecommerce markets bounced back strongly. Between 2020 and 2021, ecommerce sales jumped by 14.2%, and total retail sales weren’t far behind with a solid 14% increase. (Source)

- In the United States, total retail sales for Q1 2025 were $1.86 trillion, with e-commerce accounting for 16.2% of that total. (Source)

- By 2025, 24% of all global retail sales will come from e-commerce stores, up from 19.9% in 2024. (Source)

- 94% of U.S. consumers returned to physical stores by 2022, showing a strong rebound for in-person shopping after the pandemic-driven online boom. (Source)

- In the U.S., 75% of consumers shop both online and in physical stores. Additionally, 29% use buy online, pick up in-store (BOPIS) services, and 45% turn to social media to discover, review, and purchase products. (Source)

- 70% of shoppers use three or more channels—like online, in-store, and mobile apps—during a single purchase journey. (Source)

- There are 7.1 million online retailers worldwide, with 1.8 million based in the U.S., meaning the U.S. accounts for a solid 25% of all global online retailers. (Source)

- One in three U.S. shoppers say they don’t trust retailers that operate exclusively online—out of 4,400 adults surveyed, 1,496 admitted to this concern. (Source)

- There are 1,045,422 brick-and-mortar retail stores in the U.S., alongside 1.8 million online retailers, making up 25% of all online stores globally. (Source)

- Global eCommerce sales are expected to hit $6.56 trillion in 2025, with 2024 seeing an 8.4% revenue jump from 2023. Meanwhile, global brick-and-mortar retail sales will reach $21.8 trillion by the end of 2024, though in-person sales are growing more slowly than online transactions. (Source)

7) Retail consumer behavior statistics

Retail consumer behavior is evolving rapidly, driven by technology, convenience, and shifting values. Today’s shoppers expect seamless experiences, personalized offers, and brands that align with their beliefs, both online and in-store.

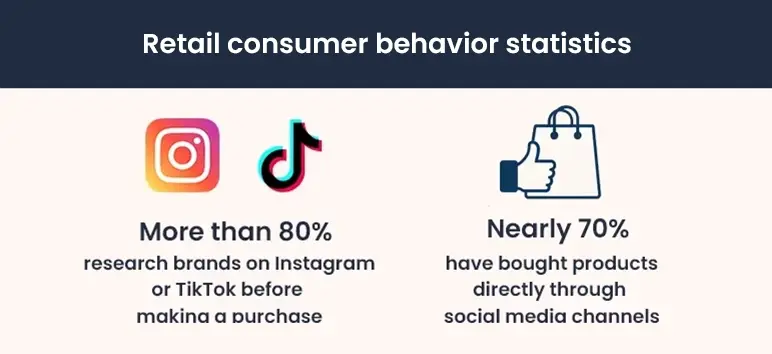

- More than 80% of consumers research brands on Instagram or TikTok before making a purchase, and nearly 70% have bought products directly through social media channels. (Source)

- Most shoppers today use multiple channels before buying, with 30% relying on at least three different touchpoints for a single purchase. (Source)

- A recent study revealed that 73% of consumers value personalized rewards programs, but only 60% feel current personalization meets their expectations, showing clear room for retailers to improve. (Source)

- 42% of consumers say they plan to stop buying luxury products because of the economic slowdown. (Source)

- Luxury categories like watches, handbags, accessories, and jewelry are facing a slowdown, with just 14% of consumers showing interest in spending on these items. (Source)

- 38% of consumers say they’ll stop buying from a brand after a poor call experience, making quality customer support crucial for retention. (Source)

- 32% of consumers find phone calls the most frustrating customer service channel. Having caller data on hand is key to resolving issues faster and improving the experience. (Source)

- Quick, free delivery attracts 60% of consumers, with younger shoppers valuing fast, no-cost shipping the most. (Source)

- About 19% of shoppers prefer products that appear in the top five search results, highlighting the importance of being easily visible online. (Source)

- When a company personalizes customer interactions well, 49% of customers feel valued, and 47% are more likely to choose that business. (Source)

- In 2023, around 45% of Gen Z consumers in the U.S. preferred shopping for jewelry and accessories mostly online, while over 60% of millennials favored buying these items online if given the choice. (Source)

- Retail marketers who invest in personalization can earn over $20 for every dollar spent, showing how powerful and rewarding personalized marketing really is. (Source)

- Among consumers aged 35-44, 30% are willing to spend noticeably more on sustainable brands and products. (Source)

- Over 44% of consumers are buying more second-hand products now compared to a year ago. (Source)

- 66% of Gen Alpha prefer buying from brands that make a positive impact. (Source)

- 18% of Gen Alpha specifically look for products made with sustainable materials. (Source)

- Younger consumers are the most willing to share personal data in return for personalized shopping experiences. (Source)

- About 41% of shoppers show no strong preference, clicking on both organic and paid search results equally. (Source)

8) Demographic statistics in the retail industry

Understanding who’s shopping, how often, and where they prefer to spend is crucial for staying competitive in today’s retail landscape. From generational shopping trends to gender-based preferences and social media influences, demographic data reveals the evolving behaviors shaping the retail industry. Let’s dive into the latest numbers driving consumer decisions in 2025.

- By the end of 2025, Gen Z and Millennials are expected to drive nearly 50% of all luxury goods sales, positioning them as the core audience for premium brands. (Source)

- According to Insider Intelligence, over 42% of U.S. Gen Z social media users watch livestream videos. With TikTok pushing its TikTok Shop, livestream shopping is set to surge among Gen Z shoppers. (Source)

- Globally, around 60% of the retail workforce is made up of women, making it one of the most female-driven industries. (Source)

- 49% of Gen Alpha consumers trust influencers just as much as family when it comes to making purchase decisions. (Source)

- About 40% of U.S. consumers surveyed said they are likely to shop in-store during Black Friday sales in 2024. (Source)

- On average, women shop online about 7.1 times a year, while men do so 5.4 times. However, men tend to spend around 10 euros more per purchase than women. (Source)

- Cyber Monday 2024 attracted 64.4 million online shoppers, making it the second most popular shopping day, though slightly down from 73.1 million in 2023. (Source)

- The typical online shopper is male, aged 25 to 49. According to Affilinet, 84.3% of men shop online, compared to 77% of women. (Source)

Top Retail Industry Trends to Consider in 2025

The retail landscape is evolving at lightning speed, and staying ahead means keeping a close eye on the latest trends shaping the market.

Below, we’ll break down the top retail industry trends you need to watch, so you can stay competitive, relevant, and profitable in a rapidly changing market.

Omnichannel shopping is the new normal

73% of customers now shop across multiple platforms, online, in-store, on mobile apps, and even on social media. Only 7% shop online-only, and 20% stick to physical stores. That tells you people like options.

Popular features like BOPIS are here to stay

Since COVID, 33% of Americans have used services like Buy Online, Pick Up In-Store, and guess what, 67% of them say they’ll keep using them.

Omnichannel stores keep more customers

Businesses with strong omnichannel strategies hold on to 89% of their customers, while those with weak ones only keep 33%. And those multi-channel customers spend 30% more in their lifetime.

Marketing across channels pays off

Companies using three or more marketing channels see a 494% higher order rate than those relying on just one. Sales can increase by up to 287% when you market everywhere.

Advertising budgets are following the trend

In 2025, 16.3% of total ad spending in the U.S. will go into omnichannel retail media, and this will climb to 24.4% by 2028.

Unified commerce is a smart move

Businesses using it report 27% lower order fulfillment costs and 18% fewer abandoned carts, meaning better profit and more sales.

Mobile and online research shape how people shop

83% of shoppers look things up online before visiting a store. 44% start their journey on search engines, 41% on online stores, and 36% in physical shops.

The Bottom Line

The retail industry is evolving faster than ever, and the numbers don’t lie. For entrepreneurs and retail business owners, the message is clear—meet your customers where they are.

Blend online, offline, mobile, and social media touchpoints, and keep an eye on emerging tech like AI and retail media advertising. Those who stay ahead of these trends will thrive, while others risk getting left behind.

In short: Be flexible, go omnichannel, embrace smart tech, and stay connected with your customers everywhere they shop. That’s the way forward in retail’s next chapter.

Remember, the businesses that listen to the market and move with it are the ones that last. Stay sharp, stay curious, and never stop adapting.

Frequently Asked Questions

How big is the retail industry in 2025?

The global retail industry is expected to reach $35.18 trillion in 2025.

How many retail stores are there in the US?

As of Q3 2024, the U.S. had 1,081,474 private retail establishments, according to preliminary data from the U.S. Bureau of Labor Statistics. Among these, around 68,365 were classified as non-store retailers, based on the latest available data from the last quarter of 2021.

What are the most important retail market trends?

Key trends include rapid e-commerce growth, in-store automation, AI adoption, omnichannel strategies, and a focus on personalized customer experiences.

How is AI transforming the retail industry?

AI is enabling smarter inventory management, personalized marketing, dynamic pricing, and frictionless checkout, with most major retailers investing in AI to streamline operations and enhance customer experience.

What is the market size of e-commerce within retail?

Global retail e-commerce revenue is projected at $6.67 trillion in 2024 and expected to reach $13.89 trillion by 2032.

Which region leads in global retail growth?

The Asia Pacific region is the fastest-growing retail market, with the highest CAGR forecast through 2030.

What are the challenges facing the retail sector in 2025?

Major challenges include supply chain disruptions, inflation, rising operational costs, labor shortages, and increasing retail theft.

What’s the role of mobile commerce in the retail industry?

Mobile commerce is a primary driver of e-commerce growth, as more consumers shop via smartphones, contributing significantly to online retail sales expansion